5 Key Actions To Secure A Private Credit Job During The Boom

Table of Contents

Master the Art of the Private Credit Resume

Your resume is your first impression; make it count. A well-crafted resume tailored to the specific requirements of each private credit job application is crucial.

Tailor Your Resume to Specific Job Descriptions

Generic resumes won't cut it in the competitive private credit market. Each application requires a customized approach.

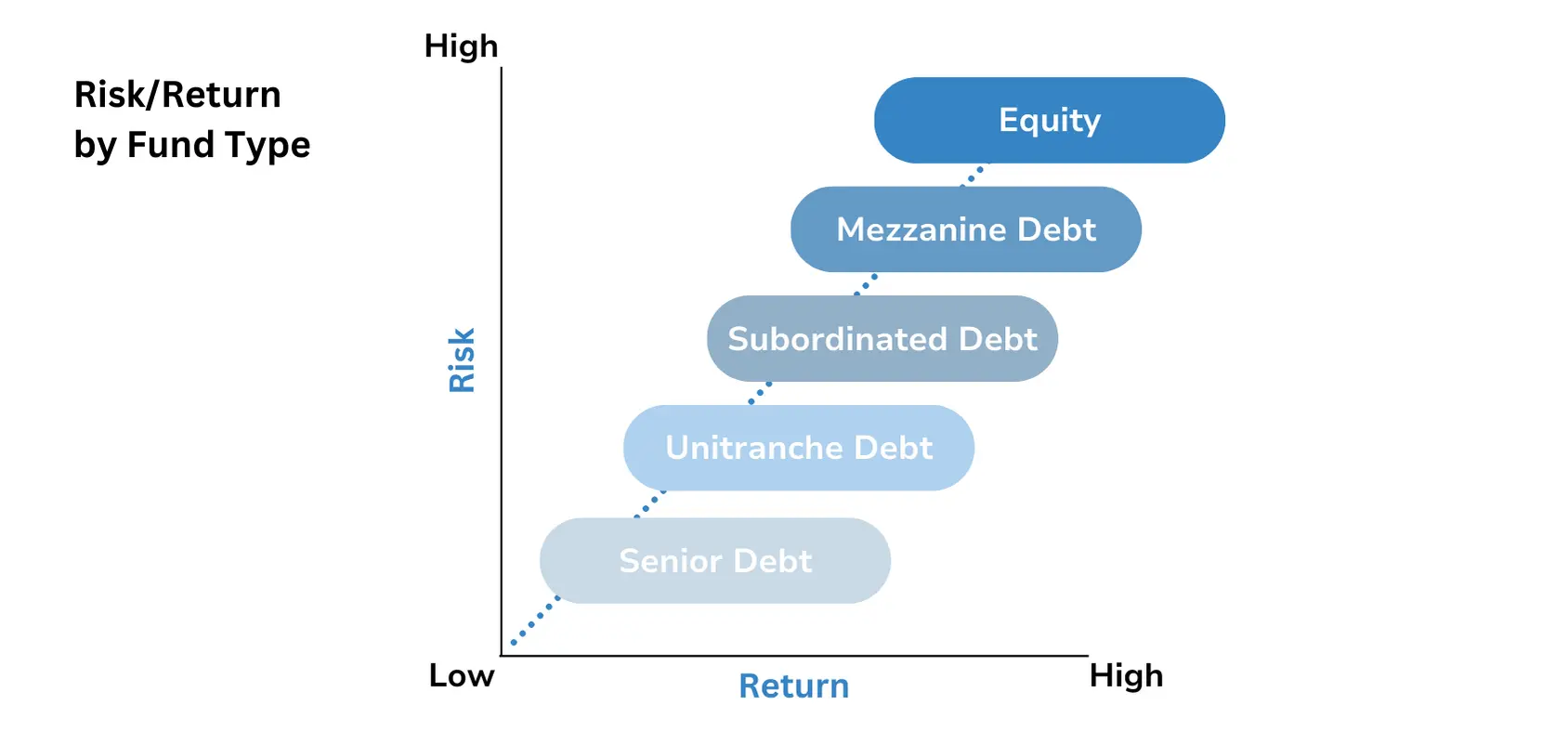

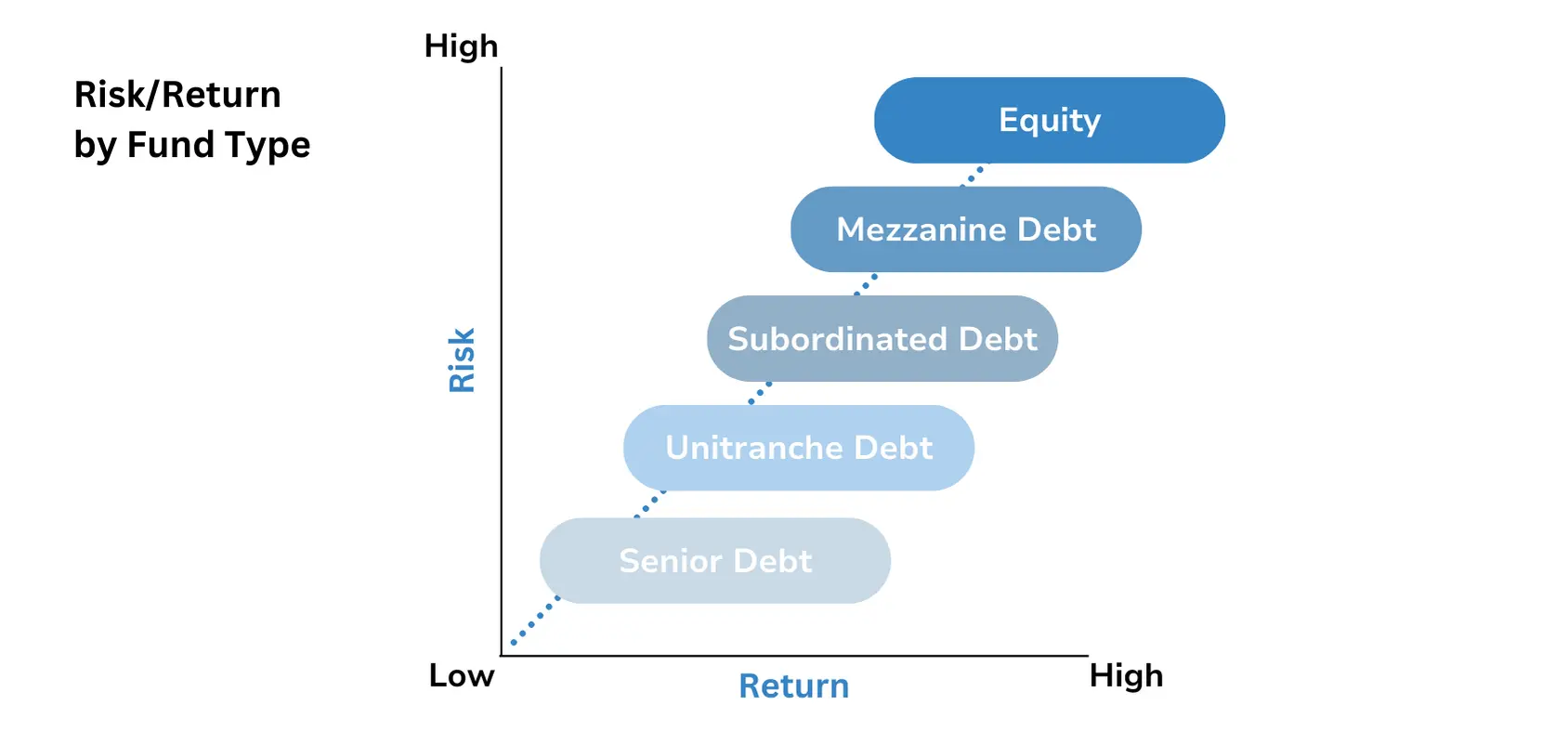

- Keyword Optimization: Carefully review the job description and incorporate relevant keywords throughout your resume. Common keywords include "debt restructuring," "credit analysis," "portfolio management," "underwriting," "due diligence," "distressed debt," "mezzanine debt," "direct lending," and "credit risk assessment."

- Quantifiable Achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, instead of "Managed a portfolio of loans," write "Managed a $50 million portfolio of loans, resulting in a 15% increase in portfolio returns."

- Action Verbs: Use strong action verbs to showcase your accomplishments. Examples include "analyzed," "negotiated," "managed," "developed," and "implemented."

- Software Proficiency: Highlight your proficiency in relevant software, such as Bloomberg Terminal, Argus, and Excel (including advanced modeling skills like LBO modeling, DCF analysis, and sensitivity analysis).

Emphasize Relevant Experience

Focus on experience directly relevant to private credit roles.

- Showcase Expertise: Clearly articulate your experience in underwriting, due diligence, portfolio management, or credit risk analysis. Demonstrate your understanding of financial modeling, valuation, and credit risk assessment techniques.

- Highlight Asset Class Experience: Specify your experience with different asset classes within private credit, including direct lending, mezzanine debt, distressed debt, and other relevant areas. This demonstrates your breadth of knowledge and adaptability.

- Industry Knowledge: Demonstrate your understanding of current market trends and economic factors that influence private credit investments.

Network Strategically Within the Private Credit Industry

Networking is paramount in the private credit industry. Building relationships with key players can significantly increase your job prospects.

Attend Industry Events and Conferences

Industry events are excellent networking opportunities.

