2025 Gold Market: First Double-Digit Weekly Loss Streak

Table of Contents

Causes of the Double-Digit Weekly Loss in the 2025 Gold Market

Several interconnected factors contributed to the significant drop in gold prices. Understanding these factors is crucial for assessing the current situation and predicting future gold market trends.

Strengthening US Dollar

The inverse relationship between the US dollar and gold prices is well-established. A stronger dollar makes gold more expensive for holders of other currencies, reducing demand. The recent surge in the dollar's value, driven by several economic factors, significantly impacted gold prices.

- Increased Federal Reserve Rate Hikes: The Federal Reserve's aggressive interest rate hikes aimed at curbing inflation made the dollar more attractive to investors seeking higher returns, diverting capital away from gold.

- Positive Economic Indicators: Stronger-than-expected economic data from the US boosted investor confidence in the dollar, further strengthening its position against other currencies, including the Euro and the Yen. This is reflected in the Dollar Index (DXY) which showed a [insert hypothetical percentage increase] rise during the period.

- Global Economic Uncertainty: Ironically, even amidst global economic uncertainty, the dollar often acts as a safe haven, drawing investment away from gold.

Rising Interest Rates

Rising interest rates increase the opportunity cost of holding gold, a non-yielding asset. When interest rates climb, investors can earn higher returns on alternative investments like bonds and savings accounts, making gold less appealing.

- Increased Bond Yields: The rise in interest rates led to higher bond yields, making bonds a more attractive alternative to gold for income-seeking investors.

- Decreased Demand for Safe-Haven Assets: With rising interest rates offering returns, the demand for traditional safe-haven assets like gold decreased, as investors felt less need to hedge against economic uncertainty.

- Projected Interest Rate Trajectory: The anticipation of further interest rate increases in the coming months further dampened investor enthusiasm for gold, creating a negative feedback loop. [Insert hypothetical prediction of future interest rates].

Shifting Investor Sentiment

A change in investor sentiment towards gold also played a significant role in the recent downturn. Several factors contributed to this shift:

- Reduced Inflation Fears: Easing inflation concerns led some investors to reduce their gold holdings, believing that the need for a hedge against inflation had diminished.

- Geopolitical Developments: While geopolitical risks remain, certain events had a less negative impact on investor sentiment than previously expected, diminishing the demand for gold as a safe haven. [Insert specific geopolitical events if applicable with sources].

- Gold ETF Outflows: A significant outflow of gold from exchange-traded funds (ETFs) indicated a reduction in investor confidence and a shift towards other asset classes. Data from [insert source] show a [insert hypothetical percentage] decrease in gold ETF holdings.

Impact and Implications of the Gold Market Decline

The double-digit weekly loss in the gold market has far-reaching implications, both short-term and long-term.

Short-Term Market Volatility

The immediate impact of the decline was increased volatility in the gold market. This created opportunities and risks for traders.

- Technical Analysis Indicators: Technical indicators such as RSI and MACD showed signs of overselling, suggesting a potential short-term bounce.

- Support and Resistance Levels: Key support and resistance levels were tested, and further price fluctuations were anticipated based on how these levels held. [Insert hypothetical support and resistance levels].

- Trading Strategies: Short-term traders might use strategies like scalping or swing trading to capitalize on short-term price fluctuations.

Long-Term Outlook for Gold Investments

The long-term outlook for gold investments remains uncertain, depending on several factors.

- Inflationary Pressures: Persistent inflationary pressures could lead to renewed interest in gold as an inflation hedge.

- Geopolitical Instability: Escalating geopolitical tensions could increase the demand for gold as a safe haven asset.

- Central Bank Policies: The policies adopted by central banks worldwide will play a crucial role in determining the direction of gold prices in the long term.

Alternative Investment Strategies

Investors concerned about the recent gold market performance may explore alternative investment options.

- Other Precious Metals: Silver, platinum, and palladium offer diversification within the precious metals sector.

- Other Commodities: Energy commodities like oil and natural gas, or agricultural commodities, could provide different investment exposures.

- Diversified Portfolios: A well-diversified portfolio spread across various asset classes can help mitigate risks and reduce reliance on a single asset.

Conclusion

The first double-digit weekly loss streak in the 2025 gold market highlights the complex interplay between the US dollar strength, rising interest rates, and shifting investor sentiment. The short-term outlook suggests continued volatility, while the long-term forecast remains uncertain, dependent on several macroeconomic and geopolitical factors. It is crucial for investors to remain informed about 2025 gold market trends and conduct thorough research before making any investment decisions related to gold or other precious metals. Consider consulting a qualified financial advisor for personalized guidance in navigating the complexities of the 2025 gold market and building a robust investment strategy.

