Amsterdam Stock Exchange: 11% Loss Highlights Ongoing Market Instability

Table of Contents

Analyzing the 11% Drop at the Amsterdam Stock Exchange

The steep fall in the AEX index wasn't an isolated event; it reflects a confluence of factors impacting the Amsterdam Stock Exchange and the wider global economy.

Macroeconomic Factors Contributing to the Decline

Several macroeconomic headwinds have conspired to create this perfect storm of market instability. The global economy is grappling with:

-

Global inflation and rising interest rates: Persistent inflation across the globe has forced central banks to aggressively raise interest rates, increasing borrowing costs for businesses and dampening economic growth. This directly impacts corporate profitability and investor confidence, contributing to the sell-off on the Amsterdam Stock Exchange.

-

Geopolitical uncertainties: The ongoing war in Ukraine continues to disrupt global supply chains and fuel energy price volatility. The resulting energy crisis has placed immense pressure on European economies, including the Netherlands, directly impacting the performance of companies listed on the AEX.

-

Supply chain disruptions: Lingering supply chain bottlenecks, exacerbated by the war and other geopolitical factors, continue to constrain production and drive up prices, impacting profitability across various sectors listed on the Amsterdam Stock Exchange.

-

Examples: The energy sector, heavily represented on the AEX, has been particularly hard hit by the energy crisis, leading to significant losses for energy companies. Furthermore, companies reliant on global supply chains have experienced production delays and increased input costs, negatively impacting their stock prices.

Sector-Specific Performance on the Amsterdam Stock Exchange

The 11% drop wasn't uniform across all sectors. Some sectors were hit harder than others, reflecting the varied sensitivities to the macroeconomic environment:

-

Hardest hit sectors: The energy and technology sectors bore the brunt of the decline, reflecting global trends in energy prices and investor sentiment towards tech stocks.

-

Resilient sectors: Certain sectors, such as consumer staples, showed more resilience, demonstrating their defensive characteristics during periods of market instability.

-

Individual company performance: Within these sectors, individual companies exhibited varying degrees of performance. Some companies with strong fundamentals and effective risk management strategies weathered the storm better than others.

-

Examples: While some energy companies experienced significant losses due to price volatility, others with diversified portfolios or effective hedging strategies demonstrated comparatively better performance. Similarly, within the technology sector, some companies with strong growth prospects maintained relatively stable stock prices.

Investor Sentiment and Market Psychology

Fear and uncertainty played a significant role in driving the sell-off on the Amsterdam Stock Exchange. Negative news coverage and escalating geopolitical tensions fueled risk aversion among investors.

-

Fear and uncertainty: The combination of rising inflation, interest rates, and geopolitical uncertainty created a climate of fear and uncertainty, prompting investors to reduce their risk exposure.

-

Impact of media: Negative news and media portrayals of the economic outlook further exacerbated investor anxieties, triggering a wave of selling.

-

Increased risk aversion: Investors shifted towards safer assets, such as government bonds, leading to a significant outflow of funds from the stock market, including the AEX.

-

Examples: Sharp declines in the AEX were often amplified by negative news headlines, creating a self-fulfilling prophecy of selling pressure. Investors reacted swiftly to any negative news, further contributing to the market downturn.

The Wider Implications of Amsterdam Stock Exchange Instability

The decline in the AEX has significant implications, extending beyond the Dutch market.

Impact on the European Market

The interconnected nature of European stock markets means that the AEX's instability has ripple effects across the continent.

-

Interconnectedness: European stock markets are closely linked, and a downturn in one market can easily trigger declines in others.

-

Ripple effects: The AEX's decline has already impacted other European exchanges, indicating the interconnected nature of these markets.

-

Examples: The negative sentiment surrounding the AEX spillover into other European markets, leading to correlated declines in various indices.

Global Market Context and Correlation

The Amsterdam Stock Exchange decline needs to be viewed within the broader context of global market volatility.

-

Global volatility: The current market instability is a global phenomenon, affecting markets worldwide.

-

Correlation with global indices: The AEX's performance is correlated with other major global indices, indicating a shared sensitivity to macroeconomic factors.

-

Examples: The AEX's decline mirrored similar downturns in indices like the Dow Jones and S&P 500, reflecting the interconnected nature of global markets.

Long-Term Outlook and Potential Recovery

The long-term outlook for the Amsterdam Stock Exchange remains uncertain, but several factors could influence its recovery.

