2025 Quantum Stock Outlook: Performance Analysis Of Rigetti (RGTI) And IonQ

Table of Contents

Rigetti Computing (RGTI) Stock Performance Analysis

Current Market Position and Technological Advantages

Rigetti Computing holds a significant position in the quantum computing industry, distinguished by its focus on a hybrid quantum architecture. This approach combines the power of superconducting qubits with classical computing capabilities, offering a potentially more robust and scalable solution. Their partnerships with various research institutions and corporations contribute to their market presence.

- Market Capitalization: (Insert current market cap data – requires real-time data update)

- Revenue Projections: (Insert projected revenue data – requires real-time data update and reputable source citation)

- Key Technological Differentiators: Hybrid architecture, advanced qubit control techniques, and a focus on practical applications.

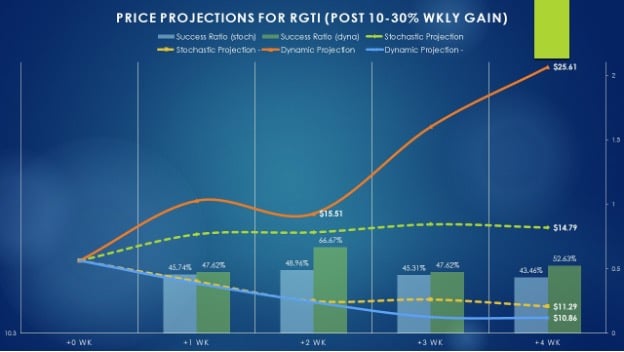

RGTI Stock Price Prediction and Future Growth Potential

Analyzing RGTI's historical stock performance reveals (insert historical data and trends, citing reliable sources). Future growth hinges on several factors: successful development and commercialization of its quantum computers, securing significant contracts, and the overall maturation of the quantum computing market. However, challenges exist, including intense competition from other quantum computing companies and the inherent risks associated with investing in a rapidly evolving technology.

- Projected EPS: (Requires real-time data update and reputable source citation)

- Potential Catalysts for Growth: Successful large-scale quantum simulations, groundbreaking algorithm development, and strategic partnerships.

- Risk Factors: Competition from established tech giants, funding challenges, technological hurdles in qubit scalability and error correction.

Investment Strategies for RGTI

Investing in RGTI requires a long-term perspective, given the nascent nature of the quantum computing industry. Investors should consider their risk tolerance and diversify their portfolios accordingly. A staggered investment approach, rather than a lump-sum investment, may mitigate risk.

- Risk Assessment: High risk, high reward potential.

- Diversification Strategies: Allocate a small percentage of your overall investment portfolio to RGTI.

- Potential Return on Investment: Potentially substantial long-term returns, but with significant short-term volatility.

IonQ Stock Performance Analysis

IonQ's Competitive Landscape and Technological Differentiation

IonQ distinguishes itself through its use of trapped ion technology, offering potential advantages in qubit coherence and scalability. Its competitive landscape includes other quantum computing companies employing different technologies. IonQ's progress in achieving high-fidelity quantum operations and securing commercial contracts is key to its success.

- Market Share: (Insert market share data – requires real-time data update and reputable source citation)

- Technological Advantages: High-fidelity qubits, scalability potential, and proven trapped ion technology.

- Partnerships and Collaborations: (List significant partnerships, if any).

IonQ Stock Price Predictions and Future Growth Potential

Analyzing IonQ's stock performance (insert historical data and trends, citing reliable sources) shows (insert analysis). Future growth depends on factors such as further technological advancements, securing significant contracts with commercial clients, and maintaining a strong competitive edge. Risk factors include competition, technological hurdles, and the overall market acceptance of quantum computing solutions.

- Projected Revenue Growth: (Requires real-time data update and reputable source citation)

- Key Performance Indicators: Qubit count, fidelity, gate speed, and error rates.

- Potential Risks and Challenges: Competition from other quantum computing companies, technological limitations, and securing sufficient funding.

Investment Strategies for IonQ

Similar to RGTI, investing in IonQ involves a long-term outlook and careful consideration of risk tolerance. Investors should diversify their investments and consider a phased approach.

- Risk Assessment: High risk, high reward potential.

- Diversification Strategies: Allocate a small percentage of your portfolio to IonQ.

- Potential Return on Investment: Potentially substantial long-term returns, but with considerable short-term volatility.

