Addressing High Stock Market Valuations: BofA's Argument For Investor Calm

Table of Contents

BofA's Key Arguments for Maintaining a Positive Market Outlook

BofA's analysis suggests that while high stock market valuations are a valid concern, a nuanced approach is necessary. They point to several key factors that support their relatively positive market outlook, even in the face of seemingly inflated prices.

Strong Corporate Earnings and Profitability

BofA highlights the robust earnings reports of numerous companies, demonstrating sustained profitability despite persistent economic headwinds. This resilience, they argue, underpins continued market growth and mitigates some of the concerns surrounding high stock valuations.

- Strong revenue growth in various sectors: Many companies have reported impressive revenue growth, showcasing their ability to navigate challenging economic landscapes. This suggests underlying strength and potential for future expansion.

- Effective cost management strategies: Businesses have implemented efficient cost-cutting measures, improving profit margins and bolstering their financial health. This demonstrates adaptability and financial prudence.

- Increased pricing power in many industries: Several industries have demonstrated the ability to pass on increased costs to consumers, maintaining profitability even with rising inflation. This shows strength and resilience in the face of economic pressure, suggesting continued earnings growth.

This demonstrable corporate strength supports the argument that current valuations, while potentially high, are not necessarily unsustainable.

Low Interest Rates and Ample Liquidity

BofA points to the continued influence of low-interest rate environments and substantial liquidity in the financial markets as crucial factors supporting market stability. This ample liquidity, combined with low borrowing costs, fuels further investment and economic activity.

- Easy access to capital for businesses and investors: Low interest rates make it easier for businesses to access capital for expansion and investment, fostering growth. Investors also benefit from lower borrowing costs for investment purposes.

- Supportive monetary policies from central banks: Central banks globally have maintained accommodative monetary policies, keeping interest rates low and injecting liquidity into the markets. This is intended to stimulate economic growth.

- Reduced borrowing costs stimulating economic activity: Lower borrowing costs encourage investment, spending, and overall economic activity, supporting higher valuations in a positive feedback loop.

This supportive monetary environment and ample liquidity contribute to a positive market environment, even with elevated valuations.

Long-Term Growth Potential and Technological Advancements

BofA emphasizes the long-term growth potential fueled by technological innovation and expansion into emerging markets. This potential future growth, they contend, justifies higher present-day valuations.

- Expansion into new sectors like renewable energy and artificial intelligence: Investment in high-growth sectors like renewable energy and artificial intelligence is driving innovation and economic expansion, offering significant long-term growth opportunities.

- Growth potential in developing economies: Emerging markets present considerable opportunities for expansion and investment, offering further potential for long-term growth and returns.

- Technological disruption creating new opportunities and efficiencies: Technological advancements continue to create new industries and efficiencies, further stimulating economic growth and justifying higher valuations based on future expectations.

These long-term growth drivers provide a compelling argument for the sustainability of current, potentially high stock valuations.

