1050% Price Hike: AT&T Sounds Alarm Over Broadcom's VMware Deal

Table of Contents

AT&T's Specific Concerns Regarding the 1050% Price Increase

The Magnitude of the Price Hike and its Impact

AT&T's reported 1050% price increase for specific VMware services represents a seismic shift in the enterprise software market. This isn't a minor adjustment; it's an astronomical jump that could significantly impact AT&T's operational budget and profitability. While the exact VMware services affected haven't been publicly disclosed in full detail, the sheer magnitude suggests a substantial portion of AT&T's reliance on VMware's infrastructure is threatened. This price increase isn't just an isolated incident; it potentially signals a broader trend if the Broadcom acquisition proceeds without significant regulatory intervention. The financial burden on AT&T, and potentially other large enterprises, could be immense.

- Specific VMware services affected: While not fully disclosed, the price hike likely impacts core VMware virtualization, cloud management, and networking products critical to AT&T's infrastructure.

- Potential financial burden on AT&T: A 1050% increase represents a colossal cost escalation, potentially impacting millions, if not billions, of dollars in AT&T's annual expenditure. This could force the company to re-evaluate its IT strategy and potentially cut back on other crucial investments.

- Ripple effects on AT&T's customers: Ultimately, these increased costs could be passed on to AT&T's customers, impacting the pricing of their services and potentially hindering AT&T’s competitiveness.

Antitrust Concerns and Regulatory Scrutiny

Potential Monopoly Power of Broadcom Post-Acquisition

The Broadcom-VMware merger has sparked significant antitrust concerns. Broadcom's acquisition of VMware could create a near-monopoly in several key sectors, including networking, enterprise software, and cloud infrastructure. This consolidation of market power raises serious concerns about the potential for Broadcom to leverage its dominance to arbitrarily raise prices, stifle innovation, and limit choices for businesses relying on these crucial technologies.

- Existing antitrust investigations or concerns: Several regulatory bodies, including the US Federal Trade Commission (FTC) and similar entities globally, are actively reviewing the deal, investigating its potential anti-competitive effects.

- Potential market dominance: The combined entity would control significant market share in virtualization software, server networking, and other critical enterprise technologies, potentially creating a chokehold on the industry.

- Potential legal challenges and their impact: The legal challenges to the merger could significantly delay or even prevent the acquisition from completing, potentially altering the competitive landscape in the long term.

Impact on the Broader Technology Landscape

Consequences for Enterprise Software and Cloud Computing

The potential implications of the Broadcom-VMware merger extend far beyond AT&T. The 1050% price hike serves as a stark warning to other businesses that rely on VMware's products and services. If Broadcom is allowed to consolidate this market power, we could see widespread price increases across the enterprise software and cloud computing sectors, harming innovation and potentially stifling smaller companies.

- Reduced innovation: A lack of competition often leads to reduced innovation. Without the pressure of competing solutions, Broadcom might have less incentive to invest in developing new technologies and improving existing ones.

- Effect on smaller companies: Smaller companies that depend on VMware services could face significant financial hardship, potentially forcing them out of business or significantly limiting their growth.

- Alternative solutions: The price hike may accelerate the search for alternative virtualization and cloud computing solutions, potentially benefiting open-source projects and other competing vendors.

AT&T's Strategic Response and Industry Implications

AT&T's Actions and Potential Future Strategies

AT&T's vocal opposition to the Broadcom-VMware deal is a significant development. Their public statements highlight the potential for widespread negative consequences, and they are likely to actively engage with regulators and explore alternative solutions to mitigate the impact of the price increase. Their actions might include lobbying efforts, exploring alternative virtualization technologies, and potentially pursuing legal action.

- AT&T’s public statements and actions: AT&T is actively engaging with regulatory bodies to express its concerns and will likely continue to do so to influence the outcome of the merger review.

- Similar concerns from other major telcos or enterprises: We can expect other major telecommunication companies and large enterprises heavily reliant on VMware to voice similar concerns.

- Long-term implications for the industry: The outcome of this merger will have far-reaching implications for the entire technology industry, shaping the competitive landscape of enterprise software and cloud computing for years to come.

Conclusion

AT&T's reported 1050% price increase for VMware services following Broadcom’s proposed acquisition highlights the significant risks associated with this mega-merger. The potential for reduced competition, inflated prices, and stifled innovation in the enterprise software and cloud computing markets is a major concern. The ongoing regulatory scrutiny and potential antitrust investigations are crucial to determine the future of this deal and its impact on the broader technology landscape. The price hike underscores the significant impact this merger could have on the availability and affordability of crucial technologies for businesses of all sizes. Stay informed about the ongoing regulatory scrutiny and potential antitrust investigations surrounding the Broadcom VMware acquisition. Monitor the situation closely to understand how this mega-merger will shape the future of enterprise software and cloud computing.

Featured Posts

-

Pw Cs Strategic Shift Leaving Nine African Markets

Apr 29, 2025

Pw Cs Strategic Shift Leaving Nine African Markets

Apr 29, 2025 -

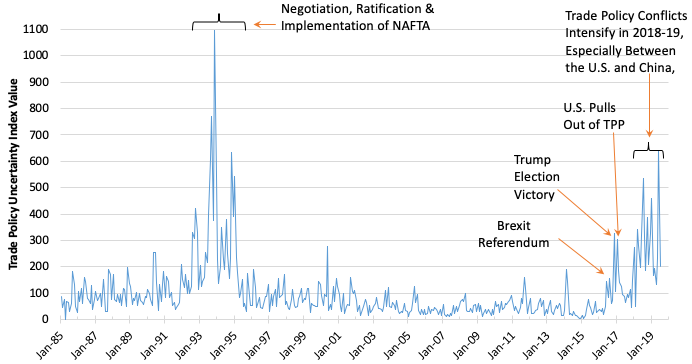

Tariff Uncertainty Forces Us Companies To Prioritize Cost Reduction

Apr 29, 2025

Tariff Uncertainty Forces Us Companies To Prioritize Cost Reduction

Apr 29, 2025 -

Navigating Tariff Uncertainty Cost Cutting Strategies For Us Companies

Apr 29, 2025

Navigating Tariff Uncertainty Cost Cutting Strategies For Us Companies

Apr 29, 2025 -

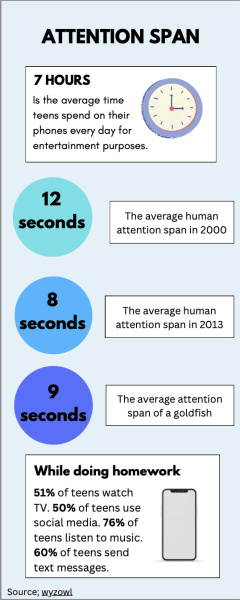

Tik Tok And Adhd Is The Algorithm Making Us Question Our Attention Spans

Apr 29, 2025

Tik Tok And Adhd Is The Algorithm Making Us Question Our Attention Spans

Apr 29, 2025 -

How To Buy Capital Summertime Ball 2025 Tickets Now

Apr 29, 2025

How To Buy Capital Summertime Ball 2025 Tickets Now

Apr 29, 2025