1,050% VMware Price Increase: AT&T Challenges Broadcom's Proposal

Table of Contents

The proposed acquisition of VMware by Broadcom has sent shockwaves through the tech industry, particularly with the revelation of a potential 1,050% price increase for certain VMware products. This drastic price jump has prompted significant backlash, with major players like AT&T actively challenging the deal, raising crucial antitrust concerns and highlighting the potential impact on competition and pricing in the virtualization market. This article delves into the details of this significant VMware price increase and AT&T's opposition.

<h2>The Controversial 1,050% VMware Price Increase</h2>

Reports suggest that Broadcom's acquisition of VMware could lead to a staggering 1,050% increase in the price of certain VMware products. While the exact figures remain somewhat opaque and depend on the specific product, customer segment, and licensing agreement, the sheer magnitude of the potential price hikes is undeniable and has sparked outrage. The reported increases aren't a uniform across-the-board jump; rather, they represent a range of potential increases impacting various VMware product lines. The lack of complete transparency regarding the pricing changes has further fueled concerns.

-

Affected Products: While the full list of affected products isn't publicly available, reports indicate that key VMware solutions within their virtualization and cloud infrastructure portfolios are facing significant price increases. This includes, but is not limited to, specific licensing tiers for vSphere, vSAN, and NSX.

-

Impact on Customer Segments: The impact varies depending on the customer segment. Large enterprises with significant VMware deployments might face millions of dollars in increased annual costs, while small and medium-sized businesses (SMBs) could be priced out of the market entirely, forcing them to seek alternative, potentially less robust, virtualization solutions.

-

Examples of Price Increases (Illustrative): While precise figures are difficult to obtain due to the complexity of VMware's licensing model, anecdotal evidence suggests some customers face potential increases exceeding 1000% for specific components. For example, a specific licensing tier previously costing $X might see a price increase to $10X or more. (Note: The use of "X" is due to the lack of publicly available precise figures.)

-

Impact on SMBs: The potential price increases pose a significant threat to SMBs. The cost of upgrading or maintaining VMware solutions could become prohibitive, forcing them to consider less feature-rich or less secure alternatives, potentially compromising their IT infrastructure and business continuity.

-

Reduced Competitiveness for Alternatives: Such drastic price hikes could significantly reduce the competitiveness of alternative virtualization solutions. Even if superior or more cost-effective alternatives exist, the entrenched position of VMware in the market might make it difficult for businesses to switch, creating a lock-in effect that benefits Broadcom.

<h2>AT&T's Opposition and Antitrust Concerns</h2>

AT&T, a major VMware customer, has voiced strong opposition to the Broadcom acquisition, citing concerns about the potential for monopolistic practices and anti-competitive behavior. AT&T's arguments center on the significant VMware price increase and its potential negative impact on the broader technology landscape. They argue that Broadcom's control of VMware would lead to reduced competition and innovation.

-

Monopolistic Practices: AT&T contends that the acquisition would grant Broadcom undue market power, allowing them to leverage VMware's dominant market share to artificially inflate prices and stifle competition. This would limit the choices available to businesses, potentially harming innovation and customer choice.

-

Competitive Impact: AT&T argues that the acquisition would severely limit competition within the virtualization market. By controlling VMware, Broadcom could potentially eliminate or significantly weaken alternative virtualization solutions.

-

Legal Actions: AT&T, along with other parties, is actively participating in regulatory reviews of the merger, submitting evidence and arguments against the deal to relevant antitrust authorities.

-

Key Arguments Against the Acquisition:

- Substantial VMware price increases will harm consumers and reduce competition.

- The merger will create a monopoly, limiting customer choice and innovation.

- Broadcom lacks the necessary expertise to effectively manage VMware's complex technology portfolio.

<h3>The Wider Impact on the Tech Industry</h3>

The potential VMware price increase and the Broadcom acquisition have far-reaching implications for the tech industry. This situation serves as a cautionary tale regarding the potential downsides of unchecked mergers and acquisitions in the tech sector.

-

Innovation and Competition: The acquisition could stifle innovation within the virtualization market, as competitors might struggle to compete with a dominant, potentially monopolistic player.

