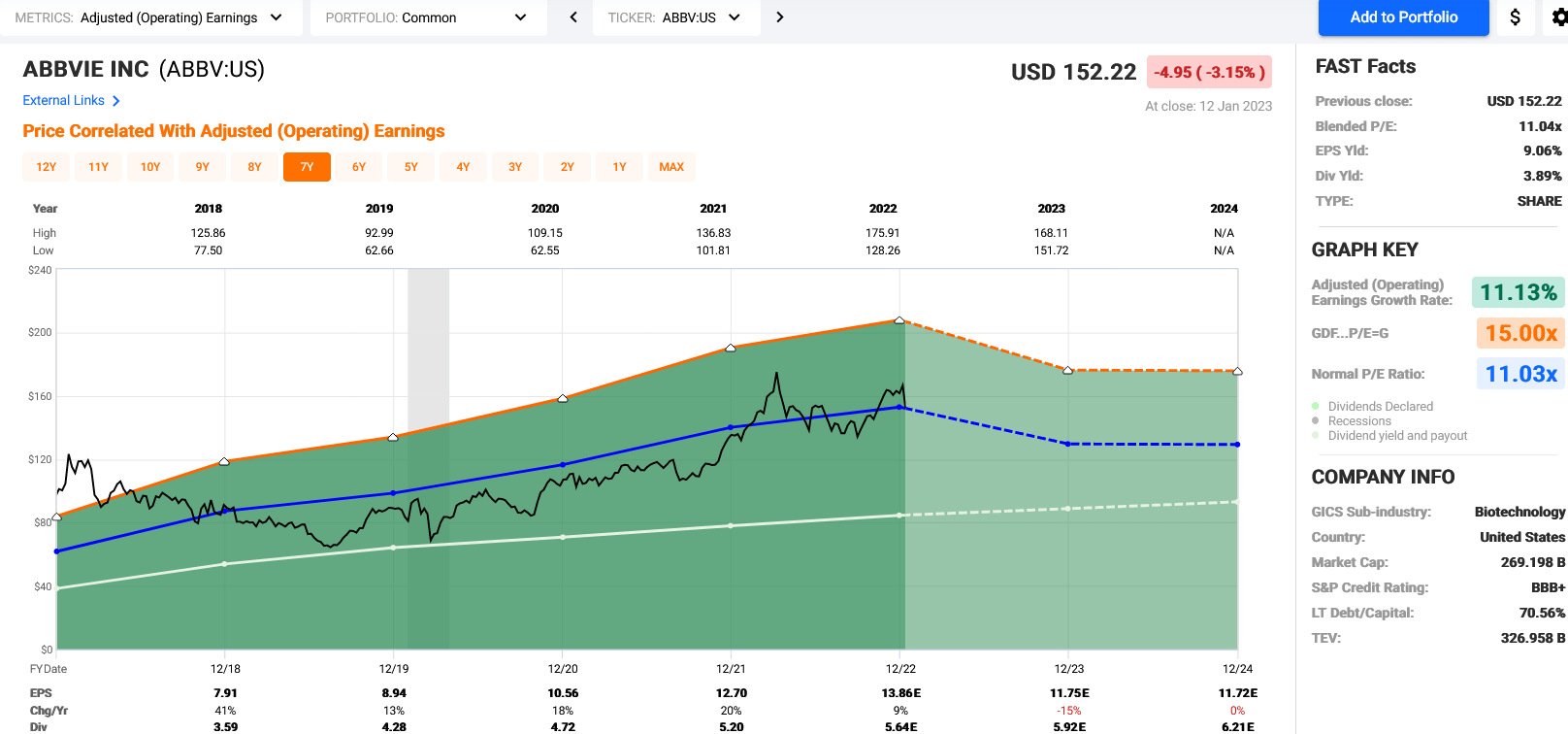

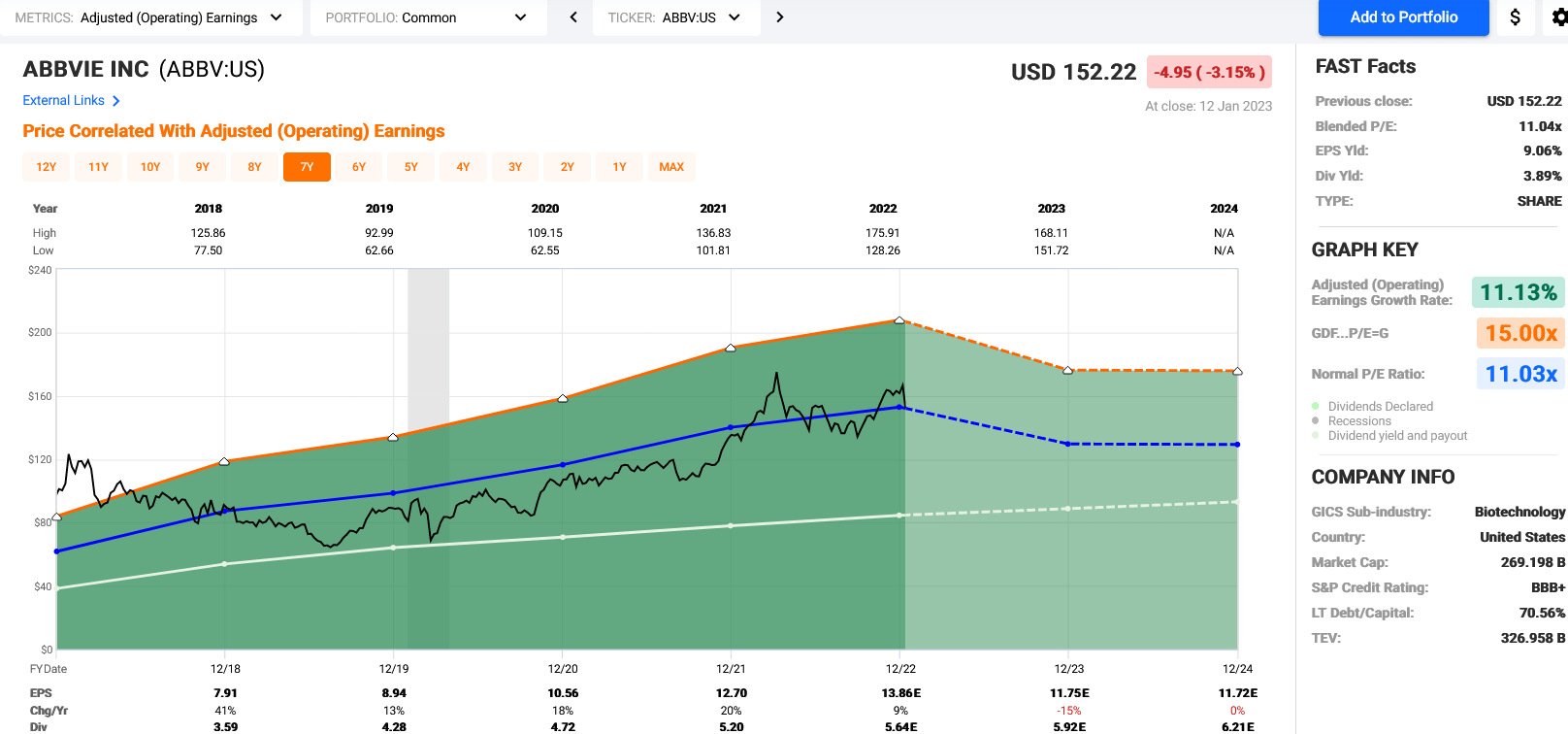

AbbVie (ABBV) Stock Rises On Exceeding Sales Expectations And Increased Profit Forecast

Table of Contents

AbbVie's Q2 Earnings Report: A Detailed Look at the Numbers

AbbVie's Q2 2024 earnings report showcased impressive financial performance, significantly exceeding analysts' projections. This strong showing reflects the company's strategic initiatives and the success of its key product lines. Key highlights from the report include:

-

Revenue Growth: Revenue reached $14.0 billion, surpassing analyst estimates of $13.5 billion. This represents a 7% year-over-year increase, demonstrating continued market dominance and robust sales growth. The increase is largely attributed to strong performance of key drugs like Rinvoq and Skyrizi.

-

Earnings Per Share (EPS): AbbVie reported an EPS of $3.17, exceeding the projected EPS of $3.00. This positive deviation reflects improved operational efficiency and strong revenue generation.

-

Key Contributing Factors: The exceeding sales were primarily driven by the strong performance of its immunology portfolio, particularly Rinvoq and Skyrizi, which continue to capture significant market share in their respective therapeutic areas. Strong sales growth was also observed in its aesthetics portfolio.

-

Year-Over-Year Comparison: Compared to Q2 2023, AbbVie demonstrated a significant 7% increase in revenue and a 10% increase in EPS, showcasing sustained growth and strong financial management.

Increased Profit Forecast: A Positive Outlook for AbbVie's Future

Building on its strong Q2 performance, AbbVie also significantly increased its full-year profit forecast. This positive outlook reflects confidence in the company's future growth trajectory and underlying strength.

-

Quantifiable Data: AbbVie raised its full-year EPS guidance to $13.50 - $13.70, a substantial increase from the previous guidance of $12.90 - $13.10. This represents approximately a 4-5% increase in projected earnings.