- Active Participation: Actively participate in conferences, workshops, and networking events focused on private credit.

- Meaningful Conversations: Engage in meaningful conversations, demonstrating genuine interest in the industry and the people you meet. Exchange business cards and follow up with personalized emails afterward.

- Follow-up: Following up with connections is crucial for building lasting relationships. A simple email expressing your appreciation for their time and reiterating your interest in the private credit industry can go a long way.

Leverage LinkedIn and Online Platforms

LinkedIn is a powerful tool for networking.

- Optimize your LinkedIn Profile: Create a compelling LinkedIn profile showcasing your skills and experience in private credit. Use keywords relevant to the industry.

- Connect with Professionals: Connect with recruiters and professionals working in the private credit industry. Engage in relevant conversations and join industry groups.

- Online Presence: Maintain a professional online presence across all platforms, showcasing your expertise and passion for the field.

Highlight Your Unique Skills and Expertise

In a competitive market, showcasing your unique skills is crucial.

Develop Specialized Skills

Developing specialized skills sets you apart from the competition.

- Niche Expertise: Become proficient in a specific area of private credit, such as distressed debt investing, structured finance, or a particular asset class.

- Advanced Skills: Develop strong financial modeling and analytical skills, demonstrating your ability to analyze complex financial data and make informed investment decisions.

- Software Mastery: Master relevant software and demonstrate proficiency in advanced analytical techniques.

Showcase Your Value Proposition

Articulate your value proposition clearly and concisely.

- Unique Strengths: Highlight your unique strengths and how they align with the needs of potential employers.

- Quantifiable Impact: Quantify your achievements to demonstrate the value you bring to an organization.

- Problem-Solving Abilities: Showcase your ability to identify and solve problems, highlighting your critical thinking and analytical skills.

Prepare for the Private Credit Interview Process

Thorough preparation is essential for success in the interview process.

Research Potential Employers

Research is key to a successful interview.

- In-depth Research: Thoroughly research the firms you are interviewing with, understanding their investment strategies, portfolio composition, and recent transactions.

- Investment Thesis: Understand their investment thesis and how your skills and experience align with their strategies.

- Thoughtful Questions: Prepare thoughtful questions to ask the interviewers, demonstrating your genuine interest and engagement.

Practice Behavioral and Technical Questions

Practice answering common interview questions.

- Behavioral Questions: Practice answering common behavioral interview questions (e.g., "Tell me about a time you failed," "Describe a challenging situation you overcame").

- Technical Questions: Prepare for technical questions related to financial modeling, credit analysis, and private credit markets. Practice your responses aloud.

- Communication Skills: Develop strong communication and interpersonal skills, ensuring you can articulate your thoughts clearly and concisely.

Negotiate Your Private Credit Job Offer Effectively

Negotiating your job offer is a crucial step.

Research Industry Compensation

Research is crucial for effective negotiation.

- Salary Ranges: Research average salaries and compensation packages for private credit professionals with similar experience and skills.

- Benefits Packages: Understand the benefits offered by different firms and consider the total compensation package, including health insurance, retirement plans, and other perks.

Prepare for Salary Negotiations

Be prepared to negotiate your offer.

- Know Your Worth: Know your worth and be prepared to negotiate your salary and benefits package confidently and assertively.

- Negotiation Strategy: Develop a negotiation strategy, considering your desired salary, benefits, and other aspects of the offer.

Conclusion

Securing a private credit job during this booming market requires a proactive and strategic approach. By mastering your resume, networking effectively, highlighting your unique skills, preparing thoroughly for interviews, and negotiating confidently, you significantly increase your chances of success. Don't delay – start implementing these five key actions to secure your dream private credit job today! Begin optimizing your resume and network within the private credit industry to take advantage of this exciting market opportunity. Remember, a well-defined plan and proactive approach are crucial to landing your desired private credit position.

Featured Posts

-

Nyt Mini Crossword Help Solutions For March 20 2025

May 20, 2025

Nyt Mini Crossword Help Solutions For March 20 2025

May 20, 2025 -

Rtl Groups Streaming Strategy A Path To Profitability

May 20, 2025

Rtl Groups Streaming Strategy A Path To Profitability

May 20, 2025 -

New Jersey Transit Engineers Reach Tentative Deal Averted Strike

May 20, 2025

New Jersey Transit Engineers Reach Tentative Deal Averted Strike

May 20, 2025 -

The Eurovision 2025 Artists Lineup A Comprehensive Look

May 20, 2025

The Eurovision 2025 Artists Lineup A Comprehensive Look

May 20, 2025 -

Ai Industry Celebrates Legislative Victory But Challenges Lie Ahead

May 20, 2025

Ai Industry Celebrates Legislative Victory But Challenges Lie Ahead

May 20, 2025