Affirm Holdings (AFRM) IPO Failure: A Direct Result Of Trump's Trade Policies?

Table of Contents

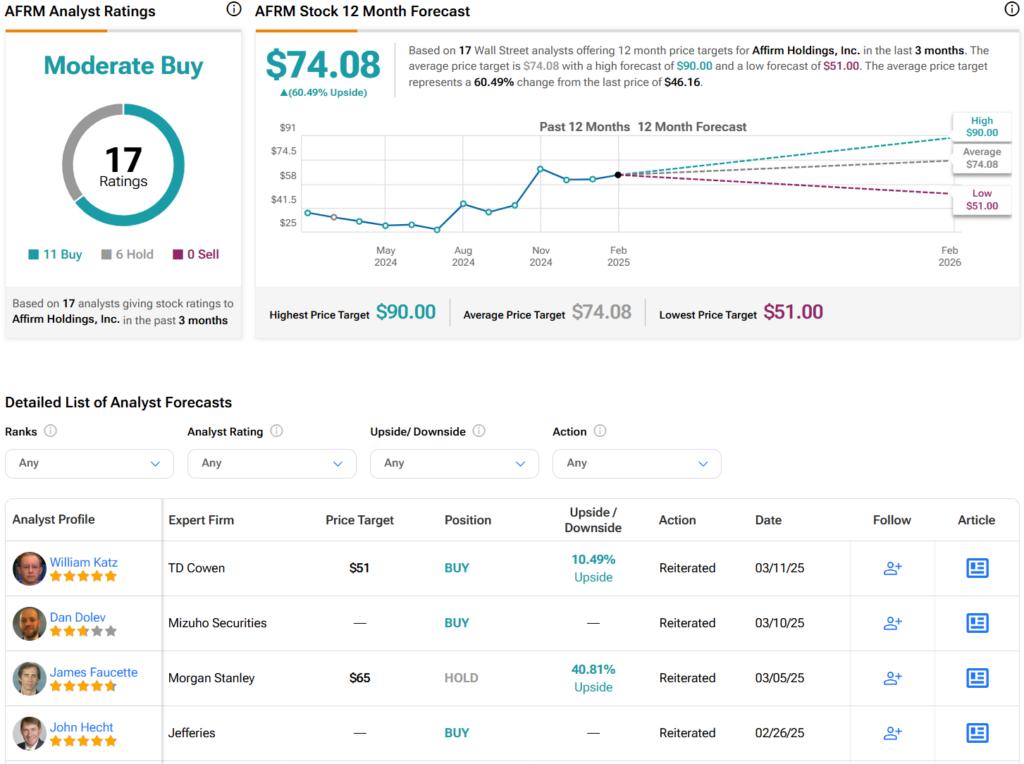

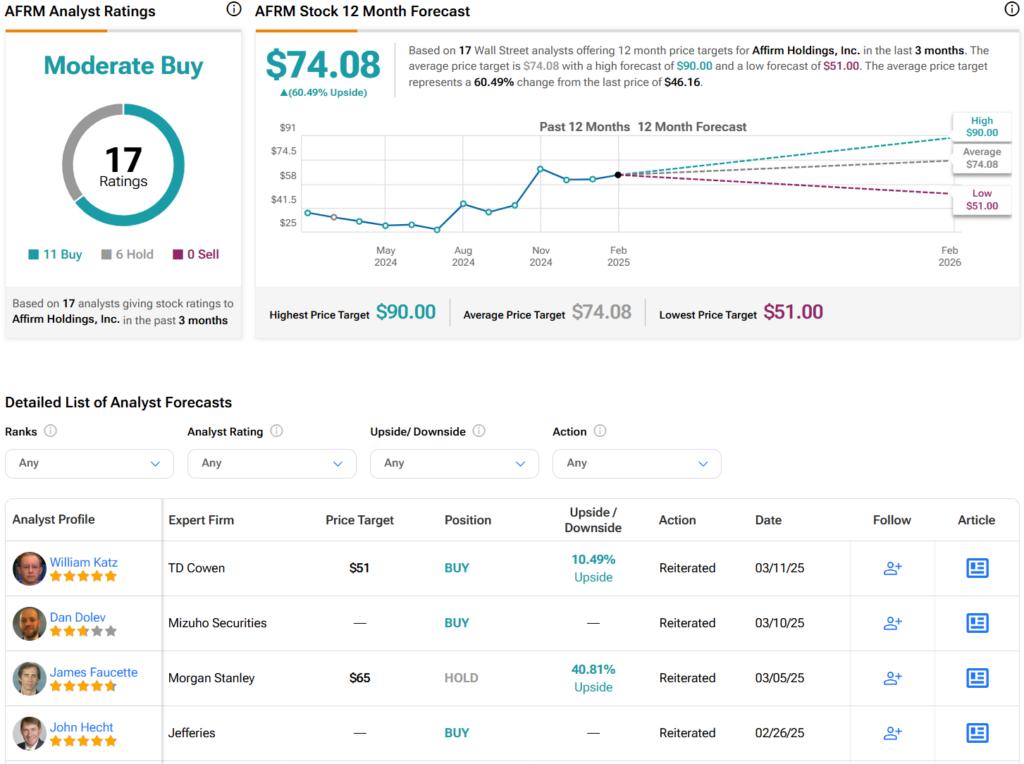

The Affirm Holdings (AFRM) Initial Public Offering (IPO) didn't quite live up to initial expectations. While multiple factors undoubtedly contributed to its performance, this article delves into the argument that Donald Trump's protectionist trade policies played a significant, albeit perhaps not solely decisive, role in hindering AFRM's success. We'll analyze the economic climate and its impact on the Buy Now Pay Later (BNPL) sector, specifically focusing on how trade tensions affected investor sentiment and the overall market conditions surrounding AFRM's IPO.

The Impact of Trade Wars on Investor Sentiment

Trump's trade wars created a climate of significant uncertainty, impacting investor decisions and the overall market. This uncertainty had a ripple effect on various aspects of the financial landscape and significantly influenced the performance of companies like AFRM.

Increased Uncertainty and Market Volatility

Trade wars inherently introduce uncertainty. Investors, naturally risk-averse, tend to pull back from potentially volatile sectors during such times. The fintech sector, including companies like Affirm, is often considered more volatile than established industries.

- Decreased consumer confidence: Trade tensions lead to anxieties about job security and future economic prospects, dampening consumer spending.

