30% Tariffs On Chinese Goods: The Trump Legacy Until 2025?

Table of Contents

The Origins and Rationale Behind the 30% Tariffs

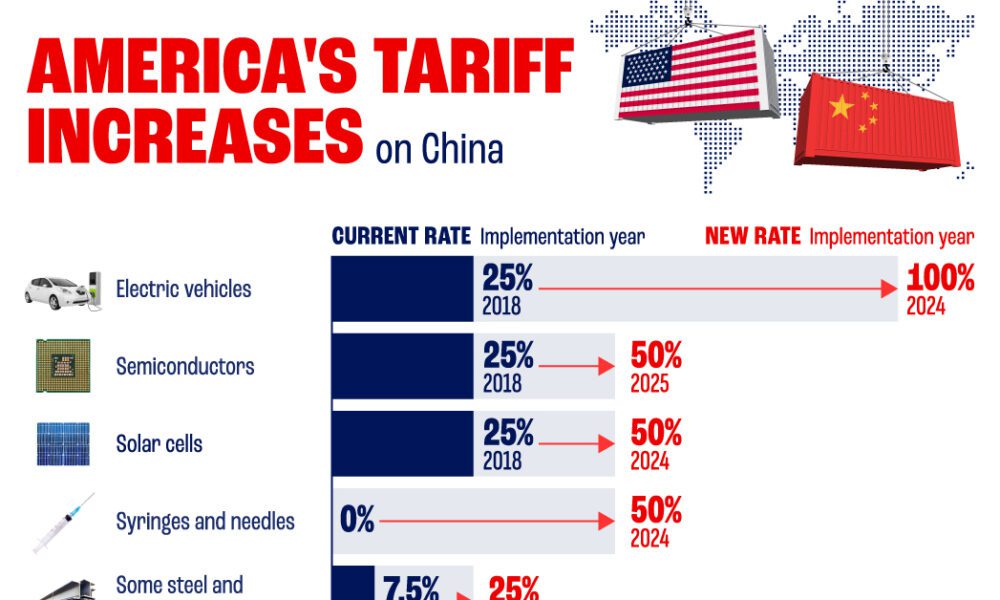

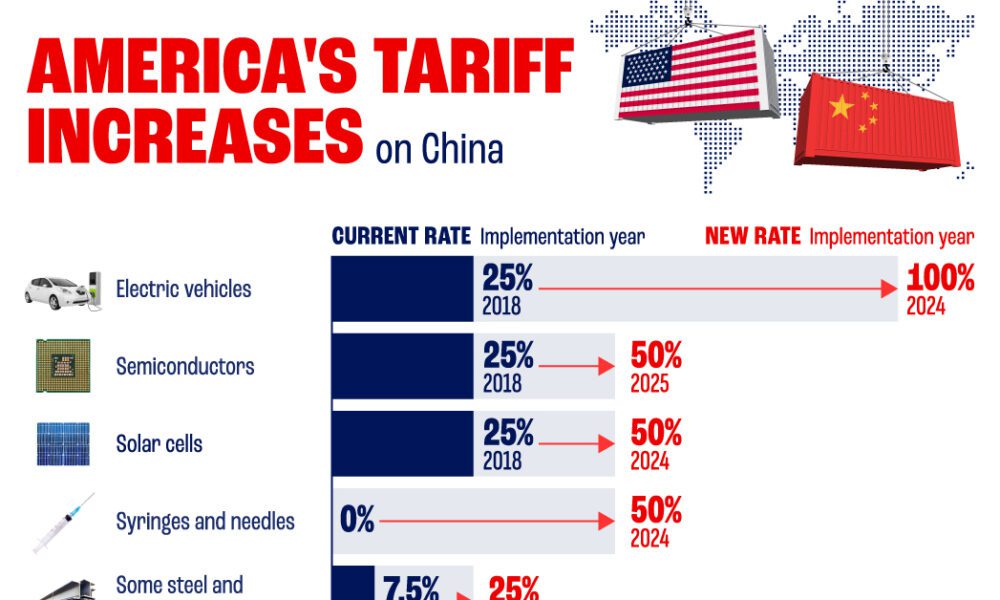

The 30% tariffs, primarily implemented under Section 301 of the Trade Act of 1974, were justified by the Trump administration as a necessary response to what it deemed unfair trade practices by China. These practices included:

-

Intellectual Property Theft: The administration argued that China systematically stole intellectual property from American companies, costing US businesses billions of dollars annually. This included forced technology transfer, where US companies were compelled to share their proprietary technology in exchange for access to the Chinese market.

-

Trade Deficit: The large and persistent US trade deficit with China was another key justification. The tariffs were presented as a means to reduce this deficit and rebalance the trade relationship.

-

National Security Concerns: Certain sectors, like technology and telecommunications, were targeted due to national security concerns. The administration argued that dependence on Chinese manufacturers for critical technologies posed a risk to US national security.

The Section 301 tariffs, therefore, aimed to address these perceived injustices and protect American industries and national interests. However, their effectiveness and long-term implications remain a subject of intense debate.

