A Real Safe Bet: Assessing Risk Tolerance Before Investing

Table of Contents

Understanding Your Risk Tolerance

Risk tolerance refers to your psychological comfort level with the possibility of losing money in an investment. It's fundamentally different from risk capacity, which represents your financial ability to withstand potential losses. Understanding both is vital for successful investing.

- Risk tolerance is your emotional response to market fluctuations. Are you comfortable seeing your investment value decline temporarily? Can you sleep at night knowing your investments might experience short-term losses?

- Risk capacity is a measure of your financial strength. How much money can you afford to lose without jeopardizing your essential needs or long-term financial goals? This is often tied to your net worth, income, and existing debt.

Individual circumstances significantly influence risk tolerance.

- Age: Younger investors generally have a higher risk tolerance due to a longer time horizon to recover from potential losses. They can afford to take on more risk in pursuit of higher returns.

- Financial Goals: Short-term goals (e.g., a down payment on a house) require a more conservative approach, while long-term goals (e.g., retirement) allow for greater risk-taking.

- Time Horizon: The longer your investment timeline, the greater your ability to withstand market downturns, allowing for a higher risk tolerance.

Ignoring your risk tolerance can have serious consequences:

- Panic Selling: Facing market dips, investors with low risk tolerance might sell assets at a loss, locking in losses and missing out on potential future gains.

- Poor Investment Choices: Investing in high-risk assets that don't align with your risk tolerance can lead to significant stress and potentially devastating financial losses.

Assessing Your Risk Tolerance: Methods and Tools

Several methods can help you assess your risk tolerance:

Questionnaires and Online Assessments

Many online questionnaires and assessments gauge your risk tolerance by asking questions about your investment experience, financial situation, and comfort level with potential losses. While convenient, these assessments have limitations; they offer a general overview rather than a deeply personalized analysis. Remember to be honest in your self-assessment for accurate results.

(Note: Include links to reputable sources offering risk tolerance questionnaires if available and appropriate. Always verify the credibility of any online tool before using it.)

Professional Financial Advice

A financial advisor can provide a comprehensive risk tolerance assessment tailored to your unique circumstances. They consider your financial goals, time horizon, and risk capacity, offering personalized investment strategies that align with your comfort level. This personalized approach is invaluable for navigating complex investment decisions.

Reviewing Your Past Investment Behavior

Analyzing past investment decisions provides crucial insight into your risk appetite. Did you panic sell during market downturns? Did you consistently seek high-growth investments, or prefer safer options? Reflecting on your past behavior can reveal your true risk tolerance level.

- Consider using a combination of these methods for a more comprehensive assessment.

- Don't hesitate to seek professional help; an advisor can provide unbiased guidance.

Matching Your Risk Tolerance to Investment Strategies

Investment strategies cater to different risk tolerance levels:

Conservative Investments

Suitable for low risk tolerance, these options prioritize capital preservation over high returns.

- Bonds: Generally considered less volatile than stocks.

- Savings Accounts: Offer low returns but guaranteed principal.

- Money Market Funds: Provide liquidity and relatively low risk.

Moderate Investments

A balanced approach combining stocks and bonds suits individuals with moderate risk tolerance. This strategy aims for a blend of growth and stability.

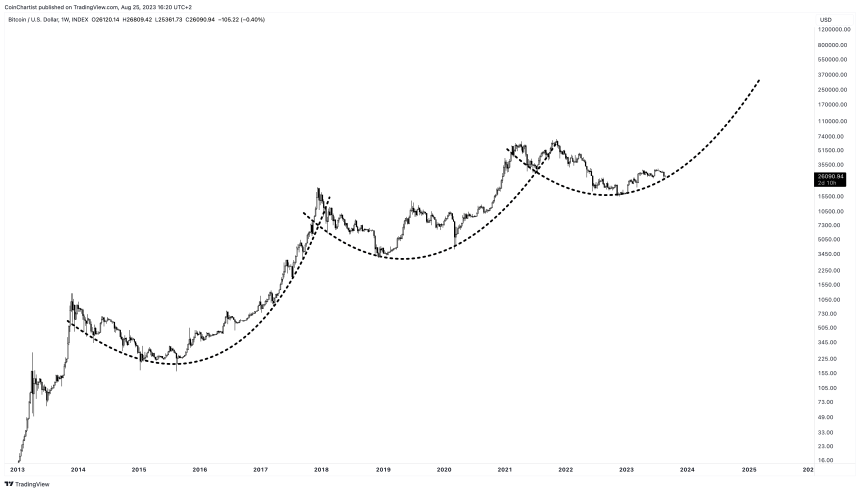

Aggressive Investments

High-risk, high-reward strategies like individual stocks, options, or cryptocurrencies are suitable only for those with a high risk tolerance and a thorough understanding of the potential for substantial losses. Thorough due diligence and diversification are crucial.

- There's no "one size fits all" approach to investing.

- Your investment strategy should accurately reflect your individual risk tolerance.

- Diversification is crucial regardless of your risk tolerance level.

Conclusion

Determining your risk tolerance is fundamental to successful investing. By understanding your comfort level with potential losses and aligning your investment strategy accordingly, you can build a portfolio that aligns with your financial goals and reduces unnecessary stress. Remember, honestly assessing your risk tolerance, utilizing available resources, and seeking professional guidance when needed is a real safe bet for long-term financial success. Take the time to assess your risk tolerance today and start building a more secure financial future.

Featured Posts

-

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

May 09, 2025

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

May 09, 2025 -

Nottingham Attack Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025

Nottingham Attack Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025 -

Oilers Beat Islanders In Overtime Draisaitl Hits 100 Point Mark

May 09, 2025

Oilers Beat Islanders In Overtime Draisaitl Hits 100 Point Mark

May 09, 2025 -

Uy Scuti Album Young Thug Offers Release Date Clues

May 09, 2025

Uy Scuti Album Young Thug Offers Release Date Clues

May 09, 2025 -

The Future Of Bitcoin Bitcoin Seoul 2025

May 09, 2025

The Future Of Bitcoin Bitcoin Seoul 2025

May 09, 2025