- Increased market volatility indices (e.g., VIX): The VIX, a measure of market volatility, typically rises during periods of geopolitical and economic uncertainty, reflecting investor anxiety.

- Flight to safety investments (e.g., government bonds): Investors often seek the relative safety of government bonds during uncertain times, diverting funds from riskier assets like newly issued stocks.

This decreased investor appetite directly impacted overall market capitalization and reduced the enthusiasm for new IPOs, including AFRM's. The uncertainty made it harder for AFRM to attract the level of investment needed to justify its valuation.

Disruption of Global Supply Chains

Tariffs and trade disputes imposed by the Trump administration significantly disrupted global supply chains. This had a direct impact on the cost of goods and potentially affected AFRM's merchant partners.

- Increased import costs for merchants: Tariffs increased the cost of imported goods, squeezing profit margins for many retailers.

- Potential delays in product delivery: Trade disputes created logistical bottlenecks, leading to delays in the delivery of goods.

- Impact on merchant profitability and BNPL usage: Reduced profitability for merchants could decrease their willingness to partner with BNPL providers like Affirm, impacting AFRM's revenue streams.

Affirm’s business model is inherently tied to the health of the retail sector. Disruptions within this sector, caused by trade tensions, directly impacted the company's growth potential and attractiveness to investors.

