30% Drop In Palantir: Is It A Buy Or Sell Signal?

Table of Contents

Analyzing the Reasons Behind Palantir's Stock Decline

Weakening Q2 Earnings and Revenue Projections

Palantir's recent Q2 earnings report significantly underperformed expectations, triggering the substantial stock price decline. The missed revenue projections were largely attributed to several key factors. Slowing government spending, a key revenue source for Palantir, played a significant role. Increased competition in the data analytics market also put pressure on revenue growth. Key financial metrics such as EPS (earnings per share) and revenue growth figures fell short of analyst estimates, negatively impacting investor sentiment.

- Lower-than-expected government contract wins: Fewer than anticipated new contracts with government agencies impacted overall revenue.

- Increased operating expenses: Higher-than-projected operating costs further squeezed profit margins.

- Concerns about future growth potential: The underperformance raised concerns about Palantir's ability to meet future growth targets.

Macroeconomic Factors and Market Sentiment

The broader macroeconomic environment also contributed to Palantir's stock decline. Rising interest rates and persistent inflation have created a challenging climate for growth stocks, including Palantir. The overall tech sector downturn, characterized by decreased investor confidence and a general market correction, further exacerbated the situation. Negative news coverage and analyst downgrades added to the downward pressure on Palantir's stock price.

- Overall tech stock market correction: A widespread sell-off in the tech sector negatively impacted Palantir.

- Investor risk aversion due to economic uncertainty: Economic uncertainty led investors to move away from riskier assets.

- Negative media coverage impacting investor confidence: Negative news reports further eroded investor confidence in Palantir.

Evaluating Palantir's Long-Term Prospects and Potential for Growth

Strengths and Competitive Advantages

Despite the recent setback, Palantir possesses several key strengths and competitive advantages that warrant consideration. Its unique technology and expertise in big data analytics provide a strong foundation for future growth. The company's established relationships with government agencies and its expanding commercial customer base offer significant potential. Furthermore, Palantir's ongoing investments in artificial intelligence (AI) and related technologies could drive substantial future growth.

- Advanced data analytics capabilities: Palantir offers sophisticated data analytics solutions unmatched by many competitors.

- Strong relationships with government agencies: Government contracts provide a stable revenue stream.

- Expanding commercial customer base: Growth in the commercial sector offers diversification and significant future potential.

- Potential for AI-driven growth: Investments in AI are positioning Palantir for leadership in the evolving data analytics landscape.

Risks and Challenges Facing Palantir

It's crucial to acknowledge the risks and challenges facing Palantir. Intense competition from established tech giants presents a significant threat. Dependence on large government contracts exposes the company to potential fluctuations in government spending. Concerns remain about Palantir's ability to achieve sustained profitability and scale its operations efficiently. Regulatory scrutiny could also impact its future growth.

- Competition from established tech giants: Competition from larger, more established tech companies is a constant challenge.

- Dependence on large government contracts: Fluctuations in government spending could significantly impact revenue.

- Concerns about profitability and scaling: Achieving sustainable profitability and scaling operations effectively remain key challenges.

- Potential for regulatory scrutiny: Increased regulatory oversight could impact Palantir's operations and growth.

Making the Investment Decision: Buy, Sell, or Hold?

The 30% drop in Palantir stock presents a complex investment scenario. Whether to buy, sell, or hold depends heavily on individual risk tolerance, investment horizon, and financial goals. For investors with a long-term perspective and a higher risk tolerance, the current price might present a compelling buying opportunity, considering Palantir's innovative technology and long-term growth potential. However, investors with lower risk tolerance or shorter-term investment horizons might prefer to wait for greater clarity or consider alternative investment options. Strategies like dollar-cost averaging can help mitigate risk.

- Long-term perspective: A long-term investor might view the dip as a buying opportunity.

- Short-term perspective: A short-term investor might prefer to wait or sell.

- Risk tolerance: Higher risk tolerance favors buying; lower risk tolerance suggests caution.

Conclusion: Navigating the Palantir Stock Dip – Your Next Move

The 30% drop in Palantir stock presents a complex scenario. While the Q2 earnings and macroeconomic factors have contributed to the decline, Palantir's technological strengths and long-term growth potential remain noteworthy. It's crucial to weigh the risks and rewards carefully, considering your individual risk tolerance and investment goals. Conduct your own thorough due diligence and consult a financial professional before deciding whether to buy, sell, or hold your Palantir investments. Remember, this analysis is for informational purposes only and not financial advice. The decision to buy, sell, or hold Palantir stock rests solely with you.