Economic Impacts of the 30% Tariffs on Chinese Goods

The 30% tariffs on Chinese goods had far-reaching economic consequences, both intended and unintended:

-

Inflation: The tariffs contributed to inflation in the US, as increased import costs were passed on to consumers in the form of higher prices for various goods. This was particularly noticeable in sectors heavily reliant on Chinese imports.

-

Supply Chain Disruptions: The tariffs disrupted global supply chains, forcing companies to seek alternative sources of goods and leading to delays and increased costs. This complexity added to overall economic instability.

-

Consumer Prices: Consumers experienced a noticeable increase in the prices of goods subject to the tariffs, impacting household budgets and reducing consumer purchasing power. The impact was disproportionately felt by lower-income households.

-

American Businesses: The impact on American businesses was mixed. While some benefited from reduced competition, others faced increased input costs and reduced profitability. Importers were particularly hard hit, while some domestic manufacturers saw increased demand.

-

Sectoral Impacts: Different economic sectors were affected differently. Industries heavily reliant on Chinese imports, such as manufacturing and retail, experienced significant negative impacts, while others were less affected or even benefited.

Political Ramifications and Future Prospects

The Biden administration inherited the complex legacy of the 30% tariffs. While initially signaling a review of the policy, the administration has maintained some tariffs while negotiating with China on other trade issues.

-

Biden Administration's Approach: The Biden administration's approach has been more nuanced, focusing on targeted actions rather than sweeping tariffs. This shift reflects a move towards multilateralism and a desire for a more balanced approach to trade relations with China.

-

Bipartisan Support: Support for the tariffs has been far from unanimous. While some argue for their continued use to protect American industries, others criticize their economic costs and negative impact on consumers. This lack of bipartisan consensus complicates any decision regarding their future.

-

Tariff Removal or Renegotiation: The possibility of tariff removal or renegotiation remains open, depending on the progress of ongoing trade negotiations and the evolving geopolitical landscape. Complete removal is unlikely in the short term, but targeted reductions or exemptions are possible.

-

US-China Trade Negotiations: The ongoing trade negotiations between the US and China are crucial in determining the future of the 30% tariffs. The outcome of these negotiations will likely significantly influence tariff policy.

-

Geopolitical Factors: Geopolitical factors, including the ongoing tensions between the US and China, significantly influence tariff policy. Any escalation in geopolitical tensions could lead to the maintenance or even expansion of the tariffs.

The Role of the WTO in Addressing Trade Disputes

China has challenged the US tariffs at the World Trade Organization (WTO), arguing that they violate international trade rules.

-

WTO Dispute Settlement: The WTO dispute settlement process is a lengthy and complex one. The outcome of China’s challenges will have significant implications for future trade policy, potentially setting precedents for other similar disputes.

-

Effectiveness of WTO Mechanisms: The effectiveness of the WTO’s dispute settlement mechanisms has been questioned in recent years, raising concerns about their ability to effectively resolve trade disputes between major economic powers.

-

Influence of Other Trade Agreements: Other international trade agreements and initiatives could also influence future US tariff policy, potentially leading to adjustments or modifications of the existing tariffs.

Conclusion

The 30% tariffs on Chinese goods imposed during the Trump administration have had a profound and lasting impact on the US-China trade relationship and the global economy. Their economic consequences, including inflation and supply chain disruptions, are undeniable. The political ramifications are equally significant, with ongoing debates regarding their effectiveness and future. While complete removal before 2025 seems unlikely, the Biden administration's more nuanced approach suggests potential for targeted adjustments based on ongoing trade negotiations and geopolitical considerations. Understanding the implications of these tariffs is crucial for businesses and policymakers alike. Further research into the effects of these tariffs and the ongoing US-China trade relationship is essential to navigate the complexities of international trade and formulate effective strategies for the future. Stay informed on developments regarding the 30% tariffs on Chinese goods and their potential impact on the global economy.

Featured Posts

-

Vip Stake Top Uk Vip Casinos For High Rollers

May 18, 2025

Vip Stake Top Uk Vip Casinos For High Rollers

May 18, 2025 -

Snl Mike Myers Powerful Message With Canada Is Not For Sale Shirt

May 18, 2025

Snl Mike Myers Powerful Message With Canada Is Not For Sale Shirt

May 18, 2025 -

Naytilia Kai Nisiotiki Politiki O Kasselakis Tonizei Ton Kentriko Rolo Tis Naytilias Stin Ellada

May 18, 2025

Naytilia Kai Nisiotiki Politiki O Kasselakis Tonizei Ton Kentriko Rolo Tis Naytilias Stin Ellada

May 18, 2025 -

Riley Greenes Unprecedented Double Home Run Ninth Inning

May 18, 2025

Riley Greenes Unprecedented Double Home Run Ninth Inning

May 18, 2025 -

A Step By Step Guide To Fortune Coins March To Fortune

May 18, 2025

A Step By Step Guide To Fortune Coins March To Fortune

May 18, 2025