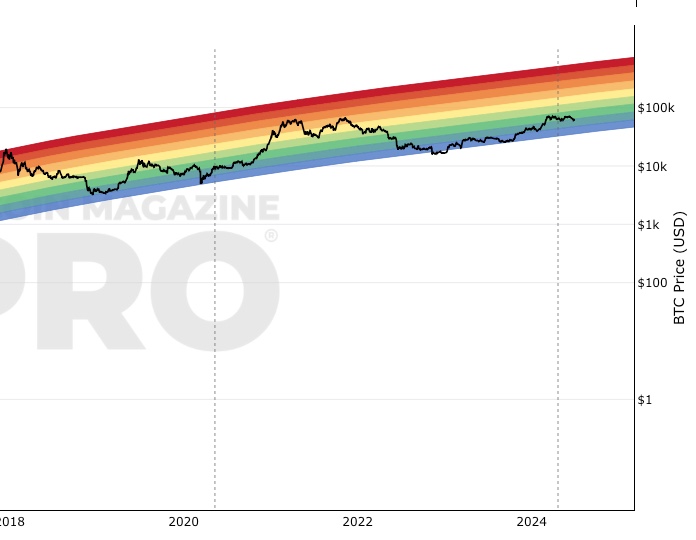

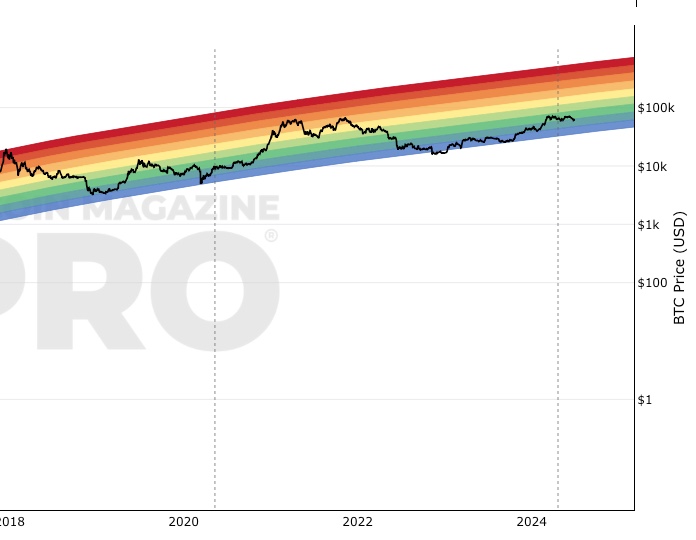

10x Bitcoin Multiplier: A Chart Of The Week Analysis

Table of Contents

Identifying Potential 10x Bitcoin Multiplier Opportunities

Achieving a 10x Bitcoin multiplier requires identifying opportune moments within the notoriously volatile cryptocurrency market. This involves careful analysis of both historical trends and current market dynamics.

Analyzing Historical Bitcoin Price Data

Examining Bitcoin's history reveals crucial insights into potential future price movements. Past bull runs offer valuable lessons in identifying patterns and gauging the potential for similar growth.

- 2010-2013: Early Bitcoin saw exponential growth, with prices increasing from cents to hundreds of dollars. This period demonstrated the rapid potential for early adoption and significant price appreciation.

- 2017 Bull Run: Bitcoin's price skyrocketed from under $1,000 to nearly $20,000, showcasing a dramatic increase in market capitalization and widespread adoption. This bull run provides a case study for understanding the dynamics of a major price surge.

- 2021 Bull Run: Another significant price increase, driven by increased institutional interest and widespread media attention.

Analyzing historical Bitcoin data from sources like TradingView and CoinMarketCap reveals recurring patterns. These patterns—such as increased trading volume preceding major price increases—can serve as valuable indicators for future predictions. Key Bitcoin chart patterns, identified through careful Bitcoin price history analysis, can help us pinpoint potential opportunities.

Evaluating Current Market Conditions

Currently, Bitcoin's price, trading volume, and market sentiment are all crucial factors to consider. Analyzing on-chain metrics like active addresses and hash rate provides additional insights into network activity and adoption.

- Current Price: The current Bitcoin price acts as a baseline for assessing potential growth.

- Trading Volume: High trading volume often indicates strong interest and potential for price volatility.

- Market Sentiment: Positive sentiment can fuel price increases, while negative sentiment can lead to corrections.

- On-Chain Metrics: Metrics like active addresses and hash rate reveal the health and adoption rate of the Bitcoin network.

