5 Drivers Behind Today's Significant Rise In Sensex And Nifty 50

Table of Contents

Robust Foreign Institutional Investor (FII) Inflows

Foreign Institutional Investors (FIIs) play a significant role in the Indian stock market's performance. Their increased investment directly impacts the Sensex and Nifty 50 values. The recent surge in FII inflows is driven by several key factors:

Increased Confidence in Indian Economy

FIIs are pouring money into the Indian stock market due to increasing confidence in India's economic growth story. This positive sentiment is fueled by:

- Strong GDP growth projections: India's consistent GDP growth, despite global headwinds, showcases its resilience and attracts foreign investment.

- Government's pro-business reforms: Initiatives aimed at simplifying regulations, improving infrastructure, and attracting foreign direct investment (FDI) are bolstering investor confidence. These reforms signal a stable and business-friendly environment.

- Positive global sentiment towards emerging markets: India, as a major emerging market, benefits from the overall positive global sentiment towards developing economies. This global perspective enhances the appeal of Indian equities.

Attractive Valuations

Compared to other global markets, Indian equities are perceived as relatively undervalued, making them an attractive investment destination for FIIs seeking higher returns. This perceived undervaluation, coupled with the growth potential of the Indian economy, creates a compelling investment proposition.

- Increased FII investments directly impact Sensex and Nifty 50 values.

- Tracking FII flows provides crucial insight into short-term and long-term market trends.

- Sustained, long-term FII investment signals unwavering confidence in the Indian market's future growth potential.

Positive Domestic Institutional Investor (DII) Participation

Domestic Institutional Investors (DIIs), including mutual funds and insurance companies, are also significantly contributing to the rise of the Sensex and Nifty 50. Their participation reflects strong domestic investor sentiment.

Rising Domestic Savings and Investments

Increased domestic savings and a burgeoning middle class are leading to higher investments in the stock market. This increased participation from within the country creates a powerful internal engine for growth.

Attractive Investment Schemes

Government initiatives and financial innovations have made investing more accessible to the average Indian. The simplification of investment processes and the introduction of various investment vehicles have broadened participation in the market.

- Strong DII participation is a key indicator of robust domestic investor sentiment and confidence in the Indian economy.

- Mutual funds and other investment vehicles play a crucial role in channeling domestic savings into the stock market, further boosting Sensex and Nifty 50.

- Positive DII trends consistently support the upward trajectory of Sensex and Nifty 50, signifying a strong and growing domestic market.

Strong Corporate Earnings

Robust corporate earnings are a fundamental driver of stock market performance. Improved profitability and a positive business outlook are key factors contributing to the recent rise.

Improved Profitability

Many Indian companies are reporting robust earnings growth, reflecting improved operational efficiency and increased demand, both domestically and internationally. This improved performance directly translates into higher stock valuations.

Positive Business Outlook

A positive business outlook fuels investor confidence and drives up stock prices. This optimism is often reflected in higher earnings forecasts and increased investment in future projects.

- Strong corporate earnings directly translate to higher stock valuations, pushing the Sensex and Nifty 50 upwards.

- Analyzing quarterly earnings reports is crucial for understanding the underlying strength of the market and predicting future trends.

- Consistent earnings growth is a vital driver of long-term market performance and investor confidence.

Government Initiatives and Reforms

Government policies play a significant role in shaping market dynamics. Pro-growth policies and regulatory changes are creating a more attractive investment climate.

Pro-Growth Policies

The government's focus on infrastructure development, ease of doing business, and attracting foreign investment is boosting market sentiment. These initiatives create a more conducive environment for both domestic and international businesses to thrive.

Regulatory Changes

Positive regulatory changes, such as streamlining approval processes and reducing bureaucratic hurdles, make the Indian market more attractive to investors. A transparent and efficient regulatory framework is essential for sustainable market growth.

- Government policies play a significant role in shaping the market's overall trajectory.

- Tracking policy announcements and understanding their implications is crucial for informed investment decisions.

- Government initiatives aimed at reducing bureaucratic hurdles encourage investment and stimulate economic growth, directly impacting Sensex and Nifty 50.

Global Macroeconomic Factors

Global macroeconomic factors also influence the performance of the Sensex and Nifty 50. Easing global inflation and a relatively stable geopolitical landscape have contributed positively.

