31% Decrease In BP Chief Executive's Compensation

Table of Contents

Reasons Behind the 31% Decrease in BP CEO Compensation

The 31% reduction in BP's CEO's compensation package is a substantial move, signaling a significant shift in either the company's performance or its approach to executive remuneration. Several factors likely contributed to this decision:

-

Company Performance: BP's recent financial performance may have fallen short of expectations. Missed profit targets, lower-than-anticipated returns on investment, and challenges in adapting to the energy transition could all have played a role in the decision to reduce executive compensation. Keywords: BP financial performance, BP profits, return on investment.

-

Shareholder Pressure: Activist investors and shareholders increasingly demand greater accountability from executives. Pressure for lower CEO pay, particularly in the face of underperformance, is a growing trend. Keywords: shareholder activism, BP shareholders, executive accountability.

-

Changes in BP's Executive Compensation Structure: BP may have revised its executive compensation structure to align it more closely with long-term performance goals and sustainability targets. This could include a greater emphasis on performance-based bonuses and a reduction in fixed salaries. Keywords: BP compensation structure, performance-based bonuses, executive pay structure.

-

Impact of the Energy Transition and ESG Investing: The global shift towards renewable energy sources and the growing importance of ESG (Environmental, Social, and Governance) investing are influencing executive compensation practices. Companies are facing increased pressure to demonstrate their commitment to sustainability, and lowering CEO pay could be seen as a way to demonstrate fiscal responsibility and align with ESG principles. Keywords: ESG investing, energy transition, sustainable investing, corporate social responsibility.

Specific examples from BP's official statements and news releases would further illuminate the exact reasons behind this pay cut.

