Akeso Plunges: Cancer Drug Trial Disappoints

Table of Contents

Akeso's Stock Plummets Following Negative Trial Data

Akeso's stock price experienced a sharp decline of 25% on October 26th, 2023 (replace with actual date), following the announcement of negative Phase III trial data for its investigational drug, AKS-XXXX (replace with actual drug name), a targeted therapy aimed at treating advanced non-small cell lung cancer (NSCLC). The pre-announcement stock price stood at $XX (replace with actual price), plummeting to $XX (replace with actual price) in the immediate aftermath. Trading volume surged significantly, indicating a high level of investor activity and anxiety.

- Stock price decline: 25% (replace with actual percentage)

- Trading volume: Increased by XXX% (replace with actual percentage) compared to the previous day's average.

- Analyst reactions: Several leading financial institutions downgraded their ratings on Akeso's stock, citing concerns about the future prospects of AKS-XXXX and the company's overall pipeline.

Analysis of the Disappointing Trial Results

The disappointing results for AKS-XXXX stem primarily from the trial's failure to meet its primary endpoint of improving overall survival in patients with advanced NSCLC. While the drug demonstrated some level of efficacy in shrinking tumors (a secondary endpoint), this effect wasn't statistically significant enough to warrant further development based on the current data.

- Primary endpoint failure: The trial failed to demonstrate a statistically significant improvement in overall survival compared to the control group (standard-of-care treatment).

- Secondary endpoint results: While tumor shrinkage was observed, the effect size was modest and not considered clinically meaningful.

- Safety profile: The safety profile of AKS-XXXX appeared manageable, with side effects comparable to existing treatments. This mitigates some of the negative impact, but the lack of efficacy remains the central concern.

- Comparison with existing treatments: AKS-XXXX failed to outperform existing NSCLC therapies in terms of efficacy, raising concerns about its competitive advantage in the crowded oncology market.

Implications for Akeso's Future and the Oncology Market

The failed trial poses significant challenges for Akeso. The immediate impact is a substantial financial setback, potentially jeopardizing future funding rounds and impacting the development of other drugs in its pipeline. The long-term implications include a potential reassessment of their R&D strategy and possibly a shift in focus away from AKS-XXXX or its similar analogs.

- Impact on Akeso's pipeline: The setback could lead to delays or cancellations of other projects, as investors may become hesitant to fund further development.

- Potential for future funding rounds: Securing additional funding may prove difficult given the negative trial data.