Featured Posts

-

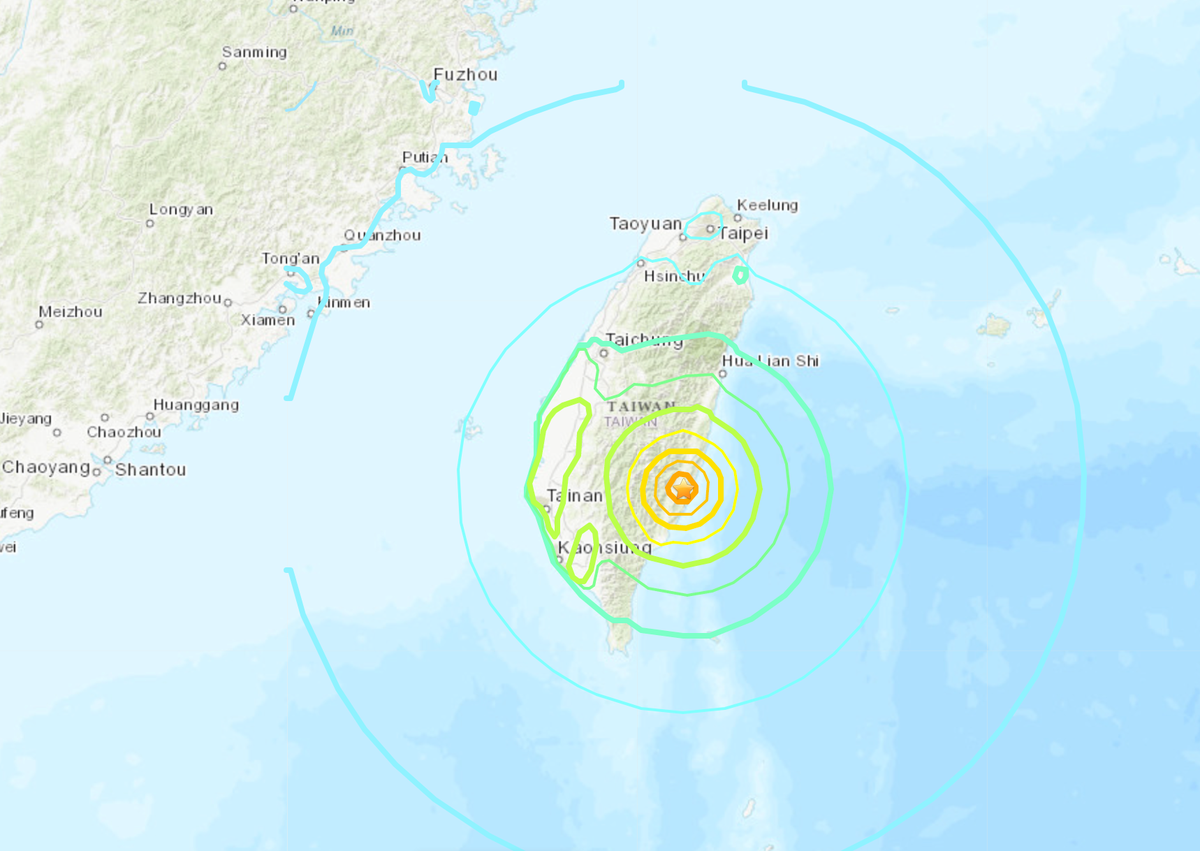

Totalitarian Threat Lais Stark Ve Day Warning To Taiwan

May 10, 2025

Totalitarian Threat Lais Stark Ve Day Warning To Taiwan

May 10, 2025 -

The Nottingham Attacks Victims Voices And The Path To Healing

May 10, 2025

The Nottingham Attacks Victims Voices And The Path To Healing

May 10, 2025 -

Land Your Dream Private Credit Role 5 Dos And Don Ts To Follow

May 10, 2025

Land Your Dream Private Credit Role 5 Dos And Don Ts To Follow

May 10, 2025 -

Oilers Defeat Golden Knights 3 2 But Vegas Secures Playoff Berth

May 10, 2025

Oilers Defeat Golden Knights 3 2 But Vegas Secures Playoff Berth

May 10, 2025 -

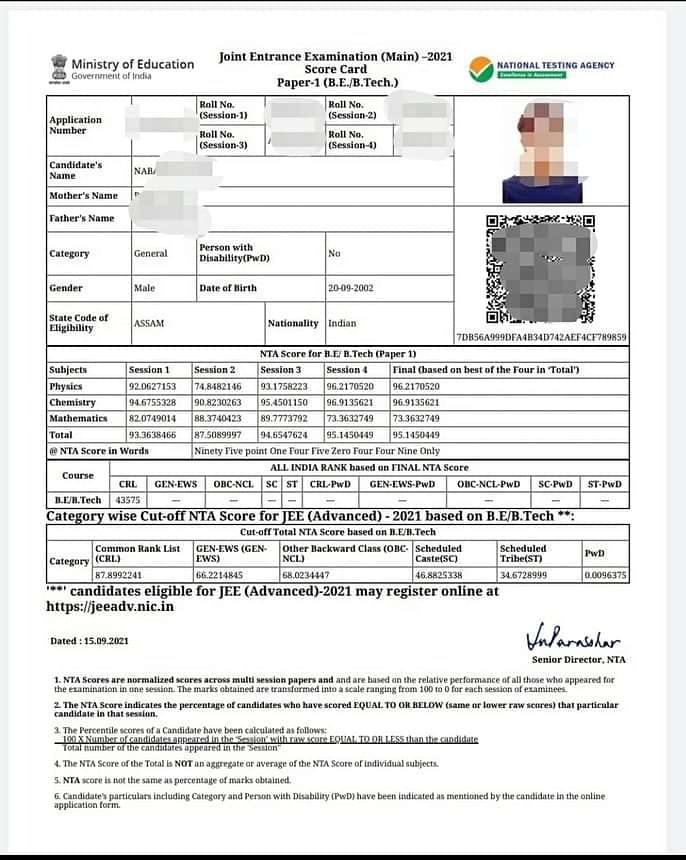

Madhyamik Pariksha 2025 Result Check Merit List Online

May 10, 2025

Madhyamik Pariksha 2025 Result Check Merit List Online

May 10, 2025