1050% Price Hike: AT&T's Strident Opposition To Broadcom's VMware Deal

Table of Contents

The 1050% Price Hike Allegation: Understanding AT&T's Concerns

AT&T's central claim revolves around a projected 1050% increase in the price of certain VMware services following Broadcom's acquisition. This isn't a minor adjustment; it represents an astronomical jump that could significantly impact AT&T's operations and potentially those of other major telecoms reliant on VMware's infrastructure. While the exact methodology behind the 1050% figure remains somewhat opaque, AT&T has cited internal analyses and projections based on Broadcom's past behavior and statements regarding pricing strategies post-acquisition. The implication is that Broadcom, once in control of VMware, will leverage its market dominance to extract substantially higher prices from existing customers like AT&T.

- Specific VMware services affected: AT&T hasn't publicly specified every service impacted, but their statements suggest crucial networking and virtualization components central to their network operations are at risk of dramatic price increases.

- Examples of current pricing and projected prices post-acquisition: Precise figures are scarce due to the confidential nature of these contracts; however, AT&T's filings hint at potentially massive differences between current costs and projected future costs. The scale of the alleged price increase underscores the gravity of their concerns.

- Impact on AT&T's business operations: Such a massive price hike could negatively affect AT&T's profitability, potentially forcing them to increase prices for their own services or reduce their reliance on VMware, impacting service quality and potentially creating wider industry disruption.

- Links to relevant news articles and official statements: [Insert links to relevant news articles and official statements from AT&T and regulatory bodies].

Antitrust Concerns and Regulatory Scrutiny

Beyond the immediate financial impact, AT&T's opposition rests on strong antitrust concerns. The merger raises the specter of reduced competition and increased market dominance for Broadcom, potentially stifling innovation and ultimately harming consumers. The acquisition could lead to a monopolistic or oligopolistic market structure, reducing choice and driving up prices across various sectors reliant on VMware's technology. The FTC and the EU Commission are actively investigating these concerns, with the potential for a lengthy regulatory review process.

- Key antitrust arguments presented by AT&T: AT&T's argument centers on the potential for Broadcom to leverage VMware's market position to unfairly raise prices and limit competition, hurting both businesses and consumers.

- Broadcom's responses to antitrust concerns: Broadcom has countered by arguing that the acquisition will promote innovation and efficiency, leading to benefits for consumers in the long run. They have also committed to certain measures aimed at alleviating antitrust concerns.

- Timeline of regulatory reviews and investigations: The regulatory review process is ongoing, with a timeline still uncertain. The outcome will significantly shape the future of the tech landscape.

- Potential outcomes of the regulatory process: Possible outcomes range from outright rejection of the merger to conditional approval with stipulations designed to address antitrust concerns.

Broadcom's Counterarguments and Proposed Solutions

Broadcom has vigorously defended its proposed acquisition, asserting that the deal will foster innovation and efficiency within the industry. They argue that integrating VMware's technologies into their portfolio will lead to synergies and cost savings that ultimately benefit consumers. While acknowledging AT&T's concerns, Broadcom has attempted to address them by proposing certain concessions and remedies, potentially including commitments to maintaining fair pricing and competition.

- Key arguments presented by Broadcom: Broadcom emphasizes the potential for enhanced product offerings, improved customer experiences, and long-term economic benefits resulting from the merger.

- Proposed remedies to alleviate concerns: Broadcom's proposed solutions might include commitments to pricing transparency, continued support for competing technologies, or other measures designed to address concerns about reduced competition.

- Broadcom's commitment to competition: Broadcom is attempting to demonstrate its dedication to maintaining a competitive market, despite the potential for increased market share post-acquisition.

- Potential impact on shareholders and the market: The success or failure of the deal will have significant ramifications for Broadcom's and VMware's shareholders, as well as broader market dynamics.

The Wider Implications for the Tech Industry

The Broadcom-VMware deal has far-reaching implications for the tech industry, particularly within cloud computing, networking, and enterprise software. The potential for increased prices and reduced competition could ripple through these sectors, affecting businesses and consumers alike. This acquisition also sets a precedent; if approved, it could trigger a wave of similar mergers and acquisitions, potentially leading to further consolidation and a less competitive landscape.

