ABN Amro Bonus System: Investigation By Dutch Regulator

Table of Contents

The Dutch Regulator's Concerns Regarding the ABN Amro Bonus System

The Dutch regulator's investigation into the ABN Amro bonus system stems from concerns about several key areas. The primary focus appears to be on compliance with stringent European Union banking regulations and specific Dutch rules on executive compensation. The regulator is reportedly concerned that the bonus system may have incentivized excessive risk-taking, potentially jeopardizing the bank's financial stability and violating established regulations.

- Specific Regulatory Concerns: The investigation likely centers on whether the bonus structure aligns with regulations designed to prevent reckless behavior and protect depositors. This includes examining whether the system adequately considers long-term performance, risk management, and sustainable growth.

- Timeline of the Investigation: While the exact start date may not be publicly available, the investigation is ongoing, and updates are expected as the regulator gathers more information and conducts its analysis.

- Involved Regulatory Bodies: The investigation is primarily led by [Insert Name of Dutch Regulatory Body if available, otherwise say "the relevant Dutch regulatory authority"], potentially in collaboration with other European supervisory bodies.

ABN Amro's Response to the Investigation into its Bonus System

ABN Amro has responded to the investigation with a statement emphasizing its commitment to transparency and regulatory compliance. The bank has reportedly initiated an internal review to assess its bonus system and identify any areas needing improvement. This internal review is likely intended to demonstrate cooperation with the regulator and mitigate potential penalties.

- Key Points from Official Statements: ABN Amro's public statements have likely focused on cooperation with the investigation, a commitment to ethical conduct, and the implementation of corrective measures.

- Details About Internal Reforms: The bank may have already begun to adjust its bonus structure to better align with regulatory requirements, perhaps shifting the focus from short-term gains to long-term sustainable performance.

- Impact on Employee Morale and Retention: The investigation and potential changes to the bonus system could significantly impact employee morale and retention, especially among high-performing employees whose compensation is heavily reliant on bonuses.

Potential Consequences and Outcomes of the ABN Amro Bonus System Investigation

The consequences of non-compliance for ABN Amro could be significant. The bank faces the potential for substantial financial penalties, reputational damage, and even changes in leadership. The outcome of the investigation will undoubtedly have a ripple effect across the Dutch banking sector and could influence regulatory practices elsewhere in Europe.

- Possible Financial Penalties: Depending on the severity of the violations, ABN Amro could face substantial fines, potentially impacting its profitability and shareholder value.

- Impact on Shareholder Confidence: Negative publicity surrounding the investigation could erode shareholder confidence, leading to a decrease in the bank's stock price.

- Long-Term Effects on the Bank's Strategy: The investigation may force ABN Amro to re-evaluate its overall business strategy, particularly its approach to risk management and compensation practices.

Impact on Employee Compensation and Morale at ABN Amro

The investigation into the ABN Amro bonus system has created uncertainty about employee compensation. Potential changes to bonus structures could significantly impact employee morale and trust in the bank's leadership. This uncertainty could also affect the bank's ability to attract and retain top talent.

- Changes in Bonus Structures: The bank may already be implementing changes to its bonus system to align with regulatory requirements and mitigate future risks.

- Employee Reactions and Concerns: Employees may express concerns about the fairness and transparency of the new compensation system.

- Impact on Recruitment Efforts: The negative publicity surrounding the investigation could make it more challenging for ABN Amro to attract new talent.

Conclusion: Understanding the Implications of the ABN Amro Bonus System Investigation

The investigation into the ABN Amro bonus system highlights the crucial importance of regulatory compliance within the financial sector. The potential consequences for the bank – financial penalties, reputational damage, and strategic shifts – underscore the need for robust risk management and ethical compensation practices. The ongoing nature of the investigation necessitates continuous monitoring of developments. Stay informed about further updates on the ABN Amro bonus scandal and related Dutch banking regulation changes to fully understand the long-term implications of this case. Keep an eye on the news for developments regarding the ABN Amro bonus system and the broader implications for the Dutch financial sector.

