Addressing Investor Concerns: BofA's View On High Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Valuations

BofA generally holds a cautious stance on current market valuations, acknowledging that while certain sectors show promising growth, the overall picture suggests elevated levels of risk. They aren't outright bearish, but they emphasize the need for prudent investment strategies.

-

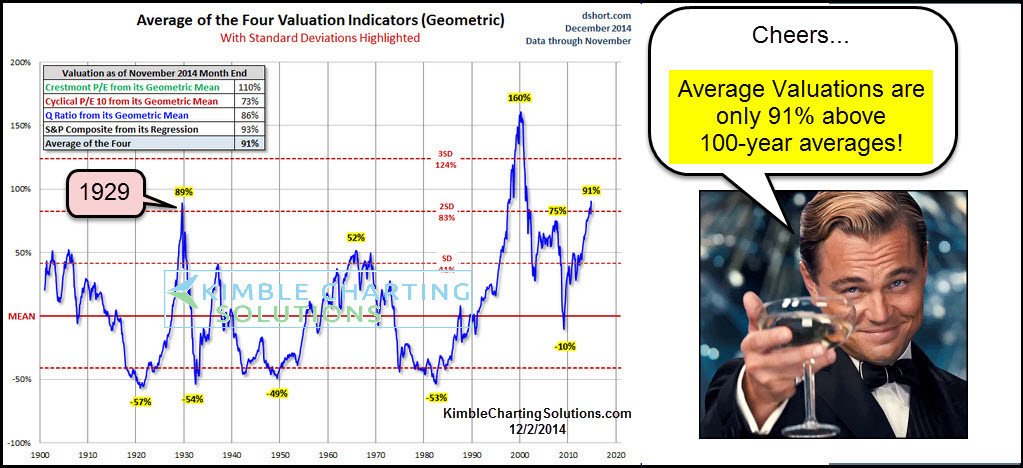

Key Metrics: BofA utilizes various metrics to assess valuations, including the widely used Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE), which considers inflation-adjusted earnings over a longer period. These metrics, along with others, help them gauge whether current prices accurately reflect underlying company performance and future growth prospects.

-

Sectoral Analysis: BofA's reports often highlight specific sectors they deem overvalued or undervalued. For example, they might identify technology stocks as potentially overvalued given their high P/E ratios compared to historical averages, while certain value sectors might be deemed relatively undervalued. This analysis is frequently updated and depends on numerous factors.

-

Supporting Reports: BofA's research team publishes regular reports and market commentaries that provide detailed analysis of their valuation assessments. These publications often include charts, graphs, and in-depth explanations of their methodology. Searching for "BofA Global Research" will yield numerous relevant resources.

-

Interest Rate Impact: BofA acknowledges the significant impact of interest rates on stock valuations. Higher interest rates typically lead to lower valuations as investors seek higher returns in fixed-income instruments. Conversely, lower interest rates can boost valuations, but the current environment presents a complicated interplay of these factors.

Identifying Potential Risks Highlighted by BofA

BofA identifies several risks associated with the current high valuations, emphasizing the need for cautious optimism among investors.

-

Market Correction/Downturn: The elevated valuations increase the potential for a market correction or even a more significant downturn. A sharp decrease in stock prices could significantly impact investor portfolios.

-

Inflationary Pressures: Persistent inflation erodes purchasing power and can impact corporate profitability, potentially leading to lower stock prices. BofA analyzes inflation trends and their likely impact on various sectors.

-

Geopolitical Risks: Geopolitical events, such as international conflicts or trade disputes, can create significant market uncertainty and volatility, impacting stock valuations regardless of underlying fundamentals.

-

Sector-Specific Risks: BofA frequently points out risks associated with specific sectors, urging investors to diversify and avoid overexposure to any single industry.

-

Increased Volatility: High valuations are often correlated with increased market volatility, meaning larger price swings in the short term.

BofA's Strategic Recommendations for Investors

BofA recommends a prudent and risk-managed approach for investors navigating this market environment.

-

Diversification: BofA strongly advocates for diversification across various asset classes (stocks, bonds, real estate), sectors, and geographies. This strategy helps mitigate risk and protect against losses in any single area.

-

Defensive Strategies: Employing defensive investment approaches, such as value investing (focusing on undervalued companies) or investing in dividend-paying stocks, can offer stability and income generation during periods of market uncertainty.

-

Long-Term Perspective: BofA emphasizes the importance of maintaining a long-term investment horizon, avoiding impulsive decisions based on short-term market fluctuations.

-

Asset Allocation: BofA may provide recommendations on specific asset allocation strategies depending on investor risk tolerance and financial goals. This often involves a balanced approach to managing risk and return.

-

Portfolio Adjustments: BofA advises regularly reviewing and adjusting portfolios based on their ongoing market analysis and outlook. Staying informed is critical to proactive management.

Considering Alternative Investment Options

BofA may suggest exploring alternative investment options, depending on market conditions and investor profiles. These may include:

-

Bonds: Bonds can provide stability and income during periods of market uncertainty, offering a counterbalance to the volatility of stocks.

-

Real Estate: Real estate investments can offer diversification benefits and potentially hedge against inflation, though they usually have lower liquidity.

Conclusion

This article summarized Bank of America's perspective on high stock market valuations, highlighting their assessment of current risks and offering strategic recommendations for investors. BofA's analysis provides crucial insights for navigating the complexities of the current market, emphasizing the importance of diversification, risk management, and a long-term investment approach. Understanding BofA's view on high stock market valuations is key to making informed investment choices.

Call to Action: Stay informed about BofA's ongoing analysis of high stock market valuations and adapt your investment strategy accordingly. Regularly review your portfolio and consider seeking professional financial advice to manage your investments effectively in this fluctuating market. Keywords: BofA, high stock market valuations, investment strategy, financial advice, market analysis.

Featured Posts

-

Ftc Probe Into Open Ais Chat Gpt Implications For Ai Development And Use

May 28, 2025

Ftc Probe Into Open Ais Chat Gpt Implications For Ai Development And Use

May 28, 2025 -

Galaxy S25 256 Go A 862 42 E Un Bon Plan A Saisir

May 28, 2025

Galaxy S25 256 Go A 862 42 E Un Bon Plan A Saisir

May 28, 2025 -

Manchester Uniteds Garnacho Lyon Player Cites Amorims Role In Struggles

May 28, 2025

Manchester Uniteds Garnacho Lyon Player Cites Amorims Role In Struggles

May 28, 2025 -

Costly Inning For Kochanowicz Angels Defeat Against Yankees

May 28, 2025

Costly Inning For Kochanowicz Angels Defeat Against Yankees

May 28, 2025 -

Kritiki Foinikiko Sxedio I Nea Tainia Toy Goyes Anterson

May 28, 2025

Kritiki Foinikiko Sxedio I Nea Tainia Toy Goyes Anterson

May 28, 2025