5 Key Actions To Secure A Role In The Private Credit Boom

Table of Contents

Network Strategically within the Private Credit Industry

The private credit industry thrives on relationships. Building a strong network is crucial for finding and securing a role.

Attend Industry Events & Conferences

- SuperReturn: A leading global event for private equity and credit professionals.

- Private Debt Investor Conferences: Numerous regional and international conferences offer networking opportunities.

- Industry-Specific Workshops: Smaller, focused workshops allow for more intimate networking.

Face-to-face interactions are invaluable. These events provide opportunities to learn about specific firms, exchange ideas, and build relationships that could lead to informational interviews and even job offers. Don't underestimate the power of a brief conversation – it could be the start of your private credit career.

Leverage LinkedIn and Online Communities

- Join relevant LinkedIn groups: Search for groups focused on private credit, leveraged finance, and alternative investments.

- Participate actively in discussions: Share your insights, ask thoughtful questions, and engage with other professionals.

- Connect with industry professionals: Reach out to people working in private credit firms and initiate conversations.

- Follow key influencers: Stay updated on industry trends and news by following thought leaders on LinkedIn and other platforms.

Building a strong online presence is essential. Participating in relevant conversations showcases your knowledge and helps you establish credibility within the private credit community.

Informational Interviews

- Prepare targeted questions: Research the individual and the firm beforehand to ask insightful questions.

- Express genuine interest: Show enthusiasm for the private credit industry and the specific firm you're researching.

- Follow up with a thank-you note: Express your gratitude and reiterate your interest in learning more.

Informational interviews provide invaluable insights into the day-to-day workings of private credit firms. They allow you to learn about different roles, career paths, and the culture of specific organizations, significantly increasing your chances of securing a position.

Develop In-Demand Skills for Private Credit Roles

Private credit roles require a specific skill set. Developing these skills will make you a highly competitive candidate.

Master Financial Modeling & Analysis

- Essential modeling skills: Discounted Cash Flow (DCF) analysis, Leveraged Buyout (LBO) modeling, sensitivity analysis.

- Relevant software: Microsoft Excel (advanced proficiency), Bloomberg Terminal.

Strong financial modeling skills are paramount in private credit. Your ability to analyze financial statements, build robust models, and assess the financial health of potential borrowers is critical.

Understand Credit Underwriting & Risk Assessment

- Credit analysis: Thoroughly assess the creditworthiness of borrowers, including their financial statements, industry dynamics and collateral.

- Due diligence: Conduct comprehensive due diligence to identify and mitigate potential risks.

- Risk management: Develop strategies to manage various types of risk, including credit risk, market risk, and operational risk.

Understanding and mitigating risk is a cornerstone of private credit. Demonstrating a strong grasp of credit analysis, due diligence, and risk management techniques is essential.

Gain Expertise in Legal and Regulatory Compliance

- Relevant regulations: Understand regulations related to lending, securities, and privacy.

- Compliance frameworks: Familiarize yourself with industry best practices and regulatory requirements.

Navigating the legal and regulatory landscape is crucial. Demonstrating knowledge of relevant regulations and compliance frameworks will significantly enhance your credibility.

Tailor Your Resume and Cover Letter for Private Credit Positions

Your resume and cover letter are your first impression. Tailoring them effectively is crucial.

Highlight Relevant Experience and Skills

- Transferable skills: Highlight skills from previous finance roles, such as financial analysis, modeling, and communication.

