Addressing Investor Concerns: BofA On High Stock Market Valuations

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

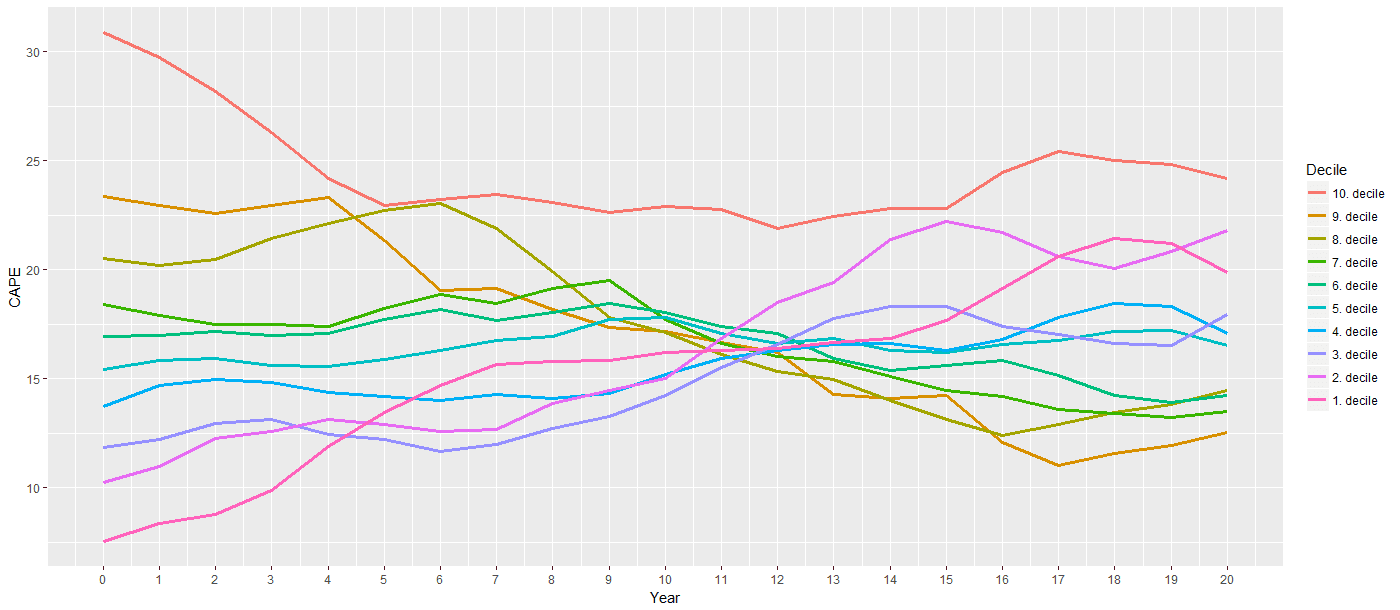

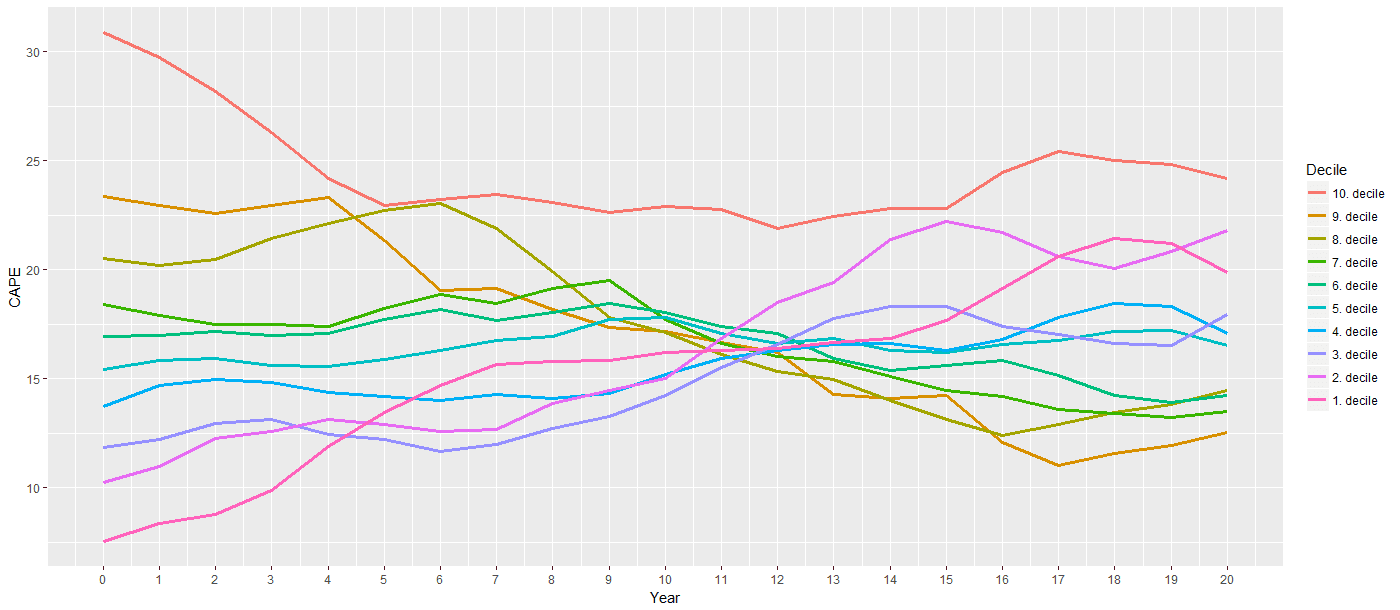

BofA's stock market analysis employs a range of valuation metrics to gauge the overall health and potential risks within the equity markets. Their assessment considers both quantitative data and qualitative factors, providing a comprehensive overview of the current market landscape. Key metrics used by BofA typically include:

- Price-to-Earnings Ratio (P/E): A widely used metric comparing a company's stock price to its earnings per share. High P/E ratios often suggest high valuations, indicating investors are willing to pay more for each dollar of earnings. BofA's analysis likely incorporates sector-specific P/E comparisons to historical averages and industry benchmarks.

- Price-to-Sales Ratio (P/S): This metric compares a company's stock price to its revenue per share. It's particularly useful for valuing companies with no earnings or those in high-growth sectors. BofA's assessment likely uses P/S ratios to analyze the valuation of growth stocks, a significant component of the current market.

- Market Capitalization: This represents the total market value of a company's outstanding shares. BofA likely considers the overall market capitalization to assess the size and potential risks of the market as a whole.

BofA's Overall Assessment: (Note: This section requires current data from BofA's reports. Replace the bracketed information below with BofA's actual findings.) [Insert BofA's overall assessment here – e.g., "BofA considers the market to be [overvalued/fairly valued/undervalued], citing [specific reasons based on their analysis and the metrics above]."] This assessment is likely contextualized with historical valuations, comparing current levels to past market cycles to identify potential anomalies. [Insert specific sectors or stocks mentioned by BofA as being particularly overvalued or undervalued].

Underlying Factors Driving High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. Understanding these drivers is essential for developing an effective investment strategy.

- Low Interest Rates: Historically low interest rates have made borrowing cheaper for corporations and individuals, fueling investment and consumption. This increased demand for assets, including stocks, has driven up prices.

- Inflation and Monetary Policy: While inflation poses a challenge, central banks' responses (monetary policy) play a key role. BofA's analysis likely considers the balance between inflation control measures and their impact on market sentiment and valuations.