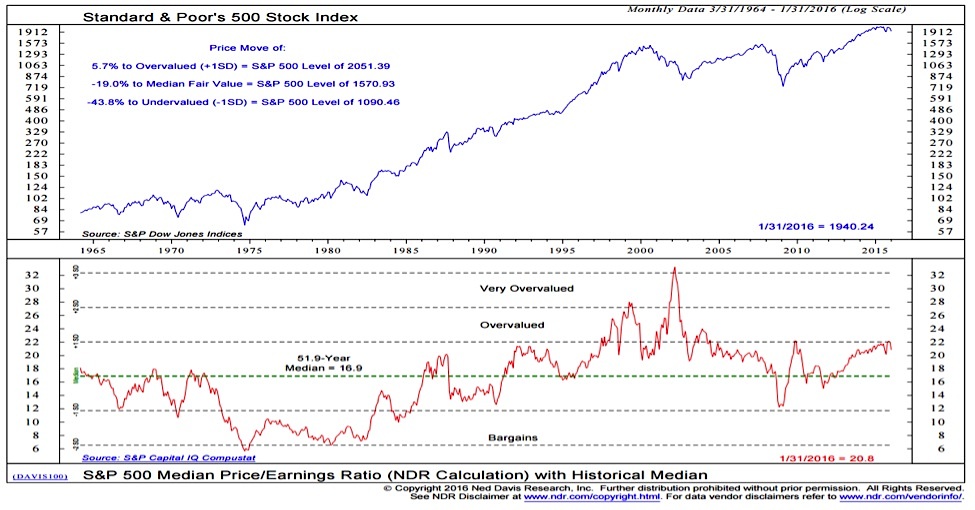

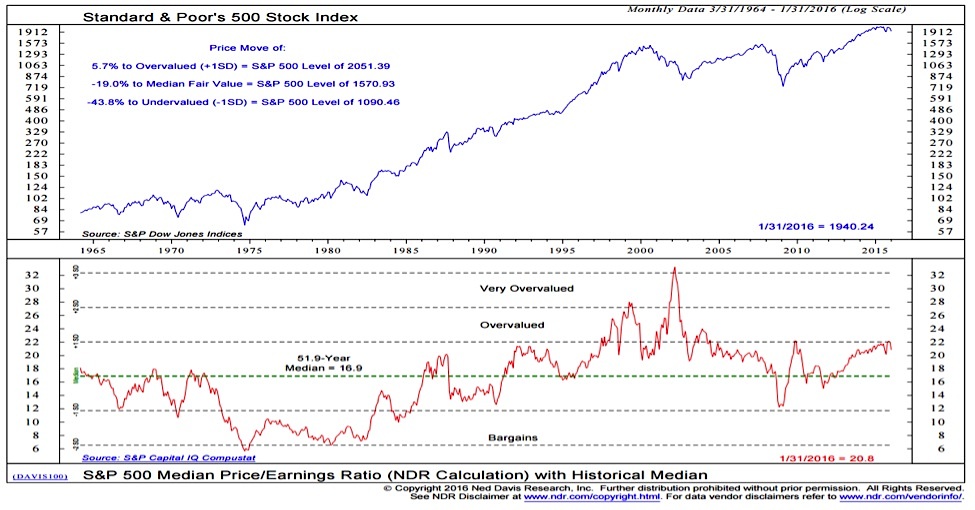

Addressing Valuation Concerns through a Multi-Factor Approach

BofA acknowledges concerns about high stock market valuations but advocates for a more nuanced approach than simply relying on price-to-earnings ratios (P/E ratios). They suggest considering a broader range of factors for a comprehensive assessment.

- Analyzing growth prospects and future earnings potential: Focusing solely on current earnings can be misleading. A more accurate assessment requires considering future growth prospects and potential earnings increases.

- Considering discounted cash flow models for valuation: Discounted cash flow (DCF) models provide a more comprehensive valuation by considering the present value of future cash flows, offering a longer-term perspective.

- Acknowledging the impact of low interest rates on valuation metrics: Low interest rates can artificially inflate valuation multiples. Therefore, it’s important to consider this impact when interpreting valuation metrics.

This holistic approach allows for a more informed assessment of market risks and a more realistic interpretation of what constitutes high stock market valuations.

Conclusion

While concerns about high stock market valuations are understandable, BofA's analysis presents a compelling case for maintaining a measured, optimistic outlook. The combination of strong corporate earnings, ample liquidity, and significant long-term growth potential offers a counterbalance to perceived overvaluation. By considering these factors alongside traditional valuation metrics, investors can make more informed decisions. Don't let the fear of high stock market valuations paralyze your investment strategy. Instead, take a balanced approach and carefully consider BofA’s perspective when assessing your investment portfolio and future investments in the face of high stock valuations.

Featured Posts

-

Elon Musks Space X Stake Surges Now Worth 43 B More Than Tesla Holdings

May 10, 2025

Elon Musks Space X Stake Surges Now Worth 43 B More Than Tesla Holdings

May 10, 2025 -

Nyt Strands April 9 2025 Complete Gameplay Guide And Answers

May 10, 2025

Nyt Strands April 9 2025 Complete Gameplay Guide And Answers

May 10, 2025 -

Leon Draisaitl Reaches 100 Points Oilers Defeat Islanders In Overtime

May 10, 2025

Leon Draisaitl Reaches 100 Points Oilers Defeat Islanders In Overtime

May 10, 2025 -

Todays Sensex And Nifty 800 Point Jump Key Stock Performances

May 10, 2025

Todays Sensex And Nifty 800 Point Jump Key Stock Performances

May 10, 2025 -

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Package Firstpost

May 10, 2025

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Package Firstpost

May 10, 2025