Accessing Private Stakes: A Business Opportunity Through Elon Musk's Network

Table of Contents

Understanding Elon Musk's Network and its Investment Potential

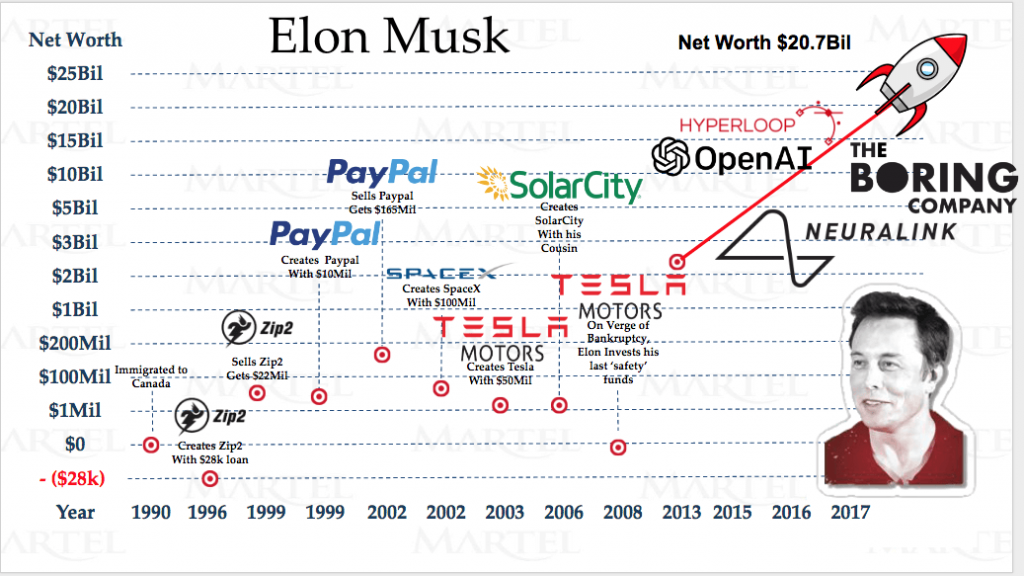

Elon Musk's influence extends far beyond Tesla and SpaceX. His network encompasses a constellation of innovative companies, each with its own unique investment potential. This ecosystem includes, but is not limited to, Neuralink (focused on brain-computer interfaces), The Boring Company (developing tunneling technologies), and even potential future ventures yet to be announced. Investing in this network offers exposure to cutting-edge technologies and disruptive business models.

-

Analyze the growth trajectory and potential of companies within the network: Meticulous analysis of financial projections, market trends, and competitive landscapes is crucial. Look for companies demonstrating strong revenue growth, innovative product pipelines, and a clear path to profitability. Consider factors like intellectual property, team expertise, and market share.

-

Identify key indicators of future success and potential for high returns: Focus on companies exhibiting strong intellectual property portfolios, a skilled and experienced management team, a large and growing addressable market, and a demonstrably superior product or service. Look for evidence of strong partnerships, strategic acquisitions, and positive media coverage.

-

Discuss the risks involved in investing in companies connected to Musk's network: Investing in private stakes is inherently risky. The high-risk, high-reward nature of these investments is undeniable. Companies associated with Musk, while potentially lucrative, can also experience significant volatility. Market shifts, regulatory hurdles, and even changes in Musk's own strategic direction can all impact the value of your investment.

Strategies for Accessing Private Stakes

Gaining access to private investment opportunities within Elon Musk's network requires a strategic and multifaceted approach. Several pathways exist, each demanding its own unique set of skills and resources.

-

Angel Investing: This involves directly investing in early-stage companies. It requires significant capital and a strong understanding of the startup landscape. Angel investors often leverage their network and expertise to provide not only funding but also mentorship and guidance.

-

Venture Capital: Venture capital (VC) firms specialize in investing in high-growth companies. Gaining access to VC deals can be challenging, requiring a strong track record and established network within the investment community.

-

Networking Events: Industry conferences, tech summits, and exclusive investor events provide valuable networking opportunities to connect with founders, investors, and other key players in the ecosystem.

-

Private Placement Memoranda (PPMs): These legal documents detail the terms and conditions of private investments. Accessing PPMs often requires connections within the investment community.

-

Online Investment Platforms: Several online platforms facilitate private equity investments, allowing accredited investors to access a broader range of opportunities, although due diligence remains critical.

Due Diligence and Risk Mitigation in Private Stakes Investments

Thorough due diligence is paramount when considering private stakes, especially within the high-risk, high-reward environment of Elon Musk's network.

-

Importance of independent financial advice: Seeking professional advice from a qualified financial advisor is crucial before committing any funds.

-

Thorough company research and financial analysis: Independently verify all financial information provided by the company. Analyze market competition, regulatory landscapes, and potential future challenges.

-

Understanding the risks associated with early-stage investments: Early-stage companies are inherently risky. There's a significant chance of complete loss of investment.

-

Diversification strategies to mitigate risk: Diversifying your investment portfolio across multiple companies and asset classes minimizes the impact of potential losses.

-

Legal and regulatory compliance for private investments: Ensure full compliance with all applicable securities laws and regulations.

Case Studies of Successful Investments in Musk's Network

While specific details of private investments are often confidential, publicly available information demonstrates the potential for substantial returns from companies within Musk's sphere of influence. Early investors in Tesla, for example, saw enormous gains. Analyzing the factors contributing to the success of these investments offers valuable insights for future ventures. (Note: Specific examples require careful research to avoid misrepresentation and ensure accuracy.)

Conclusion

Accessing private stakes within Elon Musk's network presents a unique business opportunity with the potential for high returns. However, it requires careful planning, thorough due diligence, and a keen understanding of the inherent risks. By leveraging the strategies outlined above, including networking, rigorous research, and a strategic approach to risk mitigation, ambitious investors can increase their chances of successfully navigating this dynamic landscape and securing profitable private stakes. Remember to always conduct thorough due diligence before investing in any private stake, and seek professional financial advice when needed. Begin exploring your options for accessing private stakes today and capitalize on the exciting investment opportunities within Elon Musk's network.

Featured Posts

-

Why Deion Sanders Is Proud Of Shedeurs Football Skills Despite Lack Of His Speed

Apr 26, 2025

Why Deion Sanders Is Proud Of Shedeurs Football Skills Despite Lack Of His Speed

Apr 26, 2025 -

Europe Rejects Ai Rulebook Amidst Trump Administration Pressure

Apr 26, 2025

Europe Rejects Ai Rulebook Amidst Trump Administration Pressure

Apr 26, 2025 -

Us China Rivalry A Key Military Base In The Crosshairs

Apr 26, 2025

Us China Rivalry A Key Military Base In The Crosshairs

Apr 26, 2025 -

Long Live The Lente Your Guide To Springs Language

Apr 26, 2025

Long Live The Lente Your Guide To Springs Language

Apr 26, 2025 -

Post Roe America How Otc Birth Control Is Reshaping Reproductive Healthcare

Apr 26, 2025

Post Roe America How Otc Birth Control Is Reshaping Reproductive Healthcare

Apr 26, 2025

Latest Posts

-

Jennifer Aniston Gate Crash Man Charged With Stalking And Vandalism

May 10, 2025

Jennifer Aniston Gate Crash Man Charged With Stalking And Vandalism

May 10, 2025 -

Chief Justice Roberts Recounts Being Mistaken For Former Gop House Leader

May 10, 2025

Chief Justice Roberts Recounts Being Mistaken For Former Gop House Leader

May 10, 2025 -

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025 -

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025 -

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025