11 Million ETH Accumulated: Implications For Ethereum's Price

Table of Contents

Who is Accumulating ETH and Why?

The accumulation of 11 million ETH isn't happening in a vacuum. Several key players are driving this trend, each with their own motivations.

Large Institutional Investors

Institutional investors, such as hedge funds and investment firms, are increasingly recognizing the long-term potential of Ethereum.

- Evidence of institutional investment in ETH: Recent reports indicate a significant increase in ETH holdings by major financial institutions, driven by growing acceptance of cryptocurrencies as an asset class.

- Reasons for their interest: Institutional investors are attracted to Ethereum's robust blockchain technology, its role in the burgeoning DeFi ecosystem, and its potential for future growth. Long-term investment strategies are a major driver, as are the opportunities presented by staking and participation in DeFi protocols.

- Keyword integration: The increasing prevalence of "institutional ETH investment" and significant "hedge fund ETH holdings" are key indicators of this trend.

Retail Investors and HODLers

Individual investors and long-term holders ("HODLers") also contribute significantly to ETH accumulation.

- Growth of retail ETH ownership: The growing popularity of cryptocurrency among individual investors has fueled a surge in ETH ownership, driven by both belief in its future and speculation.

- Impact of positive sentiment and market narratives: Positive news stories and a generally bullish market sentiment encourage retail investors to hold onto their ETH and potentially acquire more.

- Keyword integration: The increase in "retail ETH investors" and the unwavering stance of "ETH HODLers" contribute significantly to the overall "long-term ETH investment" narrative.

Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) play a vital role in ETH accumulation, particularly within the DeFi landscape.

- Growth of ETH locked in DeFi protocols: A substantial amount of ETH is locked in various DeFi protocols, providing liquidity and facilitating decentralized applications (dApps).

- Impact on liquidity and price: The locking of ETH in DeFi protocols affects the circulating supply, potentially influencing the price due to decreased availability.

- Keyword integration: The growth of "ETH DeFi" and the resulting "DEX ETH holdings" are crucial for maintaining "DeFi liquidity" and impacting the overall price of ETH.

The Impact of ETH Accumulation on Price Volatility

The massive ETH accumulation has a significant impact on price volatility through supply and demand dynamics and market sentiment.

Supply and Demand Dynamics

Increased ETH accumulation directly impacts supply and demand dynamics.

- Reduced circulating supply: As more ETH is held, the circulating supply decreases, potentially creating scarcity.

- Potential for future price increases due to scarcity: This scarcity, in a market with consistent demand, can drive up the price.

- Keyword integration: Understanding the interplay between "ETH supply" and "ETH demand" is crucial in analyzing "price volatility."

Market Sentiment and Speculation

ETH accumulation heavily influences market sentiment and speculation.

- Positive news stories driving price increase: News of large ETH accumulations fuels positive sentiment, leading to price increases.

- Potential for future price corrections: While accumulation often indicates a bullish market, price corrections are possible due to various market factors.

- Keyword integration: Analyzing "market sentiment" and understanding "ETH speculation" is critical to predicting potential "price prediction" scenarios.

Potential Future Scenarios for Ethereum's Price

Analyzing the implications of 11 million ETH accumulated requires considering both bullish and bearish scenarios.

Bullish Scenarios

Several factors could contribute to a bullish market for ETH.

- Factors driving a bullish market: Continued institutional investment, increasing DeFi adoption, and positive regulatory developments could fuel a significant price increase.

- Potential price targets: Predicting price targets is speculative, but a sustained bullish trend could lead to significant gains.

- Keyword integration: Speculation around an "Ethereum price prediction" and a potential "ETH bull run" are important considerations for those hoping for a significant "price increase."

Bearish Scenarios

Conversely, several factors could negatively impact Ethereum's price.

- Factors that could lead to a bearish market: Regulatory uncertainty, a broader cryptocurrency market downturn, or unforeseen technical issues could dampen the price.

- Risks associated with ETH investment: While ETH offers significant potential, it's crucial to acknowledge the inherent risks associated with cryptocurrency investments.

- Keyword integration: The possibility of an "ETH bear market" and subsequent "price correction" are important considerations and highlight the "ETH risk" associated with the investment.

Conclusion

The accumulation of 11 million ETH has profound implications for Ethereum's price. Understanding the interplay of supply and demand, coupled with careful analysis of market sentiment, is crucial for navigating this dynamic market. While the significant ETH accumulation points towards a potentially bullish future, it's essential to consider both bullish and bearish scenarios. Stay informed about Ethereum price fluctuations, learn more about ETH investment strategies, and analyze the impact of ETH accumulation on your portfolio before making any investment decisions. Conduct thorough Ethereum price analysis and stay updated on ETH market trends to make informed choices.

