Amsterdam Exchange: Significant Stock Index Decline

Table of Contents

Analyzing the Causes of the Amsterdam Exchange Stock Index Decline

Several interconnected factors have contributed to the recent downturn in the Amsterdam Exchange stock index. Understanding these contributing elements is crucial for navigating the current market volatility and making informed investment decisions.

Geopolitical Factors

Geopolitical instability has played a significant role in the Amsterdam Exchange stock index decline. Specific events have exerted considerable pressure on the market:

- The ongoing war in Ukraine: The conflict has disrupted global supply chains, increased energy prices, and created widespread economic uncertainty, impacting investor confidence in the Amsterdam Exchange. Sectors like energy and technology, heavily reliant on global trade, have been particularly affected.

- Escalating international trade tensions: Increased protectionist measures and trade disputes between major economies have created additional uncertainty, impacting the performance of Dutch companies involved in international trade. This has led to a decrease in investment and dampened growth prospects, contributing to the Amsterdam Exchange stock index decline.

- Geopolitical risks in other regions: Instability in various regions around the globe contributes to a general climate of uncertainty, making investors wary and leading to a sell-off in riskier assets, including those listed on the Amsterdam Exchange. Data showing a correlation between global geopolitical risk indices and the Amsterdam AEX index supports this conclusion.

Economic Indicators

Several key economic indicators have also contributed to the Amsterdam Exchange stock index decline:

- High inflation rates: Persistently high inflation rates across Europe, including the Netherlands, erode purchasing power and increase the cost of borrowing, negatively impacting business investment and consumer spending. The resulting economic slowdown directly affects corporate profits and stock valuations on the Amsterdam Exchange.

- Interest rate hikes: Central banks, including the European Central Bank (ECB), have implemented aggressive interest rate hikes to combat inflation. While aiming to control price increases, these hikes increase borrowing costs for businesses, potentially slowing down economic growth and reducing corporate profitability, thus impacting the Amsterdam Exchange stock index.

- Slowing GDP growth: The Netherlands, like many other European economies, is experiencing slower-than-expected GDP growth. This reflects the combined impact of high inflation, rising interest rates, and geopolitical uncertainties. Lower GDP growth directly translates to lower corporate earnings and reduced investor confidence in the Amsterdam Exchange. Data from the Dutch Central Bank (De Nederlandsche Bank) can confirm this correlation.

Investor Sentiment and Market Volatility

Investor sentiment and market volatility are inextricably linked to the decline in the Amsterdam Exchange stock index.

- Decreased investor confidence: Negative news surrounding the war in Ukraine, rising inflation, and interest rate hikes have significantly eroded investor confidence, leading to a sell-off in the stock market. Fear and uncertainty are driving investors to seek safer havens for their investments.

- Increased market volatility: The current geopolitical and economic climate has led to increased market volatility, characterized by sharp price swings in a short period. This volatility makes it harder for investors to predict market movements and increases the risk of significant losses, prompting further selling.

- Algorithmic and high-frequency trading: The role of algorithmic and high-frequency trading in amplifying market fluctuations cannot be ignored. These automated trading strategies can exacerbate volatility and contribute to rapid price declines during periods of uncertainty, as seen in the recent Amsterdam Exchange stock index decline.

Impact and Consequences of the Amsterdam Exchange Stock Index Decline

The decline in the Amsterdam Exchange stock index has far-reaching consequences for investors and the Dutch economy.

Impact on Investors

The recent market downturn has resulted in significant losses for many investors:

- Losses for individual investors: Many individual investors holding Dutch equities have experienced portfolio losses due to the decline. This can have a substantial impact on their financial plans and retirement savings.

- Impact on institutional investors: Pension funds, mutual funds, and other institutional investors with significant holdings in Dutch stocks have also suffered losses, potentially impacting their ability to meet their obligations.

- Increased market risk and uncertainty: The decline increases the overall risk in the market, making it harder for investors to predict future returns and manage their portfolios effectively. This uncertainty can lead to further market volatility and potential losses.

Effect on the Dutch Economy

The stock market decline has broader implications for the Dutch economy:

- Reduced business investment: The uncertainty caused by the stock market decline may discourage businesses from investing in expansion and innovation, potentially hindering economic growth.

- Decreased consumer confidence: Falling stock prices can negatively impact consumer confidence, leading to reduced spending and further slowing economic activity.

