A-List Husband, Low-Income Wife: Navigating Financial Disparities

Table of Contents

Understanding the Root Causes of Financial Disparities in Marriage

Significant income differences in a marriage don't always stem from a lack of effort or ambition. Several factors contribute to these financial disparities in marriage, creating unique challenges for couples.

Career Choices and Earning Potential

Career paths, education levels, and industry norms significantly impact earning potential. Differences in income often arise from:

- Differences in job opportunities: Access to high-paying jobs can be influenced by location, networking opportunities, and educational background.

- Salary negotiation skills: Effective negotiation can significantly impact starting salaries and future raises. Women, in particular, often face a disadvantage in this area.

- Industry saturation: Certain industries offer higher earning potential than others, leading to inherent income gaps between spouses in different fields.

- Impact of career breaks: Career interruptions, such as those for childcare, can significantly impact long-term earning potential and contribute to income disparities.

Statistics on gender pay gaps and income inequality highlight the systemic issues at play. Addressing these broader societal factors is crucial for understanding and mitigating income discrepancies within marriages.

Unforeseen Circumstances and Life Events

Unexpected life events can dramatically alter a couple's financial landscape, creating or exacerbating existing financial disparities in marriage. These events include:

- Impact of unexpected medical bills: High medical costs can quickly deplete savings and create significant financial strain.

- Long-term care needs: The costs associated with long-term care can be substantial, impacting both the individual and the couple's overall financial stability.

- Unemployment benefits: The adequacy of unemployment benefits varies, and unexpected job loss can severely impact a household's income.

- Support systems: The availability of family support or other resources can influence a couple's ability to navigate financial hardship.

Comprehensive financial planning, including emergency funds and appropriate insurance coverage, is vital to mitigate the impact of unforeseen circumstances.

Differing Financial Priorities and Spending Habits

Contrasting viewpoints on saving, spending, and investment contribute to financial imbalances. Couples may differ in:

- Discrepancies in risk tolerance: One spouse may be more inclined to take financial risks, while the other prefers a more conservative approach.

- Investment strategies: Differences in investment knowledge and experience can lead to disagreements on financial decisions.

- Luxury spending vs. saving: Differing priorities regarding luxury purchases versus saving for long-term goals can create conflict.

- Differing cultural backgrounds impacting financial behaviors: Cultural norms around money management can contribute to diverse approaches to spending and saving.

Effective communication strategies are essential to bridge these differences and establish shared financial goals. Understanding each other's perspectives is key to finding common ground.

Strategies for Navigating Financial Disparities in a Marriage

Successfully navigating financial disparities in marriage requires proactive measures and a strong commitment to teamwork.

Open and Honest Communication

Transparent conversations about finances are fundamental. This involves:

- Regular budget meetings: Establish a routine for discussing finances, reviewing budgets, and tracking expenses.

- Shared financial goals: Define common financial objectives, such as saving for a house, retirement, or children's education.

- Financial transparency tools: Utilize budgeting apps and other tools to enhance communication and track spending.

- Professional financial counseling: Seek guidance from a financial therapist or counselor experienced in working with couples facing financial disparities.

Active listening, empathy, and a willingness to compromise are essential for effective communication.

Creating a Joint Financial Plan

Collaboratively creating a budget and a long-term financial plan is crucial. This involves:

- Allocating funds for shared expenses: Determine how to allocate funds for housing, groceries, utilities, and other shared expenses.

- Individual needs: Acknowledge and accommodate individual financial needs and spending allowances.

- Savings goals: Establish shared savings goals and strategies for reaching them.

- Debt management strategies: Develop a plan to manage and reduce any existing debt.

A realistic budget that considers both incomes and expenses is paramount. It's important to ensure the plan reflects the needs and priorities of both partners.

Seeking Professional Financial Advice

Consulting a financial advisor or therapist specializing in couples' finances offers significant benefits:

- Objective financial guidance: An unbiased perspective can help resolve disagreements and make informed financial decisions.

- Personalized financial planning: A financial advisor can create a customized plan tailored to the couple's unique financial situation.

- Conflict resolution support: A therapist can provide guidance in navigating emotional challenges related to financial disparities.

- Legal and tax implications: Professionals can advise on legal and tax implications of financial decisions.

Seeking professional help empowers couples to address complex financial situations effectively.

Preserving Individuality While Building a United Financial Future

Maintaining a sense of individual autonomy while working towards shared financial goals is achievable.

Maintaining Separate Accounts

While a joint account is essential for shared expenses, maintaining separate accounts can offer benefits:

- Maintaining personal spending autonomy: Allows each spouse to maintain control over their personal spending.

- Managing individual debts: Facilitates managing individual debts separately, improving transparency and accountability.

- Preserving financial independence: Maintains a sense of financial independence for each spouse.

Transparency and trust remain essential even with separate accounts. Open communication regarding individual spending habits and financial goals is still crucial.

Supporting Individual Goals and Aspirations

Balancing individual financial needs with shared goals is vital for a successful partnership.

- Supporting education: Supporting further education or professional development for either spouse can lead to long-term financial benefits.

- Career advancement: Supporting career aspirations through education, training, or other resources can enhance income potential.

- Personal hobbies and interests: Allocating funds for individual hobbies and interests can contribute to overall well-being and prevent resentment.

- Long-term care planning: Planning for long-term care needs protects both partners' financial security in the future.

Mutual support and understanding are key to achieving individual and shared financial goals.

Addressing Power Dynamics

Significant income differences can create power imbalances. Addressing this requires:

- Promoting equal decision-making: Ensure both partners have an equal voice in financial decisions.

