20-Cent Gas Price Increase: Impact And Analysis

Table of Contents

Impact on Consumers

The 20-cent gas price increase directly translates to higher transportation costs for everyday consumers. This seemingly small increase quickly adds up, significantly impacting household budgets.

Increased Transportation Costs

- Daily Commute: A 20-cent increase per gallon can add up to $10-$20 per month, or even more, depending on commute distance and vehicle fuel efficiency. This extra expense can strain already tight household budgets.

- Weekly Grocery Shopping: Increased fuel costs directly impact the cost of transporting goods, ultimately leading to higher prices at the grocery store. Consumers will see an increase in their overall food bill.

- Vacation Travel: With gas prices rising, many families are reconsidering their summer vacation plans or opting for closer, less fuel-intensive destinations. The overall cost of leisure travel increases considerably.

These increased costs may force consumers to adapt their behavior. Many are likely to reduce unnecessary driving, carpool more frequently, or even consider switching to more fuel-efficient vehicles or public transportation to mitigate the impact of this gas price increase.

Inflationary Pressure

The 20-cent gas price increase doesn't exist in a vacuum. It contributes to overall inflation, impacting the cost of goods and services across the board.

- Food Transportation: A significant portion of food prices reflects transportation costs. The increased fuel prices will inevitably increase the cost of transporting agricultural products from farms to processing plants and finally to grocery stores.

- Manufacturing Costs: Many manufactured goods rely on transportation throughout their supply chains. The increased gas prices contribute to higher manufacturing costs, ultimately leading to higher prices for consumers.

This inflationary pressure can significantly impact consumer spending and potentially slow down economic growth as people tighten their belts in response to rising prices across the board. The gas price increase acts as a catalyst for broader economic instability.

Impact on Businesses

Businesses, particularly those heavily reliant on transportation, are also feeling the pinch from this 20-cent gas price increase.

Increased Operational Costs

- Logistics Companies: Trucking companies, delivery services, and other logistics businesses face a direct and substantial increase in their operational costs. This can lead to delays and higher shipping charges.

- Retail Businesses: Retailers relying on trucking for product deliveries will see increased costs, which may be passed on to consumers through higher prices.

- Agriculture: The agricultural sector is significantly affected, impacting the cost of transporting produce and livestock. This rise in transport costs can translate to higher food prices.

Businesses are exploring strategies to mitigate these rising fuel costs. This includes investing in fuel-efficient vehicles, optimizing delivery routes, and potentially renegotiating contracts with transportation providers. However, these efforts may not fully offset the financial burden imposed by the significant gas price increase.

Impact on Profit Margins

The increased fuel costs directly impact businesses' profit margins. This squeeze can lead to various consequences.

- Reduced Profits: Businesses may absorb some of the increased fuel costs, leading to lower profits. This can hinder business growth and investment.

- Price Increases for Consumers: To maintain profit margins, many businesses may pass the increased fuel costs onto consumers, leading to higher prices for goods and services.

- Reduced Investment and Expansion: Facing tighter margins, businesses might reduce investment in expansion, new technologies, or hiring.

Industries with already thin profit margins are particularly vulnerable. The long-term effects of this sustained gas price increase could significantly impact business growth and job creation.

Governmental Response and Policy Implications

The 20-cent gas price increase highlights the need for government intervention and long-term strategic planning.

Potential Policy Interventions

The government could implement several strategies to address this significant gas price increase and its economic consequences.

- Tax Relief: Temporary tax breaks on fuel could offer short-term relief to consumers and businesses.

- Fuel Subsidies: Direct subsidies could help reduce the burden on specific industries or vulnerable populations.

- Investment in Renewable Energy: Long-term investments in renewable energy sources would reduce dependence on fossil fuels and contribute to energy independence.

Each of these policy options has potential pros and cons that need careful consideration, balancing immediate relief with long-term sustainability.

Long-Term Energy Security

The gas price increase underscores the urgency of transitioning towards more sustainable and secure energy sources.

- Renewable Energy Sources: Investing in solar, wind, and other renewable energies is crucial for long-term energy independence and price stability.

- Energy Efficiency Improvements: Government initiatives promoting energy-efficient technologies and practices can reduce overall fuel consumption.

Government policies play a critical role in driving this transition, fostering innovation, and promoting the adoption of sustainable energy solutions. Long-term energy security is crucial for mitigating the impact of future gas price increases.

