Addressing Investor Concerns: BofA On Stretched Stock Market Valuations

Table of Contents

BofA's Key Concerns Regarding Current Stock Market Valuations

BofA's Global Research has highlighted several factors contributing to their concerns about stock market overvaluation. These concerns are based on a thorough analysis of various valuation metrics and market trends. Key elements of their analysis include:

-

High Price-to-Earnings (P/E) Ratios: BofA's research indicates that current P/E ratios for many sectors are significantly higher than historical averages, suggesting stocks may be overpriced relative to their earnings potential. This elevated P/E ratio is a major indicator of potentially stretched stock market valuations.

-

Elevated Market Capitalization: The overall market capitalization, representing the total value of all listed companies, appears inflated compared to underlying economic fundamentals. This disparity between market value and economic reality is a red flag for potential overvaluation and future market corrections.

-

Rising Interest Rates' Impact: The anticipated and ongoing rise in interest rates poses a significant threat to stock valuations. Higher interest rates increase borrowing costs for companies, potentially impacting profitability and reducing the attractiveness of equities relative to fixed-income investments. This is a crucial factor in assessing stretched stock market valuations.

-

Sector-Specific Overvaluation: BofA's analysis points to specific sectors exhibiting signs of significant overvaluation. These sectors, often characterized by rapid growth and high investor enthusiasm, are particularly vulnerable to corrections should investor sentiment shift. Specific reports detailing these sectors should be consulted for a comprehensive understanding.

-

BofA's Data and Reports: Investors should refer to BofA's official publications and research reports for detailed data and analysis supporting these concerns. This detailed information will provide a more thorough understanding of the specifics underlying their warnings about stretched stock market valuations.

Understanding the Risks Associated with Stretched Valuations

Overvalued markets present several significant risks for investors. Understanding these risks is paramount to effective risk management:

-

Market Corrections and Crashes: Stretched stock market valuations significantly increase the vulnerability of the market to sharp corrections or even crashes. A sudden shift in investor sentiment could trigger a rapid decline in prices.

-

Reduced Returns on Investment: When markets are overvalued, the potential for future returns is diminished. Investors purchasing assets at inflated prices face a lower probability of achieving substantial capital appreciation.

-

The Importance of Risk Management: Given the elevated risks, robust risk management strategies are crucial. This includes careful consideration of investment time horizons and tolerance for risk.

-

Portfolio Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) can help mitigate the impact of a market correction in any single asset class, thereby lessening the risk associated with stretched stock market valuations.

-

Potential Scenarios and Impacts:

- Scenario 1 (Mild Correction): A modest decline in prices, potentially recovering within a few months.

- Scenario 2 (Significant Correction): A more substantial decline, lasting longer and potentially leading to significant losses.

- Scenario 3 (Market Crash): A severe and rapid decline in prices, potentially causing widespread economic disruption.

Strategies for Investors to Navigate the Current Market

Navigating the current market requires a cautious and strategic approach. Here's how investors can mitigate the risks associated with potentially stretched stock market valuations:

-

Conservative Investment Approach: Adopting a more conservative investment strategy, potentially reducing equity exposure and increasing allocations to less volatile assets, is prudent.

-

Value Investing: Focusing on value investing – identifying undervalued companies with strong fundamentals – can help to mitigate the risks of overpaying for assets.

-

Portfolio Diversification: As previously mentioned, diversification remains crucial to protect against market downturns. Spread investments across various asset classes and geographies.

-

Portfolio Re-evaluation: It's essential to regularly re-evaluate your portfolio's allocation to ensure it aligns with your risk tolerance and long-term investment goals.

-

Long-Term Investment Strategy: Maintaining a long-term investment horizon reduces the impact of short-term market fluctuations and allows for recovery from corrections.

-

Specific Investment Actions:

- Reduce exposure to high-growth, high-valuation sectors.

- Increase allocation to defensive sectors like consumer staples and utilities.

- Consider investing in high-quality dividend-paying stocks for income generation.

Conclusion

BofA's warnings regarding stretched stock market valuations underscore the importance of cautious investment strategies. The potential risks associated with overvalued markets – including market corrections and reduced returns – cannot be ignored. By diversifying portfolios, adopting a more conservative approach, and focusing on value investing, investors can mitigate these risks and enhance their chances of long-term success. Don't let concerns about stretched stock market valuations leave you unprepared. Take proactive steps to manage your investments wisely. Conduct thorough research, consult with a qualified financial advisor, and develop a robust investment strategy to navigate the market with confidence.

Featured Posts

-

Pabrik Zuffenhausen Pusat Kelahiran Porsche 356

May 24, 2025

Pabrik Zuffenhausen Pusat Kelahiran Porsche 356

May 24, 2025 -

Luxus Porsche 911 80 Millio Forintos Extrafelszereltseg

May 24, 2025

Luxus Porsche 911 80 Millio Forintos Extrafelszereltseg

May 24, 2025 -

Bangladesh Europe Trade Collaborative Efforts For Economic Development

May 24, 2025

Bangladesh Europe Trade Collaborative Efforts For Economic Development

May 24, 2025 -

Nemecke Spolocnosti Rusia Pracovne Miesta Rozsiahle Prepustanie V Roznych Odvetviach

May 24, 2025

Nemecke Spolocnosti Rusia Pracovne Miesta Rozsiahle Prepustanie V Roznych Odvetviach

