Addressing High Stock Market Valuations: Insights From BofA

Table of Contents

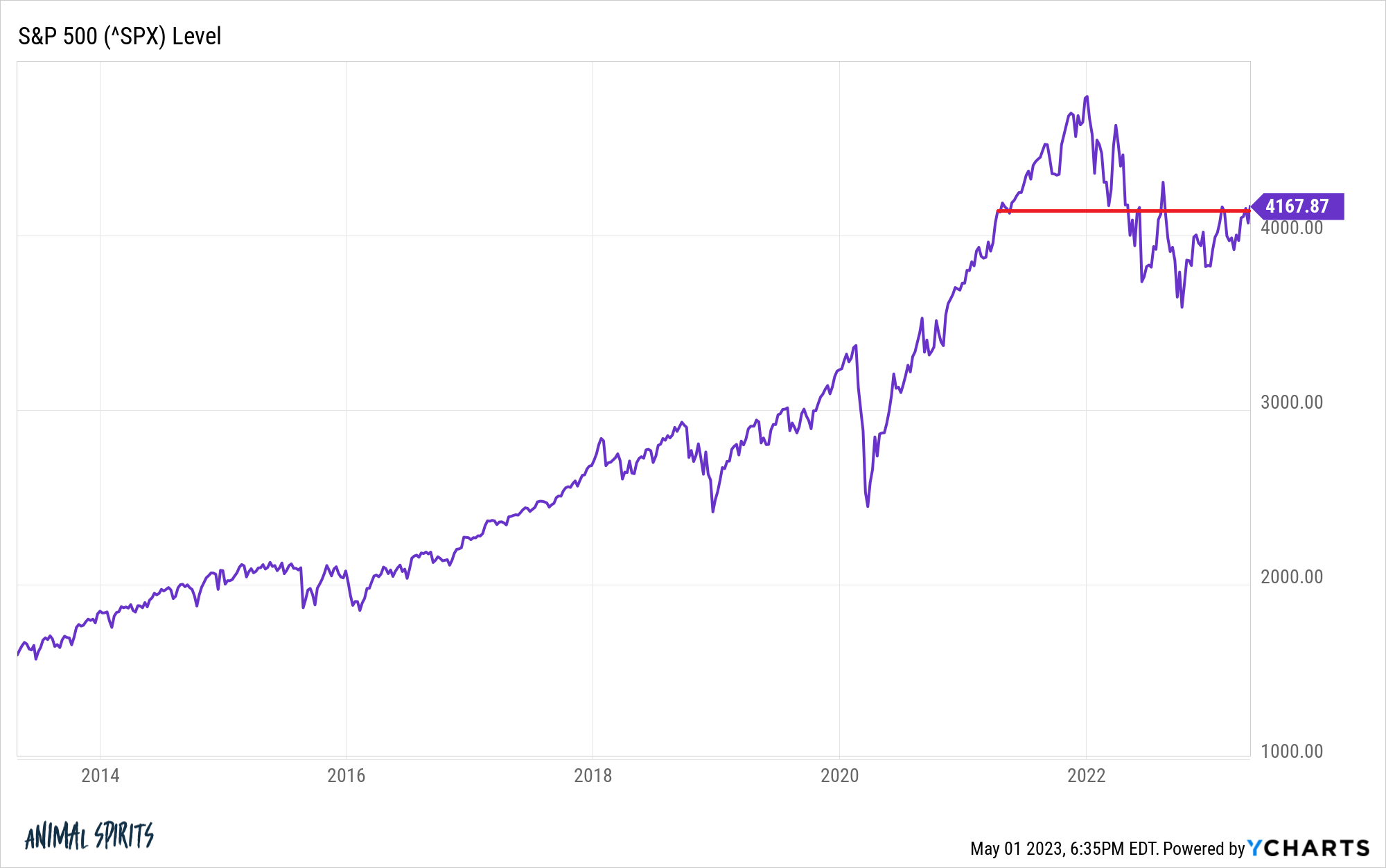

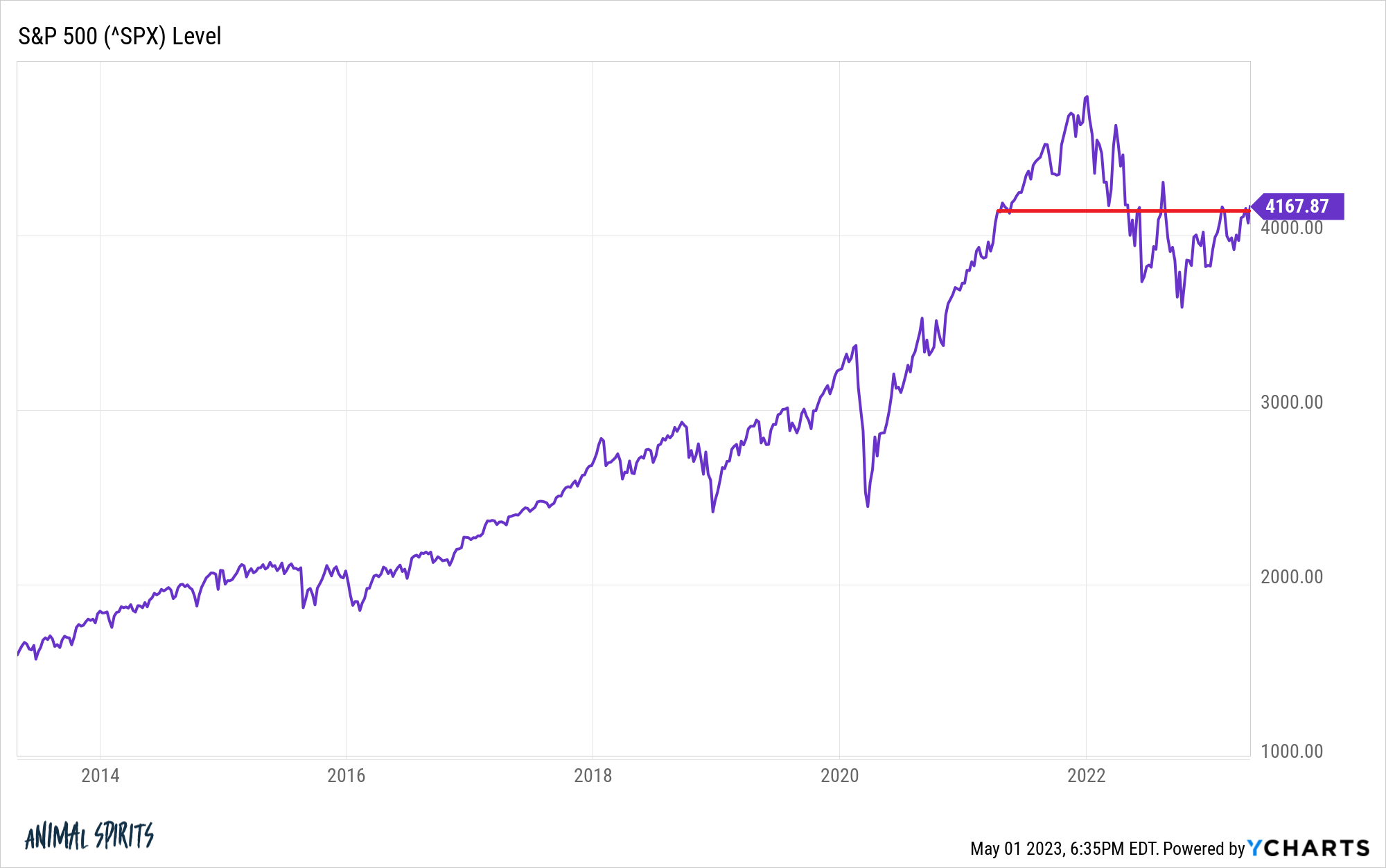

BofA's Assessment of Current Market Conditions

BofA's recent reports delve deep into the current state of the market, providing a comprehensive analysis of high stock market valuations and their potential implications. Their analysis considers both sector-specific valuations and the broader macroeconomic environment.

Identifying Overvalued Sectors

BofA's sector analysis pinpoints several areas potentially exhibiting overvalued stocks. This assessment relies heavily on metrics like price-to-earnings ratios (P/E), price-to-sales ratios (P/S), and market capitalization to identify sectors showing signs of inflated prices relative to their underlying fundamentals.

- Technology: Many technology companies, particularly in the growth-stock segment, have seen significant price appreciation, leading BofA to flag potential overvaluation in this sector. High growth expectations, often exceeding sustainable levels, are a key driver.

- Consumer Discretionary: Companies in this sector, heavily reliant on consumer spending, have shown strong performance, yet BofA cautions that current valuations might not fully account for potential economic slowdowns or shifts in consumer behavior.

- Real Estate: The real estate market, boosted by low interest rates and high demand, has seen significant price increases. BofA suggests a potential overvaluation in certain segments, particularly in specific geographical locations.

- Communication Services: The communication services sector, encompassing media and telecommunications companies, has also experienced strong growth, prompting BofA to examine whether current prices justify the future earnings potential.

- Financials: While the financial sector generally trades at lower valuations than technology, some sub-sectors, particularly those heavily exposed to interest rate sensitivity, may present some overvaluation concerns according to BofA's analysis.

BofA supports these claims with specific data points. For instance, they might highlight that certain technology stocks are trading at P/E ratios significantly above their historical averages or industry peers, suggesting a potential disconnect between price and intrinsic value.

Macroeconomic Factors Influencing Valuations

Several macroeconomic factors contribute to the high stock market valuations observed by BofA. Understanding these factors is crucial for predicting future market behavior.

- Low Interest Rates: Historically low interest rates encourage borrowing and investment, driving up asset prices, including stocks. This low-cost capital fuels corporate expansion and stock buybacks, further boosting valuations.

