270MWh Battery Energy Storage System (BESS) Financing In Belgium

Table of Contents

Understanding the Belgian Energy Landscape and BESS Potential

Belgium is actively transitioning towards a more sustainable energy future, with ambitious targets for renewable energy integration. However, the intermittent nature of solar and wind power presents significant challenges to grid stability. This is where Battery Energy Storage Systems (BESS) play a vital role. A 270MWh BESS project can significantly enhance grid reliability, balancing supply and demand fluctuations, and enabling greater integration of renewable energy sources.

- Analysis of Belgium's renewable energy targets: Belgium aims to significantly increase its share of renewable energy in the coming years. Meeting these targets necessitates efficient energy storage solutions like BESS.

- Discussion of grid stability challenges and how BESS mitigates them: Integrating large amounts of intermittent renewable energy leads to voltage fluctuations and frequency instability. BESS provides a crucial buffer, ensuring grid stability and reliability.

- Overview of available government support schemes for BESS projects: The Belgian government recognizes the importance of energy storage and offers various incentives for BESS deployment, including subsidies, tax breaks, and feed-in tariffs. These incentives are designed to make BESS projects more financially attractive.

Exploring Financing Options for a 270MWh BESS Project

Securing funding for a 270MWh BESS project requires a multifaceted approach, incorporating various financing instruments.

Debt Financing

Bank loans, green bonds, and other debt instruments offer a significant portion of the capital needed. Green bonds, in particular, are gaining traction due to their focus on environmentally friendly projects.

- Advantages: Predictable repayments, potential tax benefits.

- Disadvantages: Requires strong creditworthiness, interest payments add to the overall cost.

- Eligibility Criteria: Varies depending on the lender, but generally involves a thorough financial assessment and project viability study.

Equity Financing

Attracting private equity, venture capital, and strategic investors offers long-term capital investment and expertise.

- Advantages: No debt repayment obligations, potential for higher returns.

- Disadvantages: Dilution of ownership, potential loss of control.

- Examples of successful projects: Several large-scale renewable energy projects in Belgium have successfully utilized equity financing.

Public-Private Partnerships (PPPs)

PPPs combine public and private sector resources, expertise, and risk-sharing.

- Advantages: Access to public funding, shared risk, efficient project management.

- Disadvantages: Complex negotiations, potential delays.

- Application Processes: Involve detailed proposals and negotiations with government agencies.

Grants and Subsidies

Government grants and subsidies significantly reduce the upfront costs.

- Advantages: Reduced financial burden, accelerates project development.

- Disadvantages: Competitive application process, specific eligibility criteria.

- Examples of successful projects: Numerous successful BESS projects in Belgium have leveraged government support.

Due Diligence and Risk Mitigation Strategies

A thorough due diligence process is crucial for successful 270MWh BESS project financing. This includes:

- Key elements of a comprehensive due diligence process: Technical feasibility studies, environmental impact assessments, market analysis, financial modeling, and legal review.

- Identification and assessment of major risks associated with BESS investment: Technology risk, regulatory risk, market risk, construction risk, operational risk.

- Strategies for minimizing financial and operational risks: Insurance, hedging strategies, robust project management, experienced project teams.

Legal and Regulatory Framework for BESS in Belgium

Navigating the Belgian regulatory landscape is critical for securing permits and ensuring compliance.

- Key regulatory bodies involved in BESS project approval: Federal and regional energy agencies, environmental protection agencies.

- Overview of permit applications and timelines: The application process can be lengthy, requiring meticulous documentation and stakeholder engagement.

- Environmental regulations specific to energy storage projects in Belgium: Environmental impact assessments are mandatory and compliance with relevant environmental regulations is essential.

Conclusion

Securing funding for a 270MWh BESS project in Belgium presents significant challenges but also substantial opportunities. A comprehensive financing strategy, encompassing debt, equity, and potentially PPPs, combined with a robust risk mitigation plan and meticulous adherence to the regulatory framework, is crucial for success. Understanding the Belgian energy market, leveraging available government incentives, and undertaking thorough due diligence are essential steps in this process. Ready to explore financing options for your own BESS project in Belgium? Contact us today to discuss your 270MWh or smaller-scale Battery Energy Storage System financing needs!

Featured Posts

-

Why Did Teddy Magic Quit Britains Got Talent Simon Cowells Surprise

May 04, 2025

Why Did Teddy Magic Quit Britains Got Talent Simon Cowells Surprise

May 04, 2025 -

Novorizontino Vs Corinthians Resumen Del Partido 0 1

May 04, 2025

Novorizontino Vs Corinthians Resumen Del Partido 0 1

May 04, 2025 -

Sandhagen Vs Figueiredo Key Moments And Results From Ufc On Espn 67

May 04, 2025

Sandhagen Vs Figueiredo Key Moments And Results From Ufc On Espn 67

May 04, 2025 -

Capitals 2025 Playoffs Push New Initiatives Unveiled By Vanda Pharmaceuticals

May 04, 2025

Capitals 2025 Playoffs Push New Initiatives Unveiled By Vanda Pharmaceuticals

May 04, 2025 -

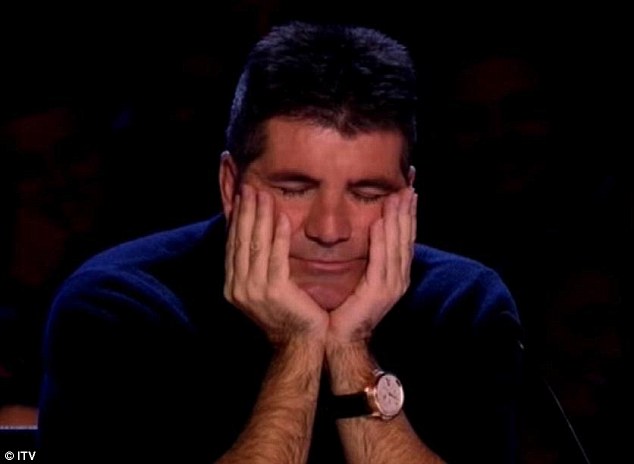

Partial Solar Eclipse Viewing In Nyc Time Location And Safety

May 04, 2025

Partial Solar Eclipse Viewing In Nyc Time Location And Safety

May 04, 2025