ABN Amro Bonus Scheme Under Scrutiny: Potential Regulatory Action

Table of Contents

Allegations of Misconduct and Unethical Practices within the ABN Amro Bonus Scheme

Allegations of misconduct within the ABN Amro bonus scheme are serious and far-reaching. These claims center around the potential for excessive bonuses awarded despite poor performance, a lack of transparency in the bonus allocation process, and potential conflicts of interest. This ABN Amro bonus scandal has raised significant concerns about unethical bonus practices within the institution.

- Specific examples: Allegations include awarding substantial bonuses to executives despite significant losses in specific departments or investment failures. There are also reports suggesting bonuses were not properly aligned with the bank's overall performance and strategic goals.

- Sources of allegations: These allegations have surfaced through a combination of whistleblowers within the bank, investigative journalism reports from prominent Dutch media outlets, and hints from internal audits that have only partially been made public.

- Potential violations: The alleged practices potentially violate Dutch banking regulations concerning transparency and responsible compensation structures, as well as breaching internal ethical codes and guidelines on fair and equitable remuneration. These ABN Amro bonus scandal allegations raise questions about whether the bank adhered to best practices within the industry.

Regulatory Bodies Investigating the ABN Amro Bonus Scheme

Several key regulatory bodies are actively investigating the ABN Amro bonus scheme. The Dutch Central Bank (De Nederlandsche Bank or DNB) and potentially the European Central Bank (ECB) are playing crucial roles in this investigation.

- Roles and Responsibilities: The DNB has the primary responsibility for overseeing the financial health and regulatory compliance of banks operating within the Netherlands. The ECB's involvement stems from its broader supervisory role over significant financial institutions within the Eurozone. Their investigation focuses on whether ABN Amro's bonus practices comply with European banking regulations.

- Timeline and Potential Penalties: The investigation is ongoing, with the timeline currently uncertain. However, potential penalties for ABN Amro are substantial and could include significant fines, restrictions on future bonus payouts, and even reputational sanctions. Past actions by these bodies against other financial institutions for similar violations have resulted in multi-million euro fines and significant reputational damage. This ABN Amro regulatory investigation is a high-stakes situation.

- Previous Actions: Both the DNB and ECB have a history of imposing penalties on financial institutions that violate regulatory rules concerning executive compensation and bonus structures. These past actions set a precedent for potential action against ABN Amro. This ABN Amro penalties investigation underscores the increasing scrutiny of bank compensation schemes.

Impact of the Scrutiny on ABN Amro's Reputation and Share Price

The scrutiny surrounding the ABN Amro bonus scheme has had a demonstrably negative impact on the bank's reputation and share price. Negative publicity and diminished investor confidence are key consequences.

- Public Reaction and Media Coverage: The allegations have been widely reported in national and international media, leading to public criticism of the bank's practices. This negative publicity directly impacts the public perception of ABN Amro's ethical standards and corporate governance. This ABN Amro share price decline mirrors the negative sentiment surrounding the bonus scandal.

- Changes in Investor Sentiment: The negative media coverage and the ongoing investigation have led to a decline in investor confidence, reflected in the bank's share price. Trading volume may also increase as investors react to the unfolding situation and reassess the risk associated with investing in ABN Amro. This reputational damage is a major concern for the long-term stability of the bank.

- Long-Term Damage: The long-term effects on ABN Amro's brand reputation could be substantial. Restoring trust with clients, investors, and the public will require significant efforts and transparent reform of its compensation practices. This negative publicity could extend beyond this immediate crisis.

Potential Changes to the ABN Amro Bonus Structure

In response to the scrutiny, ABN Amro is likely to implement changes to its bonus scheme to mitigate risks and improve transparency. This ABN Amro bonus reform is likely to include stricter ethical guidelines and more robust oversight mechanisms.

- Potential Reforms: Expected changes include linking bonuses more closely to long-term performance metrics, reducing the reliance on short-term targets, and introducing independent oversight committees to review bonus allocations. Increased transparency in the bonus calculation methodology and stricter criteria for eligibility are also likely. This ABN Amro bonus reform will impact how bonuses are distributed and awarded going forward.

- Impact on Employee Morale: The changes could impact employee morale and retention, especially if perceived as excessively punitive. Carefully managing these changes is crucial to minimize negative consequences and maintain a productive workforce.

- Long-Term Implications: These changes will have significant long-term implications for compensation strategies within ABN Amro and could influence compensation practices across the broader financial industry. The ABN Amro bonus scandal and subsequent reforms could lead to significant changes within the entire banking sector.

Conclusion

The ABN Amro bonus scheme is under intense scrutiny, facing potential regulatory action due to allegations of misconduct. The investigation's impact on the bank's reputation, share price, and future bonus structure is significant. The outcome of this situation will have broader implications for the banking industry and its approach to executive compensation. Understanding the nuances of ABN Amro bonus scheme scrutiny is crucial for investors and stakeholders alike.

Call to Action: Stay informed about the ongoing investigation into the ABN Amro bonus scheme and its potential implications for the financial sector. Follow further developments on the ABN Amro bonus scandal and its regulatory repercussions. Understanding the nuances of ABN Amro bonus scheme scrutiny is crucial for investors and stakeholders alike.

Featured Posts

-

The Billionaire Boys Investment Strategies A Deep Dive Into Portfolio Management

May 21, 2025

The Billionaire Boys Investment Strategies A Deep Dive Into Portfolio Management

May 21, 2025 -

Assessing Giorgos Giakoumakis Transfer Prospects In Major League Soccer

May 21, 2025

Assessing Giorgos Giakoumakis Transfer Prospects In Major League Soccer

May 21, 2025 -

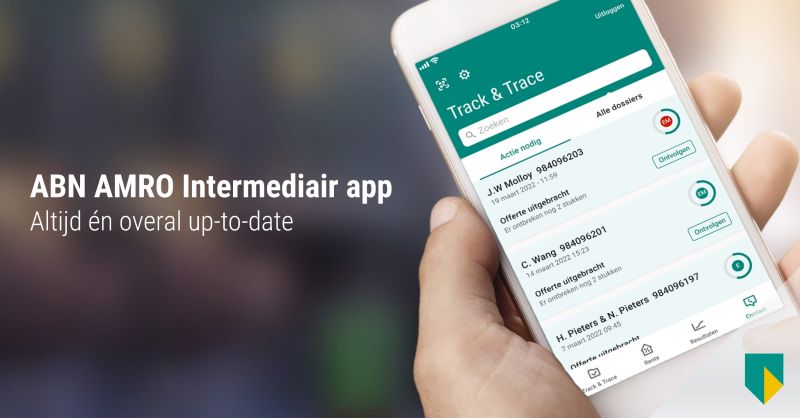

Directeur Hypotheken Intermediair Abn Amro Florius En Moneyou Karin Polman

May 21, 2025

Directeur Hypotheken Intermediair Abn Amro Florius En Moneyou Karin Polman

May 21, 2025 -

The Strategy Behind Michael Strahans High Profile Interview A Ratings War Analysis

May 21, 2025

The Strategy Behind Michael Strahans High Profile Interview A Ratings War Analysis

May 21, 2025 -

Hypotheken Intermediair Karin Polman Nieuwe Directeur Bij Abn Amro Florius En Moneyou

May 21, 2025

Hypotheken Intermediair Karin Polman Nieuwe Directeur Bij Abn Amro Florius En Moneyou

May 21, 2025