Featured Posts

-

Good Morning America Faces Staff Reductions Impact On Talent And Production

May 21, 2025

Good Morning America Faces Staff Reductions Impact On Talent And Production

May 21, 2025 -

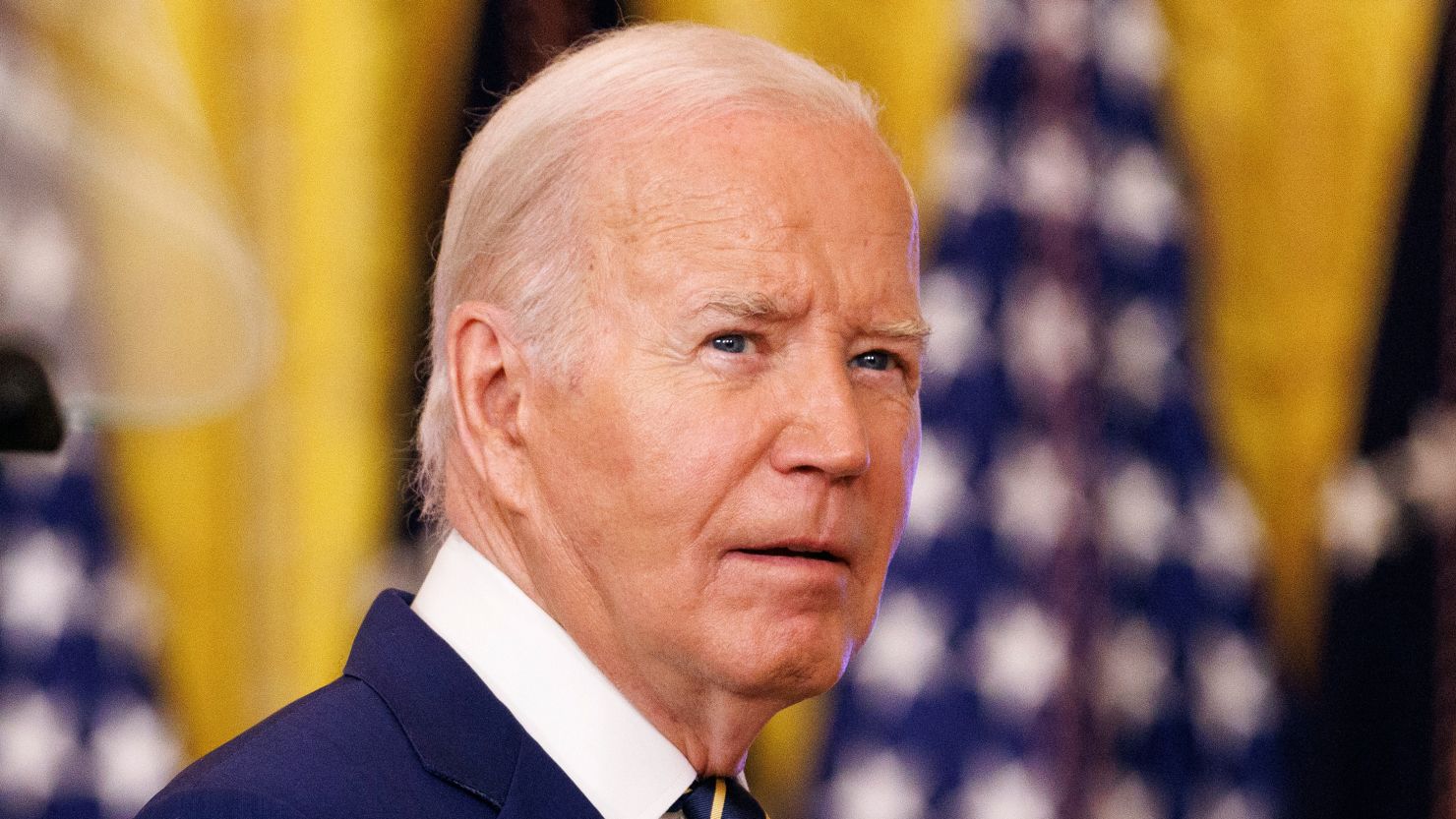

Hunter Bidens Recordings Insights Into Joe Bidens Mental Fitness

May 21, 2025

Hunter Bidens Recordings Insights Into Joe Bidens Mental Fitness

May 21, 2025 -

Peppa Pigs Family Celebrates Gender Reveal Party For The Newest Addition

May 21, 2025

Peppa Pigs Family Celebrates Gender Reveal Party For The Newest Addition

May 21, 2025 -

Peppa Pigs Expanding Family The Newborns Debut

May 21, 2025

Peppa Pigs Expanding Family The Newborns Debut

May 21, 2025 -

La Forte Croissance Des Tours Nantaises Et L Essor De L Activite Des Cordistes

May 21, 2025

La Forte Croissance Des Tours Nantaises Et L Essor De L Activite Des Cordistes

May 21, 2025