Comparison of Rigetti (RGTI) and IonQ: A 2025 Perspective

Side-by-Side Comparison of Key Metrics

| Metric | Rigetti (RGTI) | IonQ |

|---|---|---|

| Market Capitalization | (Insert data) | (Insert data) |

| Revenue (projected 2025) | (Insert data) | (Insert data) |

| Technology | Superconducting qubits (hybrid architecture) | Trapped ion qubits |

| Key Strengths | Hybrid approach, potential scalability | High-fidelity qubits, established tech |

| Key Risks | Technological challenges, competition | Scalability challenges, competition |

Identifying the Better Investment Opportunity

(Based on the provided data and analysis, offer a reasoned opinion on which company presents a more promising investment opportunity in 2025. Support this opinion with specific evidence from the analysis above. This section requires in-depth research and data analysis that cannot be provided here.)

Conclusion: Making Informed Decisions in the Quantum Stock Market

This analysis of Rigetti (RGTI) and IonQ offers a glimpse into the potential of quantum computing stocks. Both companies present opportunities but also carry significant risks. Thorough due diligence, including understanding the technological landscape, market dynamics, and financial performance, is crucial before investing in this sector. Remember, investing in quantum computing stocks, like RGTI and IonQ, is a long-term endeavor requiring patience and a tolerance for risk. Conduct further research, assess your risk tolerance, and make informed decisions based on your individual investment goals. Remember to consult with a financial advisor before making any investment decisions regarding quantum computing stocks such as RGTI and IonQ, and consider the 2025 outlook for these promising but volatile companies.

Featured Posts

-

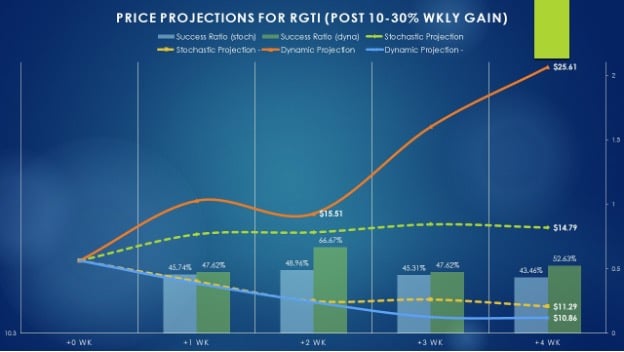

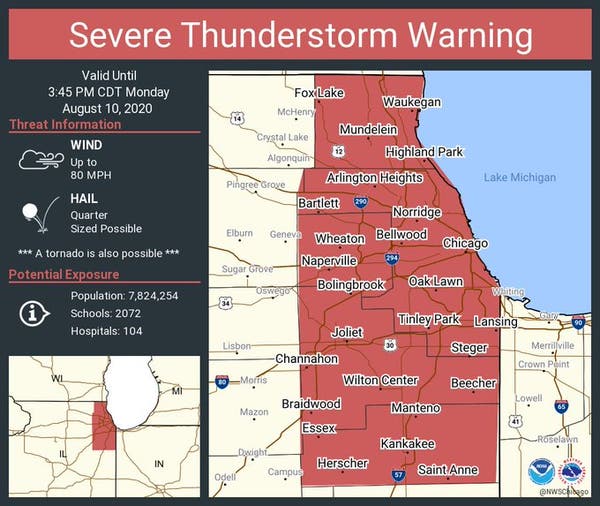

Watch Out For Damaging Winds Fast Moving Storms

May 21, 2025

Watch Out For Damaging Winds Fast Moving Storms

May 21, 2025 -

Directeur Hypotheken Intermediair Abn Amro Florius En Moneyou Karin Polman

May 21, 2025

Directeur Hypotheken Intermediair Abn Amro Florius En Moneyou Karin Polman

May 21, 2025 -

Hell City Nouvelle Brasserie Pres Du Hellfest A Clisson

May 21, 2025

Hell City Nouvelle Brasserie Pres Du Hellfest A Clisson

May 21, 2025 -

Car Dealerships Increase Pressure Against Government Ev Mandates

May 21, 2025

Car Dealerships Increase Pressure Against Government Ev Mandates

May 21, 2025 -

Athlete Poised To Break Trans Australia Run World Record

May 21, 2025

Athlete Poised To Break Trans Australia Run World Record

May 21, 2025