10-Year Mortgages In Canada: Reasons For Limited Adoption

Table of Contents

Higher Initial Interest Rates and Costs

The allure of a 10-year mortgage lies in the potential for long-term stability and predictable payments. However, this certainty often comes at a cost.

The Premium for Long-Term Certainty:

Lenders typically charge a higher initial interest rate for 10-year mortgages compared to shorter-term options like 5-year mortgages. This is because they assume a greater risk over the extended term. Interest rates fluctuate, and a lender is exposed to potential losses if rates drop significantly during the 10-year period. This increased risk is reflected in the higher interest rate offered to borrowers.

- Increased borrowing costs over the life of the loan: While you might benefit from lower rates later in the term if rates decrease, the higher initial rate can significantly increase your overall borrowing costs compared to a shorter-term mortgage with potentially lower initial rates.

- Higher upfront fees associated with longer-term mortgages: Some lenders may charge higher fees for processing and securing a 10-year mortgage due to the increased administrative burden and risk.

- Difficulty predicting long-term interest rate fluctuations: Predicting interest rate movements over a decade is incredibly challenging, making it difficult to assess the true long-term cost of a 10-year mortgage.

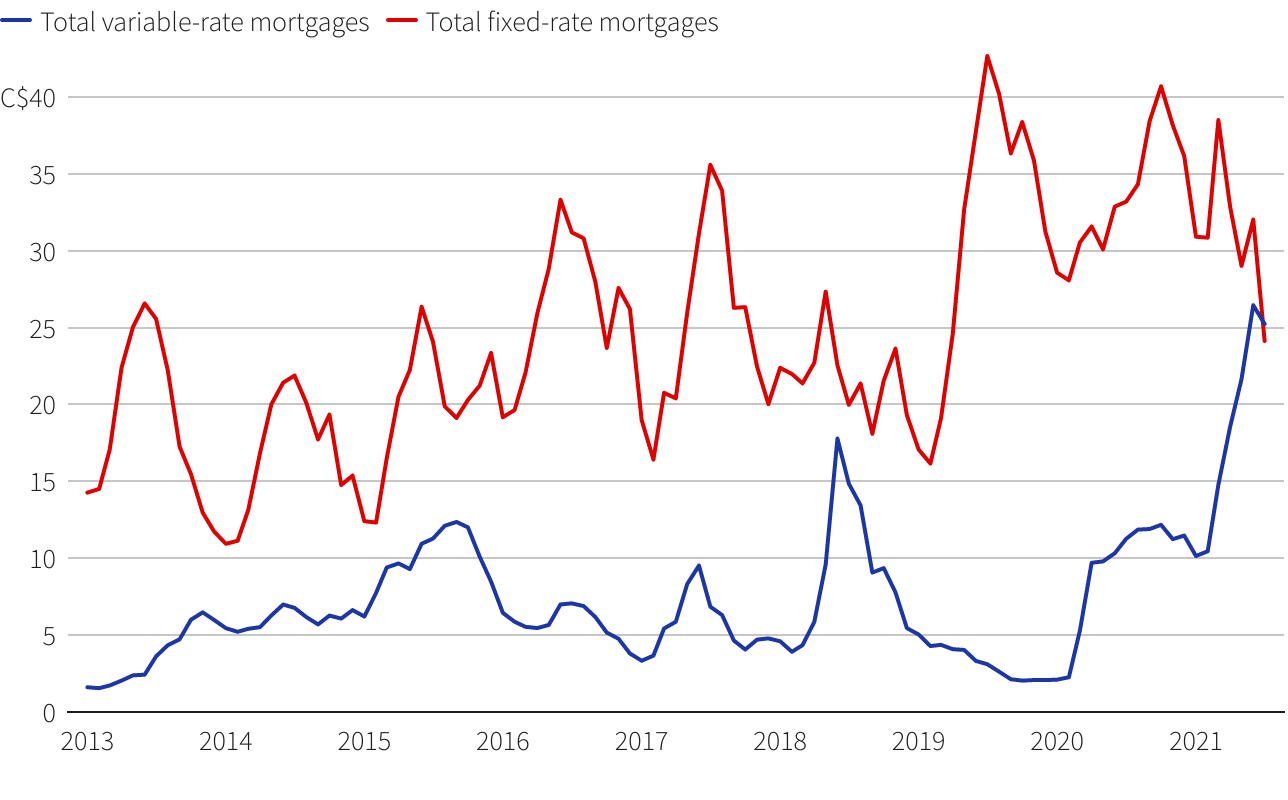

Market Volatility and Interest Rate Risk

The Canadian mortgage market, like any financial market, is subject to volatility. Interest rates are influenced by various economic factors, making long-term predictions difficult.

