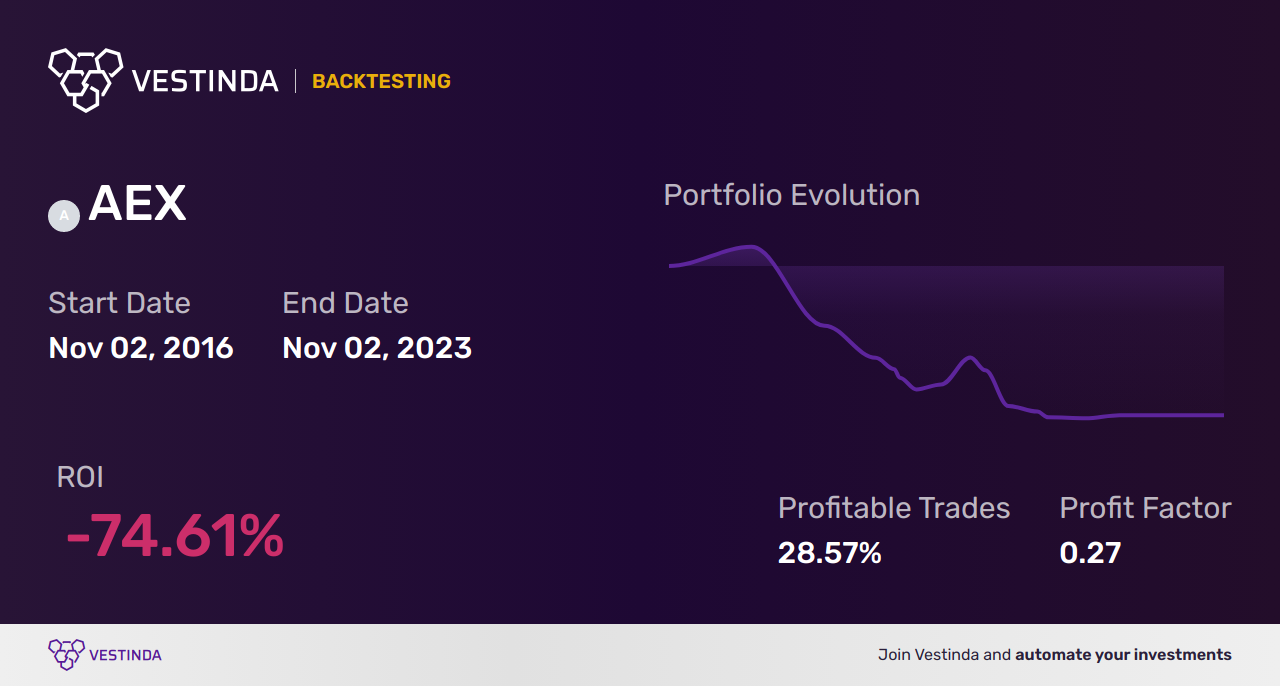

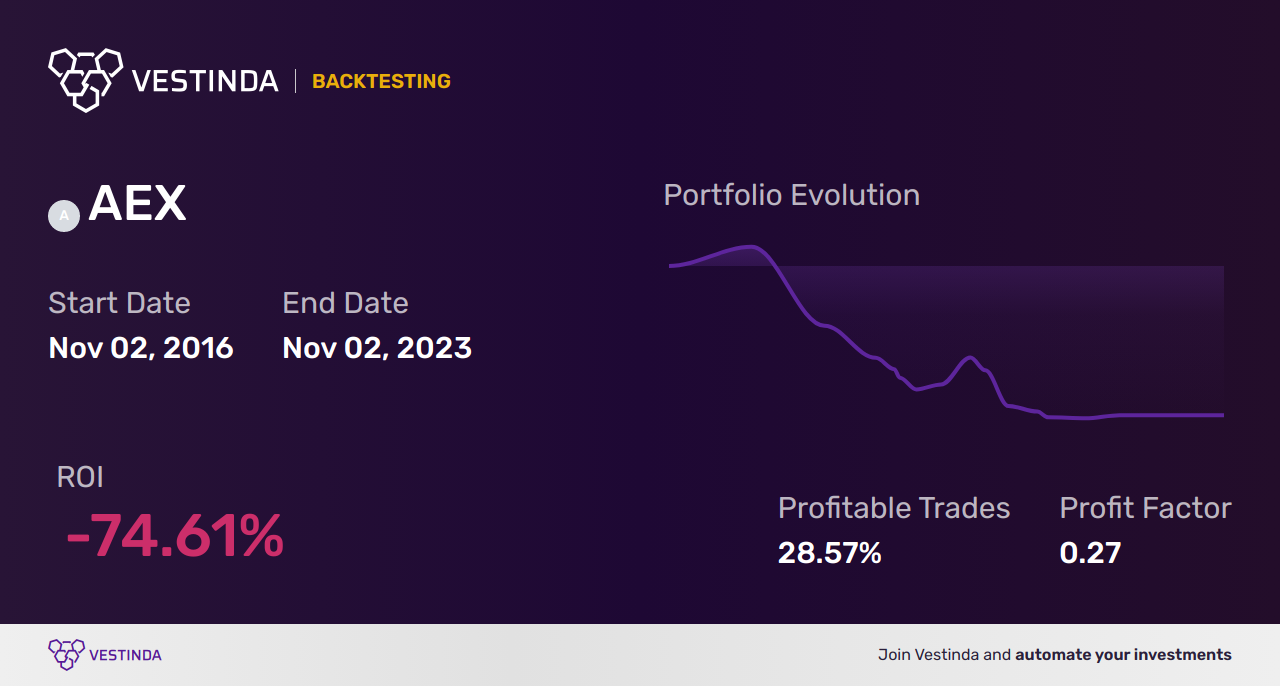

AEX Index Crumbles: More Than 4% Loss Marks 12-Month Low

Table of Contents

Causes of the AEX Index Decline

The dramatic fall in the AEX index is a multifaceted issue, stemming from a confluence of global and sector-specific factors that have significantly impacted investor sentiment and market psychology.

Global Economic Uncertainty

Global economic headwinds are a major contributor to the AEX's decline. Rising inflation rates across the Eurozone, coupled with aggressive interest rate hikes by the European Central Bank (ECB) to combat inflation, have dampened economic growth prospects.

- Contributing Events: The ongoing war in Ukraine, the persistent energy crisis, and supply chain disruptions are all significant factors contributing to this instability. The resulting uncertainty has negatively impacted investor confidence.

- Impact on Investor Confidence: The fear of further economic slowdown and potential recession has prompted investors to sell off assets, leading to a sell-off in the AEX and other European indices.

- Data Points: Eurozone inflation recently reached X%, while the ECB has raised interest rates by Y% in the past Z months. These figures highlight the severity of the economic challenges facing the region.

Sector-Specific Weakness

The AEX decline isn't uniform across all sectors. Certain sectors have been disproportionately affected, exacerbating the overall market downturn.

- Hardest Hit Sectors: The technology and energy sectors have experienced particularly steep losses. Companies heavily reliant on global supply chains or sensitive to energy price fluctuations have been particularly vulnerable.

- Reasons for Underperformance: Supply chain bottlenecks continue to plague many industries, impacting production and profitability. Additionally, decreased consumer demand, partly due to inflation, has further pressured these sectors.

- Stock Price Examples: For instance, [Company A] in the technology sector saw its share price drop by Z%, while [Company B] in the energy sector experienced a W% decline.

Investor Sentiment and Market Psychology

Fear and uncertainty are powerful drivers of market downturns. Negative news coverage amplifies existing anxieties, contributing to a self-reinforcing cycle of selling.

- Impact of Negative News: Negative headlines about inflation, recessionary fears, and geopolitical instability fuel a climate of pessimism, influencing investor decisions.

