8% Stock Market Rally On Euronext Amsterdam: Trump's Tariff Impact

Table of Contents

Analyzing the Unexpected Rally on Euronext Amsterdam

Pre-Rally Market Conditions

Before the unexpected 8% rally, the Euronext Amsterdam market, reflected in the AEX index, showed signs of cautious optimism, tempered by concerns about global trade tensions and the broader impact of Trump's tariffs. Investor sentiment was generally subdued, with many anticipating further market volatility.

- Market sentiment before the news: Cautious optimism, mixed with uncertainty about the future.

- Key economic indicators: Mixed signals, with some positive indicators offset by concerns about global trade.

- Investor expectations: Generally subdued, anticipating further market fluctuations.

The Role of Trump's Tariff Announcements (or Changes)

The rally coincided with a series of unexpected developments related to Trump's tariff policies. While initially perceived as potentially negative, these shifts ultimately triggered a positive market reaction. For example, a temporary suspension of planned tariff increases on certain goods, or perhaps a surprise announcement of trade negotiations with a key partner, could have contributed to this unexpected shift in sentiment. The market's response suggests a potential overreaction to initially negative news, followed by a reassessment of the situation.

- Specific tariff changes: (Insert specific details of the tariff announcements or changes that coincided with the rally. Be precise and cite sources).

- Market reaction to the initial announcement: Initial negative reaction, followed by a significant upward swing.

- Potential reasons for the unexpected positive effect: Reassessment of long-term prospects, potential for de-escalation of trade tensions.

Sector-Specific Performance

The rally wasn't uniform across all sectors. Certain sectors within the Euronext Amsterdam market experienced disproportionately large gains. Understanding which sectors benefited most helps explain the nature of the market reaction.

- Top-performing sectors: (List the sectors with the largest gains, e.g., technology, energy, etc. Explain the reasons for their strong performance. Did they benefit from decreased competition due to tariff changes? Increased demand? )

- Reasons for their strong performance: (Explain the specific reasons for the outperformance of these sectors – e.g., reduced reliance on impacted imports, increased domestic demand).

- Underperforming sectors: (Mention sectors that didn't participate in the rally or experienced smaller gains, and the reasons why).

Potential Explanations for the Disparity Between Expected and Actual Market Reaction

Market Sentiment and Investor Psychology

The unexpected rally underscores the significant role of investor psychology and market sentiment. The initial negative reaction to tariff news might have created a buying opportunity for astute investors, as the market potentially overreacted to the perceived risks.

- Behavioral finance principles: Overreaction, herd behavior, anchoring bias played a significant role in shaping the market response.

- Herd behavior: Investors may have followed the initial negative sentiment, but later reversed course as others started buying.

- Market speculation: Speculation about future policy developments also played a crucial role.

Unforeseen Economic Consequences

The tariff announcements may have triggered unforeseen positive consequences, contributing to the unexpected rally.

- Potential positive ripple effects: For example, a reduction in trade barriers could have increased exports for certain industries within the Euronext Amsterdam market.

- Unforeseen opportunities created by policy changes: The changes might have created new opportunities for domestic businesses, reducing reliance on foreign goods.

Global Market Influences

The rally on Euronext Amsterdam wasn't isolated. Global market dynamics and international influences played a role.

- Correlation with other major stock exchanges: (Analyze the correlation between the Euronext Amsterdam rally and the performance of other major stock exchanges).

- Impact of global economic news: (Discuss any significant global economic news that might have influenced the rally).

- Influence of currency fluctuations: (Analyze the influence of currency exchange rates on the rally).

Long-Term Implications and Investment Strategies

Sustainability of the Rally

Whether this 8% rally on the Euronext Amsterdam is sustainable remains to be seen. Several factors could contribute to either a continuation of the upward trend or a correction.

- Factors that could sustain the rally: Continued positive economic data, further de-escalation of trade tensions.

- Potential for a correction: Renewed trade tensions, global economic slowdown.

- Risks and opportunities: Investors should carefully weigh the risks and opportunities presented by the current market conditions.

Investment Recommendations

Based on the analysis, investors should adopt a cautious approach. This is not financial advice, but rather an observation based on market behavior.

- Suggested investment strategies (general, not specific stocks): Diversification across different sectors and asset classes is crucial to mitigate risks.

- Risk management: Careful risk assessment is essential, given the inherent volatility of the market.

- Diversification: Don't put all your eggs in one basket. Diversify across different asset classes to reduce risk.