- Impact on cloud infrastructure costs: The acquisition could lead to increased costs for cloud infrastructure services, affecting businesses of all sizes.

- Influence on enterprise software market dynamics: The deal could reshape the enterprise software market, potentially leading to reduced choice and increased pricing for businesses.

- Potential for consolidation in the tech sector: This merger could spur further consolidation within the tech sector, potentially leading to a smaller number of dominant players.

- Long-term effects on innovation and competition: The ultimate impact on innovation and competition remains uncertain and will depend heavily on the regulatory outcome and Broadcom's post-acquisition behavior.

Conclusion: The Future of the Broadcom-VMware Deal and the 1050% Price Hike Specter

The debate surrounding the Broadcom-VMware acquisition is far from over. AT&T's strident opposition, fueled by the alleged 1050% price hike, has injected significant uncertainty into the deal's future. While Broadcom maintains its commitment to a competitive market, the antitrust concerns and the potential for dramatic price increases remain serious obstacles. The regulatory review process will ultimately determine the fate of this merger, shaping the future of the tech landscape and the pricing dynamics for crucial enterprise software and cloud services. Stay informed about the developments in this crucial case, as the future of VMware and the potential for significant price increases remain hotly contested. Continue to follow the evolving story of the Broadcom VMware acquisition, and monitor the regulatory response to concerns about this potential price increase. The implications for the tech industry and consumers are profound.

Featured Posts

-

Nba Playoffs Charles Barkleys Prediction For Warriors Vs Timberwolves

May 16, 2025

Nba Playoffs Charles Barkleys Prediction For Warriors Vs Timberwolves

May 16, 2025 -

Foot Locker Executive Departures A Trend Analysis

May 16, 2025

Foot Locker Executive Departures A Trend Analysis

May 16, 2025 -

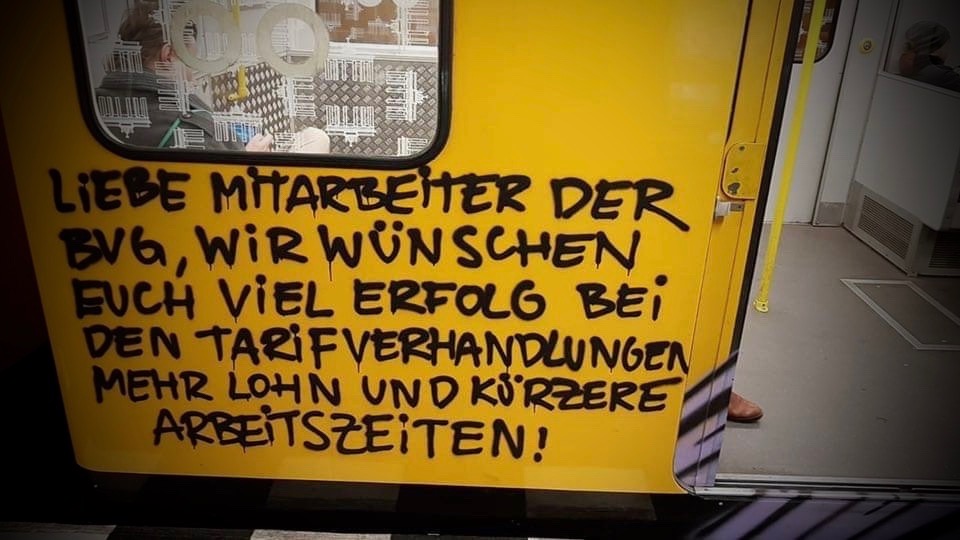

Berlin Bvg Streik Was Bedeutet Das Fuer Pendler Und Touristen

May 16, 2025

Berlin Bvg Streik Was Bedeutet Das Fuer Pendler Und Touristen

May 16, 2025 -

How Mentorship Kim And Snell Enhances The Success Of Korean Baseball Players

May 16, 2025

How Mentorship Kim And Snell Enhances The Success Of Korean Baseball Players

May 16, 2025 -

Jalen Brunsons Ankle Recovery Progress And Sundays Game Outlook

May 16, 2025

Jalen Brunsons Ankle Recovery Progress And Sundays Game Outlook

May 16, 2025