- Herd Mentality: The "herd mentality," where investors mimic the actions of others, often leads to panic selling during periods of market volatility, further accelerating the decline.

- Market Sentiment Indicators: Trading volume has increased significantly, indicating heightened activity driven by fear and uncertainty. Various market sentiment indicators point towards a prevailing bearish outlook.

Impact of the AEX Decline

The AEX decline has wide-ranging consequences, impacting Dutch investors and potentially influencing the broader European and global economies.

Impact on Dutch Investors

The consequences for Dutch investors are significant, potentially impacting both individual and institutional portfolios.

- Retirement Savings: Many Dutch retirees rely on their investments for retirement income; the AEX's fall directly impacts their savings and future financial security.

- Dutch Economy: A weakening AEX can lead to decreased consumer confidence and spending, potentially impacting economic growth and business investment within the Netherlands.

- Ripple Effects: Reduced investor confidence can trigger a decline in business investments, further dampening economic activity.

International Implications

The AEX decline's impact extends beyond the Netherlands. It reflects broader concerns about the global economy and could affect other European markets.

- Contagion Effect: The volatility in the AEX could trigger a contagion effect, impacting other European stock markets such as the DAX (Germany) and CAC 40 (France).

- International Trade and Investment: Uncertainty in the Dutch market can impact international trade and investment flows, potentially affecting economic growth in other countries.

- European Index Comparisons: Comparing the AEX's performance against other major European indices reveals the extent of the current downturn and its relative impact on the Netherlands.

Strategies for Navigating the AEX Downturn

Navigating a market downturn requires a proactive and strategic approach focused on risk management and a long-term perspective.

Risk Management Strategies

Effective risk management is crucial during periods of market volatility.

- Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate) can help mitigate losses.

- Asset Allocation: Adjusting the asset allocation in your portfolio to reflect your risk tolerance and investment goals is vital.

- Hedging and Stop-Loss Orders: Employing hedging strategies and setting stop-loss orders can limit potential losses.

Long-Term Investment Perspective

Maintaining a long-term investment horizon is crucial for weathering market fluctuations.

- Historical Performance: The AEX has historically recovered from downturns. Focusing on long-term growth potential is key.

- Avoid Panic Selling: Avoid making impulsive decisions based on short-term market fluctuations.

- Historical Data: Analyzing historical data on the AEX index shows a pattern of recovery following periods of decline, reinforcing the importance of a long-term perspective.

Conclusion

The more than 4% drop in the AEX index, marking a 12-month low, reflects significant challenges in the global and Dutch economies. While the impact on Dutch investors is substantial, a well-defined investment strategy focusing on diversification, risk management, and a long-term perspective is crucial. By carefully monitoring AEX index performance, adapting your strategy, and seeking professional financial advice, you can better navigate this turbulent period and protect your investments. Keep a close watch on the AEX index and its future performance to make informed decisions.

Featured Posts

-

The Truth About Elon Musk And Dogecoin

May 25, 2025

The Truth About Elon Musk And Dogecoin

May 25, 2025 -

17 Celebrity Scandals That Changed Everything

May 25, 2025

17 Celebrity Scandals That Changed Everything

May 25, 2025 -

Charlene De Monaco El Lino Perfecto Para El Otono

May 25, 2025

Charlene De Monaco El Lino Perfecto Para El Otono

May 25, 2025 -

Konchita Vurst Pobeditel Evrovideniya 2014 Kaming Aut V 13 Let I Plany Stat Devushkoy Bonda

May 25, 2025

Konchita Vurst Pobeditel Evrovideniya 2014 Kaming Aut V 13 Let I Plany Stat Devushkoy Bonda

May 25, 2025 -

Eurovision Village Esc 2025 Conchita Wurst Live With Jj

May 25, 2025

Eurovision Village Esc 2025 Conchita Wurst Live With Jj

May 25, 2025