Predicting the Future is Difficult:

Locking into a 10-year mortgage means committing to a specific interest rate for a significant period. If interest rates drop substantially during that time, you might be paying more than necessary. Conversely, if rates rise unexpectedly, you'll be locked into those higher payments.

- The risk of being locked into a higher interest rate: If rates drop significantly during the 10-year term, you'll miss out on the opportunity to refinance at a lower rate, potentially costing you thousands of dollars over the life of the mortgage.

- Uncertainty about future financial situations: Your financial circumstances can change dramatically over 10 years. A job loss, unexpected medical expenses, or other unforeseen events could make maintaining high mortgage payments challenging.

- The impact of potential rate hikes on affordability: Unexpected rate hikes can severely impact the affordability of your mortgage payments, potentially leading to financial strain. A longer-term commitment increases the risk of struggling with payments if rates rise unexpectedly.

Limited Lender Availability and Product Complexity

Another factor limiting the adoption of 10-year mortgages in Canada is the availability and complexity of these products.

Finding the Right Lender:

Not all lenders offer 10-year mortgage terms. The selection is smaller compared to the readily available 5-year options. This limited supply can restrict consumer choice and potentially make it harder to find the best interest rate and terms.

- Fewer lenders offering 10-year terms: Compared to the plethora of lenders offering 5-year mortgages, the number of lenders providing 10-year options is significantly lower.

- Increased complexity in understanding the terms and conditions: Longer-term mortgages often come with more intricate terms and conditions, making them harder for borrowers to understand fully.

- Potential difficulty comparing offers: Variations in terms and conditions across different lenders offering 10-year mortgages can make comparing offers and identifying the best deal more challenging.

Psychological Barriers and Consumer Behavior

Beyond the financial aspects, psychological factors play a significant role in shaping consumer preferences for mortgage terms.

The Comfort of Shorter Terms:

Many Canadians prefer the perceived flexibility and shorter-term commitment of a 5-year mortgage. The idea of locking into a 10-year mortgage can feel daunting.

- Preference for shorter-term financial commitments: The shorter-term nature of a 5-year mortgage provides a sense of control and allows for greater flexibility to adjust payments or refinance as needed.

- Fear of being locked into a long-term mortgage: Life circumstances change. A 10-year commitment may feel restrictive, particularly for younger buyers or those anticipating major life changes.

- Lack of awareness or understanding of the potential benefits: Many Canadians may simply lack awareness of the potential long-term savings and stability that a 10-year mortgage can offer.

Conclusion

The limited adoption of 10-year mortgages in Canada is a result of several interconnected factors. Higher initial interest rates and costs, market volatility and interest rate risk, limited lender availability, and psychological barriers all contribute to the preference for shorter-term options. While 10-year mortgages in Canada aren't as common, understanding these factors can help you make an informed decision about the best mortgage term for your needs. Speak to a mortgage specialist today to learn more about 10-year mortgage options and explore if a long-term solution is right for you. Understanding the potential benefits and drawbacks of a 10-year mortgage, compared to shorter terms, is essential for making an informed choice that aligns with your individual financial circumstances and long-term goals.

Featured Posts

-

Kevin Costners Pursuit Of Demi Moore What The Insiders Say

May 06, 2025

Kevin Costners Pursuit Of Demi Moore What The Insiders Say

May 06, 2025 -

Catch Up On Broadway February 26 2025 News From Broadway World

May 06, 2025

Catch Up On Broadway February 26 2025 News From Broadway World

May 06, 2025 -

Kim Kardashian A Retrospective Of Her Best Hair And Makeup Styles

May 06, 2025

Kim Kardashian A Retrospective Of Her Best Hair And Makeup Styles

May 06, 2025 -

Watch March Madness Online The Ultimate Guide To Cord Cutting During The Tournament

May 06, 2025

Watch March Madness Online The Ultimate Guide To Cord Cutting During The Tournament

May 06, 2025 -

Martin Compston Addresses Line Of Duty Future His Latest Comments Explained

May 06, 2025

Martin Compston Addresses Line Of Duty Future His Latest Comments Explained

May 06, 2025