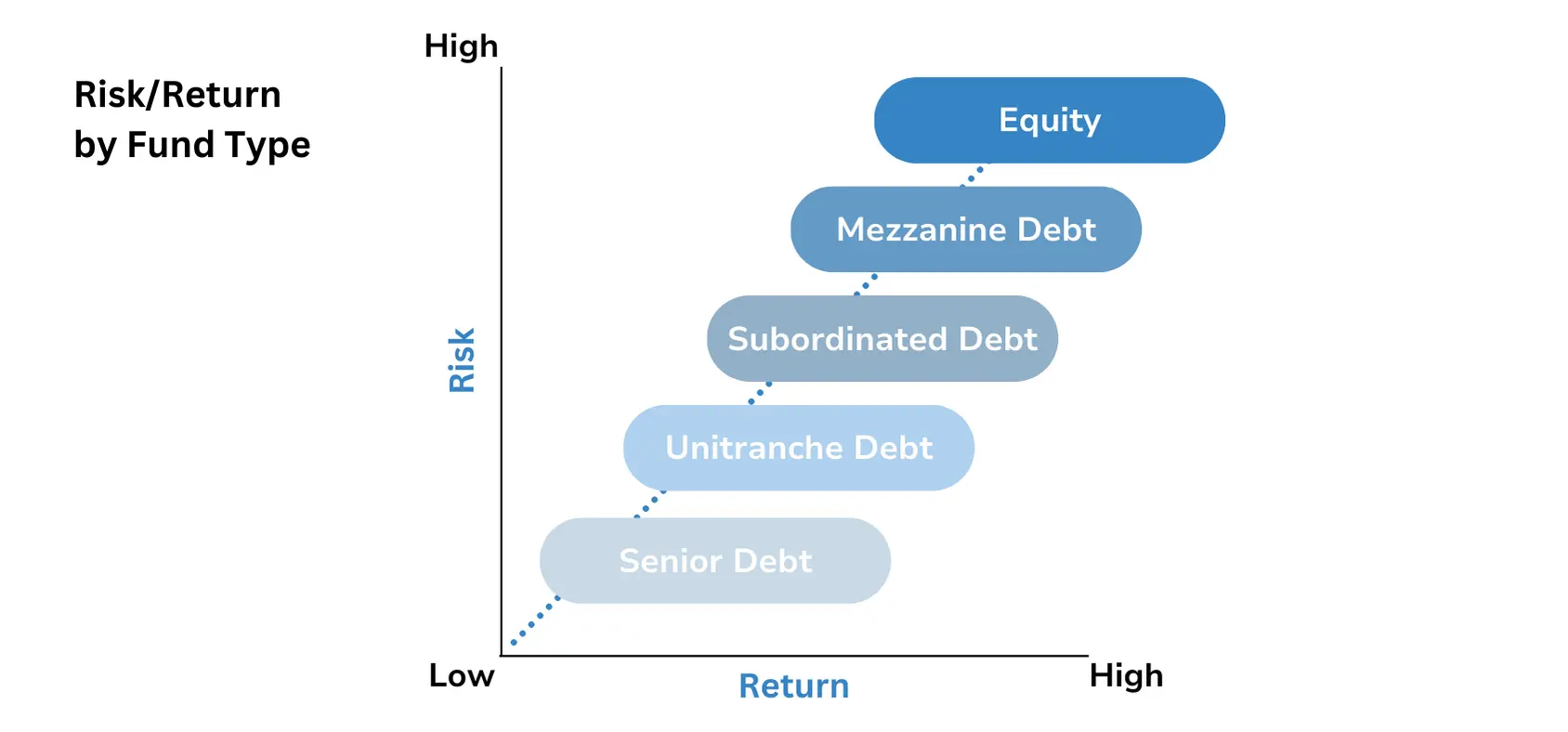

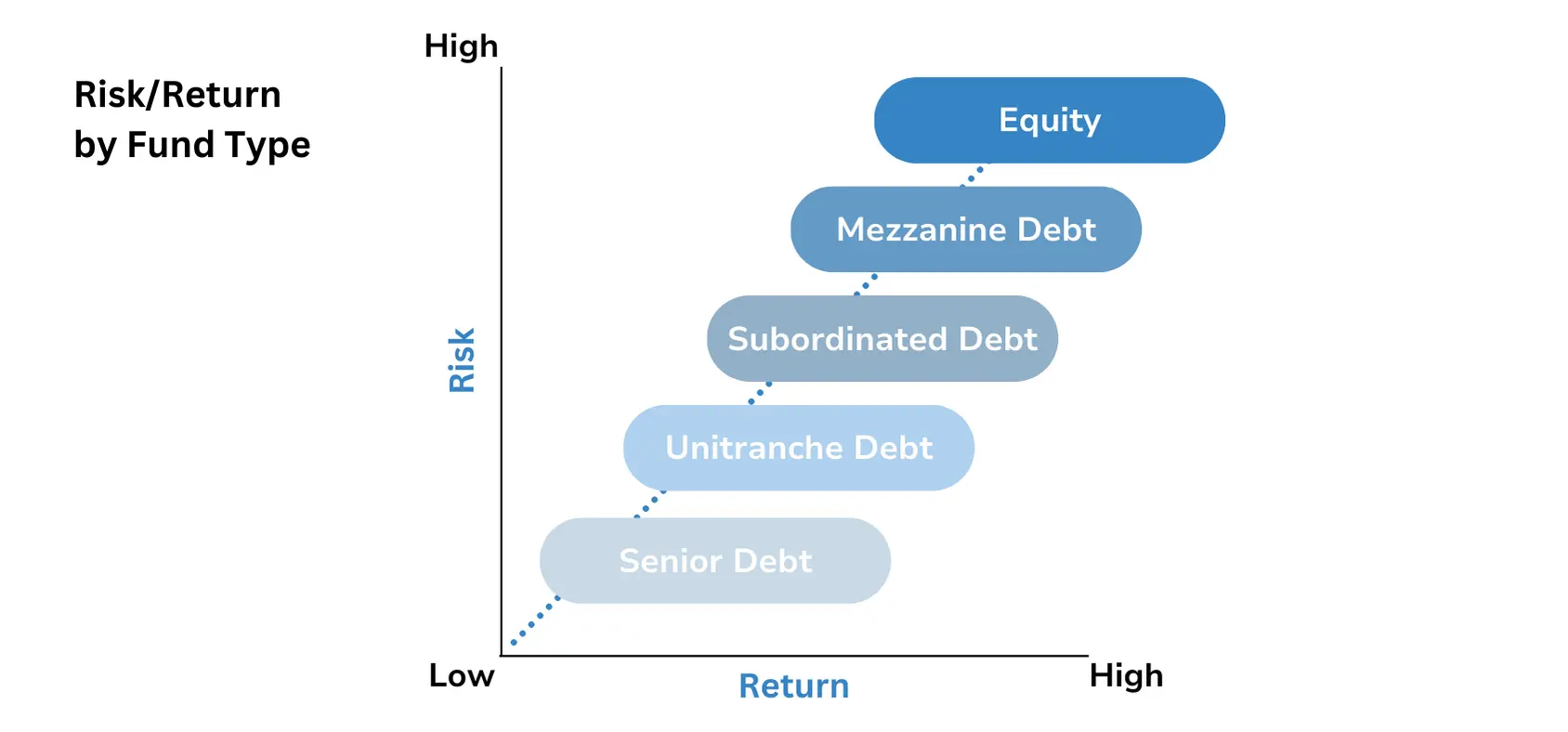

- Private credit principles: Demonstrate an understanding of private credit concepts, such as leveraged lending, mezzanine financing, and distressed debt.

Showcase how your existing skills translate directly to the requirements of private credit roles.

Showcase Quantifiable Achievements

- Use numbers and data: Quantify your accomplishments wherever possible (e.g., "increased efficiency by 15%," "managed a portfolio of $X million").

Highlighting quantifiable achievements demonstrates the impact you've made in previous roles.

Use Keywords Effectively

- Relevant keywords: Private credit, leveraged finance, credit analysis, due diligence, risk assessment, portfolio management, alternative investments, distressed debt, mezzanine financing, covenant compliance.

Using relevant keywords improves the chances of your resume and cover letter being noticed by Applicant Tracking Systems (ATS) and recruiters.

Prepare for Private Credit Interviews

Thorough preparation is crucial for success in private credit interviews.

Research Potential Employers

- Company culture: Understand the firm's culture, values, and investment philosophy.

- Investment strategies: Research their investment focus and recent transactions.

- Recent deals: Familiarize yourself with their recent investments to demonstrate your interest.

Demonstrating genuine interest in the firm sets you apart from other candidates.

Practice Behavioral and Technical Questions

- Behavioral questions: Prepare answers that showcase your skills, experience, and personality. Use the STAR method (Situation, Task, Action, Result).

- Technical questions: Practice financial modeling questions, credit analysis scenarios, and risk assessment problems.

Practice answering common interview questions confidently and clearly.

Ask Thoughtful Questions

- Examples: "What are the firm's growth plans for the next few years?" "What are some of the biggest challenges facing the private credit market?" "How does the firm foster collaboration and teamwork?"

Asking insightful questions demonstrates your engagement and intellectual curiosity.

Consider Further Education or Certifications

