Amsterdam Exchange Down 2%: Impact Of Trump's Latest Tariff Increase

Table of Contents

Sectors Most Affected by the Tariff Increase

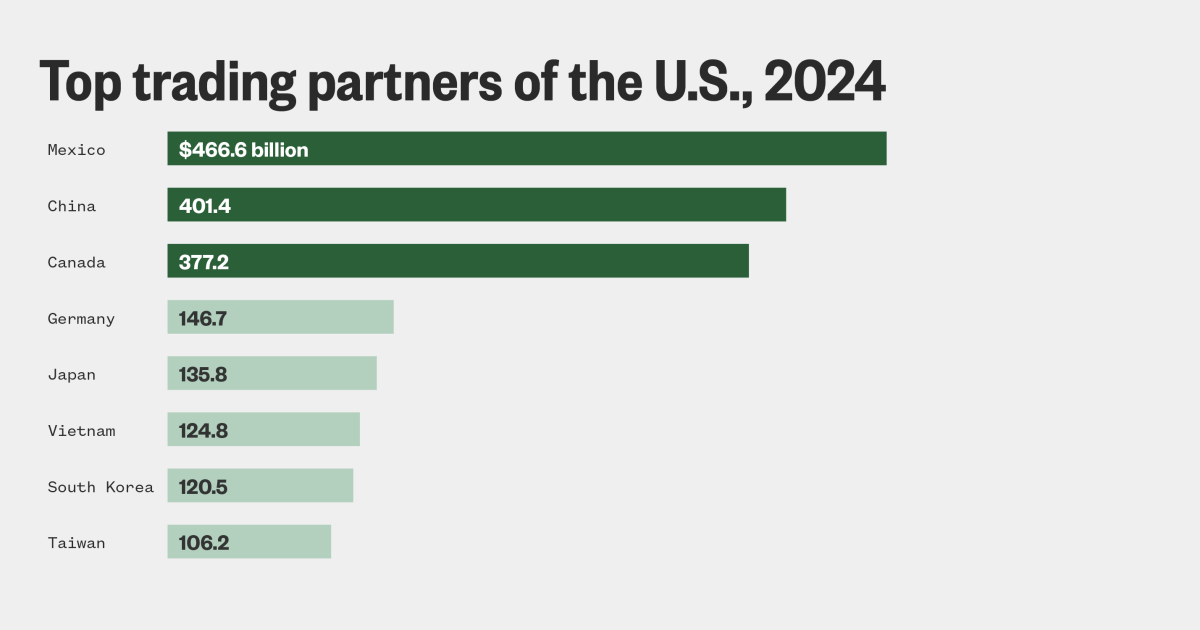

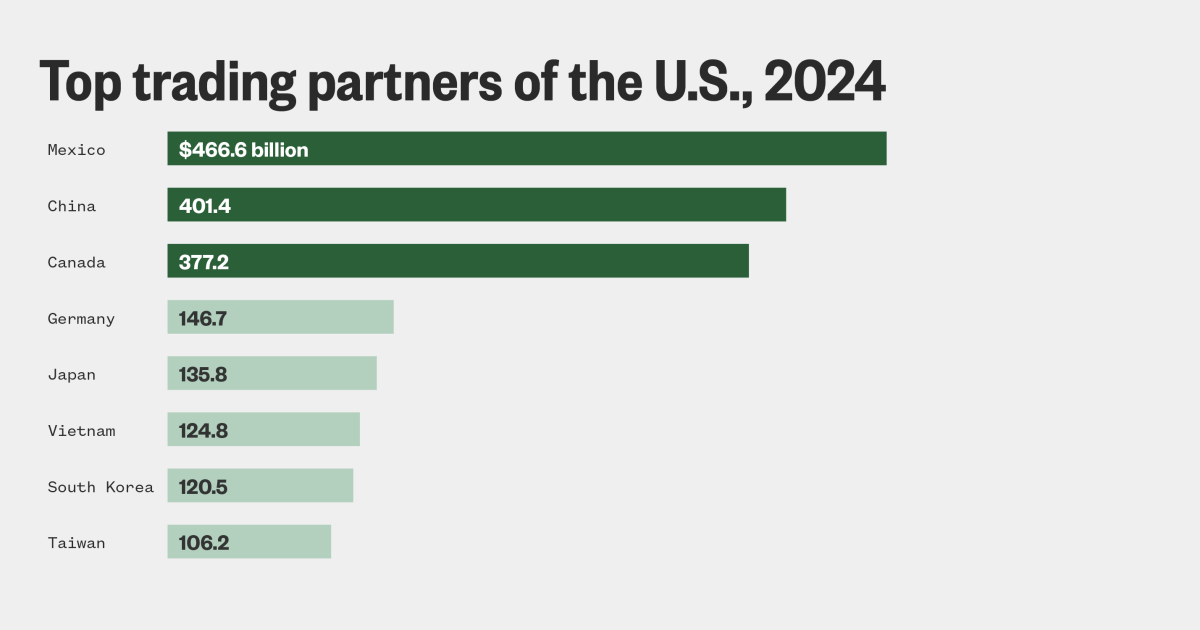

The impact of the new tariffs wasn't felt uniformly across the Amsterdam Exchange. Certain sectors bore the brunt of the negative consequences. The tariff impact is particularly acute in sectors heavily reliant on international trade.

