ABN Amro: Potential Fine From Dutch Central Bank Over Bonuses

Table of Contents

The DNB's Investigation into ABN Amro's Bonus System

De Nederlandsche Bank (DNB) plays a crucial role in supervising Dutch banks, ensuring their compliance with stringent financial regulations designed to maintain financial stability and protect consumers. The DNB's investigation into ABN Amro's bonus system stems from concerns about the potential misalignment between bonus payouts and long-term sustainable performance. Specifically, the DNB is reportedly scrutinizing whether the bank's bonus system inadvertently incentivizes excessive risk-taking, potentially jeopardizing financial stability.

- DNB's Supervisory Role: The DNB's mandate includes monitoring compliance with regulations related to capital adequacy, liquidity, and risk management. This includes a close examination of internal control systems, including compensation structures.

- Specific Concerns: While the DNB hasn't publicly detailed all its concerns, reports suggest that the investigation focuses on whether bonuses are appropriately linked to long-term, sustainable profitability and whether they adequately account for risk management. Concerns may also exist regarding transparency and the overall fairness of the bonus system.

- Investigation Timeline and Statements: The timeline of the investigation remains undisclosed, however, both ABN Amro and the DNB have issued brief, carefully worded public statements acknowledging the ongoing process. Neither party has commented extensively on the specifics of the investigation's findings.

- Past Regulatory Actions: ABN Amro has faced regulatory scrutiny in the past, though not necessarily directly related to bonus structures. Understanding this history is crucial to assessing the current situation and its potential consequences.

Potential Financial Penalties and Their Impact on ABN Amro

The potential financial penalties ABN Amro faces are substantial. The DNB has the power to impose significant fines for non-compliance with banking regulations. The exact amount remains uncertain, but it could range from millions to tens of millions of euros, depending on the severity of the findings.

- Financial Performance Impact: A hefty ABN Amro fine would undoubtedly impact the bank's financial performance, reducing profitability and potentially affecting its quarterly and annual earnings reports.

- Share Price Volatility: News of the investigation and potential fine has already created volatility in ABN Amro's share price. A confirmed fine would likely lead to further negative market reactions.

- Reputational Damage: Even if the fine is relatively small, the reputational damage associated with regulatory action is considerable. It can erode investor confidence and damage the bank's brand image.

- Talent Retention: A negative public perception can also make it more difficult for ABN Amro to attract and retain top talent, as potential employees might be hesitant to join a bank facing regulatory challenges.

Wider Implications for the Dutch Banking Sector

The DNB's action against ABN Amro sends a clear message to the entire Dutch banking sector regarding the importance of robust risk management and compliant compensation structures. The investigation could spur broader changes in bonus structures across the sector.

- Regulatory Changes: The outcome of this investigation might precipitate regulatory changes aimed at improving the design and oversight of bonus systems in Dutch banks.

- Promoting Financial Stability: The DNB's actions directly contribute to maintaining financial stability by discouraging excessive risk-taking driven by potentially misaligned bonus structures.

- EU Alignment and Best Practices: The DNB’s actions align with broader European Union banking regulations and international best practices aimed at preventing reckless behavior fueled by excessive compensation.

ABN Amro's Response and Future Outlook

ABN Amro has publicly stated its commitment to cooperating fully with the DNB's investigation. The bank has also indicated its dedication to improving its internal control systems and ensuring full compliance with all relevant regulations.

- Corrective Actions: ABN Amro is likely to implement corrective actions, possibly including changes to its bonus structure, enhanced risk management processes, and improved internal controls.

- Long-Term Impact: The long-term impact on ABN Amro's business strategy will depend on the outcome of the investigation and the specific measures taken to address the DNB's concerns.

- Future Scrutiny: This investigation is likely to lead to increased regulatory scrutiny of ABN Amro's operations in the future, emphasizing the bank's need for sustained commitment to compliance.

Conclusion

This article explored the potential fine facing ABN Amro from the Dutch Central Bank over its bonus practices. The investigation underscores the vital role of robust regulatory oversight within the Dutch banking sector and the necessity for banks to align their bonus structures with sound risk management principles and long-term sustainable performance. The potential financial penalties and reputational damage highlight the serious consequences of non-compliance. The ABN Amro case serves as a reminder of the evolving regulatory landscape and the need for continuous adaptation and vigilance within the financial industry.

