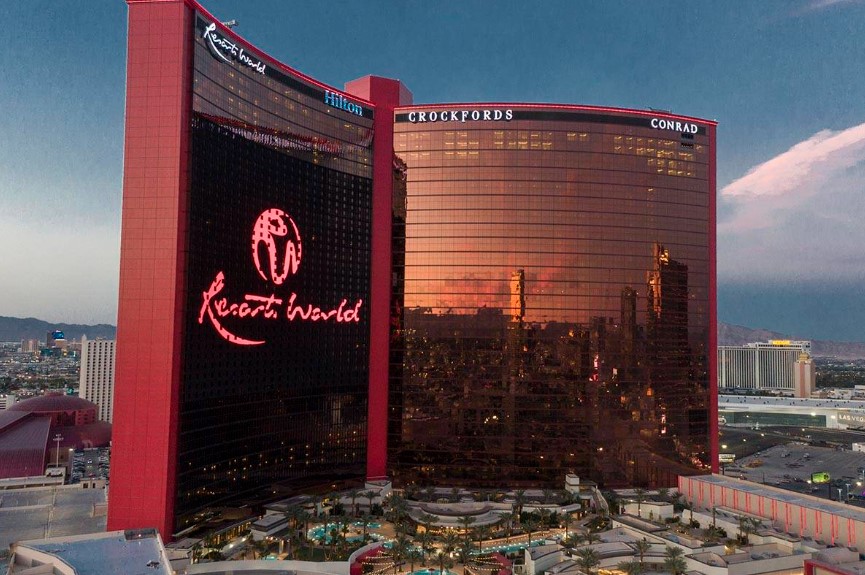

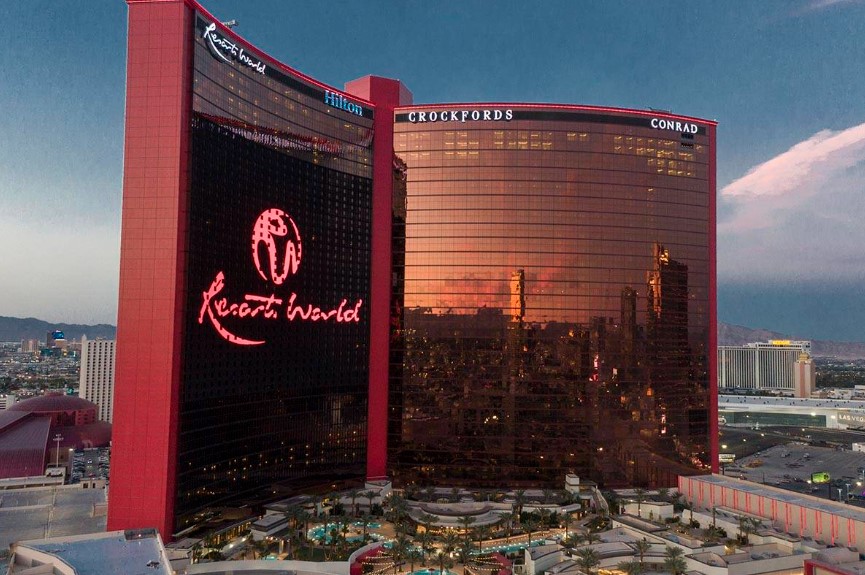

$10.5 Million Fine For Resorts World Casino In Las Vegas Money Laundering Case

Table of Contents

The Allegations of Money Laundering at Resorts World Casino

Resorts World Casino faced allegations of serious money laundering violations. While the specifics of the methods used remain partially undisclosed due to the ongoing nature of some investigations, the fine itself suggests substantial evidence of failing to properly monitor and report suspicious financial transactions. The investigation likely uncovered a pattern of activities, potentially involving structuring transactions to avoid detection, failing to file adequate suspicious activity reports (SARs), and perhaps overlooking red flags during customer due diligence (CDD). The amounts involved are believed to be significant, contributing to the substantial size of the fine. Investigations of this nature often involve a meticulous examination of numerous financial transactions and a detailed timeline of events to establish a pattern of illegal behavior.

- Summary of the alleged violations: The casino allegedly failed to adequately implement and maintain its anti-money laundering program, resulting in the processing of transactions that fell under suspicion for money laundering activities. This failure likely encompassed weaknesses in various aspects of their AML compliance program, including transaction monitoring and suspicious activity reporting.

- Timeline of events leading to the investigation and fine: While precise dates remain confidential in some parts, the timeline likely involved initial suspicions, an internal investigation (possibly), an external investigation by regulatory bodies, and finally, the imposition of the fine.

