1,050% Price Hike: AT&T Sounds Alarm On Broadcom's VMware Deal

Table of Contents

Broadcom's Acquisition of VMware: A Deep Dive

Broadcom, a leading semiconductor company, is aiming to acquire VMware, a virtualization giant, in a deal valued at approximately $61 billion. This acquisition represents a significant consolidation within the IT industry, combining Broadcom's hardware expertise with VMware's software dominance in virtualization and cloud computing. The strategic motivation behind Broadcom's move appears multifaceted. They aim to expand their software portfolio, strengthen their position in the enterprise market, and potentially leverage VMware's technology for future growth in areas like artificial intelligence and 5G infrastructure.

- Acquisition Price: Approximately $61 billion

- Timeline: The deal is currently undergoing regulatory review and is expected to close in 2023.

- Regulatory Approvals: The acquisition requires approvals from various regulatory bodies worldwide, including the US Federal Trade Commission (FTC) and other international competition authorities.

- Market Share Implications: The combined entity would control a significant portion of the virtualization and cloud infrastructure market, raising concerns about potential monopolies.

AT&T's Concerns and the 1,050% Price Hike

AT&T's vocal opposition to Broadcom's VMware deal stems from the proposed price increase for VMware services. The company claims a 1,050% hike in licensing costs, a figure that represents a catastrophic blow to their operational budget and long-term profitability. This drastic increase impacts AT&T's ability to provide competitive telecommunications services and maintain its current service levels to consumers and businesses.

- Drastic Increase in Licensing Costs: The 1,050% price hike is the central point of contention.

- Lack of Transparency: AT&T has expressed concerns about the lack of transparency surrounding the pricing changes proposed by Broadcom post-acquisition.

- Potential for Reduced Service Quality: The increased costs could force AT&T to compromise on service quality or reduce the features offered to customers.

- Competitive Disadvantages: The substantial price increase puts AT&T at a significant competitive disadvantage compared to other telecom providers who may not rely as heavily on VMware services.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware deal faces intense regulatory scrutiny due to significant antitrust concerns. Regulators are examining the potential for the combined entity to create a monopoly, stifling competition and innovation within the IT industry. Concerns exist that the merger could lead to higher prices, reduced choice, and less innovation for consumers and businesses relying on virtualization and cloud technologies. Several investigations are underway, and the outcome will significantly impact the future of the deal.

- Concerns regarding Monopolies and Market Dominance: The merger's impact on competition is a primary concern for regulators.

- Potential Impact on Innovation and Competition: A lack of competition could stifle innovation and lead to stagnation in the market.

- Regulatory Bodies Involved: The FTC, European Commission, and other international competition authorities are reviewing the deal.

- Possible Outcomes: The deal could be approved, rejected outright, or approved with conditions designed to mitigate antitrust risks.

Impact on the Telecommunications Industry and Consumers

The Broadcom VMware deal’s outcome will have far-reaching consequences for the telecommunications industry and its consumers. The potential for increased costs for telecom services is a major concern, possibly leading to higher prices for consumers and businesses. This could also impact smaller telecommunication providers who may struggle to absorb the increased costs, potentially hindering competition and innovation within the sector.

- Increased Costs for Telecommunication Services: Consumers could face higher bills for internet, phone, and other services.

- Potential Reduction in Service Quality: Telecom providers might cut back on service quality or features to compensate for increased costs.

- Impact on Smaller Telecommunication Providers: Smaller providers might face significant challenges competing with larger entities.

- Consumer Impact: Consumers could experience price increases and potentially reduced service quality or features.

Conclusion: The Future of the Broadcom VMware Deal and its Ramifications

The 1,050% price hike proposed by Broadcom for VMware services following its acquisition is a significant development with potentially far-reaching consequences. AT&T's concerns highlight the potential negative impact on the telecommunications industry and consumers. The ongoing regulatory scrutiny of this deal is critical, as its outcome will shape the competitive landscape of the IT industry for years to come. Stay informed about developments in the Broadcom's VMware deal, follow regulatory updates, and consider the potential implications for your business or personal services. Share your thoughts and opinions on this significant event in the comments below.