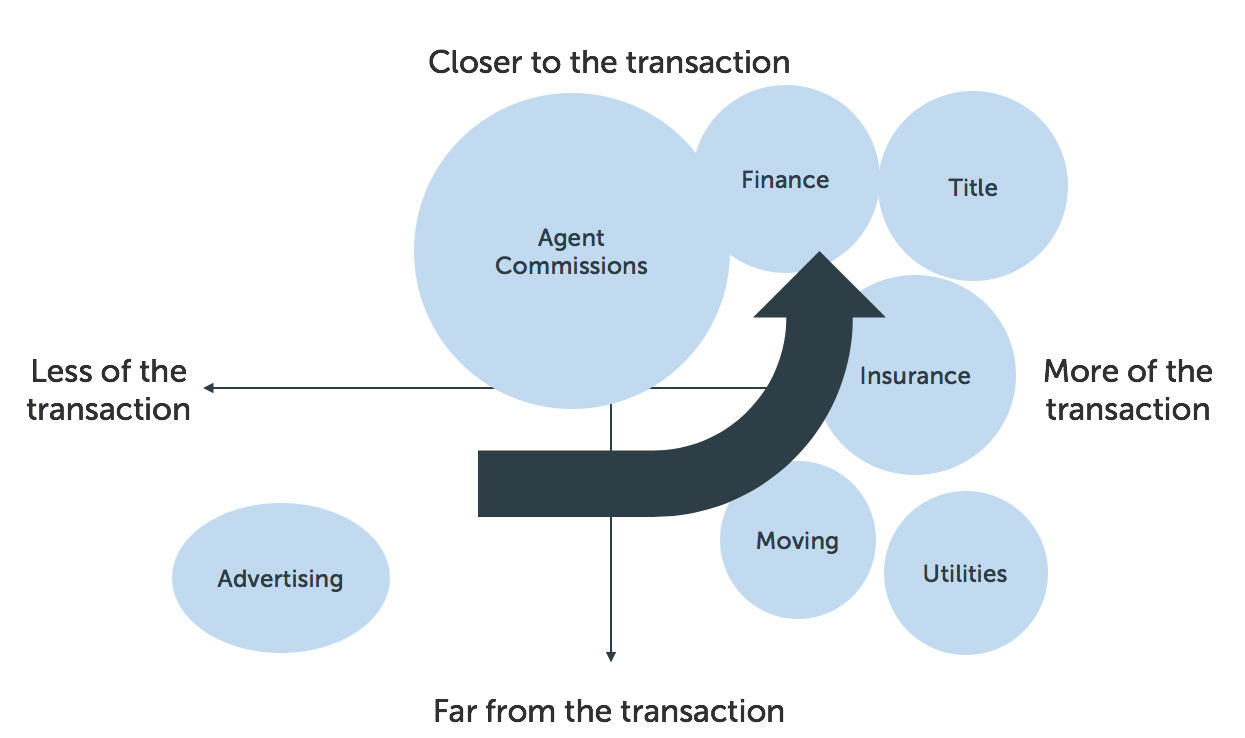

- Competitive landscape in the oncology market: Akeso faces intense competition from established pharmaceutical giants with extensive resources and a broader portfolio of oncology drugs.

- Effect on investor confidence: The Akeso plunges will likely damage investor confidence in the company, impacting its stock price and ability to attract new investors.

Investor Reactions and Market Analysis

The news of the failed trial triggered a significant sell-off, with investors rushing to divest their holdings. Financial analysts expressed concerns about the future prospects of AKS-XXXX and Akeso's overall pipeline, leading to further negative sentiment. The extent of short-selling activity remains to be seen, but the initial reaction suggests a bearish outlook for the foreseeable future.

- Sell-off volume and intensity: The sell-off was swift and substantial, reflecting a high degree of investor pessimism.

- Analyst comments and forecasts: Many analysts lowered their price targets for Akeso's stock, reflecting the increased uncertainty surrounding the company's future.

- Investor sentiment analysis: Investor sentiment has shifted dramatically from positive to negative, impacting the company's market valuation.

- Short-selling activity: Increased short-selling activity is likely, further putting downward pressure on the stock price.

Conclusion: Understanding the Akeso Plunge and its Significance

The Akeso plunges highlight the inherent risks in pharmaceutical research and development. The failure of the AKS-XXXX trial underscores the unpredictable nature of clinical trials and the substantial financial consequences that can result from disappointing results. The impact extends beyond Akeso, raising concerns about the future of similar targeted therapies for NSCLC and potentially impacting investor confidence in the broader oncology sector.

To stay informed about Akeso's progress and the implications of this setback, it's crucial to monitor Akeso's stock performance closely and understand the risks associated with Akeso investments. Learn more about Akeso plunges and similar events in the biopharmaceutical industry to make well-informed decisions. Stay updated on Akeso's progress and future announcements to gauge the long-term impact of this significant event.

Featured Posts

-

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025 -

Pw Cs Strategic Shift Leaving Nine African Markets

Apr 29, 2025

Pw Cs Strategic Shift Leaving Nine African Markets

Apr 29, 2025 -

Blue Origin Rocket Launch Abruptly Halted Subsystem Malfunction

Apr 29, 2025

Blue Origin Rocket Launch Abruptly Halted Subsystem Malfunction

Apr 29, 2025 -

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025 -

Uk Courts Definition Of Woman Impact On Sex Based Rights And Transgender Issues

Apr 29, 2025

Uk Courts Definition Of Woman Impact On Sex Based Rights And Transgender Issues

Apr 29, 2025