$2.4 Billion Catalyst Deal: Honeywell Acquires Johnson Matthey's Precious Metal Technologies Unit

Table of Contents

Deal Details and Financial Implications

Acquisition Price and Structure

The $2.4 billion price tag represents a significant investment by Honeywell, solidifying their commitment to expanding their presence in the lucrative precious metal technologies sector. The acquisition was primarily funded through cash, reflecting Honeywell's strong financial position. While the exact breakdown of the payment structure remains undisclosed, the deal's swift closure suggests a relatively straightforward transaction with minimal contingencies.

- Financial Figures: The $2.4 billion price includes the assumption of certain liabilities associated with the Johnson Matthey unit. Precise details regarding these liabilities and the net purchase price haven't been publicly released, though financial analysts are closely monitoring the situation.

- Investment Banking Firms: Several prominent investment banking firms likely played key advisory roles in this complex transaction, though specific names haven't been officially confirmed. Their expertise in mergers and acquisitions within the chemical and industrial sectors was crucial in facilitating the smooth completion of the deal.

- Synergies and Cost Savings: Honeywell expects substantial synergies through this acquisition, primarily in terms of economies of scale and streamlined operations. Combining Johnson Matthey's technological expertise with Honeywell's existing infrastructure is projected to generate significant cost savings in the long run, enhancing profitability.

- Impact on Honeywell's Stock Price: The market's initial reaction to the announcement was largely positive, with Honeywell's stock price showing a modest increase. However, the long-term impact on the stock price will depend on the successful integration of the acquired unit and the overall performance of the combined entity in the competitive catalyst market.

Johnson Matthey's Precious Metal Technologies Unit – A Closer Look

Key Technologies and Market Position

Johnson Matthey's precious metal technologies unit is a leader in the development and production of advanced catalysts for various applications. This acquisition brings a wealth of cutting-edge technologies under Honeywell's umbrella.

- Types of Catalysts: The acquired unit specializes in automotive catalysts (crucial for emission control), industrial catalysts (used in chemical processing and refining), and specialized catalysts for niche applications within the chemical industry. This diverse portfolio strengthens Honeywell's position across various market segments.

- Market Share Data: While precise market share figures for Johnson Matthey's precious metal technologies division aren't publicly available, the unit holds a significant position, especially in the automotive catalyst market. This acquisition substantially bolsters Honeywell's existing market share.

- Key Clients and Partnerships: Johnson Matthey has long-standing relationships with major players in the automotive and chemical industries. These partnerships, now under Honeywell's purview, provide access to a substantial client base and valuable collaborative opportunities.

- Innovative Technologies and Patents: The acquired unit holds a portfolio of patents and innovative technologies in catalyst design and manufacturing. These intellectual property assets are a valuable asset for Honeywell, furthering its research and development capabilities in catalyst technology.

Implications for the Automotive and Chemical Industries

Automotive Emission Control

This acquisition has significant implications for the automotive industry's ongoing efforts to meet increasingly stringent emission regulations.

- Impact on the Supply Chain: The integration of Johnson Matthey's operations into Honeywell's network will likely reshape the automotive catalyst supply chain, potentially impacting pricing and delivery times for automakers.

- Potential Advancements in Emission Control Technology: Combining Honeywell's existing expertise with Johnson Matthey's technological prowess could lead to advancements in emission control technology, resulting in more efficient and environmentally friendly vehicles.

- Analysis of the Competitive Landscape: The acquisition significantly alters the competitive dynamics within the automotive catalyst market, consolidating market power and potentially influencing pricing strategies.

Chemical Processing and Other Applications

The impact extends beyond the automotive sector, affecting various chemical processes and industrial applications.

- Specific Examples: The acquired technologies are used in numerous chemical processes, including refining, petrochemicals, and pharmaceuticals. This acquisition enhances Honeywell's capabilities in these critical sectors.

- Potential for Innovation and Efficiency Improvements: The integration of Johnson Matthey's technologies is expected to drive innovation and efficiency improvements within chemical processing, leading to cost reductions and enhanced sustainability.

- Future of Catalyst Technology: This deal signifies a strong commitment to investing in and advancing catalyst technology, positioning Honeywell at the forefront of this crucial field.

Competition and Market Share

Key Competitors and Market Dynamics

This acquisition significantly reshapes the competitive landscape within the catalyst market.

- Main Competitors: Before the acquisition, Honeywell already competed with several major players in the catalyst market. This acquisition enhances their competitive position, potentially putting pressure on rivals.

- Market Consolidation: The deal reflects a trend towards market consolidation in the catalyst sector, driven by the need for greater scale and technological expertise.

- Long-Term Implications for Market Share: Honeywell's increased market share will likely lead to greater influence over pricing and industry standards within the catalyst market.

Conclusion

Honeywell's $2.4 billion acquisition of Johnson Matthey's precious metal technologies unit is a landmark deal with far-reaching implications for the automotive, chemical, and broader industrial sectors. The acquisition brings together two industry leaders, creating a formidable force in the catalyst market. This merger promises to drive technological advancements, enhance efficiency, and potentially reshape the competitive landscape. The combination of resources and expertise positions Honeywell for continued growth and leadership in the development and application of cutting-edge catalyst technologies.

