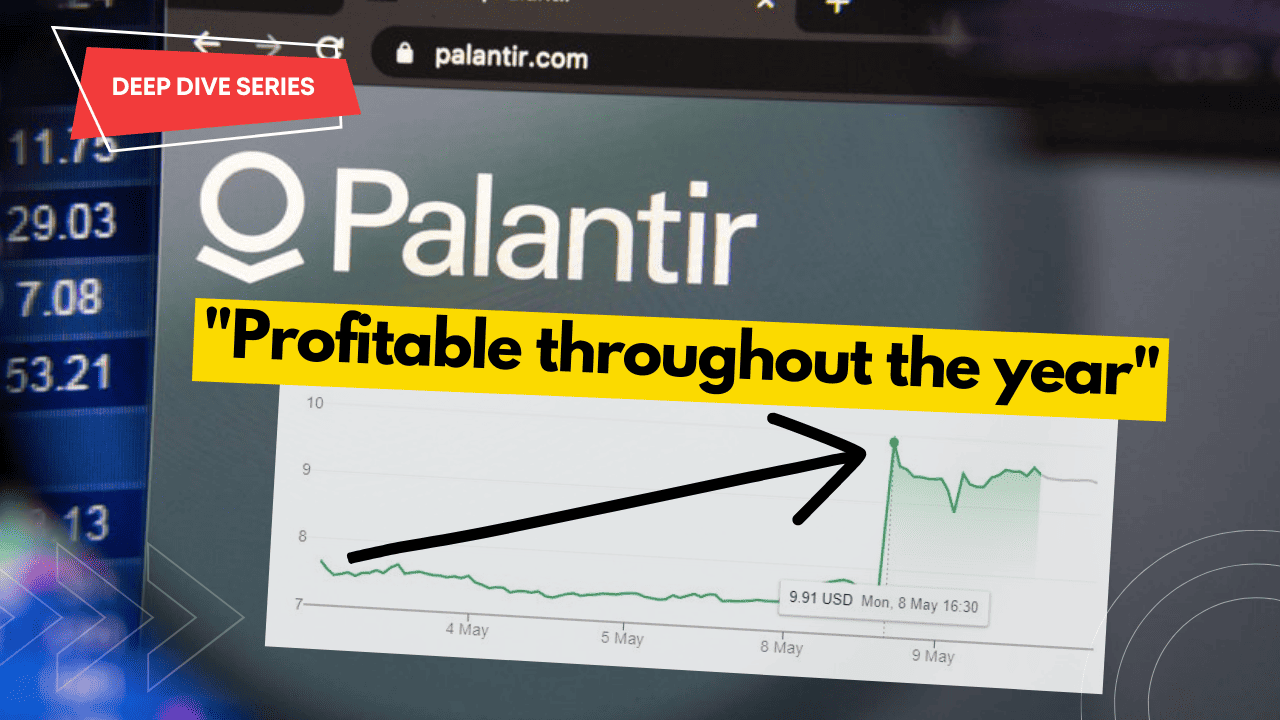

30% Drop For Palantir: Time To Invest?

Table of Contents

Analyzing the 30% Palantir Stock Price Decline

Understanding the Reasons Behind the Drop

Several factors likely contributed to Palantir's recent 30% stock price decline. Understanding these is crucial for evaluating the current Palantir stock performance and its implications for future Palantir investment.

-

Broader Tech Sector Downturn: The technology sector has experienced a significant downturn in recent months, impacting many tech companies, including Palantir. Investor sentiment towards growth stocks has soured, leading to widespread sell-offs.

-

Market Sentiment and Investor Concerns: Negative market sentiment surrounding the overall economy and rising interest rates has impacted investor confidence in growth stocks like Palantir. Concerns about future profitability and slowing revenue growth may also be contributing factors.

-

Specific Company News: While Palantir's recent earnings reports haven't been overwhelmingly negative, they might not have met overly optimistic market expectations. Any news regarding contract losses or delays could also negatively influence investor sentiment and impact the Palantir market analysis. A comparison of Palantir's performance against competitors in the data analytics space reveals a similar trend of market correction impacting the entire sector.