Specific Economic Indicators Affected by Trump's Policies and Their Relevance to AFRM

Several key economic indicators were influenced by Trump's policies, all of which had the potential to negatively affect AFRM's performance.

The Rise in Interest Rates

While not a direct result of tariffs, the uncertainty created by Trump's trade policies could have influenced the Federal Reserve's monetary policy decisions.

- Federal Reserve response to trade uncertainty: The Fed might have responded to trade uncertainty by raising interest rates to curb inflation or stabilize the economy.

- Impact of higher interest rates on borrowing costs for consumers and Affirm: Higher interest rates increase borrowing costs for both consumers and Affirm, potentially reducing consumer demand for BNPL services and increasing Affirm's lending costs.

This tightening of monetary policy could have reduced the attractiveness of Affirm’s services, thereby impacting its IPO performance.

Slowdown in Consumer Spending

Trade tensions and the resulting economic uncertainty directly impacted consumer spending, a vital component for the success of a BNPL company.

- Decreased consumer confidence: Uncertainty about the future economic climate leads to a reduction in consumer spending.

- Increased unemployment: Trade wars can lead to job losses in affected industries, further reducing consumer spending power.

- Reduction in discretionary spending: Consumers are more likely to cut back on non-essential purchases during times of economic uncertainty, directly impacting the demand for BNPL services.

This slowdown in consumer spending negatively affected the demand for Affirm's services, hindering its revenue growth and potentially impacting its IPO valuation.

Alternative Explanations for AFRM's IPO Performance

It's crucial to acknowledge that other factors, independent of Trump's trade policies, might have contributed to AFRM's IPO performance.

- Competition in the BNPL market: The BNPL market is becoming increasingly competitive, with several established players vying for market share.

- Concerns about AFRM's business model: Some investors might have had concerns about the long-term sustainability of Affirm's business model.

- Overall market conditions beyond trade policies: Broader market conditions, such as overall economic downturns, also play a significant role in IPO success.

While these factors are important to consider, the impact of the economic uncertainty generated by Trump's protectionist trade policies shouldn't be dismissed as a contributing factor to AFRM's IPO performance.

Conclusion

In summary, while isolating a single cause for AFRM's IPO performance is impossible, the economic uncertainty generated by Trump's trade policies likely played a significant role. The resulting impact on investor sentiment, supply chains, and consumer spending all negatively affected the attractiveness of the company to investors at the time of its IPO. The increased market volatility, coupled with the potential for reduced profitability for Affirm's merchant partners, created a less-than-ideal environment for a successful launch. While other factors undoubtedly contributed, understanding the broader economic context, including the significant impact of protectionist policies, is crucial for evaluating investment strategies in similar fintech companies. Further research into the interplay between trade policies and the fintech sector is needed to fully understand the long-term effects. Continue learning about the complex relationship between global trade and the Affirm Holdings (AFRM) IPO, and consider analyzing other IPOs during this period to further understand the effects of Trump's trade policies on the overall financial landscape.

Featured Posts

-

Great Value Product Recall Alert Michigan Consumers Affected

May 14, 2025

Great Value Product Recall Alert Michigan Consumers Affected

May 14, 2025 -

A Do Te Performonte Celine Dion Ne Eurovizion 2025 Ne Zvicer

May 14, 2025

A Do Te Performonte Celine Dion Ne Eurovizion 2025 Ne Zvicer

May 14, 2025 -

Visit Lindts Exquisite Chocolate Shop In Central London

May 14, 2025

Visit Lindts Exquisite Chocolate Shop In Central London

May 14, 2025 -

Haiti Plus De 33 Des Enfants Deplaces Ont Moins De 5 Ans

May 14, 2025

Haiti Plus De 33 Des Enfants Deplaces Ont Moins De 5 Ans

May 14, 2025 -

Newcastles Pursuit Of Premier League Defender Ends In Disappointment

May 14, 2025

Newcastles Pursuit Of Premier League Defender Ends In Disappointment

May 14, 2025