-

Technology: Companies involved in the import/export of technological components and finished goods experienced significant losses. For example, ASML Holding, a major player in semiconductor manufacturing equipment, saw its stock price drop by 2.5%, reflecting concerns about reduced demand from affected US markets.

-

Agriculture: Dutch agricultural exports, especially dairy and horticultural products, are highly sensitive to tariff changes. Companies involved in these sectors showed a considerable decrease in trading volume and share prices, indicating a significant impact on their bottom line. FrieslandCampina, a major dairy cooperative, saw a 1.8% decline.

-

Manufacturing: The manufacturing sector, heavily reliant on global supply chains, also felt the impact, with several companies experiencing decreased trading volumes and stock value drops. This includes companies involved in producing goods destined for the US market.

The table below summarizes the percentage drops for key companies across different sectors:

| Company | Sector | Percentage Drop |

|---|---|---|

| ASML Holding | Technology | 2.5% |

| FrieslandCampina | Agriculture | 1.8% |

| Philips | Manufacturing | 1.5% |

| Heineken | Consumer Goods | 1.2% |

Analyzing Investor Sentiment and Market Reactions

The overall market sentiment following the tariff announcement was decidedly negative. Investor confidence plummeted, reflecting concerns about the potential for prolonged trade uncertainty and its negative impact on economic growth.

Financial analysts have expressed widespread concern, with many suggesting that this is a sign of things to come unless a resolution is reached soon. The short-term implications include further market volatility and potentially lower investment returns. Long-term implications may include a slowdown in global economic growth if the trade war continues to escalate.

-

Key Investor Concerns:

- Increased costs for imported goods.

- Reduced consumer demand due to higher prices.

- Uncertainty about future trade policies.

- Potential for retaliatory tariffs from other countries.

-

Investor Actions: Many investors are adopting risk-averse strategies, including reducing exposure to affected sectors and increasing holdings in more stable assets.

Geopolitical Implications and Future Predictions

The tariff increase isn't just an economic issue; it has significant geopolitical implications. The potential for retaliatory measures from the European Union and other trading partners adds another layer of complexity to the situation.

Economists are divided on the future trajectory of the Amsterdam Exchange. Some predict a continued downturn in the short term, while others believe that the market will eventually stabilize once the trade dispute is resolved. However, the ongoing uncertainty makes accurate predictions challenging.

- Potential Scenarios:

- Scenario 1 (Optimistic): A negotiated settlement is reached, easing trade tensions and leading to market recovery. Probability: 40%

- Scenario 2 (Pessimistic): The trade war escalates, leading to further market declines and potential global recession. Probability: 30%

- Scenario 3 (Neutral): A prolonged period of uncertainty and volatility, with gradual market adjustment. Probability: 30%

Strategies for Navigating Market Volatility (Amsterdam Exchange)

Navigating the current market volatility requires careful planning and strategic adjustments. Investors should focus on risk management and diversification to minimize potential losses.

- Diversification: Spread investments across different asset classes and sectors to reduce exposure to any single risk.

- Stay Informed: Continuously monitor market developments and economic news to make informed investment decisions.

- Adjust Investment Plans: Be prepared to adjust your investment strategy based on evolving market conditions.

- Consider Defensive Assets: Explore options like government bonds or precious metals as a hedge against market uncertainty.

Conclusion: Understanding the Amsterdam Exchange's Response to Tariffs – A Call to Action

Trump's latest tariff increase has had a tangible and significant impact on the Amsterdam Exchange, particularly affecting technology, agriculture, and manufacturing sectors. Investor sentiment is negative, reflecting concerns about the short-term and long-term economic consequences. The geopolitical implications are significant, with potential for further escalation of trade tensions. The future outlook remains uncertain, highlighting the need for robust investment strategies to navigate this volatility. Stay informed about the latest developments in the Amsterdam Exchange and global trade policies. Understanding the influence of tariffs and trade wars on investment decisions is crucial for navigating the complexities of the current market. Closely monitor the Amsterdam Exchange and adjust your investment strategy accordingly.

