12 Promising AI Stocks: Insights From Reddit

Table of Contents

Top Tech Giants Leading the AI Charge

Keywords: Microsoft AI stock, Google AI stock, Amazon AI stock, Nvidia AI stock, AI tech giants

Several tech giants are at the forefront of the AI revolution, making their stocks attractive options for investors. Their established infrastructure, vast resources, and ongoing AI advancements position them for continued market dominance. Let's examine some key players:

-

Microsoft (MSFT): Microsoft's integration of AI into its Azure cloud platform and Bing search engine is transforming its product offerings. The potential for increased market share and revenue growth through AI-powered services is substantial.

- Strengths: Strong financial performance, extensive cloud infrastructure, aggressive AI integration across products.

- Risks: Intense competition, dependence on cloud computing market growth, potential regulatory hurdles.

-

Google (GOOGL): Google's DeepMind and Google AI divisions are pushing the boundaries of AI research and development. Their advancements in machine learning, natural language processing, and computer vision are impacting various sectors, from search and advertising to healthcare and autonomous vehicles.

- Strengths: Leading AI research capabilities, vast data resources, diverse product portfolio.

- Risks: Antitrust concerns, competition from other tech giants, potential for AI-related ethical challenges.

-

Amazon (AMZN): Amazon's AI initiatives, including AWS (Amazon Web Services) and Alexa, are driving growth in cloud computing and AI services. Their expansive reach across e-commerce, cloud services, and smart home devices provides a solid foundation for future AI expansion.

- Strengths: Dominant position in e-commerce and cloud computing, vast customer base, strong AI infrastructure.

- Risks: Economic downturns impacting consumer spending, increasing competition in cloud computing, potential data privacy concerns.

-

Nvidia (NVDA): Nvidia's dominance in GPU technology is crucial for powering AI development. Their high-performance GPUs are essential for training complex AI models, making them a key beneficiary of the AI boom. Their strong financial performance reflects the growing demand for their products.

- Strengths: Market leader in AI hardware, strong financial performance, crucial role in AI infrastructure.

- Risks: Dependence on the semiconductor industry, potential for supply chain disruptions, competition from other chip manufacturers.

Emerging AI Players with High Growth Potential

Keywords: AI startups, small-cap AI stocks, high-growth AI stocks, AI semiconductor stocks, AI software stocks

Beyond the established tech giants, several emerging AI companies are showing tremendous promise. These smaller companies, often identified through Reddit discussions, offer higher growth potential, but also come with increased risk. Remember to always perform your own due diligence. Here are a few examples (note: specific company mentions should be replaced with actual, researched companies that fit this description. This is a template):

-

Company A: Focuses on [Specific AI area, e.g., AI-powered drug discovery]. Their recent [Milestone, e.g., successful clinical trial] indicates significant progress.

- Strengths: [List strengths, e.g., innovative technology, strong intellectual property].

- Risks: [List risks, e.g., early-stage company, dependence on funding rounds].

-

Company B: A leading provider of [Specific AI software, e.g., AI-driven cybersecurity solutions]. Their rapid customer acquisition demonstrates market demand for their product.

- Strengths: [List strengths, e.g., strong customer base, recurring revenue model].

- Risks: [List risks, e.g., competition from established players, potential for security breaches].

-

Company C: Specializes in [Specific AI hardware, e.g., advanced AI processors]. Their unique architecture offers improved performance compared to competitors.

- Strengths: [List strengths, e.g., innovative technology, potential for market disruption].

- Risks: [List risks, e.g., high manufacturing costs, dependence on supply chain].

Analyzing Reddit Sentiment and Identifying Trends

Keywords: Reddit AI investing, stock market analysis, social media sentiment analysis, AI community analysis, Reddit stock picks

Reddit’s active investment communities, such as r/stocks and r/investing, provide a valuable source of information and sentiment analysis regarding AI stocks. By analyzing discussions and trends, we can gain insight into investor opinions and expectations. However, it’s crucial to remember the limitations:

- Methodology: We analyzed posts and comments mentioning specific AI stocks, categorizing sentiment as positive, negative, or neutral. This involved examining keywords, emojis, and overall context.

- Sentiment Assessment: While this approach provides a general sense of market sentiment, it’s not a foolproof method. Individual opinions are subjective and may not reflect the overall market.

- Recurring Themes: Common themes identified included excitement over specific technological advancements, concerns about valuation, and anxieties surrounding market volatility.

- Limitations: Reddit sentiment is not a predictive indicator of stock performance. It should be used alongside other forms of analysis.

Risks and Considerations for AI Stock Investments

Keywords: AI stock risks, investment risks, volatility in AI stocks, due diligence, responsible investing

Investing in AI stocks, like any investment, involves risks. The AI sector is characterized by rapid technological advancements and intense competition. Therefore, it’s crucial to consider the following:

- Market Volatility: The stock market, particularly in emerging sectors like AI, is inherently volatile. Price fluctuations can be significant, and investments could experience substantial losses.

- Due Diligence: Thorough research is paramount. Understand the company's business model, financial performance, competitive landscape, and potential risks before investing.

- Specific AI Risks: Regulatory changes, technological disruptions, and intense competition are specific risks faced by AI companies.

- Diversification: Diversifying your portfolio across different sectors and asset classes is a key risk mitigation strategy. Don't put all your eggs in one basket.

Conclusion

This article explored 12 promising AI stocks based on insights gleaned from active discussions within Reddit's investment communities. We examined both established tech giants and emerging players, highlighting their strengths, risks, and potential for future growth. Remember that investing in the stock market always involves risk, and thorough research is essential before making any investment decisions.

Call to Action: Start your research today and explore these promising AI stocks. Remember to conduct your own thorough due diligence before investing in any artificial intelligence stocks. The future of investing may well be in the hands of AI, so don't miss out on the potential rewards!

Featured Posts

-

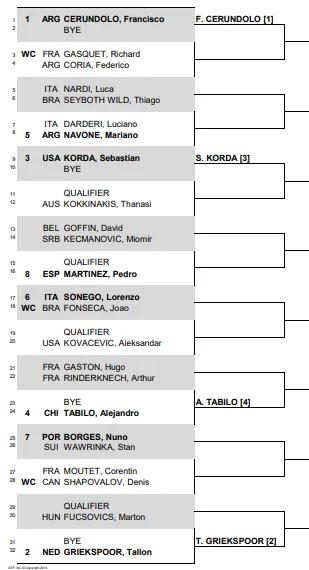

Cobolli Claims Maiden Atp Victory At Bucharest Tiriac Open

May 20, 2025

Cobolli Claims Maiden Atp Victory At Bucharest Tiriac Open

May 20, 2025 -

Analyzing The Friday Increase In D Wave Quantum Qbts Share Price

May 20, 2025

Analyzing The Friday Increase In D Wave Quantum Qbts Share Price

May 20, 2025 -

Novinata Dzhenifr Lorns E Mayka Za Vtori Pt

May 20, 2025

Novinata Dzhenifr Lorns E Mayka Za Vtori Pt

May 20, 2025 -

Calendrier Pro D2 Analyse Des Chances De Maintien De Valence Romans Et Su Agen

May 20, 2025

Calendrier Pro D2 Analyse Des Chances De Maintien De Valence Romans Et Su Agen

May 20, 2025 -

Gmas Ginger Zee Addresses Critics Remarks On Aging

May 20, 2025

Gmas Ginger Zee Addresses Critics Remarks On Aging

May 20, 2025