5 Key Dos And Don'ts To Succeed In The Private Credit Industry

Table of Contents

Do: Develop a Strong Network and Build Relationships

Success in private credit hinges significantly on your network. Building and maintaining strong relationships is crucial for accessing deals, securing information, and navigating the complexities of the industry.

Cultivate Relationships with Key Players:

- Focus on building relationships with sponsors, borrowers, legal professionals, and other industry experts. These relationships provide invaluable insights, deal flow, and support throughout the investment lifecycle.

- Networking events, industry conferences, and targeted outreach are crucial. Actively participate in industry events to meet potential partners and learn about new opportunities.

- Strong relationships lead to deal flow, preferred access to opportunities, and better due diligence support. Your network can provide you with an edge in a competitive market.

- Remember that trust is paramount in private credit. Building trust takes time and consistent effort, but it's essential for long-term success.

Understand the Importance of Reputation:

- Your reputation is your most valuable asset. In the private credit world, reputation precedes you.

- Maintain ethical standards and professional conduct. Integrity is crucial; any breach of trust can have severe consequences.

- A strong reputation attracts investors and borrowers. It signifies reliability and competence, making you a more desirable partner.

- Consider your long-term reputation when making decisions. Short-term gains should not come at the expense of your long-term standing in the industry.

Don't: Underestimate Due Diligence

Thorough due diligence is non-negotiable in the private credit industry. Skipping or rushing this crucial step can lead to significant financial losses and reputational damage.

Comprehensive Due Diligence is Non-Negotiable:

- Thoroughly investigate borrowers' financials, management teams, and business models. Gain a deep understanding of their operations, risks, and potential for success.

- Don't rush the process; take the time needed for comprehensive analysis. Hasty decisions often lead to regrettable outcomes.

- Engage experts (legal, financial, technical) when necessary. Leverage specialized knowledge to identify potential issues you may overlook.

- Assess collateral quality and market conditions rigorously. Understanding the underlying assets and the broader market context is paramount.

The Pitfalls of Inadequate Research:

- Inadequate due diligence can lead to significant losses. A poorly researched investment can quickly turn into a bad debt.

- Missing red flags can result in defaulted loans or failed investments. Thorough due diligence helps mitigate these risks.

- Due diligence is an investment that protects your capital. Consider it an essential cost, not an unnecessary expense.

Do: Diversify Your Portfolio and Manage Risk Effectively

Diversification and risk management are cornerstones of successful private credit investing. Spreading your investments across various opportunities reduces your exposure to any single risk.

Diversification Strategies for Private Credit:

- Spread investments across different industries, geographies, and borrower types. This reduces your dependence on any single sector or region.

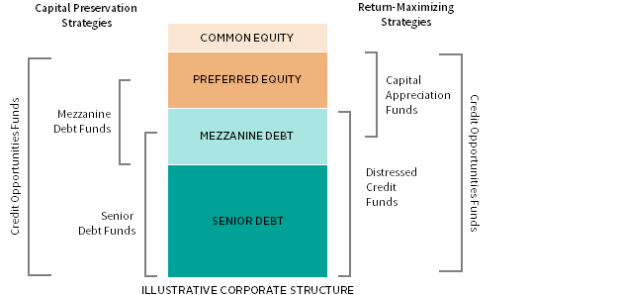

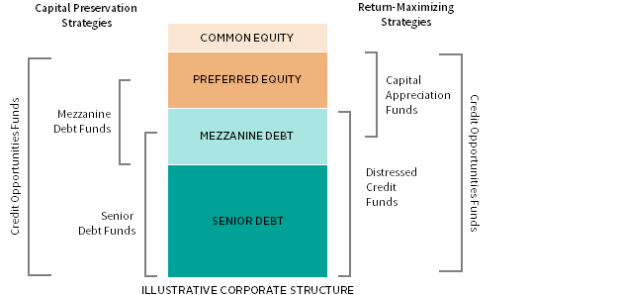

- Consider using various credit strategies (e.g., senior secured, subordinated debt, mezzanine financing). Each strategy carries a different level of risk and return.