Featured Posts

-

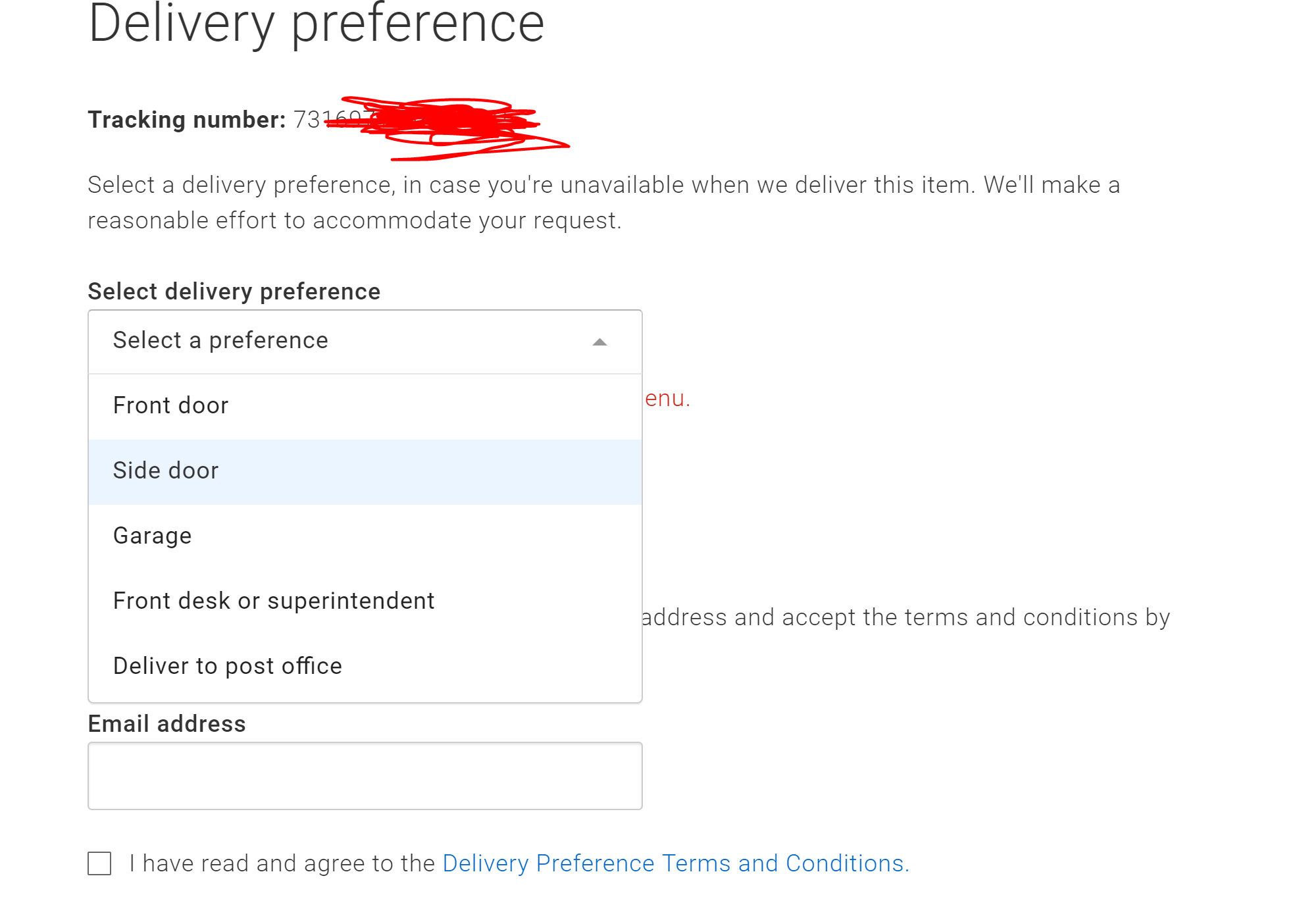

Analyzing The Shift In Delivery Preferences Away From Canada Post

May 25, 2025

Analyzing The Shift In Delivery Preferences Away From Canada Post

May 25, 2025 -

Hands On With The Fujifilm X H2 A Refreshing Take On Photography

May 25, 2025

Hands On With The Fujifilm X H2 A Refreshing Take On Photography

May 25, 2025 -

Hells Angels Their Impact And Influence

May 25, 2025

Hells Angels Their Impact And Influence

May 25, 2025 -

The Best British Pop Films Of All Time A Critics Pick

May 25, 2025

The Best British Pop Films Of All Time A Critics Pick

May 25, 2025 -

Back In The Brawn Jenson Button And His 2009 F1 Car

May 25, 2025

Back In The Brawn Jenson Button And His 2009 F1 Car

May 25, 2025