Easing Global Inflation

A decline in global inflation reduces pressure on central banks to raise interest rates, creating a more favorable environment for risk assets like equities. This allows investors to allocate more capital to the stock market.

Stable Geopolitical Landscape (relatively)

Periods of relative stability in the global geopolitical landscape tend to boost investor confidence, leading to increased investment in emerging markets like India.

- Global events can significantly impact the Sensex and Nifty 50; therefore, staying informed about international developments is essential.

- Monitoring key global economic indicators, such as inflation rates and interest rates, is crucial for anticipating potential shifts in the Indian market.

- Understanding global market trends is key to anticipating and adapting to changes that might impact the Indian stock market.

Conclusion

The significant rise in the Sensex and Nifty 50 is a result of a confluence of factors, including robust FII and DII inflows, strong corporate earnings, supportive government initiatives, and a relatively favorable global macroeconomic environment. Understanding these drivers is essential for navigating the Indian stock market effectively. To stay informed about future movements in the Sensex and Nifty 50, continue to monitor these key indicators and stay updated on economic news. By understanding the factors behind the Sensex and Nifty 50's rise, you can make more informed investment decisions and potentially benefit from the continued growth of the Indian stock market.

Featured Posts

-

Once Rejected Now A European Champion The Story Of Players Name

May 09, 2025

Once Rejected Now A European Champion The Story Of Players Name

