Addressing Investor Anxiety: BofA's View On Current Stock Market Valuations

Table of Contents

Keywords: Stock market valuations, investor anxiety, BofA, Bank of America, market volatility, stock market outlook, investment strategy, equity valuations, economic outlook, P/E ratios, Shiller PE, diversification strategies, defensive investment options.

Investor anxiety is running high as stock market valuations fluctuate wildly. Many investors are questioning the sustainability of current prices and are grappling with uncertainty about the future. This article delves into Bank of America's (BofA) perspective on these valuations, providing insights into their analysis and offering a clearer understanding of the current market landscape. We'll examine BofA's assessment of market conditions, address common investor concerns regarding volatility, and explore their outlook and recommended investment strategies.

BofA's Assessment of Current Market Conditions

The current economic climate is characterized by several intertwined factors influencing stock market valuations. Inflation, though showing signs of cooling, remains a concern, impacting interest rates and consumer spending. Geopolitical instability adds another layer of complexity, creating uncertainty in global markets.

BofA's recent reports highlight key findings on current market conditions:

-

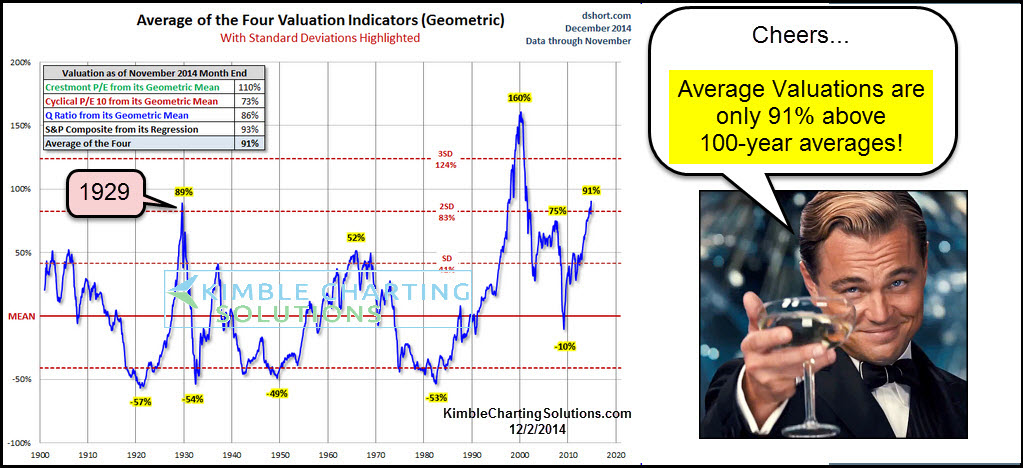

Valuation Metrics: BofA utilizes a range of valuation metrics, including Price-to-Earnings ratios (P/E ratios) and the cyclically adjusted price-to-earnings ratio (Shiller PE), to assess market valuations. Their interpretation of these metrics often indicates whether the market is overvalued, undervalued, or fairly priced compared to historical averages and future earnings expectations. Currently, some reports suggest certain sectors are trading at premium valuations compared to historical averages.

-

Sectoral Analysis: BofA's analysis identifies both overvalued and undervalued sectors. For example, while certain technology sectors may be seen as overvalued based on current P/E ratios and growth projections, others, such as energy or specific segments of the healthcare industry, might be identified as relatively undervalued. This analysis is often dynamic and depends on prevailing economic conditions.

-

Risk Identification: BofA's reports consistently identify significant risks, such as persistently high inflation, further interest rate hikes, and ongoing geopolitical uncertainties. These factors are considered crucial to assessing the potential for market corrections or sustained volatility.

Addressing Investor Concerns Regarding Market Volatility

Market fluctuations trigger common anxieties among investors: fear of a market crash, uncertainty about future returns, and the potential loss of principal. BofA addresses these concerns by providing a framework for risk management and strategic investment approaches.

BofA's strategies for mitigating risk include:

-

Diversification: BofA emphasizes the importance of diversification across asset classes (stocks, bonds, real estate, etc.) and sectors to reduce the impact of any single investment's underperformance. A well-diversified portfolio can help cushion against market downturns.

-

Defensive Investment Options: BofA often recommends incorporating defensive investment options, such as high-quality bonds or dividend-paying stocks, into a portfolio to provide stability during periods of market volatility. These investments can offer a degree of protection against significant losses.

-

Long-Term Perspective: BofA stresses the significance of maintaining a long-term investment horizon. Short-term market fluctuations are normal, and focusing on long-term goals helps mitigate the impact of short-term volatility.

BofA's Outlook and Investment Strategies

BofA's outlook on the stock market is often nuanced and depends on evolving economic data and geopolitical events. While they might express a generally bullish, bearish, or neutral sentiment, their analysis frequently emphasizes specific sectors and opportunities.

BofA's recommended investment strategies are based on their in-depth market analysis:

-

Growth Sectors: BofA identifies sectors poised for growth based on their analysis of economic trends and technological advancements. These sectors can offer opportunities for higher returns, though they might also carry increased risk.

-

Specific Recommendations: BofA's reports might highlight specific stocks or asset classes that they believe offer attractive risk-reward profiles given their market outlook. These recommendations are always accompanied by a careful discussion of inherent risks.

-

Capitalizing on Opportunities: BofA often outlines strategies for capitalizing on market opportunities, such as tactical asset allocation or using derivatives for hedging purposes. These strategies usually require a higher level of investment sophistication.

It is crucial to remember that individual risk tolerance and investment goals should always guide investment decisions. BofA's analysis provides valuable insights, but it is essential to tailor any investment strategy to individual circumstances.

Conclusion

BofA's analysis of current stock market valuations acknowledges the considerable investor anxiety stemming from market volatility. Their assessment considers factors such as inflation, interest rates, and geopolitical risks, offering a balanced perspective on the current economic climate. They advocate for diversification, defensive investment options, and a long-term investment approach to mitigate risk. While their specific recommendations on sectors and asset classes can vary, understanding BofA's view on current stock market valuations is crucial for making informed investment decisions.

Call to Action: Stay informed about current stock market valuations and investor sentiment by regularly reviewing BofA's market analysis and other credible financial sources. Understanding BofA's view on current stock market valuations is crucial for navigating the complexities of the market and making informed investment decisions. Continue your research and consult with a financial advisor before making any significant investment changes. Learn more about managing your investment portfolio in light of BofA’s analysis of current stock market valuations.

Featured Posts

-

Trump In Politikalari Tuerkiye Icin Endiseler Ve Son Gelismeler

May 27, 2025

Trump In Politikalari Tuerkiye Icin Endiseler Ve Son Gelismeler

May 27, 2025 -

Surveillance In Atlanta Leading The Nation In Camera Density

May 27, 2025

Surveillance In Atlanta Leading The Nation In Camera Density

May 27, 2025 -

Gemini On Chrome Evaluating Googles Agentic Ai Progress

May 27, 2025

Gemini On Chrome Evaluating Googles Agentic Ai Progress

May 27, 2025 -

The Future Of Family Planning Exploring Over The Counter Birth Control Post Roe

May 27, 2025

The Future Of Family Planning Exploring Over The Counter Birth Control Post Roe

May 27, 2025 -

Clarification Lizzos Comments On Janet Jacksons Pop Queen Status

May 27, 2025

Clarification Lizzos Comments On Janet Jacksons Pop Queen Status

May 27, 2025