May 24, 2025 -

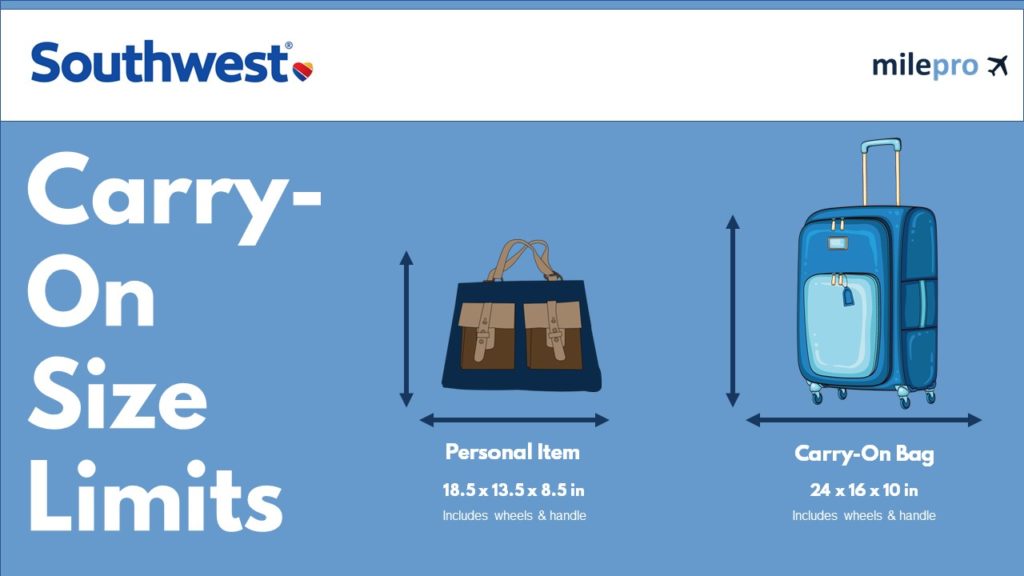

Understanding Southwest Airlines New Carry On Rules For Portable Chargers

May 24, 2025

Understanding Southwest Airlines New Carry On Rules For Portable Chargers

May 24, 2025

Latest Posts

-

Savannah Guthries Mid Week Today Show Co Host Swap

May 24, 2025

Savannah Guthries Mid Week Today Show Co Host Swap

May 24, 2025 -

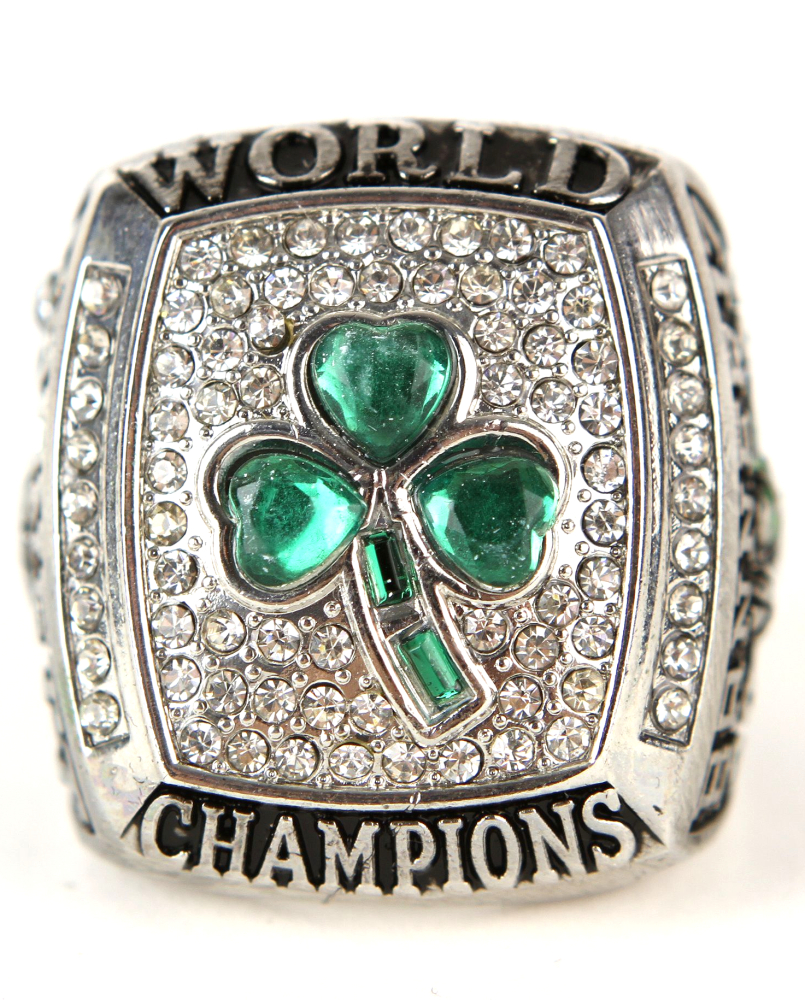

Walt Fraziers Ring Flash A Celtics Fans Reaction On Today

May 24, 2025

Walt Fraziers Ring Flash A Celtics Fans Reaction On Today

May 24, 2025 -

Behind The Scenes Drama Al Rokers Off The Record Comments Create Today Show Tension

May 24, 2025

Behind The Scenes Drama Al Rokers Off The Record Comments Create Today Show Tension

May 24, 2025 -

Dylan Dreyers Latest Post With Brian Fichera A Look At The Fan Response

May 24, 2025

Dylan Dreyers Latest Post With Brian Fichera A Look At The Fan Response

May 24, 2025 -

Walt Frazier Teases Today Show Host Dylan Dreyer With Championship Rings

May 24, 2025

Walt Frazier Teases Today Show Host Dylan Dreyer With Championship Rings

May 24, 2025