Evaluating Palantir's Long-Term Growth Potential

Despite the recent drop, Palantir boasts significant long-term growth prospects within the expanding data analytics market. Its future outlook remains positive, driven by several key factors:

-

Government Contracts: Palantir holds substantial government contracts, providing a steady revenue stream and a strong foundation for future growth. These contracts are crucial for Palantir's growth prospects and solidify their position in the market.

-

Commercial Partnerships: The company is aggressively expanding its commercial partnerships, targeting a wider range of industries and securing long-term contracts with major corporations. This diversification strategy mitigates reliance on government contracts and accelerates Palantir's expansion.

-

Technological Advancements: Palantir continues to invest heavily in research and development, staying at the forefront of data analytics technology. These advancements ensure its continued competitiveness and attract new clients.

-

Strong Competitive Advantage: Palantir's unique platform and expertise in big data analysis provide a strong competitive advantage in a rapidly growing market. This advantage is likely to play a key role in its future market share.

While Palantir faces challenges, its long-term growth potential in the data analytics market remains compelling.

Assessing the Risk and Reward of Investing in Palantir

Considering the Risks Associated with Palantir Stock

Investing in Palantir stock, like any technology stock, involves significant risks:

-

Volatility: Palantir's stock price is inherently volatile, subject to significant fluctuations based on market sentiment, news events, and overall economic conditions. This volatility is a common feature of technology stock investment.

-

Dependence on Government Contracts: A substantial portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and policy.

-

Competition: The data analytics market is increasingly competitive, with both established players and new entrants vying for market share. This competitive landscape requires constant innovation to maintain a leading edge.

-

Valuation: While the recent drop lowers the current Palantir stock valuation, it's still essential to carefully consider its current valuation against future growth projections.

Weighing the Potential Rewards Against the Risks

Despite the risks, the potential rewards of investing in Palantir are significant:

-

High Growth Potential: The data analytics market is experiencing exponential growth, presenting substantial opportunities for Palantir to expand its market share and revenue. The potential for high returns makes Palantir an attractive proposition.

-

Future Price Appreciation: If Palantir meets or exceeds its growth projections, the current Palantir stock price could experience significant appreciation, potentially offsetting the initial investment risks.

-

Potential for Dividends: While not currently paying dividends, Palantir's future financial performance might lead to the consideration of dividend payments to shareholders.

Conclusion: Should You Invest in Palantir After the 30% Drop?

The 30% Palantir price drop presents a complex investment scenario. While the reasons behind the decline—including broader market sentiment and specific company news—are valid concerns, Palantir's long-term growth potential in the data analytics sector remains significant. The risks associated with Palantir stock, particularly its volatility and reliance on government contracts, must be carefully considered.

Ultimately, whether the current situation represents a Palantir buying opportunity depends on your individual risk tolerance and investment goals. While investing in Palantir carries inherent risks, the current 30% price drop might represent a compelling entry point for long-term investors interested in the data analytics sector. Conduct thorough due diligence, including a comprehensive analysis of Palantir's financial statements and future prospects, and consult with a financial advisor before making any investment decisions related to Palantir stock. Remember, this article provides analysis; it is not financial advice.

