Amsterdam AEX Index Falls Below Year Ago Levels

Table of Contents

Factors Contributing to the Amsterdam AEX Index Decline

Several interconnected factors have contributed to the recent decline in the Amsterdam AEX Index. Understanding these contributing elements is crucial for interpreting the current market situation and making informed investment decisions.

Global Economic Headwinds

The global economic climate has significantly impacted the Amsterdam AEX Index. Several global headwinds are at play:

- Weakening Euro: The Euro's weakening against the US dollar has negatively impacted the earnings of Dutch multinational companies, many of whom report in dollars. This currency fluctuation reduces the value of their profits when converted back to Euros.

- Energy Crisis Impact: The ongoing energy crisis in Europe, particularly impacting the Netherlands, has placed significant pressure on Dutch businesses, leading to reduced profitability and impacting stock valuations. Many energy-intensive industries have suffered substantially.

- Global Recession Fears: Growing concerns about a potential global recession have increased investor risk aversion, leading to capital flight from riskier assets, including Dutch equities. Data shows a significant correlation between global recessionary fears and the AEX's performance. For example, [Insert data or statistic showing correlation, e.g., "a 10% increase in global recession probability is associated with a 5% drop in the AEX"].

Performance of Key AEX Components

The underperformance of several key sectors listed on the AEX has significantly contributed to the overall index decline.

- Technology Sector Slump: The technology sector, a significant component of the AEX, has experienced a downturn, with several prominent tech companies showing considerable losses. For example, [mention a specific company and percentage decline].

- Financial Sector Weakness: The financial sector has also underperformed, influenced by rising interest rates and global economic uncertainty. [Mention specific examples of financial institutions and their performance].

- Impact of Specific Companies: The performance of individual large-cap companies significantly influences the AEX. A decline in the share price of a major company like [mention a large company listed on the AEX] can disproportionately affect the index's overall value. Charts illustrating the performance of individual stocks can be found [link to relevant financial data source].

Investor Sentiment and Market Volatility

Decreased investor confidence and increased market volatility are key drivers behind the AEX's decline.

- Increased Risk Aversion: Investors are displaying increased risk aversion, shifting their investments towards safer assets like government bonds, which offer lower returns but greater stability.

- Capital Flight: This risk aversion has led to a noticeable outflow of capital from the Dutch stock market, further depressing the AEX.

- Decreased Foreign Investment: Reduced foreign investment in Dutch companies, due to global uncertainty, has amplified the downward pressure on the AEX. News reports from [mention financial news sources] highlight this trend.

Implications for Investors

The decline in the Amsterdam AEX Index presents both challenges and opportunities for investors. Understanding these implications is crucial for effective investment strategy.

Portfolio Diversification Strategies

The current market climate underscores the importance of portfolio diversification.

- Asset Class Diversification: Investors should consider diversifying their holdings across various asset classes, including bonds, real estate, and commodities, to mitigate the risk associated with the AEX's decline.

- Geographic Diversification: International diversification, by investing in assets outside the Netherlands and Europe, is also crucial to reduce exposure to regional economic shocks.

Risk Assessment and Management

Effective risk management is paramount in navigating the current market conditions.

- Due Diligence: Thorough due diligence is essential before making any investment decisions. Understanding the financial health of individual companies is crucial.

- Risk Tolerance: Investors need to carefully assess their own risk tolerance and adjust their investment strategies accordingly.

- Market Condition Adjustment: Investment strategies should be dynamic, adapting to changing market conditions.

Opportunities Amidst the Decline

While the decline presents challenges, it also offers potential opportunities for savvy investors.

- Value Investing: The downturn may present opportunities for value investing, identifying undervalued companies with strong long-term growth potential.

- Undervalued Stocks: Careful analysis may uncover undervalued stocks that could offer significant returns once market sentiment improves.

- Long-Term Investment Perspective: A long-term investment perspective is essential, focusing on the fundamental strength of companies rather than short-term market fluctuations.

Potential Future Trends for the Amsterdam AEX Index

Predicting the future performance of the Amsterdam AEX Index requires analyzing various factors and considering diverse expert opinions.

Economic Forecasts and Predictions

Experts offer varying forecasts regarding the AEX's future performance.

- Inflation Predictions: Predictions about inflation rates and their impact on corporate earnings are key factors influencing the AEX's outlook. [Cite forecasts from reputable economic institutions].

- Interest Rate Projections: The trajectory of interest rates, set by the European Central Bank, will significantly influence the performance of Dutch equities. [Cite relevant interest rate forecasts].