Featured Posts

-

Analyse Technique Solutions 30 Hausse A Court Et Long Terme

Apr 23, 2025

Analyse Technique Solutions 30 Hausse A Court Et Long Terme

Apr 23, 2025 -

Reprise De La Seance Du 24 Fevrier L Integrale Bfm Bourse

Apr 23, 2025

Reprise De La Seance Du 24 Fevrier L Integrale Bfm Bourse

Apr 23, 2025 -

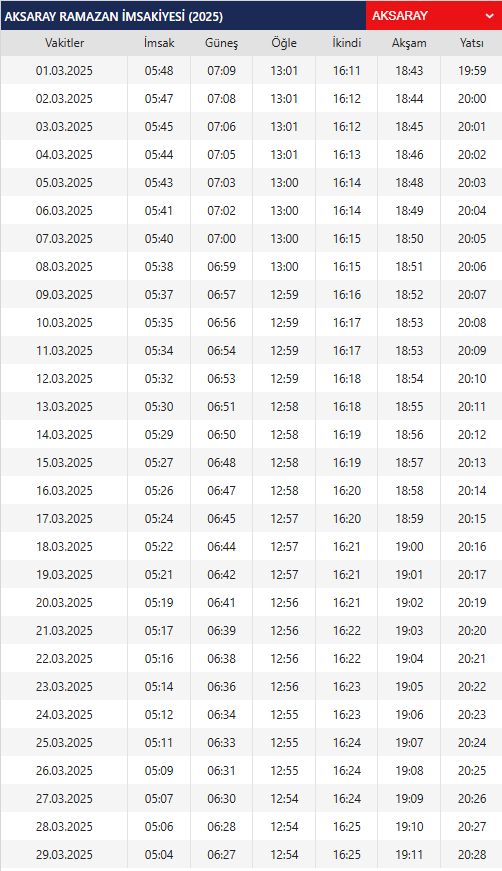

2025 Ankara Ramazan Iftar Sahur Saatleri 10 Mart Pazartesi

Apr 23, 2025

2025 Ankara Ramazan Iftar Sahur Saatleri 10 Mart Pazartesi

Apr 23, 2025 -

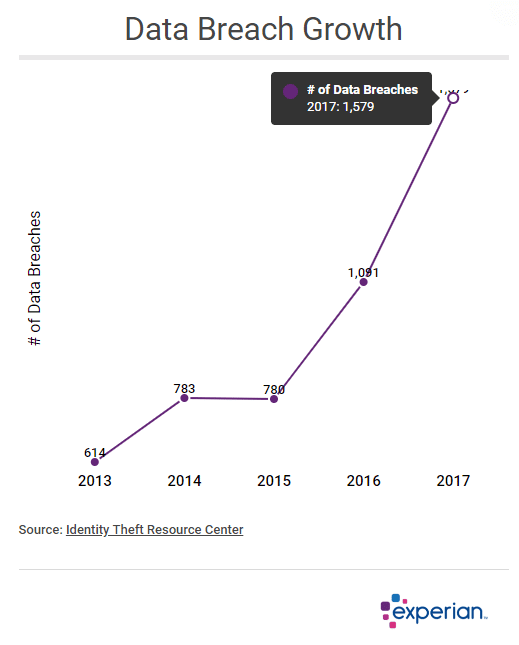

Millions In Losses From Executive Office365 Breaches Federal Case

Apr 23, 2025

Millions In Losses From Executive Office365 Breaches Federal Case

Apr 23, 2025 -

350 Kata Kata Motivasi Hari Senin Semangat Kerja Sepanjang Pekan

Apr 23, 2025

350 Kata Kata Motivasi Hari Senin Semangat Kerja Sepanjang Pekan

Apr 23, 2025