Further education can significantly enhance your credentials.

CFA Charter, CAIA Charter, or other relevant certifications

- CFA Charter: The Chartered Financial Analyst designation is highly respected in the finance industry.

- CAIA Charter: The Chartered Alternative Investment Analyst designation focuses on alternative investments, including private credit.

These certifications demonstrate a deep commitment to the field and enhance your credibility.

Specialized Master's Degrees (MBA, MSF)

- MBA: A Master of Business Administration provides a broad business education, beneficial for leadership roles.

- MSF: A Master of Science in Finance provides specialized training in financial analysis and modeling.

Advanced degrees provide a competitive edge and open doors to more senior roles.

Conclusion

The private credit boom presents a unique opportunity for ambitious finance professionals. By strategically networking, developing in-demand skills, crafting compelling applications, and preparing thoroughly for interviews, you can significantly improve your chances of securing a rewarding role in this exciting sector. Don't delay – take action today and start your journey towards a successful career in private credit! Begin by focusing on the key actions outlined above to secure your place in the private credit industry's exciting future. Don't miss out on this incredible private credit opportunity!

Featured Posts

-

The History And Design Of Dr Terrors House Of Horrors

May 25, 2025

The History And Design Of Dr Terrors House Of Horrors

May 25, 2025 -

Indonesia Classic Art Week 2025 Menjelajahi Dunia Porsche Dan Seni

May 25, 2025

Indonesia Classic Art Week 2025 Menjelajahi Dunia Porsche Dan Seni

May 25, 2025 -

Extreme Price Hike For V Mware At And T Details Broadcoms Proposed 1 050 Increase

May 25, 2025

Extreme Price Hike For V Mware At And T Details Broadcoms Proposed 1 050 Increase

May 25, 2025 -

Francis Sultanas Interior Design For Robuchon Restaurants In Monaco

May 25, 2025

Francis Sultanas Interior Design For Robuchon Restaurants In Monaco

May 25, 2025 -

Alnmw Alqyasy Ldaks 30 Tfasyl En Tjawz Dhrwt Mars

May 25, 2025

Alnmw Alqyasy Ldaks 30 Tfasyl En Tjawz Dhrwt Mars

May 25, 2025