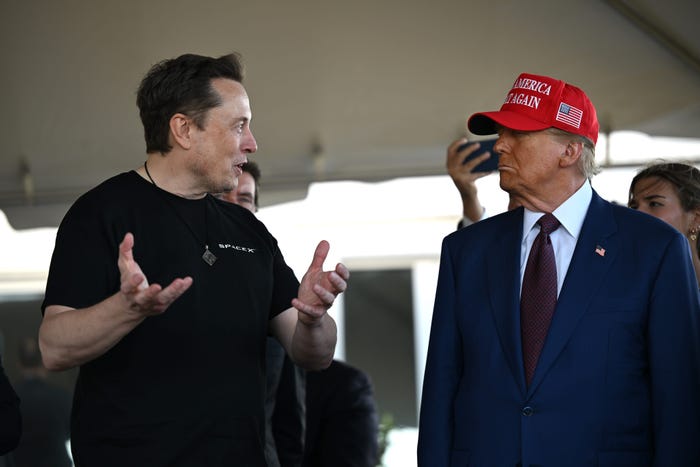

A Side Hustle For Elon Musk's Friends: Access To Private Company Stakes

Table of Contents

The Network Effect: Leveraging Connections for Private Investments

The most significant advantage in accessing private company stakes is your network. Connections, particularly within circles that include individuals like Elon Musk, often unlock doors to pre-IPO investment opportunities unavailable to the general public. This is the power of the network effect in action.

- Strategic Networking: Building relationships with venture capitalists, angel investors, and individuals involved in startups is crucial. Attend industry events, join relevant online communities, and actively engage in conversations with people in the investment space.

- Cultivating Trust and Reputation: Building a strong reputation for integrity and sound judgment is paramount. This takes time and consistent effort, but it significantly increases your credibility and access to exclusive investment opportunities.

- Leveraging Professional Platforms: Platforms like LinkedIn can be invaluable tools for networking and connecting with individuals in the venture capital and private equity space. Actively participate in relevant groups and engage in meaningful conversations.

- Exclusive Events: Attending invitation-only conferences and workshops provides unparalleled networking opportunities, allowing you to connect with key players in the private investment world.

Early access to these investments offers the potential for exponential growth. Investing before a company goes public (pre-IPO) allows you to capitalize on the significant price appreciation that often occurs after an IPO. This potential for high returns is a major draw for those seeking to leverage their networks for financial gain. It's the ultimate high-net-worth individuals’ game.

Understanding Private Company Stakes: Due Diligence and Risk Assessment

Investing in private companies carries significant risk, emphasizing the critical importance of thorough due diligence. Before committing any capital, you must rigorously evaluate the investment opportunity.

- Company Evaluation: Analyze the company's business model, its scalability, its competitive landscape, and its intellectual property. Seek independent verification of claims and projections.

- Management Team Assessment: Evaluate the experience, track record, and expertise of the management team. A strong leadership team significantly increases the chances of success.

- Financial Projections Review: Scrutinize financial projections and forecasts critically, considering various scenarios and potential market downturns.

- Market Research: Conduct thorough market research to assess the size, growth potential, and competitive dynamics of the target market.

Risk mitigation strategies are crucial. Diversification across multiple investments, understanding market volatility, and setting realistic expectations are all vital components of a sound investment strategy in the private equity world. Thorough due diligence mitigates investment risk.

Navigating Legal and Regulatory Compliance

Investing in private companies involves navigating a complex web of legal and regulatory requirements. Understanding and adhering to these regulations is crucial to avoid penalties and maintain compliance.

- Legal Documentation: Familiarize yourself with the various legal documents involved, including offering memorandums, subscription agreements, and shareholder agreements. Seek legal counsel for guidance.

- SEC Regulations: Be aware of and adhere to all applicable Securities and Exchange Commission (SEC) regulations, especially if the investment involves securities.

- Tax Implications: Consult with a tax professional to understand the potential tax implications of investing in private companies and explore strategies for tax optimization. Tax planning is essential for long-term success.

- Professional Advice: Engaging financial and legal advisors with experience in private investments is highly recommended. They provide invaluable expertise and guidance to navigate the legal landscape. This ensures compliance with private investment regulations.

Building a Portfolio of Private Company Stakes: Diversification and Long-Term Strategy

Building a diversified portfolio of private company stakes is crucial for risk management. Don't put all your eggs in one basket.

- Sector Diversification: Invest in companies across different sectors to reduce the impact of industry-specific downturns.

- Stage Diversification: Invest in companies at various stages of development (seed, Series A, etc.) to balance risk and reward.

- Geographic Diversification: Consider investing in companies located in different geographical regions to further mitigate risk.

- Long-Term Perspective: Private investments often have longer lock-up periods than public market investments. Adopting a long-term investment strategy is essential, accepting that liquidity may be limited in the short term.

A well-diversified investment portfolio reduces overall risk and improves the chances of long-term success in the private investment world.

Conclusion: Capitalizing on Exclusive Opportunities: Your Path to Accessing Private Company Stakes

Accessing private company stakes offers significant potential for high returns, but it requires a strategic approach. This involves leveraging your network to gain access to exclusive opportunities, conducting thorough due diligence to mitigate risk, adhering to legal and regulatory requirements, and building a diversified portfolio for long-term growth. While the potential for substantial financial gains is significant, remember the inherent risks associated with private investments. To begin your journey into this lucrative side hustle, start building your network, conduct in-depth research, and consider seeking professional financial and legal advice. Don't delay – your path to accessing private company stakes and achieving significant financial gains starts now.

Featured Posts

-

Manchester Uniteds Osimhen Pursuit A Financial Tightrope

Apr 26, 2025

Manchester Uniteds Osimhen Pursuit A Financial Tightrope

Apr 26, 2025 -

140 20

Apr 26, 2025

140 20

Apr 26, 2025 -

Ambasada Olandei Solicitata Sa Rezolve Situatia De La Santierul Naval Mangalia

Apr 26, 2025

Ambasada Olandei Solicitata Sa Rezolve Situatia De La Santierul Naval Mangalia

Apr 26, 2025 -

I Ll Have What Shes Having Chelsea Handlers New Book Available Online

Apr 26, 2025

I Ll Have What Shes Having Chelsea Handlers New Book Available Online

Apr 26, 2025 -

Mission Impossible 7s Omission Of Two Sequels A Franchise Anomaly

Apr 26, 2025

Mission Impossible 7s Omission Of Two Sequels A Franchise Anomaly

Apr 26, 2025

Latest Posts

-

Jennifer Aniston Gate Crash Man Charged With Stalking And Vandalism

May 10, 2025

Jennifer Aniston Gate Crash Man Charged With Stalking And Vandalism

May 10, 2025 -

Chief Justice Roberts Recounts Being Mistaken For Former Gop House Leader

May 10, 2025

Chief Justice Roberts Recounts Being Mistaken For Former Gop House Leader

May 10, 2025 -

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025 -

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025 -

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025