-

Future Mergers & Acquisitions: The outcome of this situation will significantly influence future mergers and acquisitions within the technology sector. Regulatory scrutiny of similar deals is likely to increase.

-

Reactions from Industry Players and Regulatory Bodies: Other technology companies and regulatory bodies are closely monitoring the situation, with many expressing similar concerns regarding the potential for anti-competitive practices. The outcome could set a precedent for future mergers and acquisitions within the technology sector.

-

Wider Impact Summary:

- Increased costs for businesses using virtualization technology.

- Reduced competition and innovation in the virtualization market.

- Potential for increased prices across the broader technology industry.

- Increased scrutiny of future mergers and acquisitions in the tech sector.

<h2>Potential Alternatives and Solutions</h2>

For businesses concerned about the VMware price hike, several alternatives exist:

-

Alternative Virtualization Platforms: Several reputable virtualization platforms offer compelling alternatives to VMware, including solutions from Citrix, Microsoft (Hyper-V), and open-source options like Proxmox VE.

-

Mitigation Strategies: Businesses can adopt strategies to minimize the impact of the price increase, such as negotiating better licensing agreements with VMware (before the acquisition closes), carefully evaluating their actual virtualization needs, and exploring cloud-based virtualization alternatives.

-

Open-Source Alternatives: Open-source solutions like Proxmox VE offer cost-effective alternatives, but often require more specialized technical expertise to manage and maintain.

-

Alternative Virtualization Platforms and Strategies:

- Microsoft Hyper-V

- Citrix XenServer

- Proxmox VE

- Cloud-based virtualization solutions (AWS, Azure, GCP)

- Negotiating existing contracts before the acquisition closes.

- Right-sizing virtualization infrastructure based on actual needs.

<h2>Conclusion</h2>

The potential 1,050% VMware price increase following Broadcom's acquisition is a significant concern, prompting legitimate antitrust worries and sparking opposition from major players like AT&T. The potential impact on SMBs, innovation, and competition within the virtualization market is substantial. This situation highlights the importance of considering alternative virtualization solutions and carefully monitoring regulatory actions. Stay informed about the ongoing developments concerning the Broadcom-VMware merger and the potential impact of the VMware price increase. Follow this space for further updates and analysis of the situation as it unfolds. Continue to explore alternative virtualization solutions to protect your business from potential price gouging. Keep an eye on how regulatory bodies handle this monumental VMware price increase and what it could mean for the future of the industry.