- Ripple effect on related industries and sectors: The decline affects not only the companies listed on the Amsterdam Exchange but also the broader economy through supply chains, employment, and related industries.

Government Response and Measures

The Dutch government has implemented several measures to mitigate the impact of the decline:

- Fiscal and monetary policy adjustments: The government may adjust fiscal policy (e.g., tax cuts, increased government spending) and coordinate with the ECB on monetary policy to support economic growth and boost investor confidence.

- Regulatory changes: The decline might lead to regulatory changes aimed at improving market stability, investor protection, and mitigating the impact of high-frequency trading.

- Communication strategies: Clear and transparent communication from the government to reassure investors and the public is crucial in mitigating the negative impact of the stock market decline.

Conclusion

The significant decline in the Amsterdam Exchange stock index is a result of a complex interplay of geopolitical events, unfavorable economic indicators, and decreased investor confidence. The consequences are far-reaching, impacting both investors and the Dutch economy. Understanding these factors is crucial for navigating the current market uncertainty. Stay updated on the Amsterdam Exchange stock index by monitoring key economic indicators and geopolitical events to make informed investment decisions. Understand the factors driving the Amsterdam Exchange and monitor the Amsterdam Exchange market for future trends. This will help you manage risk and potentially capitalize on future opportunities.

Featured Posts

-

Chinese Tennis Player Triumphs In Italian Open Round Of 16

May 25, 2025

Chinese Tennis Player Triumphs In Italian Open Round Of 16

May 25, 2025 -

Carmen Joy Crookes Latest Musical Offering

May 25, 2025

Carmen Joy Crookes Latest Musical Offering

May 25, 2025 -

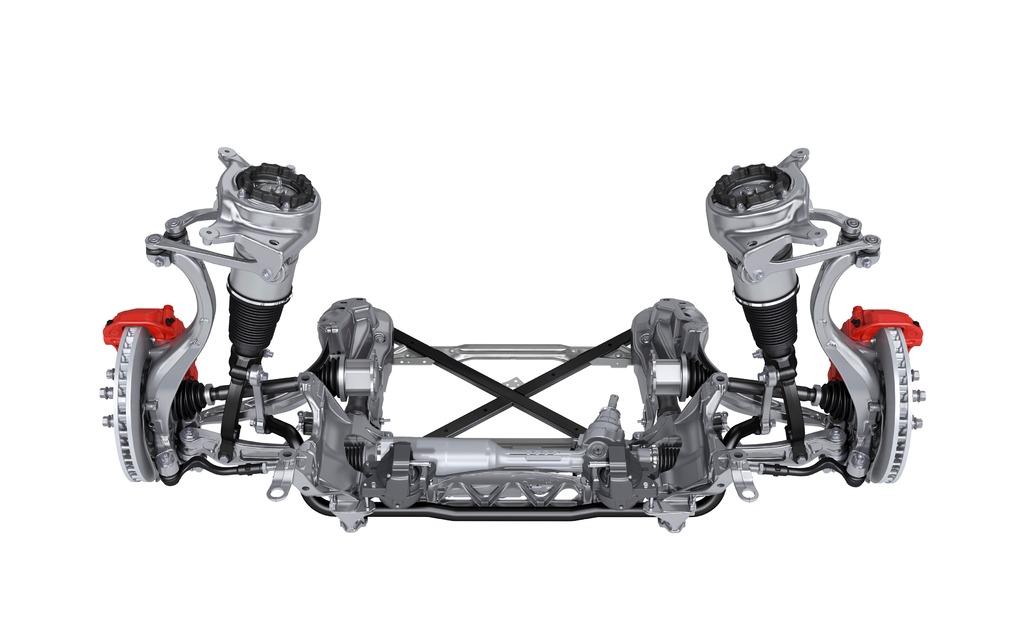

Porsche Macan Buying Guide A Comprehensive Overview

May 25, 2025

Porsche Macan Buying Guide A Comprehensive Overview

May 25, 2025 -

The History And Design Of Dr Terrors House Of Horrors

May 25, 2025

The History And Design Of Dr Terrors House Of Horrors

May 25, 2025 -

Decoding Trumps Anger A Look At His Trade Policies Against Europe

May 25, 2025

Decoding Trumps Anger A Look At His Trade Policies Against Europe

May 25, 2025