31% Drop In BP Chief Executive's Salary

Table of Contents

The Details of the Salary Cut

The 31% reduction in Bernard Looney's salary represents a substantial decrease in his annual compensation. While the exact figures may vary depending on the reporting source, let's assume, for illustrative purposes, that his previous annual salary was $5 million. This 31% cut would translate to a reduction of approximately $1.55 million, resulting in a current annual salary of roughly $3.45 million. This reduction likely impacts other forms of compensation as well. It is crucial to examine whether his bonus structure, stock options, or other benefits have been similarly affected to understand the complete picture of his compensation package. A formal statement from BP regarding these details is essential for complete transparency. Keywords relevant to this section include BP pay cut, CEO compensation reduction, and Bernard Looney compensation.

Reasons Behind the Significant Pay Cut

Several factors likely contributed to this drastic reduction in Bernard Looney's compensation. Analyzing these factors is crucial to understanding the broader context.

Company Performance:

BP's recent financial performance plays a significant role. Fluctuations in oil prices, increased operational costs, and the ongoing transition towards renewable energy sources have all impacted profitability. A dip in stock performance could also put pressure on the board to reduce executive compensation. Analyzing BP's quarterly and annual reports provides crucial insight into the company’s financial health and its direct correlation with executive pay. Keywords associated with this aspect include BP financial performance and shareholder pressure.

Shareholder Activism:

Activist investors are increasingly scrutinizing executive compensation packages, particularly within the oil and gas industry. Shareholder resolutions focusing on executive pay and corporate governance have become more common. These resolutions often target excessive CEO pay relative to company performance, potentially influencing the board's decision to reduce Looney's salary.

Environmental, Social, and Governance (ESG) Concerns:

The growing focus on ESG investing has put immense pressure on companies, including BP, to demonstrate a commitment to sustainability and corporate responsibility. A significant salary reduction for the CEO might be perceived as a gesture of aligning the company with ESG principles and signaling a commitment to responsible management. This move could influence investor perception and appeal to ESG-conscious investors. ESG investing and corporate governance are key terms relevant here.

Company Strategy Shift:

BP is undergoing a significant strategic shift towards renewable energy. This transition requires substantial investment and may involve restructuring to reflect these new priorities. A reduction in the CEO's salary might reflect a commitment to resource allocation towards the company's long-term strategic goals and a focus on sustainable growth.

Public and Industry Reaction to the Salary Cut

The 31% salary cut has garnered significant attention, sparking discussions across news outlets and social media. Public opinion is divided, with some praising the move as a sign of corporate responsibility while others criticize it as insufficient or symbolic. Comparing Bernard Looney's compensation to that of other CEOs in the oil and gas industry provides valuable context. A comparative analysis of CEO salaries across major oil companies reveals if this pay cut is an outlier or aligns with broader trends within the sector. The impact on employee morale within BP is also a critical consideration. A drastic CEO pay cut might be interpreted positively, fostering a sense of shared sacrifice and corporate unity, or it could be perceived negatively, creating resentment and perceptions of inequity. Relevant keywords for this section include: BP public image, oil industry CEO salaries, and executive pay comparison.

Long-Term Implications of the Salary Reduction

The long-term implications of this salary reduction are far-reaching. It could signal a shift in BP's approach to executive compensation, leading to revised compensation structures and policies. This could set a precedent for other companies within the industry, encouraging them to reassess their own executive pay practices. Furthermore, the symbolic importance of the salary cut cannot be overstated. It's a clear message from the board about prioritizing corporate responsibility and aligning executive pay with company performance and broader societal expectations. The success of this symbolic gesture will depend greatly on how other elements of corporate governance and sustainability efforts evolve in tandem. BP future strategy, executive compensation trends, and corporate responsibility are relevant keywords in this context.

Conclusion: Understanding the BP CEO Salary Drop and its Future Significance

The 31% reduction in Bernard Looney's salary represents a significant event in the context of corporate governance and executive compensation within the oil and gas industry. The reasons behind the cut are multifaceted, encompassing company performance, shareholder pressure, ESG concerns, and strategic shifts within BP. The public reaction has been varied, highlighting the complexity of the issue. The long-term implications remain to be seen but could influence future executive compensation trends and corporate responsibility initiatives. We encourage you to share your thoughts on the BP CEO salary reduction and its impact on corporate governance and responsibility. Further research into BP's executive compensation and similar cases within the energy sector is vital for a better understanding of the evolving landscape of executive pay.

Featured Posts

-

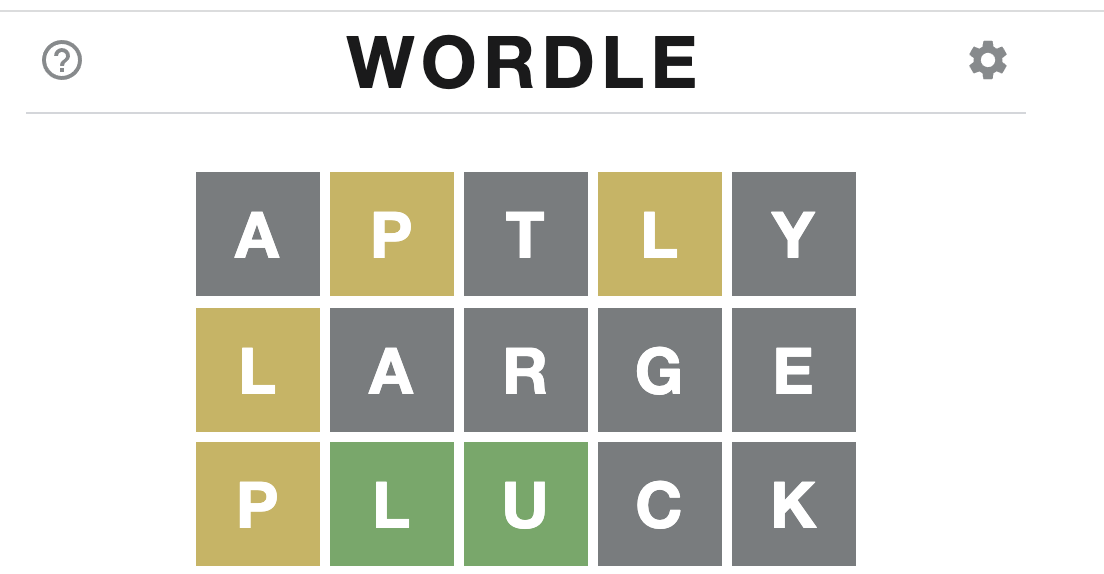

Wordle 356 Solution Hints And Clues For Thursday March 6th

May 22, 2025

Wordle 356 Solution Hints And Clues For Thursday March 6th

May 22, 2025 -

Casper Resident Battles Thousands Of Zebra Mussels On New Boat Lift

May 22, 2025

Casper Resident Battles Thousands Of Zebra Mussels On New Boat Lift

May 22, 2025 -

Coldplay Concert Review Music Lights And A Message Of Love Captivate Top Audience

May 22, 2025

Coldplay Concert Review Music Lights And A Message Of Love Captivate Top Audience

May 22, 2025 -

Puede Javier Baez Recuperar Su Productividad Salud Y Rendimiento En El 2024

May 22, 2025

Puede Javier Baez Recuperar Su Productividad Salud Y Rendimiento En El 2024

May 22, 2025 -

John Lithgow Und Jimmy Smits Kehren In Dexter Resurrection Zurueck

May 22, 2025

John Lithgow Und Jimmy Smits Kehren In Dexter Resurrection Zurueck

May 22, 2025