Featured Posts

-

Red Sox 2025 Outfield Espns Unexpected Projection

Apr 28, 2025

Red Sox 2025 Outfield Espns Unexpected Projection

Apr 28, 2025 -

Understanding The Luigi Mangione Movement What His Supporters Want You To Know

Apr 28, 2025

Understanding The Luigi Mangione Movement What His Supporters Want You To Know

Apr 28, 2025 -

Contempt Motion Looms Over Yukon Mine Managers Refusal To Testify

Apr 28, 2025

Contempt Motion Looms Over Yukon Mine Managers Refusal To Testify

Apr 28, 2025 -

A Look Back 2000 Yankees Diary Entry Victory Against Kansas City Royals

Apr 28, 2025

A Look Back 2000 Yankees Diary Entry Victory Against Kansas City Royals

Apr 28, 2025 -

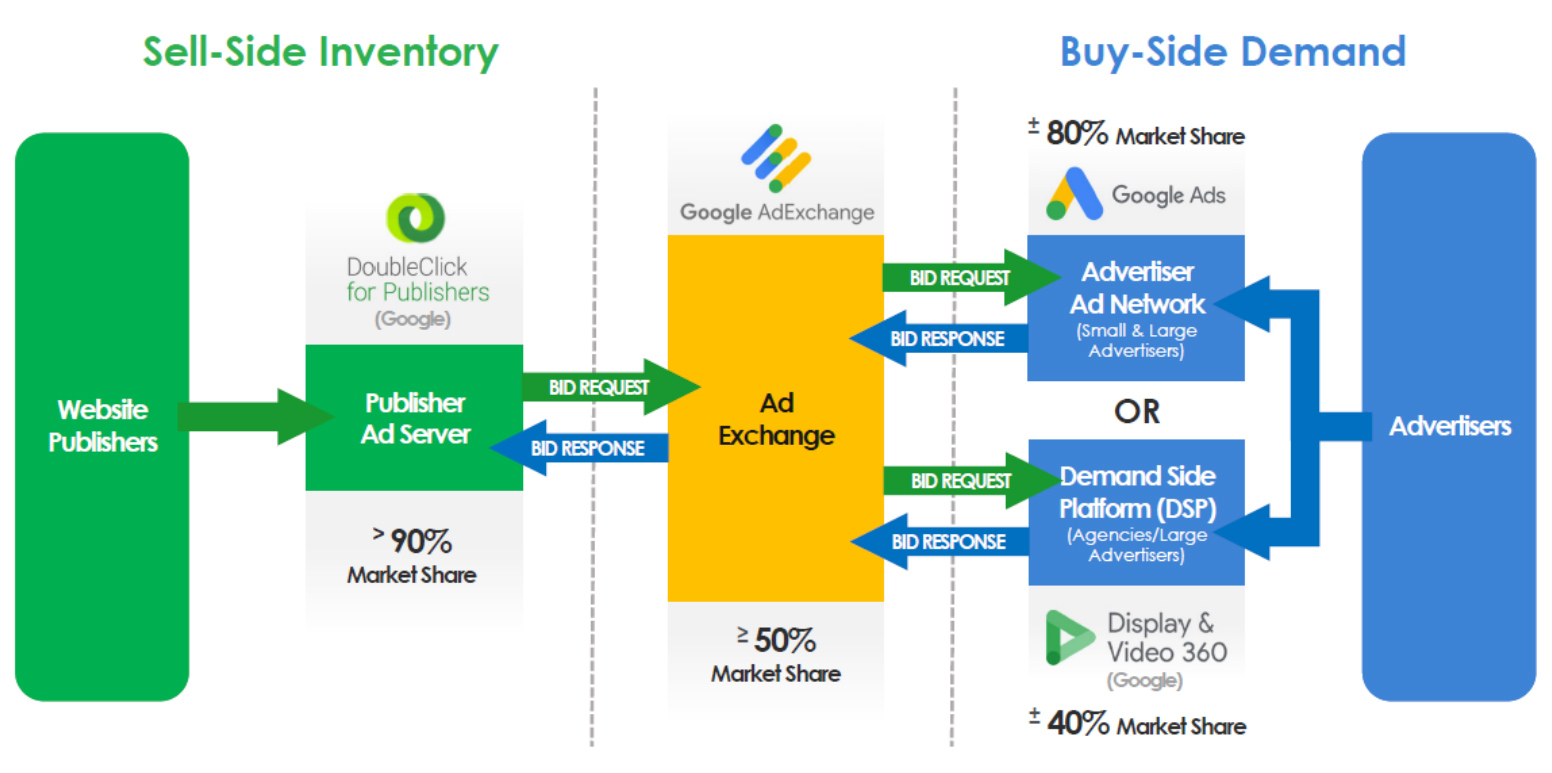

The Future Of Browsers Perplexity Ceos Fight Against Googles Dominance

Apr 28, 2025

The Future Of Browsers Perplexity Ceos Fight Against Googles Dominance

Apr 28, 2025

Latest Posts

-

Payton Pritchards Sixth Man Of The Year Candidacy A Deep Dive

May 12, 2025

Payton Pritchards Sixth Man Of The Year Candidacy A Deep Dive

May 12, 2025 -

Payton Pritchards Childhood How Family Ties Fueled His Career Success

May 12, 2025

Payton Pritchards Childhood How Family Ties Fueled His Career Success

May 12, 2025 -

Payton Pritchards Breakout Season The Details Behind His Success

May 12, 2025

Payton Pritchards Breakout Season The Details Behind His Success

May 12, 2025 -

Two Unlikely Celtics Reach 40 Points A Historic Night

May 12, 2025

Two Unlikely Celtics Reach 40 Points A Historic Night

May 12, 2025 -

Boston Celtics Clinch Division A Blowout Victory

May 12, 2025

Boston Celtics Clinch Division A Blowout Victory

May 12, 2025