- Employ risk mitigation tools like hedging and credit enhancements. These tools can help protect your investment in case of unexpected events.

Proactive Risk Management:

- Establish clear risk tolerance levels. Define the level of risk you're comfortable with and stick to it.

- Regularly monitor your portfolio performance and adjust your strategy as needed. Market conditions change, and your strategy should adapt accordingly.

- Have contingency plans in place for unexpected events. Prepare for potential downturns and market volatility.

Don't: Neglect Legal and Regulatory Compliance

The private credit industry is subject to a complex web of regulations. Non-compliance can result in severe penalties and reputational harm.

Stay Up-to-Date on Regulations:

- The private credit industry is subject to various legal and regulatory requirements. These regulations vary by jurisdiction and are constantly evolving.

- Stay informed about changes in laws and regulations. Regularly review updates and seek professional legal advice.

- Seek legal counsel when needed. Don't hesitate to consult with legal experts to ensure compliance.

- Compliance failures can lead to significant penalties and reputational damage. The costs of non-compliance can far outweigh the benefits of cutting corners.

Importance of Transparency and Proper Documentation:

- Maintain detailed records of all transactions and communications. Meticulous record-keeping is crucial for demonstrating compliance and managing risk.

- Ensure all agreements are legally sound and comply with regulations. Engage legal counsel to review all contracts and agreements.

- Transparency builds trust with investors and borrowers. Open communication fosters stronger relationships.

Do: Utilize Technology and Data Analytics

Technology and data analytics are transforming the private credit industry, offering tools to improve efficiency, manage risk, and enhance decision-making.

Leveraging Technology for Efficiency:

- Implement sophisticated software for portfolio management, risk assessment, and due diligence. Technology streamlines workflows and improves accuracy.

- Use data analytics to identify trends, assess risks, and optimize investment decisions. Data-driven insights provide a competitive edge.

- Automation of tasks can improve efficiency and reduce operational costs. Automate repetitive tasks to free up time for strategic activities.

Data-Driven Decision Making:

- Data analytics provides valuable insights into market trends and borrower performance. Use data to make informed investment decisions.

- Utilize predictive modeling to forecast potential risks and opportunities. Predictive modeling enhances risk management capabilities.

- Informed decision-making leads to better investment outcomes. Data-driven decisions minimize risk and maximize returns.

Conclusion:

Success in the private credit industry requires a combination of strategic planning, diligent execution, and a keen understanding of market dynamics. By following these dos and don'ts – prioritizing relationship building, conducting thorough due diligence, diversifying your portfolio, ensuring regulatory compliance, and leveraging technology – you can significantly improve your chances of achieving sustainable success in this competitive field. Remember, continuous learning and adaptation are crucial for navigating the complexities of the private credit market. Don't hesitate to seek expert advice and stay informed about industry trends to maximize your opportunities in private credit.

Featured Posts

-

Tom Hanks And Tom Cruises 1 Debt Will It Ever Be Repaid

May 16, 2025

Tom Hanks And Tom Cruises 1 Debt Will It Ever Be Repaid

May 16, 2025 -

Rockies Visit Petco Park Padres Aim To Extend Winning Streak

May 16, 2025

Rockies Visit Petco Park Padres Aim To Extend Winning Streak

May 16, 2025 -

San Diego Padres Pregame Report Rain Delay Impacts Tatis Return Campusano Promotion

May 16, 2025

San Diego Padres Pregame Report Rain Delay Impacts Tatis Return Campusano Promotion

May 16, 2025 -

The Price Of Kid Cudis Personal Items Auction Results

May 16, 2025

The Price Of Kid Cudis Personal Items Auction Results

May 16, 2025 -

New Free Steam Game A Players Perspective

May 16, 2025

New Free Steam Game A Players Perspective

May 16, 2025