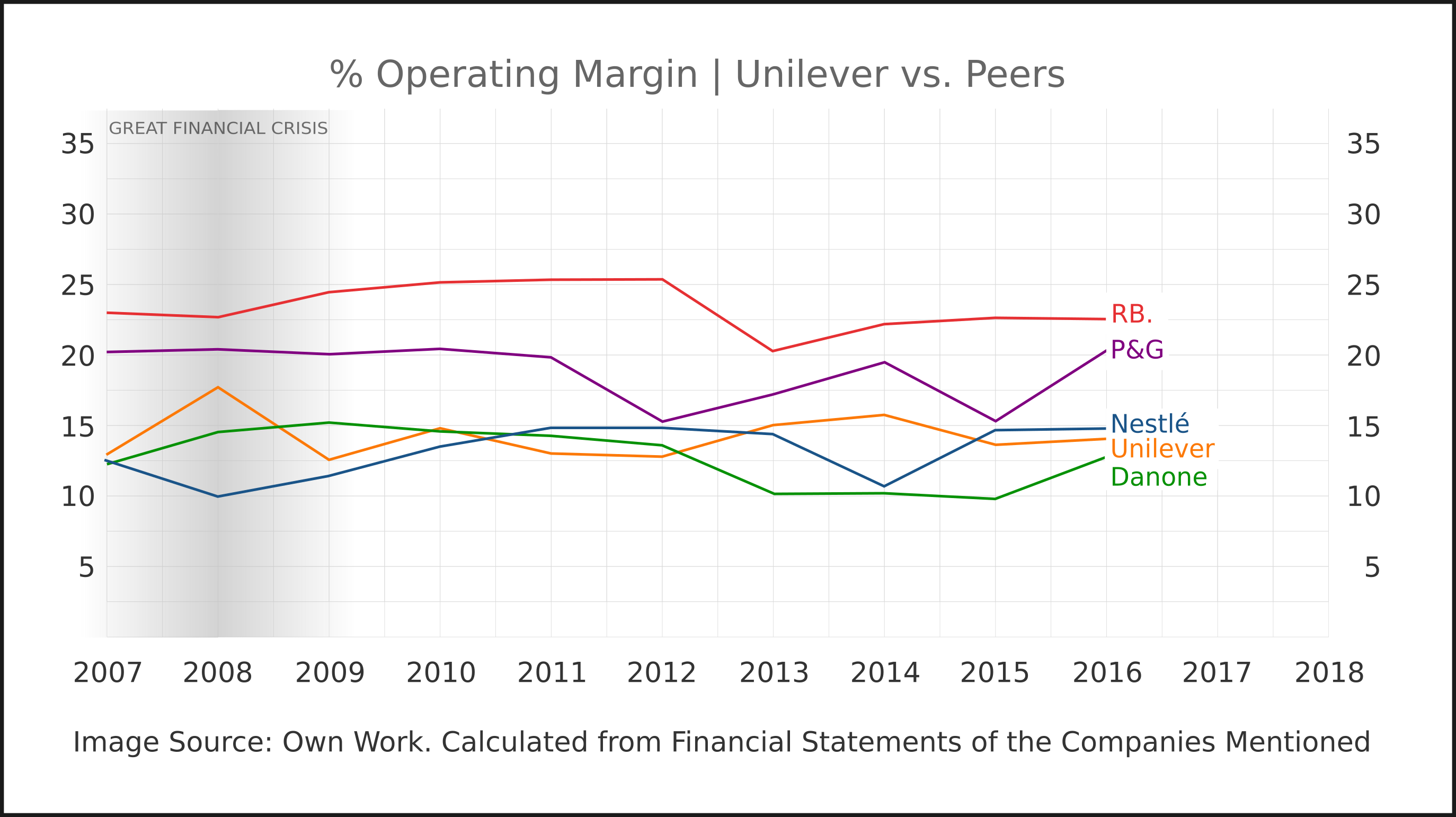

- Corporate Earnings Growth: Strong corporate earnings, particularly in certain sectors, support higher valuations. BofA's analysis likely includes an evaluation of the sustainability of earnings growth and its consistency across different sectors.

- Investor Sentiment and Speculation: Positive investor sentiment and speculation, fueled by technological advancements or economic optimism, can inflate stock prices beyond their fundamental value. BofA's analysis likely acknowledges the role of investor psychology in the market's performance.

BofA's Recommendations for Investors

Given the high valuations, BofA likely advocates for a cautious yet opportunistic approach. Their recommendations might include:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial for mitigating risk. BofA's advice probably emphasizes a balanced portfolio that accounts for current market conditions.

- Risk Management: Implementing stop-loss orders and other risk management tools can protect against potential market downturns. BofA likely recommends strategies for managing downside risk, especially in a potentially overvalued market.

- Sector-Specific Allocation: BofA may recommend overweighting certain undervalued sectors while reducing exposure to overvalued ones. [Insert specific sectors mentioned in BofA's recommendations, if available].

- Long-Term vs. Short-Term Investment: BofA’s approach likely emphasizes long-term investing, aligning with a buy-and-hold strategy for sustainable growth, while suggesting caution for short-term gains in a potentially volatile market.

Potential Risks and Opportunities in the Current Market

While the market offers potential returns, high valuations also present significant risks.

- Market Correction: A sharp decline in stock prices is always a possibility when valuations are elevated. BofA's analysis likely includes an assessment of the likelihood and potential magnitude of a market correction.

- Recession Risk: High valuations can make the market more vulnerable to an economic downturn. BofA likely discusses the potential impact of a recession on stock prices and the economy as a whole.