Featured Posts

-

The Monkey 2025 A Potential Low Point In Stephen Kings Cinematic Year

May 09, 2025

The Monkey 2025 A Potential Low Point In Stephen Kings Cinematic Year

May 09, 2025 -

Champions League Semi Final Draw Barcelona Inter Arsenal Psg Match Dates

May 09, 2025

Champions League Semi Final Draw Barcelona Inter Arsenal Psg Match Dates

May 09, 2025 -

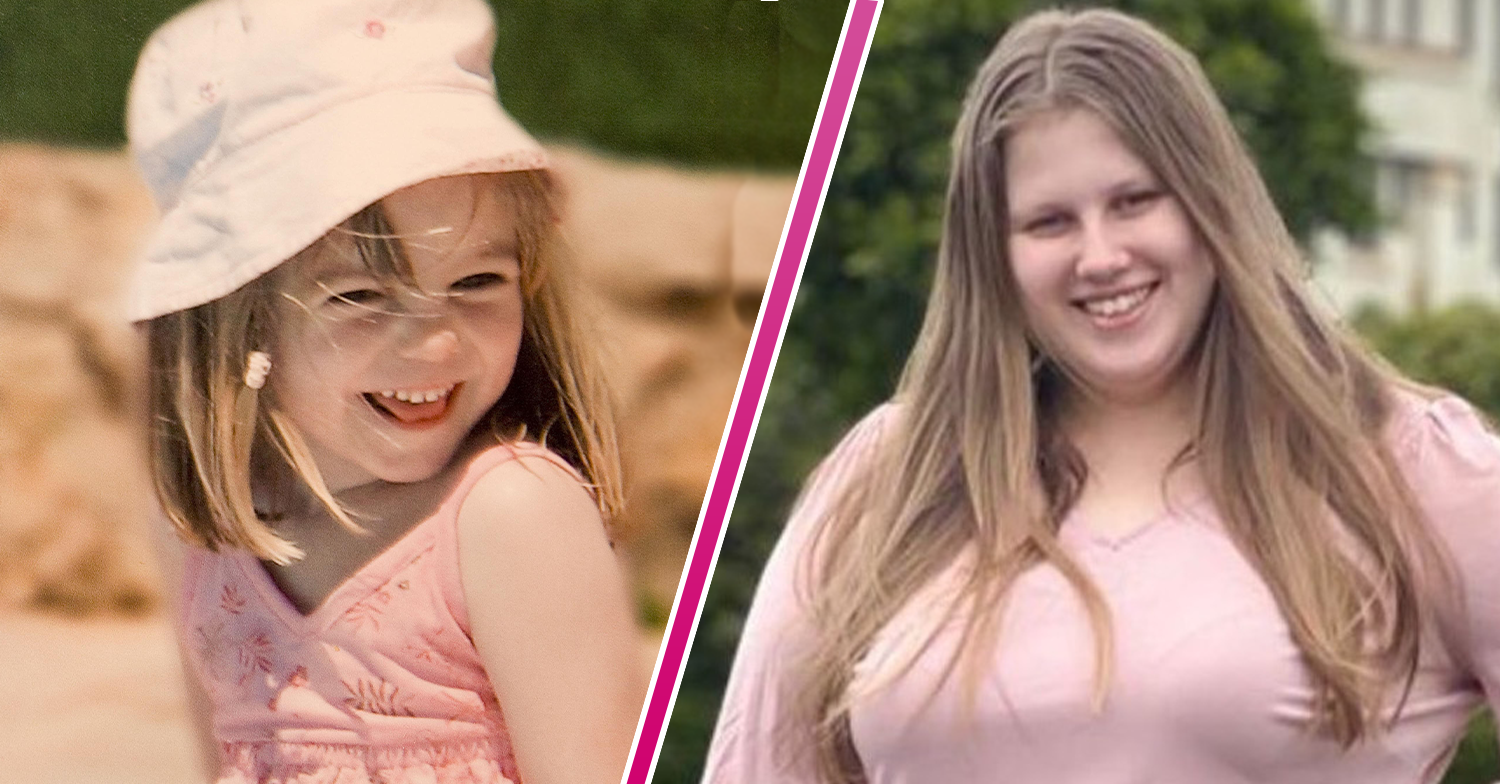

Woman 23 Claims To Be Madeleine Mc Cann Dna Test Results Revealed

May 09, 2025

Woman 23 Claims To Be Madeleine Mc Cann Dna Test Results Revealed

May 09, 2025 -

Nova Prisao Em Caso Madeleine Mc Cann Suspeita De Perseguicao Aos Pais

May 09, 2025

Nova Prisao Em Caso Madeleine Mc Cann Suspeita De Perseguicao Aos Pais

May 09, 2025 -

Taiwan Faces New Totalitarian Threat Lais Ve Day Speech Highlights Concerns

May 09, 2025

Taiwan Faces New Totalitarian Threat Lais Ve Day Speech Highlights Concerns

May 09, 2025