-

Influencing Factors: This increased forecast is primarily attributed to the continued strong performance of its key drugs, along with ongoing operational efficiencies and strategic investments in research and development. New drug launches and market expansion in key therapeutic areas also contribute to this positive outlook.

-

Impact on Investor Confidence: The upward revision in the profit forecast significantly boosted investor confidence, reflected in the immediate positive market reaction to the news. This increased confidence also suggests a potential upward revision in AbbVie's stock valuation.

-

Potential Risks: While the outlook is positive, potential risks such as increased competition, regulatory hurdles, and fluctuations in global economic conditions could influence the future performance of AbbVie and its ability to meet the revised forecast.

Market Reaction and Investor Sentiment towards ABBV Stock

The market reacted favorably to AbbVie's Q2 results, with the ABBV stock price experiencing a noticeable surge immediately following the release of the earnings report.

-

Stock Price Increase: ABBV stock saw a significant percentage increase of X% on the day of the announcement, reaching a high of Y. This reflects the positive investor sentiment towards the company's performance.

-

Trading Volume: A significant increase in trading volume accompanied the stock price increase, further demonstrating the heightened investor interest and activity following the positive news.

-

Analyst Ratings: Several financial analysts have upgraded their ratings and price targets for ABBV stock, citing the strong earnings report and increased profit forecast as key factors.

-

Media Coverage: Major financial news outlets highlighted AbbVie's strong Q2 results, contributing to the positive investor sentiment and increased market attention.

Long-Term Implications for AbbVie Investors

The exceeding sales expectations and increased profit forecast paint a positive picture for AbbVie's long-term prospects, presenting several compelling aspects for investors.

-

Long-Term Growth Potential: AbbVie's consistent revenue growth and the success of its key drugs suggest considerable potential for long-term growth and value appreciation.

-

Risk Assessment: While AbbVie presents a promising investment opportunity, investors should carefully assess the inherent risks associated with pharmaceutical stocks, including regulatory changes, patent expirations, and competition.

-

Portfolio Diversification: AbbVie could be a valuable addition to a diversified investment portfolio, offering exposure to the pharmaceutical sector while potentially mitigating overall portfolio risk.

Conclusion

AbbVie's Q2 2024 earnings report decisively exceeded expectations, delivering impressive revenue growth, exceeding EPS targets, and resulting in a substantial increase in the full-year profit forecast. The market reacted positively, with ABBV stock experiencing a significant price increase. This performance signals a strong financial outlook for AbbVie and reinforces its position as a leading player in the pharmaceutical industry. Keep an eye on AbbVie's performance, and consider adding ABBV to your portfolio as part of a well-diversified investment strategy. Learn more about investing in AbbVie and its future prospects by consulting with a financial advisor.

Featured Posts

-

Ajax Dam Safety Concerns During 125th Anniversary Celebrations

Apr 26, 2025

Ajax Dam Safety Concerns During 125th Anniversary Celebrations

Apr 26, 2025 -

Shedeur Sanders The Perfect Fit For The New York Giants

Apr 26, 2025

Shedeur Sanders The Perfect Fit For The New York Giants

Apr 26, 2025 -

Wildfire Betting In Los Angeles A Reflection Of Our Times

Apr 26, 2025

Wildfire Betting In Los Angeles A Reflection Of Our Times

Apr 26, 2025 -

Fraud Allegations Surface Against Hungarys Central Bank Index Report

Apr 26, 2025

Fraud Allegations Surface Against Hungarys Central Bank Index Report

Apr 26, 2025 -

Significant Track Failures Trigger Severe Rail Disruptions In Amsterdam And The Randstad

Apr 26, 2025

Significant Track Failures Trigger Severe Rail Disruptions In Amsterdam And The Randstad

Apr 26, 2025

Latest Posts

-

Otsutstvie Soyuznikov V Kieve 9 Maya Prichiny I Posledstviya

May 09, 2025

Otsutstvie Soyuznikov V Kieve 9 Maya Prichiny I Posledstviya

May 09, 2025 -

Vizit Soyuznikov V Kiev 9 Maya Polniy Spisok Uchastnikov

May 09, 2025

Vizit Soyuznikov V Kiev 9 Maya Polniy Spisok Uchastnikov

May 09, 2025 -

9 Maya V Kieve Ozhidaemye I Neozhidaemye Gosti

May 09, 2025

9 Maya V Kieve Ozhidaemye I Neozhidaemye Gosti

May 09, 2025 -

Soyuzniki Ukrainy Kto Priedet V Kiev 9 Maya

May 09, 2025

Soyuzniki Ukrainy Kto Priedet V Kiev 9 Maya

May 09, 2025 -

Boxeur De Dijon Accuse De Violences Conjugales Audience Fixee En Aout

May 09, 2025

Boxeur De Dijon Accuse De Violences Conjugales Audience Fixee En Aout

May 09, 2025