May 09, 2025 -

Increased Security For Mc Cann Parents At Upcoming Prayer Vigil Due To Stalking

May 09, 2025

Increased Security For Mc Cann Parents At Upcoming Prayer Vigil Due To Stalking

May 09, 2025 -

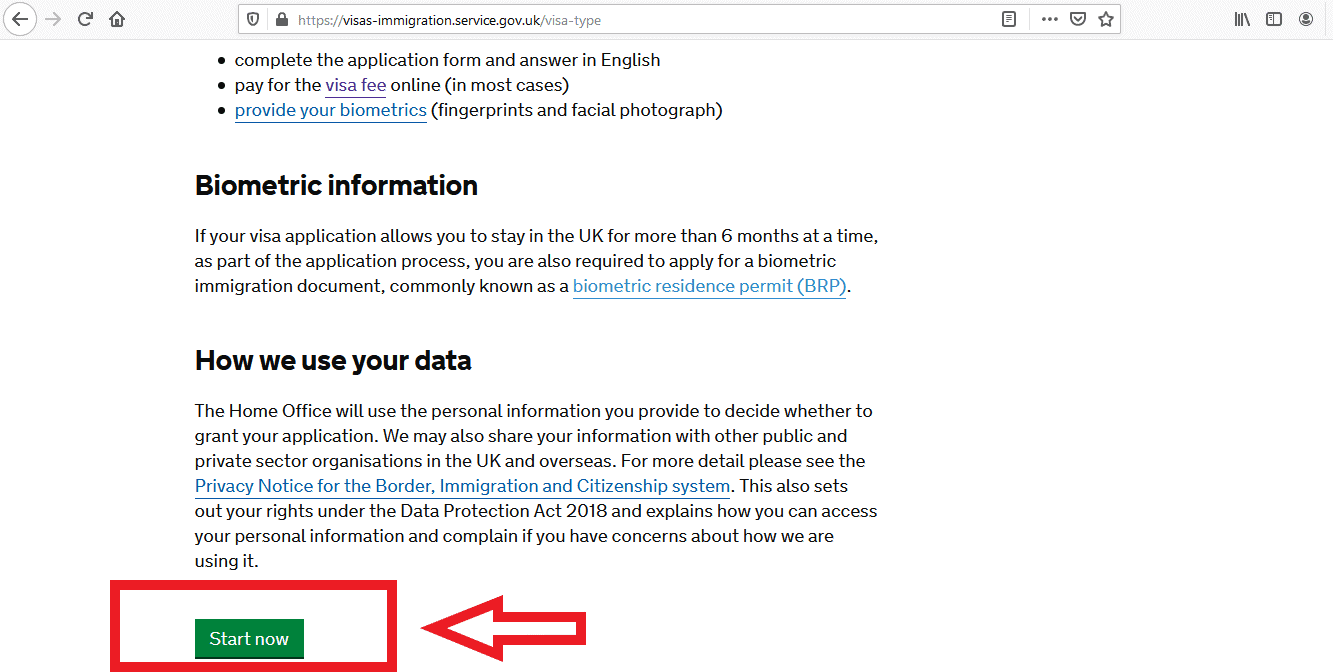

Changes To Uk Visa Application Process For Nigeria And Pakistan

May 09, 2025

Changes To Uk Visa Application Process For Nigeria And Pakistan

May 09, 2025 -

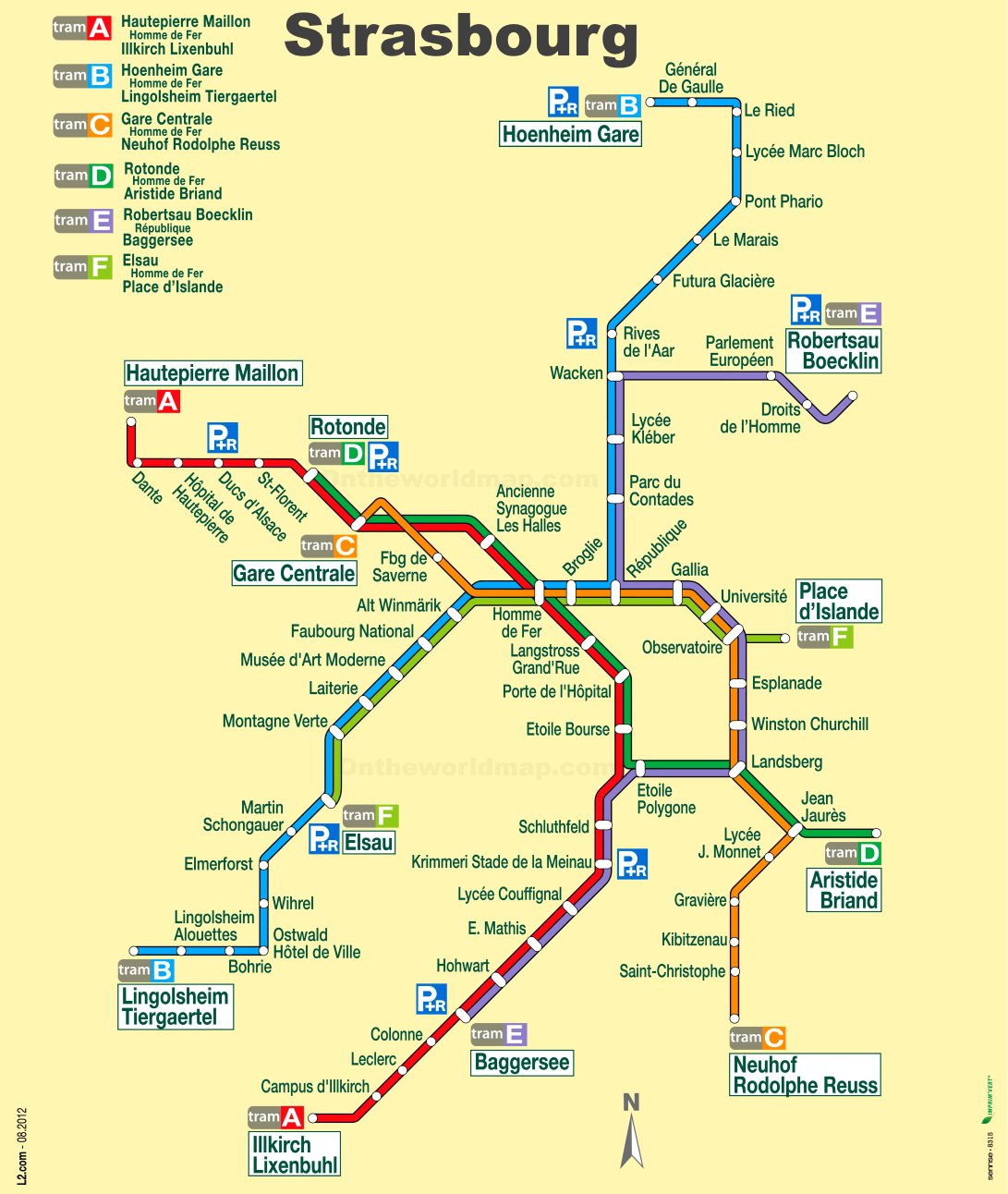

3e Ligne De Tram A Dijon La Concertation Publique Est Ouverte

May 09, 2025

3e Ligne De Tram A Dijon La Concertation Publique Est Ouverte

May 09, 2025 -

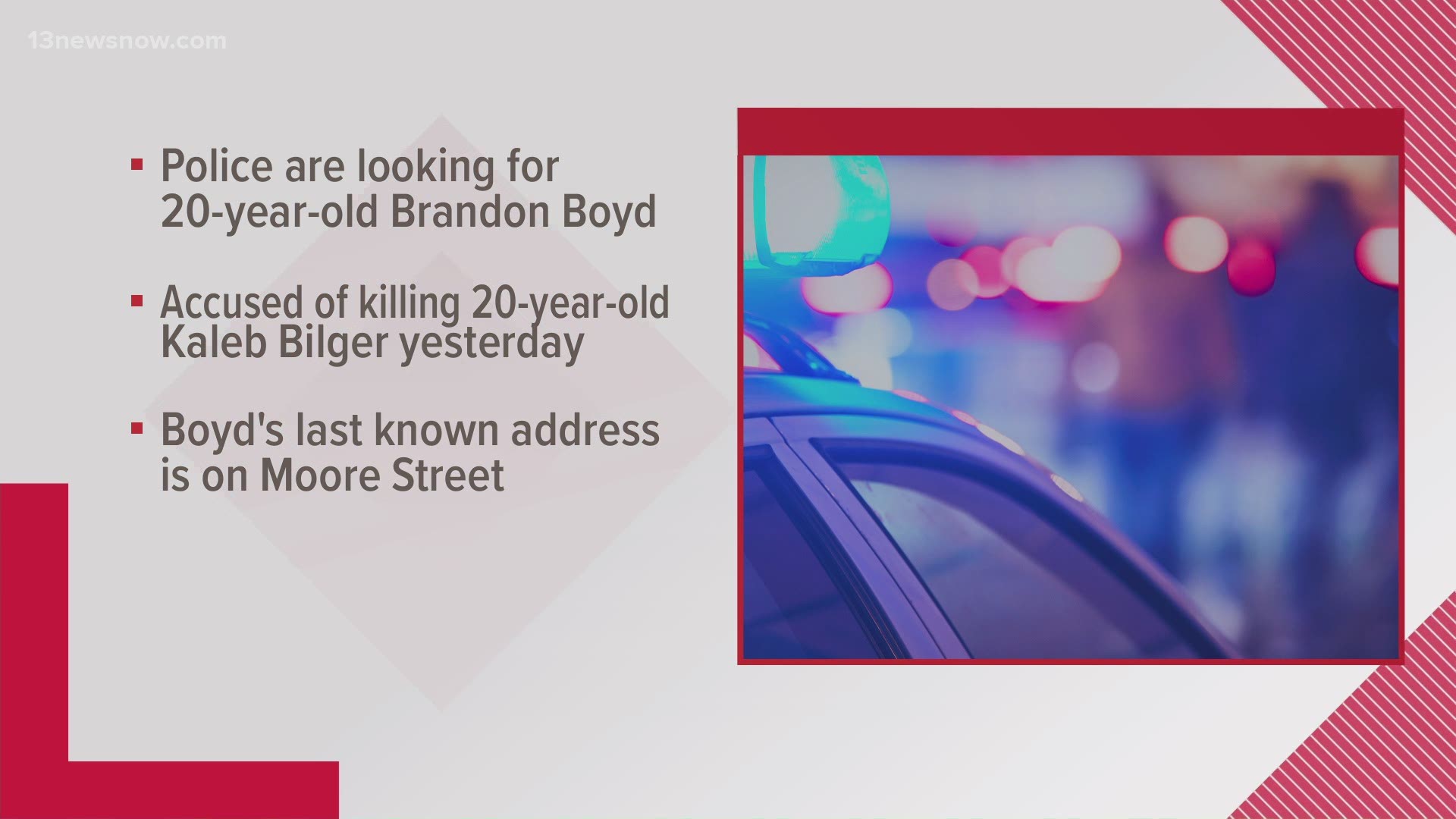

Dozens Of Cars Burglarized In Elizabeth City Apartment Complex Crime Spree

May 09, 2025

Dozens Of Cars Burglarized In Elizabeth City Apartment Complex Crime Spree

May 09, 2025