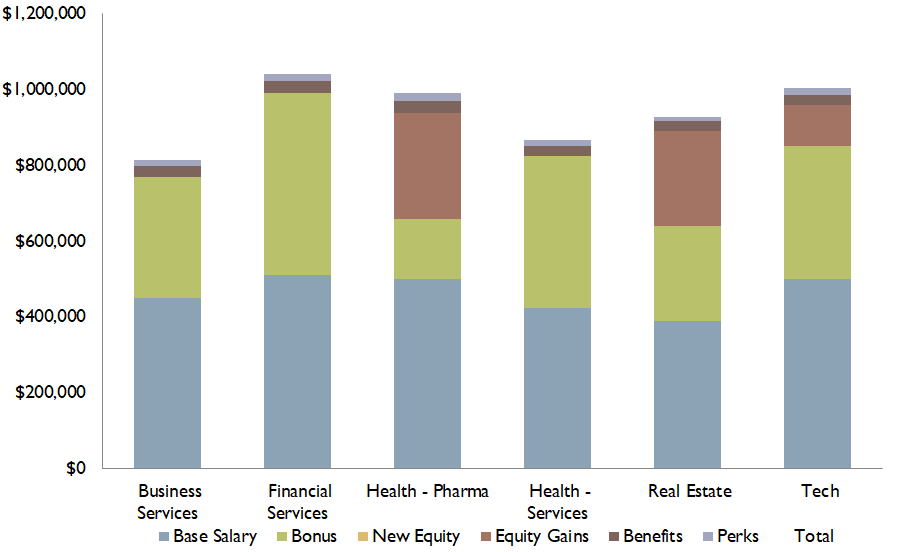

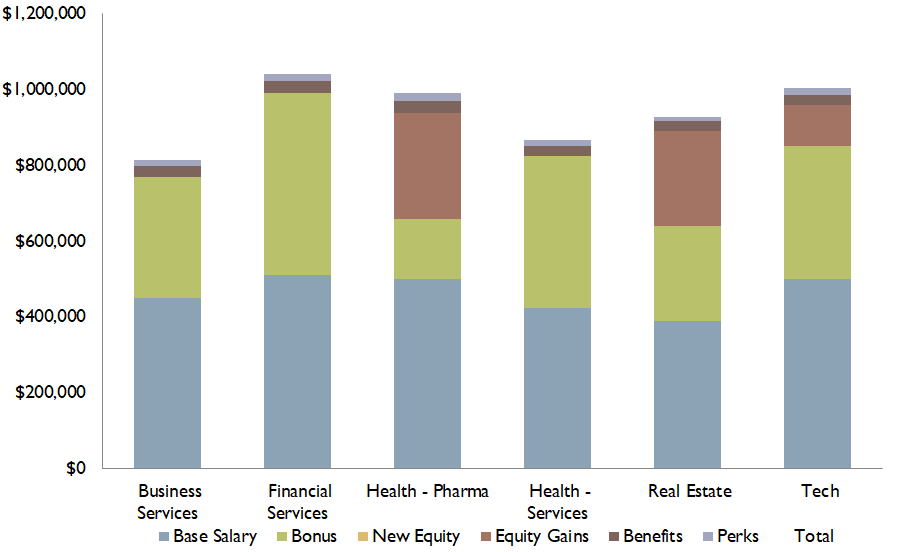

Comparison to Other Energy Company CEO Compensation

To understand the significance of BP's 31% pay cut, it's crucial to compare it to CEO compensation in other major energy companies. A comprehensive analysis, perhaps using a chart or table, would compare the BP CEO's compensation to that of CEOs at Shell, ExxonMobil, Chevron, and other significant players in the oil and gas sector. This comparison would reveal whether BP's action is an outlier or represents a broader trend towards more modest executive pay within the industry. Keywords: Shell CEO salary, ExxonMobil CEO compensation, Chevron CEO pay, energy company executive pay comparison.

This comparison would need to consider factors like company size, revenue, and overall profitability to provide a truly insightful analysis. The implications drawn from this comparative study would offer further clarity regarding the overall picture of executive compensation in the energy sector.

Impact of the Pay Cut on Shareholder Relations and Company Morale

The 31% pay cut could have both positive and negative impacts on BP's shareholder relations and internal morale.

-

Positive Impacts: The reduction could be viewed positively by shareholders as a sign of responsible management and a commitment to aligning executive compensation with company performance. This could potentially boost investor confidence and positively impact BP's stock price. Keywords: shareholder relations, BP stock price, investor confidence.

-

Negative Impacts: Some shareholders might see it as a sign of weakness or a potential indication of future financial difficulties. Furthermore, a significant pay cut could negatively affect employee morale, particularly if seen as unfair or inconsistent with the compensation of other employees. This could lead to decreased productivity and potential talent loss. Keywords: employee morale, BP employees, talent retention, executive compensation and performance.

Analyzing expert opinions from financial analysts would provide further insight into the potential effects of the pay cut on both shareholder sentiment and internal employee morale.

Long-Term Implications for BP's Compensation Strategy

The 31% pay cut might signal a significant shift in BP's long-term approach to executive compensation. This could lead to:

-

Revised Compensation Structure: BP might implement a revised compensation structure that places greater emphasis on long-term performance metrics and sustainability goals. This could include a greater weighting for performance-based bonuses and a decreased reliance on base salaries. Keywords: BP future strategy, executive compensation trends, long-term incentives.

-

Attracting and Retaining Top Talent: The impact on BP's ability to attract and retain top talent remains to be seen. A lower compensation package for the CEO might influence perceptions about overall compensation within the company, potentially creating challenges in competing for high-caliber executives in a competitive job market. Keywords: talent acquisition, retention strategies, executive recruitment.

Conclusion: Understanding the Significance of the BP CEO's 31% Pay Cut

The 31% decrease in BP's Chief Executive's compensation is a significant event with multifaceted implications. The reasons behind this pay cut are likely complex and intertwined, involving company performance, shareholder pressure, evolving compensation structures, and the increasing significance of ESG considerations within the energy sector. Comparing this pay cut to other energy companies provides context and suggests whether this is an isolated incident or a trend. The impact on shareholder relations and employee morale is crucial to consider, as is the effect this decision will have on BP's long-term compensation strategy and its ability to attract and retain top talent. Understanding these interconnected factors is critical for comprehending the full significance of this development. Stay informed about the evolving landscape of BP's executive compensation and the impact on the energy industry. Follow us for updates on BP CEO compensation and other key developments.

Featured Posts

-

Kcrg Tv 9s Coverage Of 10 Minnesota Twins Games

May 21, 2025

Kcrg Tv 9s Coverage Of 10 Minnesota Twins Games

May 21, 2025 -

Fastest Australian Crossing On Foot A New Record Is Set

May 21, 2025

Fastest Australian Crossing On Foot A New Record Is Set

May 21, 2025 -

Investing In Ai Reddits 12 Best Stock Picks Analyzed

May 21, 2025

Investing In Ai Reddits 12 Best Stock Picks Analyzed

May 21, 2025 -

Subsystem Issue Forces Blue Origin To Abort Rocket Launch

May 21, 2025

Subsystem Issue Forces Blue Origin To Abort Rocket Launch

May 21, 2025 -

Avauskokoonpanon Julkistus Kamara Ja Pukki Vaihtopenkillae

May 21, 2025

Avauskokoonpanon Julkistus Kamara Ja Pukki Vaihtopenkillae

May 21, 2025