- Specific laws or regulations violated: The violations likely involved breaches of the Bank Secrecy Act (BSA), a crucial piece of legislation in the fight against money laundering in the United States. Failure to comply with BSA regulations, including the proper filing of SARs and the maintenance of effective AML programs, are common reasons for such significant penalties in the gaming industry.

The $10.5 Million Fine and its Implications

The $10.5 million fine levied against Resorts World Casino represents a substantial financial penalty for AML compliance failures. The exact calculation of the fine likely took into account several factors, including the severity and duration of the violations, the amount of money potentially laundered, and the casino's history of compliance. Beyond the direct financial impact, the casino faces other significant consequences.

- Potential impact on Resorts World Casino's reputation and future business: The negative publicity associated with this case could damage the casino's reputation, potentially impacting its customer base and future revenue streams. Trust and transparency are crucial in the gaming industry, and this case significantly erodes confidence.

- Impact on investor confidence: Investors might reconsider their commitment due to the regulatory risk and negative publicity surrounding the casino, affecting its stock value and future investment prospects.

- Analysis of the fine's severity in comparison to other similar cases: The $10.5 million fine is substantial and positions itself as a high-profile warning to other casinos. Comparing this penalty with fines in similar cases helps assess the severity of Resorts World Casino's violations and the regulatory bodies' commitment to enforcing AML compliance.

Regulatory Response and Future Implications for the Gaming Industry in Las Vegas

The Nevada Gaming Control Board (NGCB) played a key role in investigating and resolving this case. Their actions highlight the increased scrutiny casinos face regarding AML procedures. The investigation undoubtedly involved extensive review of the casino's financial records, interviews with employees, and potentially collaboration with federal agencies.

- Increased scrutiny of casinos' AML procedures: Expect more thorough audits and investigations of casino AML procedures following this high-profile case. Regulatory bodies will likely increase the frequency and intensity of their oversight to ensure compliance.

- Potential changes in regulations and compliance requirements: This case could lead to stricter regulations and more stringent AML compliance requirements for casinos in Nevada and potentially nationwide. The industry may see an increased emphasis on technology-driven solutions for transaction monitoring.

- The message sent to other casinos regarding compliance: The size of the fine sends a powerful message to the entire gaming industry: proactive and robust AML compliance is not optional but mandatory.

Lessons Learned and Best Practices for Anti-Money Laundering Compliance

The Resorts World Casino case provides critical lessons for all casinos regarding AML compliance. Implementing and maintaining a strong AML compliance program is paramount.

- Strengthening KYC (Know Your Customer) procedures: Robust KYC procedures are essential to identify potentially high-risk customers and prevent money laundering activities. This includes thorough identity verification and ongoing monitoring of customer activities.

- Improving employee training on AML regulations: Casinos must provide comprehensive and ongoing training to their employees on AML regulations, suspicious activity recognition, and reporting procedures.

- Investing in advanced technology for transaction monitoring: Investing in sophisticated technology for transaction monitoring is crucial for identifying suspicious patterns and transactions that might otherwise go unnoticed.

Conclusion

The $10.5 million fine imposed on Resorts World Casino for money laundering violations underscores the severe consequences of AML compliance failures in the Las Vegas gambling industry. The case highlights the critical need for casinos to implement robust AML programs, including thorough KYC procedures, comprehensive employee training, and the use of advanced transaction monitoring technologies. Understanding the Resorts World Casino case and implementing strong AML strategies, including money laundering prevention and casino AML compliance, is crucial for the future of responsible gambling. Ignoring these lessons could lead to similar penalties and irreparable damage to reputation and business. Proactive measures are the only way to ensure the continued health and integrity of the Las Vegas casino industry.

Featured Posts

-

Pedro Pascals Jawline Transformation Fans Speculate On The Cause

May 18, 2025

Pedro Pascals Jawline Transformation Fans Speculate On The Cause

May 18, 2025 -

Amanda Bynes Only Fans A Post Hollywood Career Move

May 18, 2025

Amanda Bynes Only Fans A Post Hollywood Career Move

May 18, 2025 -

Experience Nycs Five Boro Bike Tour A Riders Perspective

May 18, 2025

Experience Nycs Five Boro Bike Tour A Riders Perspective

May 18, 2025 -

Ai Digest Transforming Mundane Scatological Data Into Engaging Audio Content

May 18, 2025

Ai Digest Transforming Mundane Scatological Data Into Engaging Audio Content

May 18, 2025 -

How Russias Call For Peace Talks Became A Diplomatic Setback For Putin

May 18, 2025

How Russias Call For Peace Talks Became A Diplomatic Setback For Putin

May 18, 2025