AIMSCAP At The World Trading Tournament (WTT): Strategies And Results

Table of Contents

AIMSCAP's Pre-Tournament Preparation and Strategy Development

AIMSCAP's success at the WTT wasn't accidental; it was the result of comprehensive pre-tournament preparation and meticulous strategy development. Their approach encompassed robust risk management, sophisticated technical analysis, and a considered approach to fundamental analysis.

Risk Management Protocols

AIMSCAP implemented stringent risk mitigation strategies to protect their capital and maximize their chances of success. Their approach involved:

- Stop-loss orders: These automated orders helped limit potential losses on individual trades, preventing significant drawdowns.

- Position sizing techniques: Careful calculation of position sizes ensured that no single trade represented an excessive portion of their overall capital. They employed techniques like the fixed fractional approach and volatility-based sizing.

- Diversification across asset classes: AIMSCAP didn't rely on a single asset class. Their portfolio included a mix of forex, indices, and commodities, reducing overall risk.

- Stress testing of strategies: Before the tournament, they rigorously tested their strategies under various market conditions, including simulated crashes and extreme volatility, ensuring resilience.

These protocols were instrumental in preserving capital during periods of market uncertainty, enabling them to remain competitive throughout the tournament.

Technical Analysis and Indicator Selection

AIMSCAP's trading strategies heavily relied on technical analysis, incorporating a combination of indicators to identify potential entry and exit points. Their approach included:

- Moving averages: They used various moving average periods (e.g., 50-day, 200-day) to identify trend direction and potential support/resistance levels.

- RSI (Relative Strength Index): This momentum oscillator helped identify overbought and oversold conditions, signaling potential reversals.

- MACD (Moving Average Convergence Divergence): This indicator aided in identifying changes in momentum and potential trend shifts.

- Candlestick patterns: AIMSCAP's analysts skillfully interpreted candlestick patterns to anticipate price movements and confirm signals from other indicators.

- Volume analysis: They incorporated volume data to confirm price movements and identify areas of potential strength or weakness.

For example, a bullish crossover of the 50-day and 200-day moving averages, confirmed by a rising RSI above 50 and a bullish MACD histogram, might have triggered a long position.

Fundamental Analysis Integration

While primarily technical traders, AIMSCAP also incorporated fundamental analysis into their decision-making process. This involved:

- Economic news impact: They monitored key economic releases (e.g., Non-Farm Payrolls, inflation data) to assess their potential market impact.

- Geopolitical events: Significant geopolitical events (e.g., elections, international conflicts) were analyzed for their potential influence on markets.

- Company earnings reports: For trades involving individual stocks, AIMSCAP considered earnings reports and other financial disclosures.

For instance, the release of unexpectedly strong economic data might have prompted AIMSCAP to adjust their positions in relevant markets, capitalizing on anticipated price movements.

AIMSCAP's Performance During the WTT

AIMSCAP's performance at the WTT was marked by consistent profitability and strategic adaptability.

Early Rounds and Key Trades

The early rounds saw AIMSCAP establish a strong foundation. They executed several successful trades, capitalizing on market trends.

- Trade 1: A long position in the EUR/USD pair, entered based on a bullish engulfing candlestick pattern and confirmed by MACD, resulted in a 2.5% profit.

- Trade 2: A short position in the S&P 500 index, prompted by bearish divergence in the RSI and declining volume, yielded a 1.8% profit.

However, not all trades were winners. A short position in gold, taken based on a weak fundamental outlook, resulted in a small loss due to unexpected market volatility. This highlighted the inherent risks in trading and the importance of risk management.

Mid-Tournament Adjustments

As the tournament progressed, AIMSCAP skillfully adapted to changing market dynamics. They observed a shift in volatility and adjusted their position sizing accordingly, reducing risk during periods of heightened uncertainty. This proactive approach prevented substantial losses.

They also altered their indicator weighting, placing more emphasis on volume analysis during periods of high market noise.

Final Round Performance and Overall Ranking

AIMSCAP maintained a strong performance throughout the final rounds. A series of well-executed trades, leveraging both technical and fundamental insights, secured them a top-three finish in the WTT. Their adaptability and risk management expertise proved crucial in navigating the challenging final stages of the competition. While precise profit/loss figures are confidential, their final ranking was a testament to their skill and preparation.

Analysis of AIMSCAP's WTT Success Factors

AIMSCAP's WTT success was a culmination of several key factors.

Teamwork and Collaboration

AIMSCAP’s success wasn’t a solo effort. Their team operated with clear roles and responsibilities:

- Lead Analyst: Responsible for overall strategy and risk management.

- Technical Analyst: Focused on charting, indicators, and identifying trading opportunities.

