AAPL Stock: Analysis Of Upcoming Price Levels

Table of Contents

AAPL's Recent Financial Performance and Future Projections

AAPL's recent financial performance provides a strong foundation for analyzing its future trajectory. Examining key performance indicators (KPIs) offers valuable insights into the Apple stock price.

Revenue Growth and Profitability

Apple's recent quarterly earnings reports showcase continued growth, although the pace may be slowing compared to previous years. Key metrics like revenue, earnings per share (EPS), and gross margin are vital indicators of the company's financial health.

-

Growth Areas: Strong growth continues in services revenue, driven by the expanding Apple ecosystem and robust subscription services like Apple Music and iCloud. Wearables also remain a significant growth area, with Apple Watch and AirPods sales exceeding expectations. iPhone sales, while a core component of Apple's revenue, show signs of maturity.

-

Potential Challenges: Supply chain disruptions and increased competition, particularly in the smartphone market, pose potential challenges to future profitability. Rising inflation and macroeconomic uncertainty also impact consumer spending, potentially affecting Apple product demand. The impact of these challenges on AAPL price prediction needs careful consideration.

Analyst Ratings and Price Targets

Financial analysts offer a range of price targets for AAPL stock, reflecting diverse perspectives on its future performance. These predictions factor in various elements, making a thorough analysis critical for investors looking for an Apple stock forecast.

-

Analyst Predictions: Many analysts maintain a positive outlook for AAPL, citing strong brand loyalty, a robust ecosystem, and continued innovation. However, price targets vary significantly, ranging from conservative estimates to more aggressive projections. It’s essential to consider the range of views presented.

-

Influencing Factors: Macroeconomic conditions, such as interest rate hikes and inflation, play a significant role in analyst ratings. Technological advancements, including the ongoing development of AR/VR and AI, also influence their assessment of AAPL’s future growth potential.

Market Trends and Macroeconomic Factors Influencing AAPL Stock

The broader market environment and macroeconomic factors significantly influence AAPL stock. Understanding these external pressures is vital when assessing the Apple stock price.

Overall Market Sentiment

The overall market sentiment directly impacts AAPL's performance. Periods of market optimism tend to correlate with higher AAPL stock prices, while market corrections can lead to declines.

-

Market Correlation: AAPL, as a large-cap tech stock, is often seen as a market bellwether. Its performance frequently reflects the overall health of the tech sector and the broader economy.

-

Market Volatility: Geopolitical events, interest rate changes, and inflation all contribute to market volatility, impacting AAPL's stock price. Periods of heightened uncertainty may increase the volatility of the AAPL stock price prediction.

Technological Advancements and Competition

The tech industry is highly competitive, with constant innovation and technological advancements. This impacts Apple's market share and its ability to maintain its premium pricing strategy.

-

Competitive Threats: Companies like Samsung, Google, and others constantly challenge Apple's market dominance. The development of superior technologies or innovative products by competitors poses a threat to AAPL's growth and the Apple stock price.

-

Technological Disruption: The emergence of new technologies, such as AR/VR and advanced AI, could significantly impact Apple's product lineup and its future market share. This influence on the Apple stock price requires careful examination.

Upcoming Product Releases and Their Potential Impact on AAPL Stock

Anticipated product launches play a crucial role in shaping the AAPL stock price prediction.

Expected Product Launches and Their Market Appeal

Apple's upcoming product launches, such as new iPhones, Apple Watches, and Macs, generate significant market anticipation. The success of these releases directly impacts Apple's financial performance and its stock price.

-

Demand and Reception: The market's response to new product launches is unpredictable, despite pre-release hype. Factors like pricing, features, and overall market sentiment influence consumer demand and, subsequently, the AAPL stock price.

-

Revenue Growth Impact: Successful product launches drive revenue growth and enhance profitability, contributing positively to the Apple stock price forecast. Conversely, poor reception can negatively affect the stock.

Innovation and Technological Leadership

Apple's continued commitment to innovation and its ability to maintain technological leadership are essential for long-term growth.

-

R&D Spending: Apple's substantial investment in research and development fuels future product innovation and its ability to compete. This is a critical factor to consider in your Apple stock forecast.

-

Adaptability: Apple's capacity to adapt to evolving consumer preferences and emerging technologies is critical for sustaining its market leadership position and maintaining a high Apple stock price.

Conclusion

This analysis of AAPL stock highlights several key factors impacting its potential upcoming price levels. AAPL's financial performance, market trends, competitive landscape, and upcoming product releases all contribute to its valuation. While a precise Apple stock price prediction is impossible, understanding these interwoven elements provides valuable insights for investors. The ongoing strength of its services segment and the anticipated launch of new products suggest potential for further growth, but macroeconomic conditions and competitive pressures remain significant considerations.

Key Takeaways:

- AAPL's financial health remains robust, although growth may be moderating.

- Market sentiment and macroeconomic conditions significantly influence AAPL's stock price.

- Competition and technological innovation are critical factors shaping AAPL's future.

- Upcoming product releases have the potential to significantly impact AAPL's stock price.

Call to Action: While this analysis offers insights into potential upcoming price levels for AAPL stock, remember to conduct your own thorough research before making any investment decisions. Stay informed about AAPL stock and its future prospects to make well-informed investment decisions about AAPL stock price forecast.

Featured Posts

-

Jenson Fw 22 Extended A Deeper Look At The Collection

May 25, 2025

Jenson Fw 22 Extended A Deeper Look At The Collection

May 25, 2025 -

Tuukka Taponen F1 Debyytti Jo Taenae Vuonna Jymypaukku Laehellae

May 25, 2025

Tuukka Taponen F1 Debyytti Jo Taenae Vuonna Jymypaukku Laehellae

May 25, 2025 -

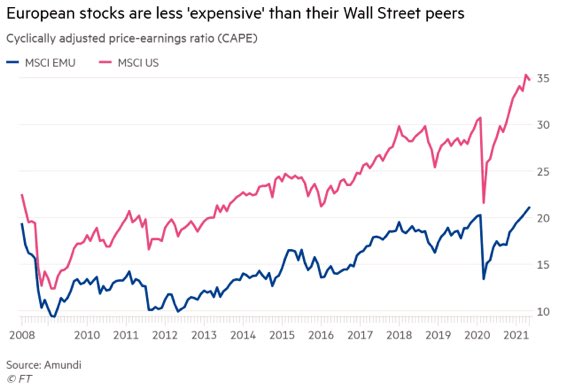

Analyseren We De Recente Snelle Koerswijziging Europese Aandelen Versus Wall Street

May 25, 2025

Analyseren We De Recente Snelle Koerswijziging Europese Aandelen Versus Wall Street

May 25, 2025 -

Amsterdam Stock Exchange Suffers Third Consecutive Major Loss Down 11 Since Wednesday

May 25, 2025

Amsterdam Stock Exchange Suffers Third Consecutive Major Loss Down 11 Since Wednesday

May 25, 2025 -

Avrupa Borsalari 16 Nisan 2025 Duesuesue Stoxx Europe 600 Ve Dax 40 Analizi

May 25, 2025

Avrupa Borsalari 16 Nisan 2025 Duesuesue Stoxx Europe 600 Ve Dax 40 Analizi

May 25, 2025