47% Surge In India's Real Estate Investment: Q1 2024 Report Highlights

Table of Contents

Key Drivers of the 47% Increase in Real Estate Investment

Several key factors contributed to the significant 47% surge in India real estate investment during Q1 2024. Let's examine the most influential drivers:

Government Initiatives: A Boost for the Sector

Government policies played a crucial role in stimulating investment. Initiatives like tax benefits for homebuyers, accelerated infrastructure development projects (keywords: government policies real estate India, infrastructure development real estate), and streamlined regulatory processes have significantly boosted investor confidence.

- Tax benefits: Reduced Goods and Services Tax (GST) rates on under-construction properties and increased tax deductions for home loans have made property ownership more attractive.

- Infrastructure development: Massive investments in infrastructure, including roads, transportation networks, and utilities, have increased property values in strategically located areas. This improved connectivity also attracts more foreign investment in real estate.

Economic Growth & Increased Disposable Income: Fueling Demand

India's robust economic growth has led to a rise in disposable incomes, directly impacting real estate demand (keywords: Indian economy growth, disposable income real estate). A larger middle class with increased purchasing power is driving the demand for both affordable and luxury housing.

- Rising middle class: The expanding middle class is a significant factor, seeking better living conditions and improved quality of life. This translates into higher demand for residential properties across various price points.

- Increased consumer spending: Higher disposable incomes also lead to increased consumer spending, with real estate often being a significant investment choice.

Low Interest Rates: Making Mortgages More Affordable

Low interest rates on home loans have made mortgages more affordable, encouraging both individual homebuyers and investors to enter the market (keywords: mortgage rates India, interest rates real estate investment). This increased affordability has been a key driver of the growth in the residential sector.

- Increased mortgage affordability: Lower interest rates reduce the monthly payments, making homeownership more accessible to a broader segment of the population.

- Attractive investment opportunity: Low interest rates make real estate a more attractive investment compared to other asset classes.

Increased Foreign Direct Investment (FDI): Global Confidence in India

Foreign investors have shown increased confidence in the Indian real estate market, contributing significantly to the investment surge (keywords: FDI real estate India, foreign investment real estate). This influx of FDI is driven by the country's strong economic fundamentals and growth potential.

- Positive market outlook: Foreign investors view India's real estate sector as a promising long-term investment opportunity.

- Government reforms: Initiatives to improve transparency and reduce bureaucratic hurdles have further encouraged foreign investment.

Sector-Wise Performance: Analyzing Investment Trends

The 47% rise in investment wasn't uniform across all sectors. Let's examine the performance of key segments:

Residential Real Estate: A Strong Performer

The residential real estate sector witnessed substantial growth, driven by strong demand for both luxury apartments and affordable housing (keywords: residential real estate India, luxury apartments, affordable housing).

- Luxury apartments: High-net-worth individuals are driving demand for luxury properties in prime locations.

- Affordable housing: Government initiatives supporting affordable housing projects have boosted this segment.

Commercial Real Estate: Steady Growth

The commercial real estate sector also showed steady growth, with increasing demand for office spaces and retail spaces (keywords: commercial real estate India, office spaces, retail real estate). The growth is fueled by expansion of businesses and increasing urbanization.

- Office spaces: Growing IT and other sectors are fueling the demand for office spaces in major cities.

- Retail spaces: The expansion of organized retail is driving demand for retail spaces in malls and high streets.

Infrastructure Development: Laying the Foundation for Future Growth

Significant investment in infrastructure projects is laying the foundation for sustained real estate growth (keywords: infrastructure investment India, real estate infrastructure). These projects improve connectivity and enhance the appeal of surrounding areas.

- Improved connectivity: Investments in transportation networks and utilities significantly improve the value and attractiveness of real estate in various regions.

- Enhanced infrastructure: Better infrastructure attracts more businesses and residents, boosting the overall demand for real estate.

Geographic Distribution of Investments: Regional Highlights

Investment growth wasn't evenly distributed across India. Major metropolitan areas like Mumbai, Delhi, and Bengaluru (keywords: Mumbai real estate, Delhi real estate, Bengaluru real estate) experienced the most significant growth. This is due to factors such as better infrastructure, job opportunities, and a higher concentration of businesses. Other cities also experienced notable growth, reflecting the broader strength of the Indian real estate market (keywords: real estate market trends India).