Call to Action: Stay informed about the developments in this case and the ongoing scrutiny of ABN Amro's bonus practices. Continue to monitor news related to the potential ABN Amro fine and Dutch banking regulations for further updates on this significant regulatory event.

Featured Posts

-

Challenges And Hopes For A New Trans Australia Run Record

May 21, 2025

Challenges And Hopes For A New Trans Australia Run Record

May 21, 2025 -

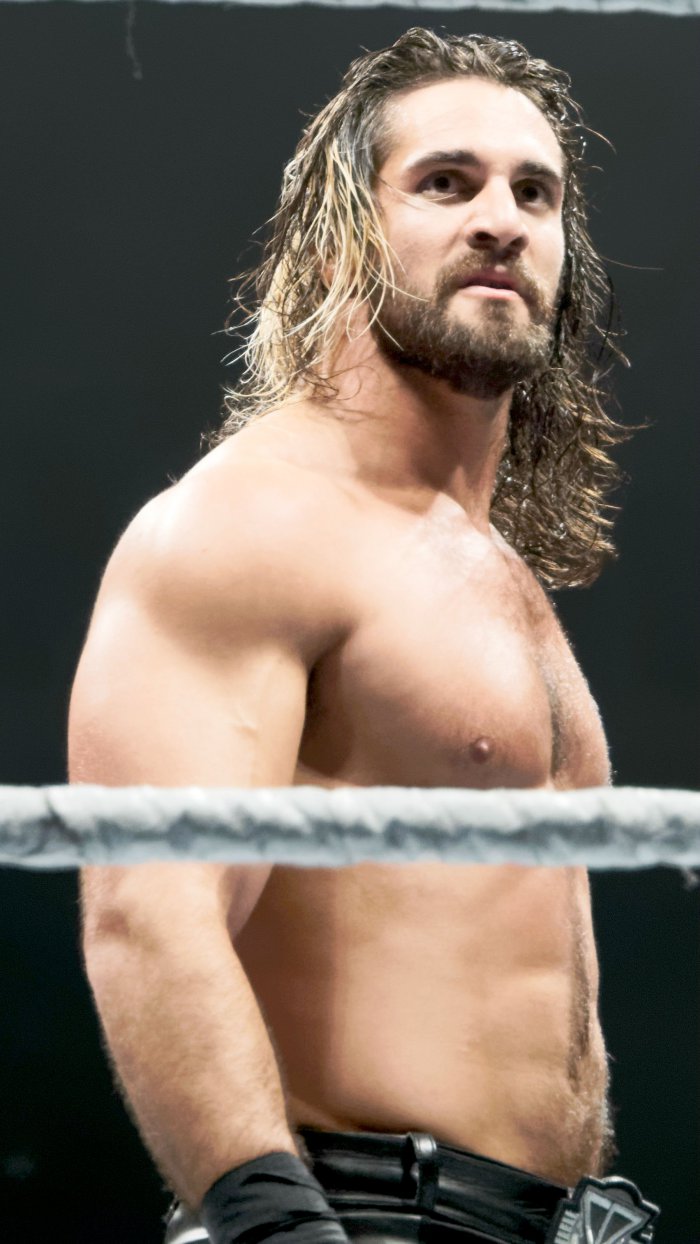

Raw Results The Brutal Assault On Sami Zayn By Rollins And Breakker

May 21, 2025

Raw Results The Brutal Assault On Sami Zayn By Rollins And Breakker

May 21, 2025 -

Bortaseger Mot Malta Jacob Friis Nya Era Inleds

May 21, 2025

Bortaseger Mot Malta Jacob Friis Nya Era Inleds

May 21, 2025 -

Wwe Raw Tyler Bates Highly Anticipated Return

May 21, 2025

Wwe Raw Tyler Bates Highly Anticipated Return

May 21, 2025 -

Switzerland China Joint Call For Tariff Negotiations

May 21, 2025

Switzerland China Joint Call For Tariff Negotiations

May 21, 2025