-

Cautious outlook: Given the persistence of macroeconomic headwinds, a cautious outlook is warranted.

-

Potential catalysts for recovery: Easing inflation, increased geopolitical stability, and improved supply chains could trigger a market rebound.

-

Potential risks: Prolonged geopolitical instability, further inflation, and unexpected economic shocks could prolong the downturn.

-

Scenarios: Several scenarios are possible, ranging from a gradual recovery to a prolonged period of market instability, depending on the resolution of the underlying macroeconomic and geopolitical challenges.

Conclusion: Navigating the Volatility of the Amsterdam Stock Exchange

The 11% loss in the Amsterdam Stock Exchange reflects a complex interplay of macroeconomic factors, sector-specific performance, and investor sentiment. The interconnected nature of global markets means this instability has wider implications for European and global markets. Key takeaways include the significant impact of global inflation, geopolitical uncertainty, and supply chain disruptions on the AEX. Understanding the volatility of the AEX and its correlation with other major indices is crucial for investors. Stay updated on the Amsterdam Stock Exchange and its related indices to navigate the challenges of this dynamic market environment and make informed investment decisions. Understand the volatility of the AEX to protect your portfolio and potentially capitalize on future opportunities within the Amsterdam Stock Exchange market.

Featured Posts

-

Nvidia Rtx 5060 Review Controversy Lessons Learned For Consumers And Critics

May 25, 2025

Nvidia Rtx 5060 Review Controversy Lessons Learned For Consumers And Critics

May 25, 2025 -

Queen Wen In Paris A Renewed Diplomatic Presence

May 25, 2025

Queen Wen In Paris A Renewed Diplomatic Presence

May 25, 2025 -

Zheng Qinwen Reaches Italian Open Round Of 16

May 25, 2025

Zheng Qinwen Reaches Italian Open Round Of 16

May 25, 2025 -

Current Flood Warning Heed Nws Advice For Safety

May 25, 2025

Current Flood Warning Heed Nws Advice For Safety

May 25, 2025 -

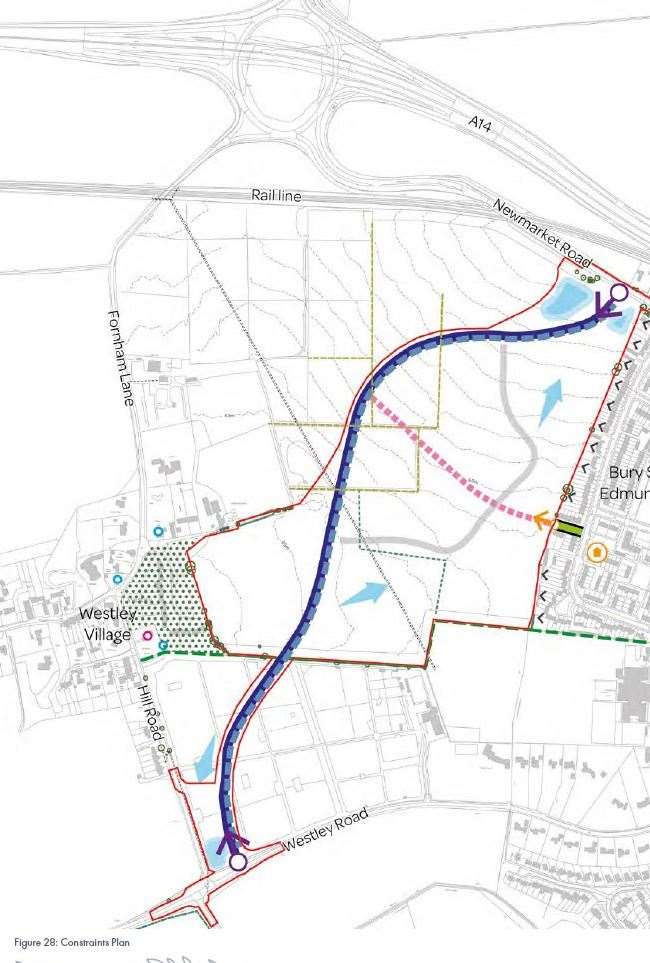

The Proposed M62 Relief Road Through Bury An Examination

May 25, 2025

The Proposed M62 Relief Road Through Bury An Examination

May 25, 2025