Featured Posts

-

Nhl Playoff Standings Showdown Saturday What To Watch

May 04, 2025

Nhl Playoff Standings Showdown Saturday What To Watch

May 04, 2025 -

Ford Remains Exclusive Automotive Partner Of The Kentucky Derby

May 04, 2025

Ford Remains Exclusive Automotive Partner Of The Kentucky Derby

May 04, 2025 -

Countdown To Kentucky Derby 151 A Complete Guide For Fans

May 04, 2025

Countdown To Kentucky Derby 151 A Complete Guide For Fans

May 04, 2025 -

Ibf Boxing News Ajagba Setback Bakole Parker Showdown

May 04, 2025

Ibf Boxing News Ajagba Setback Bakole Parker Showdown

May 04, 2025 -

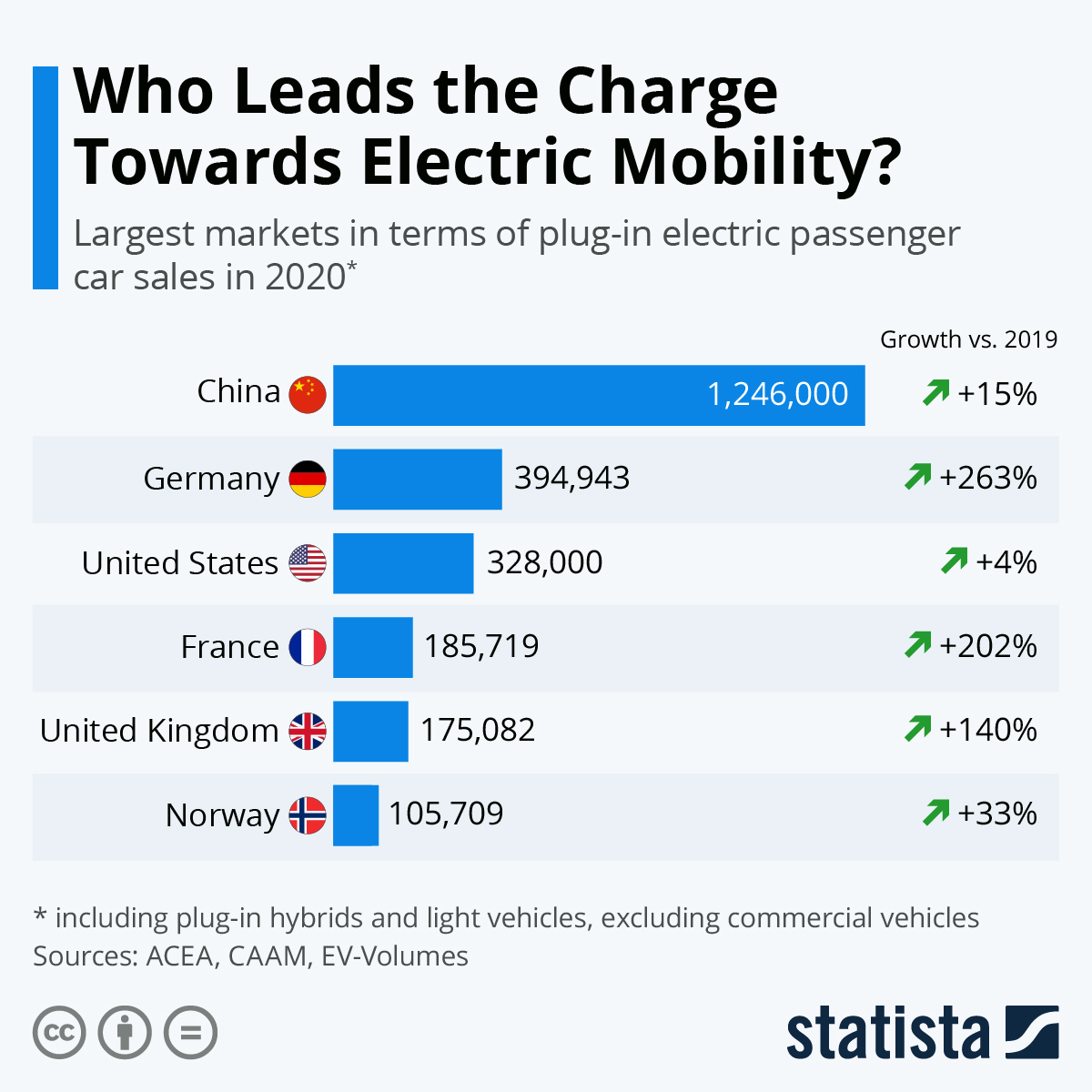

Chinas Electric Vehicle Rise Is America Prepared For Global Competition

May 04, 2025

Chinas Electric Vehicle Rise Is America Prepared For Global Competition

May 04, 2025