Featured Posts

-

Central Cordoba Salud Institucional Y El Gigante De Arroyito

May 08, 2025

Central Cordoba Salud Institucional Y El Gigante De Arroyito

May 08, 2025 -

Taiwan Dollars Surge Pressure Mounts For Economic Reform

May 08, 2025

Taiwan Dollars Surge Pressure Mounts For Economic Reform

May 08, 2025 -

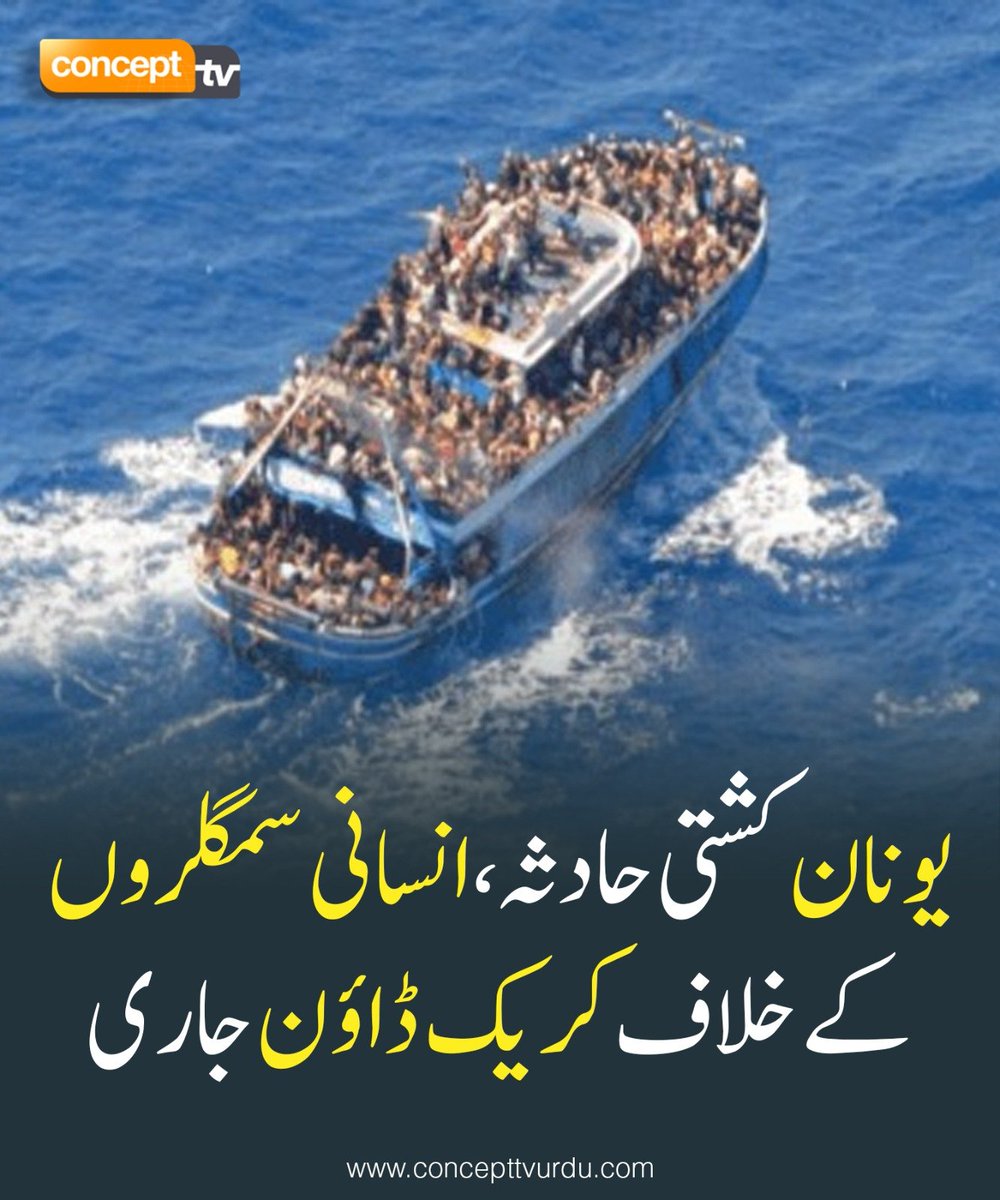

Ansany Asmglng Awr Kshty Hadthe Myn Mlwth 4 Mlzman Grftar Mraksh

May 08, 2025

Ansany Asmglng Awr Kshty Hadthe Myn Mlwth 4 Mlzman Grftar Mraksh

May 08, 2025 -

Trump Crypto Chiefs Bold Bitcoin Forecast After Price Jump

May 08, 2025

Trump Crypto Chiefs Bold Bitcoin Forecast After Price Jump

May 08, 2025 -

Flamengo Sergio Hernandez Asume Como Entrenador

May 08, 2025

Flamengo Sergio Hernandez Asume Como Entrenador

May 08, 2025