Conclusion

The 8% stock market rally on Euronext Amsterdam represents a significant and unexpected event, highlighting the complex relationship between Trump's tariff policies and market behavior. The rally's causes were multifaceted, involving a combination of unforeseen economic consequences, shifting investor sentiment, and global market influences. While the sustainability of this rally remains uncertain, understanding the factors contributing to this event is crucial for navigating the complexities of the current investment landscape. Stay informed about market developments and the impact of global trade policies on your investments. Continue your research on the Euronext Amsterdam stock market and the evolving effects of Trump's tariffs. Return to this site for further analysis of market trends and investment strategies.

Featured Posts

-

How Canada And Mexico Can Thrive Despite Us Tariffs A Trade Growth Strategy

May 25, 2025

How Canada And Mexico Can Thrive Despite Us Tariffs A Trade Growth Strategy

May 25, 2025 -

Elegantna Naomi Kempbell U Biliy Tunitsi Foto Z Londonskogo Shou

May 25, 2025

Elegantna Naomi Kempbell U Biliy Tunitsi Foto Z Londonskogo Shou

May 25, 2025 -

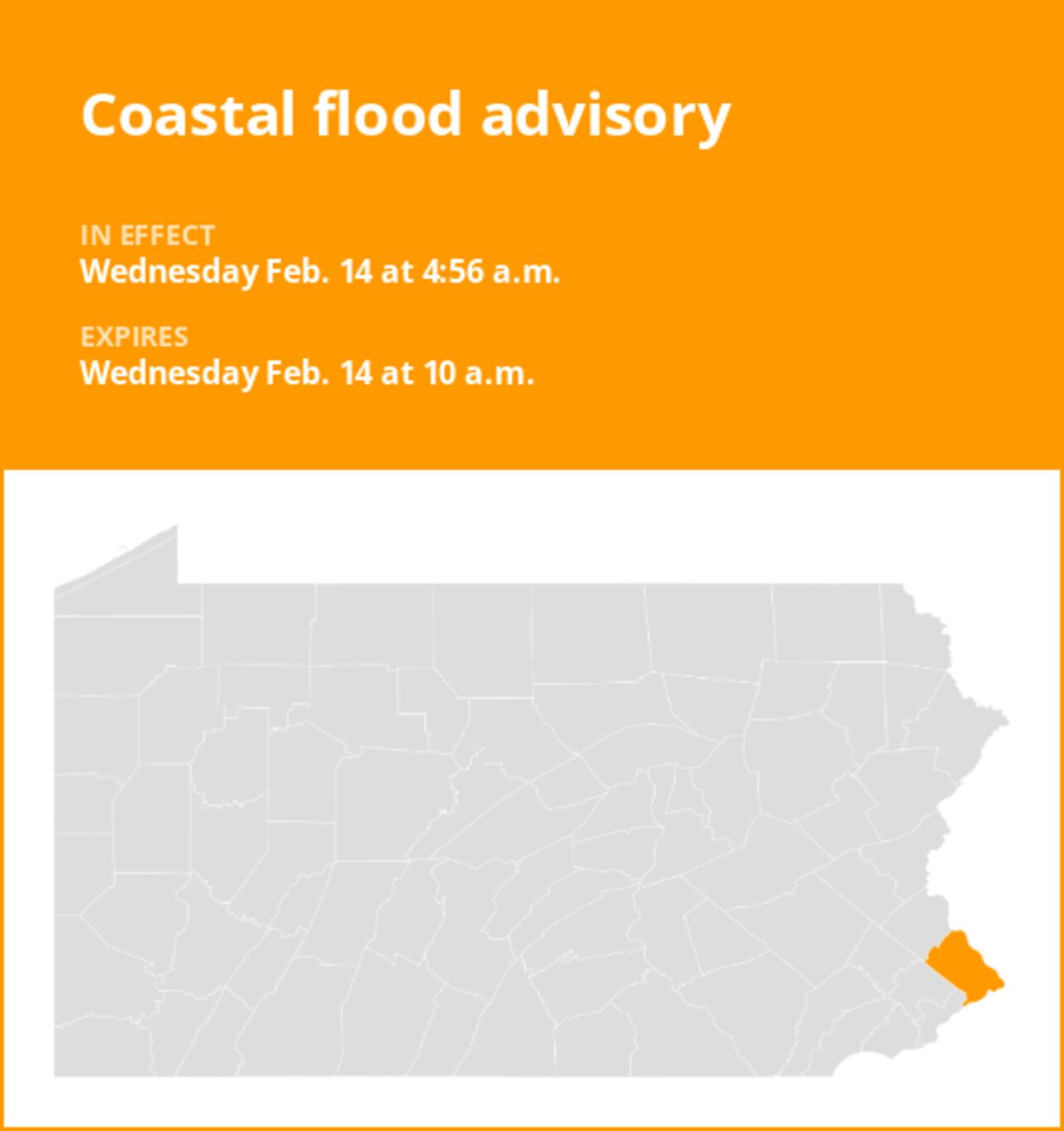

Wednesday Coastal Flood Advisory Update For Southeast Pennsylvania

May 25, 2025

Wednesday Coastal Flood Advisory Update For Southeast Pennsylvania

May 25, 2025 -

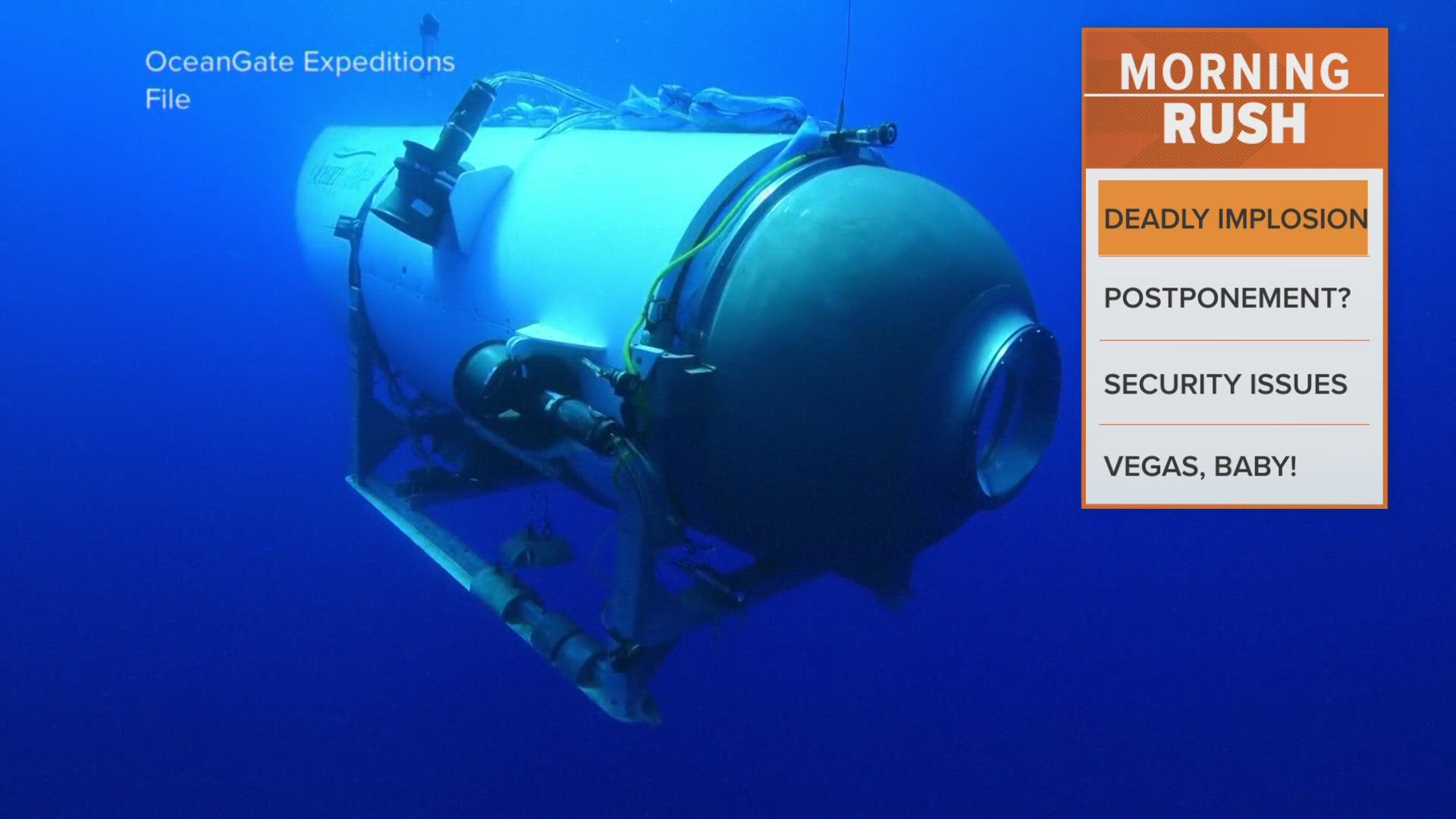

Titan Sub Implosion Footage Reveals Devastating Sound

May 25, 2025

Titan Sub Implosion Footage Reveals Devastating Sound

May 25, 2025 -

17 Celebrity Scandals That Changed Everything

May 25, 2025

17 Celebrity Scandals That Changed Everything

May 25, 2025