- Fair distribution of household responsibilities: Equitable distribution of household tasks helps prevent resentment and foster equality.

- Recognizing and addressing potential resentment: Openly acknowledging and addressing feelings of resentment or inequality is crucial.

Constructive communication and a commitment to equality are vital for navigating these sensitive issues.

Conclusion

Navigating significant financial disparities in marriage requires open communication, careful planning, and a willingness to address potential power imbalances. By understanding the root causes of these disparities, creating a joint financial plan, and seeking professional help when needed, couples can build a strong and secure financial future together. Remember, proactive communication and a collaborative approach are crucial for addressing financial disparities in marriage. Don't hesitate to seek professional guidance to effectively manage your unique financial landscape and build a financially secure and harmonious future.

Featured Posts

-

The Ultimate Guide To Orlandos Highest Rated Southern Restaurants

May 19, 2025

The Ultimate Guide To Orlandos Highest Rated Southern Restaurants

May 19, 2025 -

Baby Lasagna Se Vraca Na Eurosong

May 19, 2025

Baby Lasagna Se Vraca Na Eurosong

May 19, 2025 -

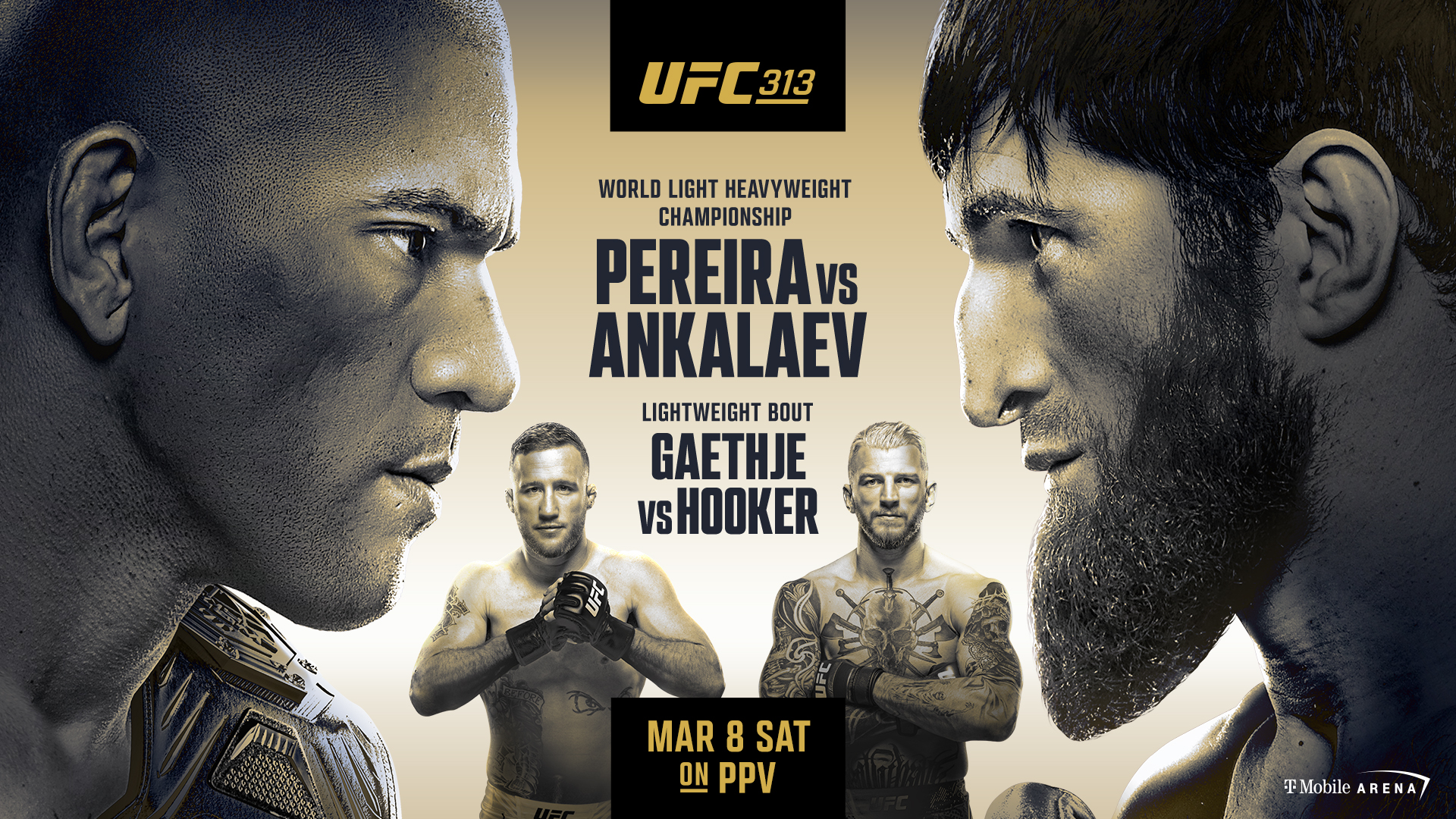

Ufc 313 Results Complete Ko And Submission Highlights

May 19, 2025

Ufc 313 Results Complete Ko And Submission Highlights

May 19, 2025 -

Is Erling Haalands Time At Man City Over Summer Transfer Window Predictions

May 19, 2025

Is Erling Haalands Time At Man City Over Summer Transfer Window Predictions

May 19, 2025 -

Ufc 313 Controversial Decision Sparks Debate Following Fighters Admission

May 19, 2025

Ufc 313 Controversial Decision Sparks Debate Following Fighters Admission

May 19, 2025