- Investment Opportunities: Despite the risks, opportunities may exist within specific undervalued sectors or through strategic investment approaches. [Insert details on opportunities highlighted by BofA's analysis, if available].

- Market Volatility: The potential for increased market volatility in a high-valuation environment is significant. BofA likely emphasizes the importance of having a robust risk management strategy in place.

Conclusion

BofA's analysis of high stock market valuations provides crucial insights for investors. Their assessment, considering key metrics and underlying economic factors, highlights the need for a balanced and diversified investment strategy. While potential risks exist, including the possibility of a market correction or economic downturn, opportunities may also be present for investors who carefully assess and manage risk. Understanding BofA's perspective on high stock market valuations is paramount for informed decision-making. Stay informed about market trends, consult with a financial advisor to develop a personalized investment strategy, and continue your research on addressing investor concerns regarding high stock market valuations to make well-informed investment choices.

Featured Posts

-

Dope Thief Episode 7 Review Ray And Manny Take Center Stage

Apr 25, 2025

Dope Thief Episode 7 Review Ray And Manny Take Center Stage

Apr 25, 2025 -

Bayern Vs Bochum Bundesliga Match Preview And Prediction

Apr 25, 2025

Bayern Vs Bochum Bundesliga Match Preview And Prediction

Apr 25, 2025 -

Saints Mock Draft Top 10 Pick Could Be Kamaras Heir Apparent

Apr 25, 2025

Saints Mock Draft Top 10 Pick Could Be Kamaras Heir Apparent

Apr 25, 2025 -

30 Stone Weight Loss The Power Of Motivation And A Friends Honest Feedback

Apr 25, 2025

30 Stone Weight Loss The Power Of Motivation And A Friends Honest Feedback

Apr 25, 2025 -

Increased Demand And Pricing Power Boost Unilever Sales Beyond Forecasts

Apr 25, 2025

Increased Demand And Pricing Power Boost Unilever Sales Beyond Forecasts

Apr 25, 2025