Future Outlook and Predictions for India's Real Estate Market

Experts predict continued growth in India's real estate market for the remainder of 2024 and beyond (keywords: real estate market forecast India, future of real estate India). However, potential challenges, such as inflation and potential interest rate hikes (keywords: real estate market risks India), need to be considered. Careful analysis of market trends and risk assessment are crucial for successful investment.

Conclusion: Investing in India's Booming Real Estate Market

The Q1 2024 report reveals a remarkable 47% surge in India's real estate investment, driven by a combination of government policies, economic growth, and increased foreign investment. The positive outlook for the Indian real estate market, supported by strong fundamentals and continued growth, makes it an attractive investment opportunity. Considering the significant 47% surge in India's real estate investment in Q1 2024, now is the time to explore lucrative investment opportunities. Learn more about the latest trends and forecasts for the Indian real estate market and make informed investment decisions. [Link to relevant resources, if applicable]

Featured Posts

-

Trump And Arab Leaders An Examination Of Their Bonds

May 17, 2025

Trump And Arab Leaders An Examination Of Their Bonds

May 17, 2025 -

Navigating Japans Steep Government Bond Curve A Complex Investment Landscape

May 17, 2025

Navigating Japans Steep Government Bond Curve A Complex Investment Landscape

May 17, 2025 -

Shkembimi I Te Burgosurve Roli Kyc I Emirateve Te Bashkuara Arabe

May 17, 2025

Shkembimi I Te Burgosurve Roli Kyc I Emirateve Te Bashkuara Arabe

May 17, 2025 -

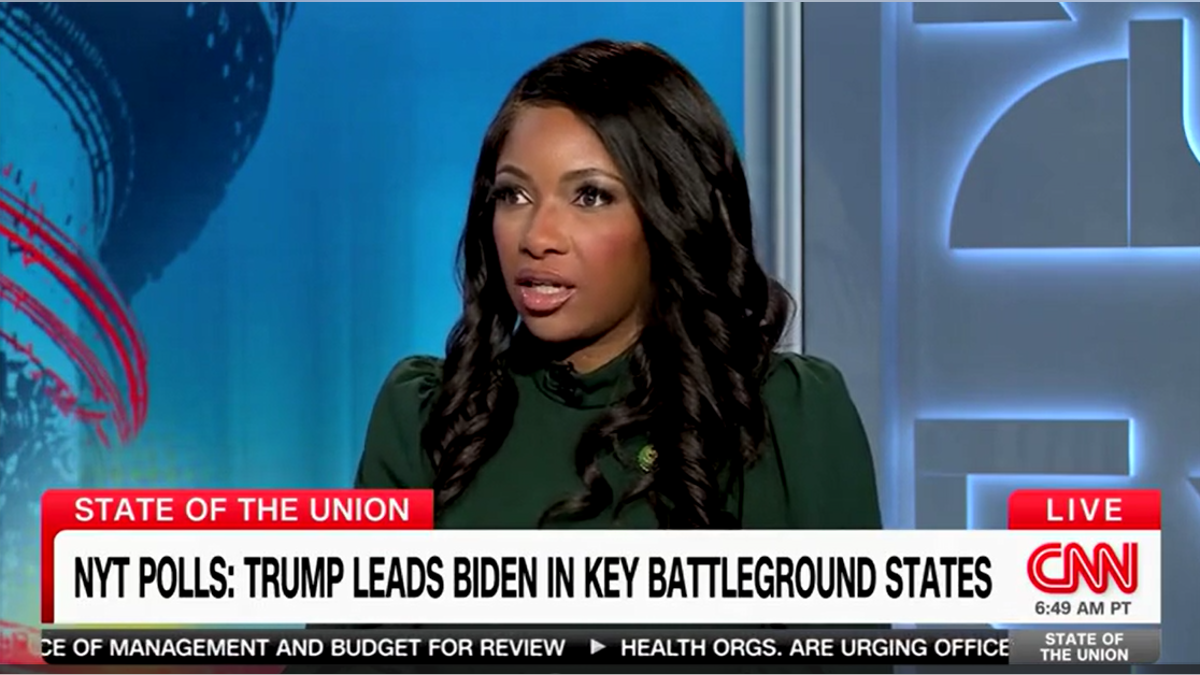

Rep Crockett On Trumps Economic Policies Rising Food Costs And Wage Stagnation

May 17, 2025

Rep Crockett On Trumps Economic Policies Rising Food Costs And Wage Stagnation

May 17, 2025 -

Mariners Vs Tigers Injured Players To Watch March 31 April 2

May 17, 2025

Mariners Vs Tigers Injured Players To Watch March 31 April 2

May 17, 2025