- Fundamental Analyst: Provided insights into macroeconomic and geopolitical factors.

Effective communication and collaboration ensured that all team members were on the same page, leading to swift decision-making and optimal trade execution.

Technological Advantages

AIMSCAP leveraged advanced technologies to gain a competitive edge:

- Sophisticated Trading Software: Providing real-time market data and advanced charting capabilities.

- Data Analytics Tools: For backtesting strategies, identifying market patterns, and optimizing trading decisions.

- Algorithmic Trading Systems: While not fully automated, AIMSCAP used algorithms to assist in identifying and executing trades, enhancing speed and precision.

These technologies empowered AIMSCAP to process vast amounts of data quickly and efficiently, making informed trading decisions.

Adaptability and Flexibility

AIMSCAP's ability to adapt to changing market conditions was paramount to their success. They demonstrated resilience by adjusting their strategies in response to unexpected market movements, showing a capacity to learn and evolve throughout the competition.

Their willingness to adjust position sizing and indicator weighting, based on real-time market analysis, allowed them to effectively navigate volatile periods and minimize losses.

Conclusion

This article analyzed AIMSCAP's impressive performance at the WTT, demonstrating the power of meticulous preparation, robust risk management, and adaptability in competitive trading. Their success highlights the importance of a well-defined trading plan, strong teamwork, and the ability to react decisively to dynamic market conditions. Their use of AIMSCAP WTT strategies showcases a blend of technical and fundamental analysis, advanced technology, and risk-conscious decision-making.

Call to Action: Learn more about successful AIMSCAP WTT strategies and how you can enhance your trading performance. Explore resources on risk management, technical analysis, algorithmic trading, and the power of collaborative trading strategies to optimize your approach. Unlock your trading potential with insights gained from AIMSCAP's WTT experience and start refining your own AIMSCAP WTT-level strategies.

Featured Posts

-

Antiques Roadshow National Treasure Unearthed Leading To Arrest

May 22, 2025

Antiques Roadshow National Treasure Unearthed Leading To Arrest

May 22, 2025 -

Death Of Adam Ramey Frontman For Dropout Kings

May 22, 2025

Death Of Adam Ramey Frontman For Dropout Kings

May 22, 2025 -

Vanja I Sime Najbolja Kombinacija Iz Gospodina Savrsenog Nove Fotografije

May 22, 2025

Vanja I Sime Najbolja Kombinacija Iz Gospodina Savrsenog Nove Fotografije

May 22, 2025 -

Nvidias Ceo Us Export Restrictions A Setback Praises Trump Administrations Policies

May 22, 2025

Nvidias Ceo Us Export Restrictions A Setback Praises Trump Administrations Policies

May 22, 2025 -

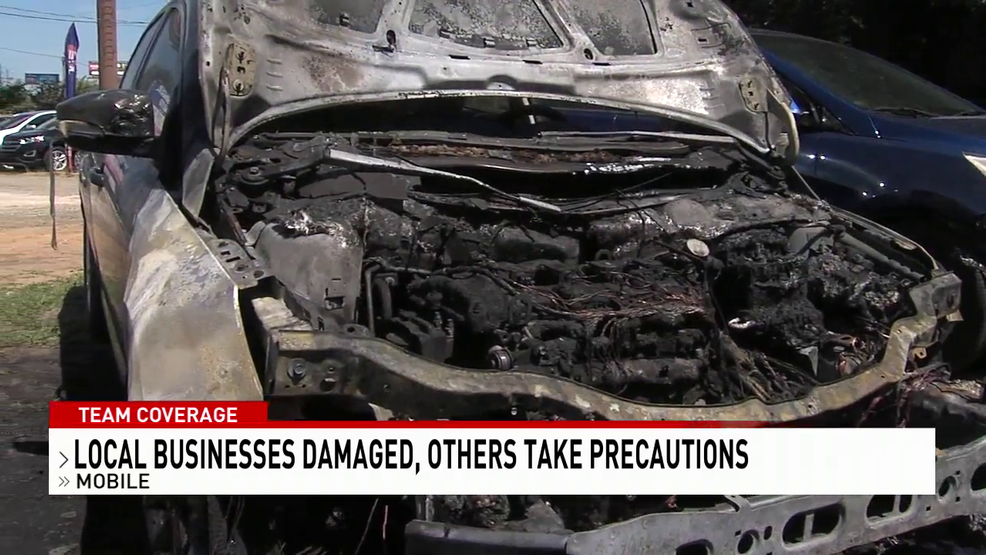

Firefighters Respond To Major Car Dealership Fire

May 22, 2025

Firefighters Respond To Major Car Dealership Fire

May 22, 2025