Influential factors like regulatory news, technological advancements, and macroeconomic conditions will significantly impact Bitcoin's future performance. These external factors must be carefully considered when assessing the possibility of a 10x Bitcoin return.

Risk Assessment and Mitigation Strategies for a 10x Bitcoin Multiplier

While the potential for a 10x Bitcoin multiplier is exciting, it's crucial to acknowledge the inherent risks involved. Bitcoin’s price volatility can lead to significant losses.

Understanding the Volatility of Bitcoin

Bitcoin's price is known for its extreme volatility. Sharp price corrections and potential market crashes are a realistic possibility. Regulatory uncertainty further contributes to the risk.

- Sharp Price Corrections: Significant price drops can quickly wipe out a substantial portion of an investment.

- Market Crashes: Historically, the cryptocurrency market has experienced periods of significant downturn.

- Regulatory Uncertainty: Changes in regulatory frameworks can dramatically impact Bitcoin's price. Proper Bitcoin risk management is crucial.

Understanding these risks is paramount before investing in Bitcoin aiming for a 10x return.

Diversification and Portfolio Management

Diversifying your investment portfolio is a crucial risk mitigation strategy. Don't put all your eggs in one basket.

- Diversification: Invest in other assets, including stocks, bonds, and other cryptocurrencies.

- Alternative Strategies: Consider alternative strategies like dollar-cost averaging to reduce the impact of price volatility.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price, helps mitigate risk by averaging out the cost per Bitcoin.

Effective Bitcoin portfolio diversification and robust portfolio management are crucial for managing the risks associated with Bitcoin investment.

Chart of the Week Deep Dive: Interpreting Key Indicators

Our "Chart of the Week" uses technical and fundamental analysis to provide a comprehensive assessment of Bitcoin's potential.

Technical Analysis Techniques

We employ technical analysis techniques to identify potential price trends and support/resistance levels.

- Moving Averages: Identifying trends using moving averages of different timeframes.

- Support and Resistance Levels: Pinpointing price levels where buying and selling pressure is expected.

- Candlestick Patterns: Interpreting candlestick patterns to anticipate price reversals or continuations.

[Insert Chart of the Week here – a clear, well-labeled chart illustrating the technical analysis.]

Fundamental Analysis Insights

We also consider fundamental factors affecting Bitcoin's long-term value.

- Network Adoption: Increased adoption and usage drive long-term value.

- Technological Advancements: Innovations like the Lightning Network improve scalability and usability.

- Regulatory Developments: Positive regulatory developments can boost confidence and price.

By integrating technical and fundamental analysis, we gain a more holistic perspective on Bitcoin's price trajectory and potential for a 10x Bitcoin multiplier.

Conclusion: Navigating the Path to a 10x Bitcoin Multiplier

Our "Chart of the Week" analysis suggests the potential for a significant Bitcoin price increase, hinting at the possibility of a 10x Bitcoin multiplier. However, it's crucial to remember the inherent volatility and risks associated with Bitcoin investment. Achieving a 10x Bitcoin return necessitates a well-defined Bitcoin investment strategy, incorporating risk mitigation techniques like diversification and dollar-cost averaging.

Start your journey towards achieving a 10x Bitcoin multiplier by carefully analyzing the market, implementing a well-defined investment strategy, and staying updated on the latest Bitcoin market trends. Remember that thorough research and a cautious approach are essential for navigating the complexities of the cryptocurrency market and maximizing your chances of success. Don't forget to consider the potential for both significant gains and losses when pursuing a 10x Bitcoin return.

Featured Posts

-

Sufians Endorsement The Made In Gujranwala Exhibitions Triumph Under Gcci Presidents Leadership

May 08, 2025

Sufians Endorsement The Made In Gujranwala Exhibitions Triumph Under Gcci Presidents Leadership

May 08, 2025 -

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

May 08, 2025

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

May 08, 2025 -

Ben Affleck On Matt Damon The Smart Strategy Behind His Career Success

May 08, 2025

Ben Affleck On Matt Damon The Smart Strategy Behind His Career Success

May 08, 2025 -

Psl 10 Ticket Sales Commence Today

May 08, 2025

Psl 10 Ticket Sales Commence Today

May 08, 2025 -

Izjava Pavla Grbovica Komentar Na Predloge Prelazne Vlade

May 08, 2025

Izjava Pavla Grbovica Komentar Na Predloge Prelazne Vlade

May 08, 2025