- Quantitative Easing (QE): Central bank policies like QE inject liquidity into the financial system, increasing the money supply and potentially inflating asset prices. BofA acknowledges the significant role QE has played in supporting higher valuations.

- Strong Corporate Earnings: Robust corporate earnings, fueled by factors such as technological innovation and global trade, support higher stock prices. However, BofA's analysis emphasizes the need to evaluate whether these earnings justify the current valuations.

These macroeconomic factors interact in complex ways. Low interest rates, combined with QE and strong corporate earnings, create a favorable environment for high stock valuations. However, this environment is not without its risks, as BofA's analysis clearly indicates.

BofA's Strategies for Navigating High Valuations

Facing high stock market valuations, BofA recommends a strategic approach, combining defensive strategies with opportunities to identify undervalued assets.

Defensive Investment Strategies

For investors concerned about high valuations and potential market corrections, BofA suggests implementing several defensive strategies to manage risk and protect capital.

- Portfolio Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces exposure to any single risk factor. This is a core tenet of risk management.

- Value Investing: Focusing on undervalued companies with strong fundamentals offers a potentially more resilient approach compared to chasing high-growth, high-valuation stocks. Thorough due diligence is crucial.

- Dividend Stocks: Companies that pay regular dividends offer a steady income stream, which can help buffer against market volatility. Dividend yields can provide some cushion in a downturn.

- Hedging Strategies: While complex, BofA might suggest considering options or other hedging instruments to protect against potential market declines.

These strategies emphasize risk management and capital preservation, allowing investors to navigate the challenges presented by high stock market valuations.

Identifying Undervalued Opportunities

Despite the overall high valuations, BofA's research might uncover specific sectors or companies that present attractive investment opportunities. This necessitates meticulous stock picking and a thorough understanding of individual company fundamentals.

- Specific examples (if mentioned in BofA's report): BofA's report may identify undervalued opportunities in sectors like cyclical industries potentially poised for recovery or smaller-cap companies with strong growth potential but comparatively lower valuations.

The rationale behind BofA’s identification of these opportunities would likely involve a detailed analysis of financial statements, competitive landscape, and industry trends, emphasizing a focus on intrinsic value rather than relying solely on market sentiment.

Potential Risks and Future Outlook (according to BofA)

BofA acknowledges the potential risks associated with high stock market valuations and offers insights into possible future market scenarios.

Market Correction Scenarios

BofA's analysis likely considers the potential for a market correction, acknowledging the inherent volatility of the stock market.

- Potential Triggers: Potential triggers for a correction include rising interest rates, unexpected inflation, geopolitical instability, or a significant slowdown in economic growth.

A market correction would likely impact different asset classes differently. Growth stocks, often the most susceptible to valuation changes, could experience more substantial declines compared to value stocks or bonds.

Long-Term Growth Prospects

Despite the risks, BofA likely maintains a long-term positive outlook for the market, though with caveats.

- Summary of Long-Term Outlook: Their outlook would probably hinge on continued economic growth, technological advancements, and favorable macroeconomic conditions.

However, BofA would likely caution that the path to long-term growth might be volatile, with potential corrections along the way. The timing and severity of any corrections remain uncertain.

Conclusion: Addressing High Stock Market Valuations – Your Next Steps

BofA's analysis provides crucial insights into the complexities of high stock market valuations. Their assessment highlights the importance of understanding both sector-specific valuations and broader macroeconomic factors. The bank suggests adopting defensive investment strategies while carefully considering undervalued opportunities. Ultimately, BofA's view acknowledges the potential for market corrections but maintains a long-term positive outlook, contingent upon continued economic growth and favorable conditions.

Understanding and addressing high stock market valuations is crucial for successful investing. Use BofA's insights to inform your strategy and build a resilient portfolio. Conduct further research, consult with a qualified financial advisor, and develop a well-informed investment strategy to navigate these challenging market conditions effectively. Remember that this information is for general knowledge and doesn't constitute financial advice.

Featured Posts

-

Cozen O Connors Pennsylvania Legal Insights April 17 2025

Apr 25, 2025

Cozen O Connors Pennsylvania Legal Insights April 17 2025

Apr 25, 2025 -

Newsoms Toxic Democrat Remarks Podcast Plan Unveiled On Bill Maher

Apr 25, 2025

Newsoms Toxic Democrat Remarks Podcast Plan Unveiled On Bill Maher

Apr 25, 2025 -

Car Accident Understanding The Value Of Legal Counsel

Apr 25, 2025

Car Accident Understanding The Value Of Legal Counsel

Apr 25, 2025 -

Eurovision Director Rejects Boycott Calls For Israel

Apr 25, 2025

Eurovision Director Rejects Boycott Calls For Israel

Apr 25, 2025 -

Tramp I Okonchanie Rossiysko Ukrainskogo Konflikta Analiz Soglasheniya

Apr 25, 2025

Tramp I Okonchanie Rossiysko Ukrainskogo Konflikta Analiz Soglasheniya

Apr 25, 2025