Government Policies and their Influence

Dutch government policies can significantly influence the AEX's recovery.

- Fiscal Policy: Government spending and taxation policies can stimulate or dampen economic growth, affecting the AEX's performance.

- Monetary Policy: The European Central Bank's monetary policy, including interest rate decisions, directly impacts the AEX.

- Regulatory Changes: New regulations impacting specific sectors can influence the performance of individual companies and the overall index.

Long-Term Outlook

The long-term outlook for the Amsterdam AEX Index is complex and dependent on numerous variables.

- Potential for Recovery: The AEX has historically shown resilience, and a recovery is likely as global economic conditions improve.

- Factors Driving Long-Term Growth: Long-term growth will be driven by factors like technological innovation, sustainable development, and the performance of key Dutch industries.

- Overall Outlook: While uncertainty remains, a cautiously optimistic outlook for the long-term performance of the Amsterdam AEX Index is warranted.

Conclusion

The recent fall of the Amsterdam AEX Index below its year-ago levels is a significant event with broad implications for investors and the Dutch economy. Global economic uncertainty, the performance of key AEX components, and prevailing investor sentiment have all played crucial roles in this decline. While the situation presents challenges, it also presents opportunities for strategic investors who understand the underlying factors driving market fluctuations.

Call to Action: Stay informed about the fluctuations of the Amsterdam AEX Index and adapt your investment strategies accordingly. Understanding the factors influencing the AEX is crucial for navigating the current market conditions and making informed investment decisions. Monitor the Amsterdam AEX Index closely for future updates and opportunities. Consider diversifying your portfolio and employing robust risk management strategies to navigate this dynamic market.

Featured Posts

-

Bbc Radio 1 Big Weekend 2025 Tickets Line Up Dates And Booking Information

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Tickets Line Up Dates And Booking Information

May 24, 2025 -

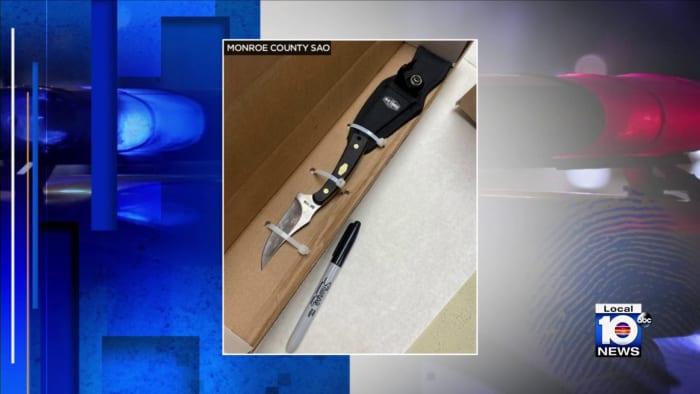

Fatal Shop Stabbing Leads To Rearrest Of Previously Released Teen

May 24, 2025

Fatal Shop Stabbing Leads To Rearrest Of Previously Released Teen

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025 -

De Zaraz Peremozhtsi Yevrobachennya Za Ostannye Desyatilittya

May 24, 2025

De Zaraz Peremozhtsi Yevrobachennya Za Ostannye Desyatilittya

May 24, 2025 -

Indian Wells 2024 Draper Secures Historic Masters 1000 Victory

May 24, 2025

Indian Wells 2024 Draper Secures Historic Masters 1000 Victory

May 24, 2025

Latest Posts

-

Finding Bbc Big Weekend 2025 Sefton Park Tickets Tips And Advice

May 25, 2025

Finding Bbc Big Weekend 2025 Sefton Park Tickets Tips And Advice

May 25, 2025 -

Get Tickets For Bbc Big Weekend 2025 In Sefton Park A Step By Step Guide

May 25, 2025

Get Tickets For Bbc Big Weekend 2025 In Sefton Park A Step By Step Guide

May 25, 2025 -

Secure Your Bbc Big Weekend 2025 Sefton Park Tickets A Complete Guide

May 25, 2025

Secure Your Bbc Big Weekend 2025 Sefton Park Tickets A Complete Guide

May 25, 2025 -

How To Get Bbc Big Weekend 2025 Sefton Park Tickets

May 25, 2025

How To Get Bbc Big Weekend 2025 Sefton Park Tickets

May 25, 2025 -

Is This Us Band Playing Glastonbury Unofficial News Creates Frenzy

May 25, 2025

Is This Us Band Playing Glastonbury Unofficial News Creates Frenzy

May 25, 2025