Conclusion

The 20-cent gas price increase presents a significant challenge, impacting consumers through higher transportation and living costs, and businesses through increased operational expenses and reduced profit margins. The inflationary pressure created by this increase has broader economic consequences. Governments must respond with carefully considered policies that address both immediate needs and long-term energy security. To mitigate the effects of future gas price increases, it's vital to monitor gas price increases, understand the impact of gas price increases, and prepare for future gas price increases. Consider exploring fuel-efficient vehicles, alternative transportation options, and advocating for sustainable energy policies.

Featured Posts

-

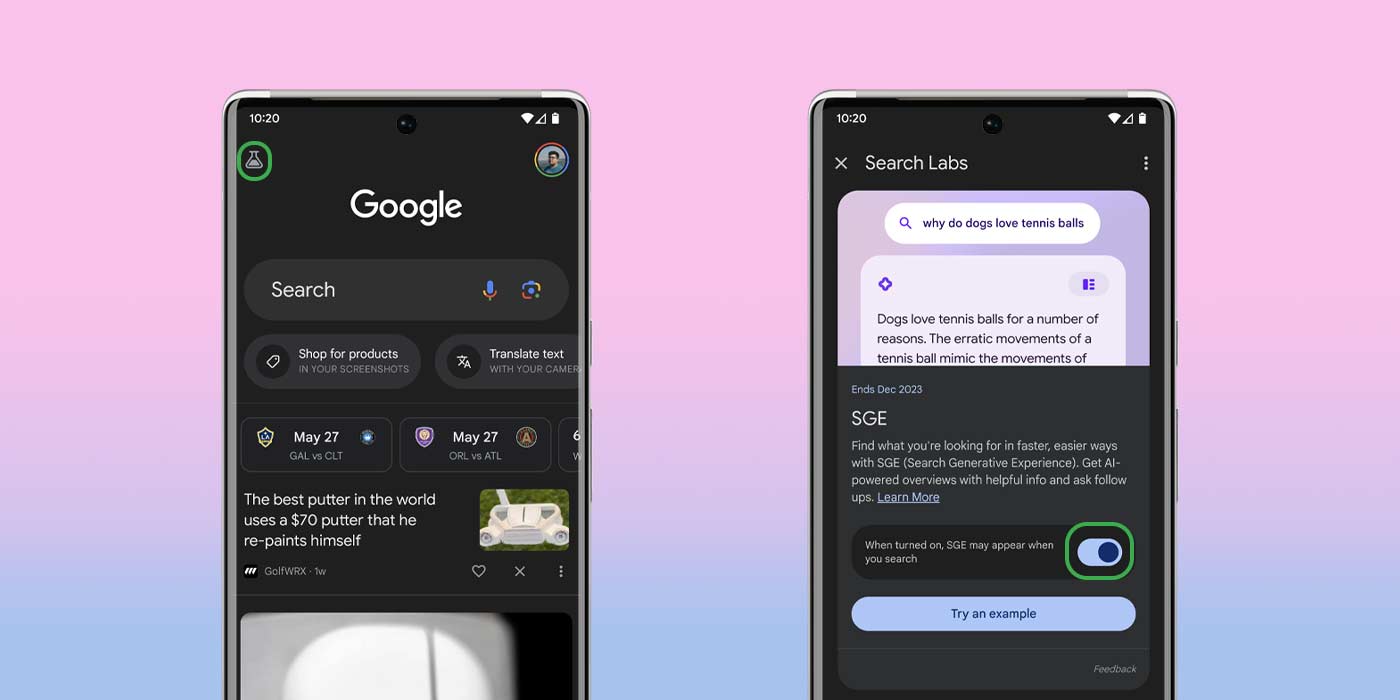

Understanding Google Searchs Ai Mode

May 22, 2025

Understanding Google Searchs Ai Mode

May 22, 2025 -

Fratii Tate In Bucuresti Parada Triumfala Cu Bolidul De Lux

May 22, 2025

Fratii Tate In Bucuresti Parada Triumfala Cu Bolidul De Lux

May 22, 2025 -

Subpoena Report Puts Strain On Blake Lively And Taylor Swifts Friendship

May 22, 2025

Subpoena Report Puts Strain On Blake Lively And Taylor Swifts Friendship

May 22, 2025 -

Tuerkiye Nato Da Yeni Bir Doenem Zirvedeki Rolue Ve Gelecegi

May 22, 2025

Tuerkiye Nato Da Yeni Bir Doenem Zirvedeki Rolue Ve Gelecegi

May 22, 2025 -

Tivoli Clisson Images Interieures Du Theatre Selectionne Au Loto Du Patrimoine 2025

May 22, 2025

Tivoli Clisson Images Interieures Du Theatre Selectionne Au Loto Du Patrimoine 2025

May 22, 2025