Call to Action: Stay informed on the evolving landscape of catalyst technology and the impact of this landmark deal. Follow us for further updates on the Honeywell-Johnson Matthey acquisition and other significant developments in the industry. Learn more about the future of precious metal technologies and the implications of this $2.4 billion catalyst deal.

Featured Posts

-

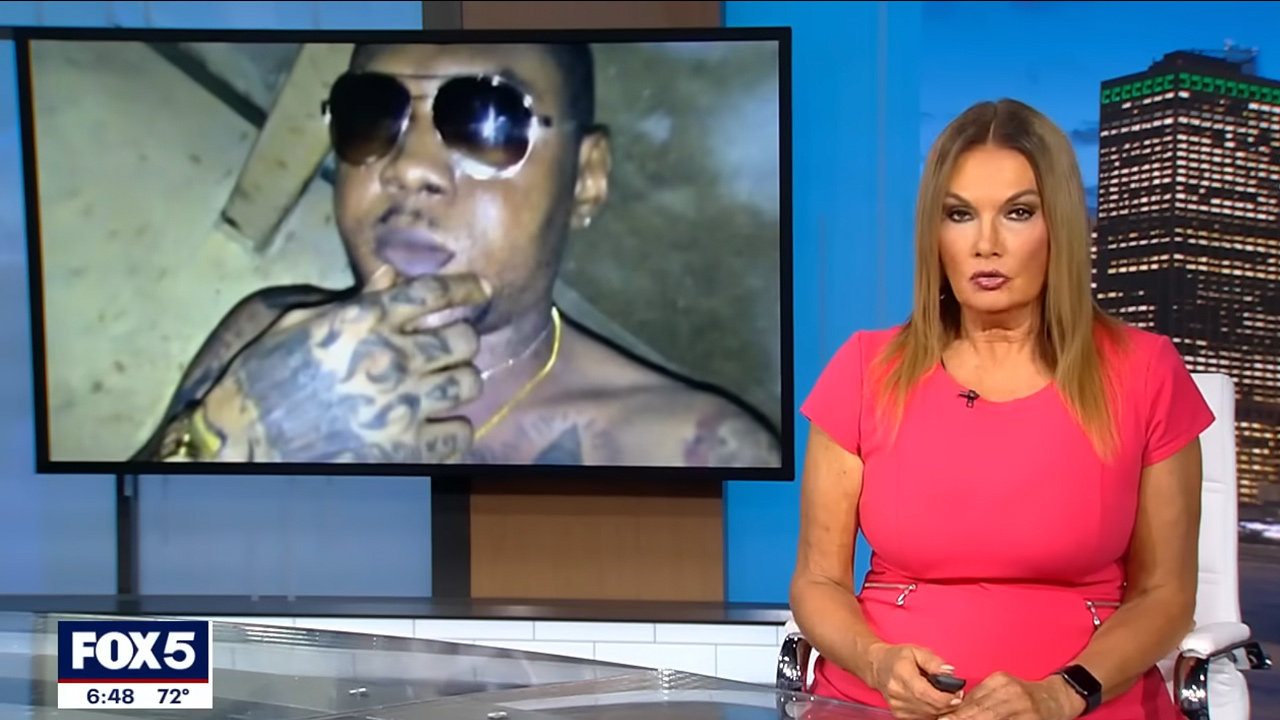

Vybz Kartels Exclusive Interview Life In Prison Family And Future Plans

May 23, 2025

Vybz Kartels Exclusive Interview Life In Prison Family And Future Plans

May 23, 2025 -

Cat Deeleys This Morning Outfit How To Nail The Cowboy Denim Trend

May 23, 2025

Cat Deeleys This Morning Outfit How To Nail The Cowboy Denim Trend

May 23, 2025 -

Landslide Risk Prompts Urgent Livestock Evacuation In Swiss Alps

May 23, 2025

Landslide Risk Prompts Urgent Livestock Evacuation In Swiss Alps

May 23, 2025 -

Untangling The Threads Cobra Kais Continuity And Its Impact On The Karate Kid Universe

May 23, 2025

Untangling The Threads Cobra Kais Continuity And Its Impact On The Karate Kid Universe

May 23, 2025 -

Antht Mbarat Qtr W Alkhwr Bkhsart Qtr W Msharkt Ebd Alqadr

May 23, 2025

Antht Mbarat Qtr W Alkhwr Bkhsart Qtr W Msharkt Ebd Alqadr

May 23, 2025

Latest Posts

-

Rio Tinto Addresses Concerns Regarding Pilbaras Environmental Impact

May 23, 2025

Rio Tinto Addresses Concerns Regarding Pilbaras Environmental Impact

May 23, 2025 -

The Pilbara Debate Rio Tinto Vs Andrew Forrest On Environmental Sustainability

May 23, 2025

The Pilbara Debate Rio Tinto Vs Andrew Forrest On Environmental Sustainability

May 23, 2025 -

The Controversy Surrounding Thames Waters Executive Bonuses

May 23, 2025

The Controversy Surrounding Thames Waters Executive Bonuses

May 23, 2025 -

Thames Waters Executive Bonus Scheme Transparency And Accountability

May 23, 2025

Thames Waters Executive Bonus Scheme Transparency And Accountability

May 23, 2025 -

Andrew Forrest And Rio Tinto Clash Over Pilbaras Environmental Future

May 23, 2025

Andrew Forrest And Rio Tinto Clash Over Pilbaras Environmental Future

May 23, 2025