1050% Price Hike For VMware? AT&T Sounds The Alarm On Broadcom's Proposal

Table of Contents

AT&T's Concerns and the Potential for Monopoly

AT&T's opposition to the Broadcom-VMware merger centers on the potential for a significant reduction in competition within the virtualization market. They argue that Broadcom's acquisition would create a monopoly, allowing them to leverage their market dominance to drastically increase prices for VMware products and services. This, AT&T claims, would stifle innovation and severely limit choices for businesses that rely on VMware solutions.

- Increased prices for VMware products and services: AT&T predicts a substantial increase in licensing fees, support contracts, and other associated costs, potentially crippling smaller businesses.

- Reduced innovation due to lack of competition: Without significant competition, Broadcom may have less incentive to innovate and improve VMware's offerings, leading to stagnation in the market.

- Limited choices for businesses relying on VMware solutions: The merger could create a situation where businesses are locked into a single, expensive vendor with limited alternatives.

- Potential for anti-competitive practices by Broadcom: AT&T expresses concerns about Broadcom potentially engaging in anti-competitive practices to further solidify their market position and limit the growth of competitors.

"The proposed acquisition raises serious concerns about the potential for monopolistic practices and harm to competition," stated an AT&T representative in a recent public statement. The impact on AT&T's operations, specifically their reliance on robust and competitively priced virtualization technologies, is substantial. The monopoly concerns extend beyond AT&T, encompassing the entire telecommunications sector and raising significant antitrust issues.

The 1050% VMware Price Hike: Fact or Speculation?

The 1050% figure, while dramatic, is based on analyses comparing Broadcom's historical pricing strategies in past acquisitions with the current VMware market. While not a confirmed price increase, the analysis suggests a potential for substantial price hikes, particularly for specific VMware products and services. It's crucial to note that this number is a projection based on extrapolations and various scenarios, and the actual increase might vary.

- Breakdown of potential price increases for various VMware offerings: Some analysts predict more significant price increases for niche products and advanced features while others anticipate moderate increases for widely used products.

- Comparison to current market prices: Analyzing current VMware pricing against Broadcom's past acquisition targets reveals a potential for a significant upward trend.

- Analysis of Broadcom's pricing strategies in past acquisitions: Examining Broadcom’s history reveals a pattern of significant price increases post-acquisition in some cases, fueling concerns about VMware's future pricing.

- Expert opinions on the likelihood of such significant price hikes: Industry experts are divided, with some believing the 1050% figure is an exaggeration, while others warn of substantial price increases, albeit perhaps less dramatic. Further VMware pricing analysis is needed for a clearer picture.

The VMware pricing debate highlights the complexities involved in evaluating the potential impact of this merger. A thorough VMware price increase analysis, considering various factors and scenarios, is critical for understanding the risks involved.

Impact on Businesses and the Broader Tech Industry

The potential VMware price hike has far-reaching implications for businesses and the broader tech industry. Companies heavily reliant on VMware solutions face the prospect of significant increased IT costs, potentially impacting budgets, project timelines, and overall operational efficiency. This could trigger a domino effect across various sectors.

- Increased IT costs for businesses: The price increases directly translate to higher operating expenses for businesses, potentially impacting profitability and competitiveness.

- Potential for budget overruns and project delays: Unexpected cost increases can disrupt carefully planned budgets and lead to project delays, impacting business continuity.

- Need for businesses to explore alternative virtualization solutions: Companies may be forced to evaluate and transition to alternative virtualization solutions, a costly and time-consuming process.

- Impact on cloud computing and data center infrastructure: The shift in VMware pricing could influence strategies related to cloud adoption and data center modernization.

The business impact extends beyond direct VMware users, affecting the entire ecosystem of software, services, and hardware that supports it. This ripple effect necessitates a careful evaluation of the long-term consequences.

Regulatory Scrutiny and Potential Outcomes

The Broadcom-VMware merger will face intense regulatory scrutiny from antitrust authorities globally. The outcome – approval, rejection, or conditional approval – will significantly impact the future of VMware and the virtualization market.

- Overview of relevant regulatory bodies involved: Agencies in the US, EU, and other jurisdictions will be involved in reviewing the merger, and their decisions will be pivotal.

- Potential antitrust challenges and legal battles: Given the potential for a monopoly, antitrust challenges and legal battles are likely.

- Possible outcomes and their implications for the market: The outcome of these reviews will determine whether the merger proceeds and, crucially, the conditions attached to its approval.

- Predictions for the future of VMware and Broadcom: The success or failure of the merger will reshape the landscape of the virtualization market.

The regulatory review process will play a crucial role in determining the ultimate impact of the merger on competition and the market for virtualization solutions.

Conclusion: The Future of VMware and the Need for Vigilance

The proposed Broadcom acquisition of VMware and the potential for a substantial VMware price hike present significant risks for businesses and the tech industry as a whole. The concerns voiced by AT&T, along with the potential for antitrust challenges, highlight the need for careful monitoring of this situation. The possibility of a monopoly and the resulting impact on innovation and competition are serious issues that demand attention.

To mitigate these potential risks, it's crucial to monitor the VMware price situation closely and stay updated on the Broadcom acquisition. Engage in discussions, advocate for fair competition, and explore alternative virtualization solutions to safeguard your business. Understanding the potential consequences of this merger is critical for navigating the evolving tech landscape. Stay informed and be prepared for the changes that may come.

Featured Posts

-

How To Stream Tracker Season 2 Episode 13 Online A Complete Guide

May 27, 2025

How To Stream Tracker Season 2 Episode 13 Online A Complete Guide

May 27, 2025 -

Fdyht Srqt Hqayb Fy Mtar Aljzayr Kamyrat Almraqbt Tkshf Alhqyqt

May 27, 2025

Fdyht Srqt Hqayb Fy Mtar Aljzayr Kamyrat Almraqbt Tkshf Alhqyqt

May 27, 2025 -

Apple Tv Studio Full List Of Release Dates And Premiere Dates

May 27, 2025

Apple Tv Studio Full List Of Release Dates And Premiere Dates

May 27, 2025 -

Trump Kueloenmegbizottja Ismet Talalkozott Putyinnal

May 27, 2025

Trump Kueloenmegbizottja Ismet Talalkozott Putyinnal

May 27, 2025 -

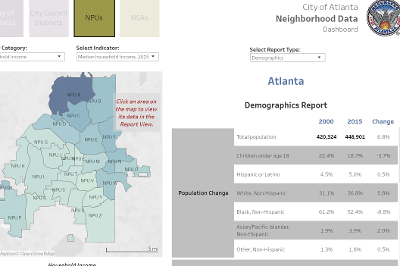

Is Atlanta The Most Surveilled City In America A Data Driven Look

May 27, 2025

Is Atlanta The Most Surveilled City In America A Data Driven Look

May 27, 2025