Amsterdam Stock Market: Three Days Of Significant Losses Totaling 11%

Table of Contents

<meta name="description" content="The Amsterdam Stock Exchange experienced a dramatic three-day downturn, losing 11% of its value. Understand the causes and implications of this significant market drop.">

The Amsterdam Stock Market (AEX), a key indicator of the Dutch economy, witnessed a severe downturn over the past three trading days, resulting in a cumulative loss of 11%. This significant drop has sent shockwaves through the Dutch financial sector and raised concerns about the broader European economy. This article delves into the key factors contributing to this dramatic decline and explores its potential consequences. Understanding the reasons behind this volatility is crucial for investors and anyone interested in the health of the Dutch and global markets.

<h2>Causes of the Amsterdam Stock Market Decline</h2>

The sharp decline in the AEX index can be attributed to a confluence of factors, both global and specific to the Dutch market.

<h3>Global Economic Uncertainty</h3>

Global economic uncertainty played a major role in the Amsterdam Stock Market's recent plunge. Rising inflation rates in many countries, coupled with fears of a looming recession, have significantly dampened investor confidence. Geopolitical instability, particularly the ongoing war in Ukraine, further exacerbates this uncertainty. The energy crisis, stemming from reduced Russian gas supplies, is another key factor impacting global market volatility and impacting the AEX index.

- Rising interest rates: Central banks globally are raising interest rates to combat inflation, increasing borrowing costs for businesses and potentially slowing economic growth.

- Energy crisis: The ongoing energy crisis, largely fueled by the war in Ukraine, is driving up energy prices and impacting businesses across various sectors.

- War in Ukraine: The conflict in Ukraine continues to create geopolitical uncertainty, impacting global supply chains and investor sentiment.

- Supply chain disruptions: Persistent supply chain disruptions contribute to inflation and hinder economic recovery.

<h3>Specific Sectoral Impacts</h3>

The impact of the market decline wasn't uniform across all sectors. Certain sectors within the Amsterdam Stock Market were hit harder than others. For example, energy companies, heavily reliant on global commodity prices, experienced significant losses. The technology sector, often sensitive to interest rate hikes and broader economic uncertainty, also saw substantial declines.

- Energy sector: Companies in the energy sector, particularly those involved in gas and oil, faced significant losses due to fluctuating commodity prices and global energy market volatility.

- Technology sector: The technology sector, vulnerable to shifts in investor sentiment and interest rate changes, experienced notable declines, reflecting broader concerns about economic growth.

- AEX Constituents: A closer look at individual AEX constituents reveals specific companies experiencing substantial losses, highlighting the sectoral disparities within the market downturn. Analyzing their performance provides valuable insights into the specific drivers behind the overall market decline.

<h3>Influence of International Markets</h3>

The Amsterdam Stock Market doesn't operate in isolation. The AEX index is closely correlated with other major global indices, such as the Dow Jones and FTSE 100. Negative trends in these international stock markets often trigger a contagion effect, impacting the AEX performance.

- Global market correlation: The strong correlation between the AEX and other major global indices indicates that global market sentiment significantly influences the Dutch market.

- International stock markets: Negative performance in other major international stock markets often leads to a sell-off in the Amsterdam Stock Market, reflecting interconnected global financial systems.

- Market contagion: Negative trends in one major market can quickly spread to others, creating a domino effect that amplifies market declines.

<h2>Implications of the 11% Loss</h2>

The 11% loss in the Amsterdam Stock Market has significant implications for various stakeholders.

<h3>Impact on Dutch Businesses and Investors</h3>

The market downturn directly impacts Dutch businesses and investors. Reduced investor confidence can lead to decreased investment, potentially resulting in job losses and slower economic growth. Companies may face difficulty securing funding, and consumers might reduce spending due to uncertainty.

- Dutch economy impact: The decline in the AEX negatively affects the overall health of the Dutch economy, influencing consumer and business confidence.

- Investor losses: Individual and institutional investors have experienced significant losses due to the market downturn.

- Business consequences: Businesses face challenges securing funding, reduced consumer demand, and potential difficulties in expansion.

<h3>Government Response and Potential Mitigation Strategies</h3>

The Dutch government may need to implement measures to mitigate the impact of the market decline. This could involve fiscal stimulus packages, targeted support for affected sectors, or regulatory interventions to stabilize the market.

- Government intervention: The government's response will be critical in determining the speed and extent of market recovery.

- Economic policy: The government may adjust its economic policies to address the market downturn and promote stability.

- Fiscal stimulus: Fiscal stimulus packages can inject money into the economy, supporting businesses and boosting consumer confidence.

<h3>Short-Term and Long-Term Outlook</h3>

The short-term outlook for the Amsterdam Stock Market remains uncertain. A recovery depends on various factors, including global economic conditions, government intervention, and investor sentiment. The long-term outlook requires continued monitoring of global and domestic developments.

- Market forecast: Predicting short-term market movements is challenging, but the long-term prospects depend on broader economic trends.

- AEX recovery: The speed of the AEX recovery depends on resolving the underlying global and sectoral issues that caused the initial decline.

- Long-term investment: Long-term investors may see opportunities amidst the volatility, but careful analysis and risk assessment are crucial.

<h2>Conclusion</h2>

The 11% loss in the Amsterdam Stock Market over three days highlights the fragility of global markets and the interconnectedness of the world economy. The causes are multifaceted, ranging from global economic uncertainty to specific sectoral challenges and the influence of international markets. The implications for Dutch businesses and investors are significant, requiring government intervention and careful monitoring of the situation.

Call to Action: Stay informed about the evolving situation in the Amsterdam Stock Market by regularly checking reputable financial news sources. Understanding the dynamics of the Amsterdam Stock Market is crucial for investors and anyone interested in the Dutch economy. Continue to monitor the AEX index and its performance for further updates on this significant market event.

Featured Posts

-

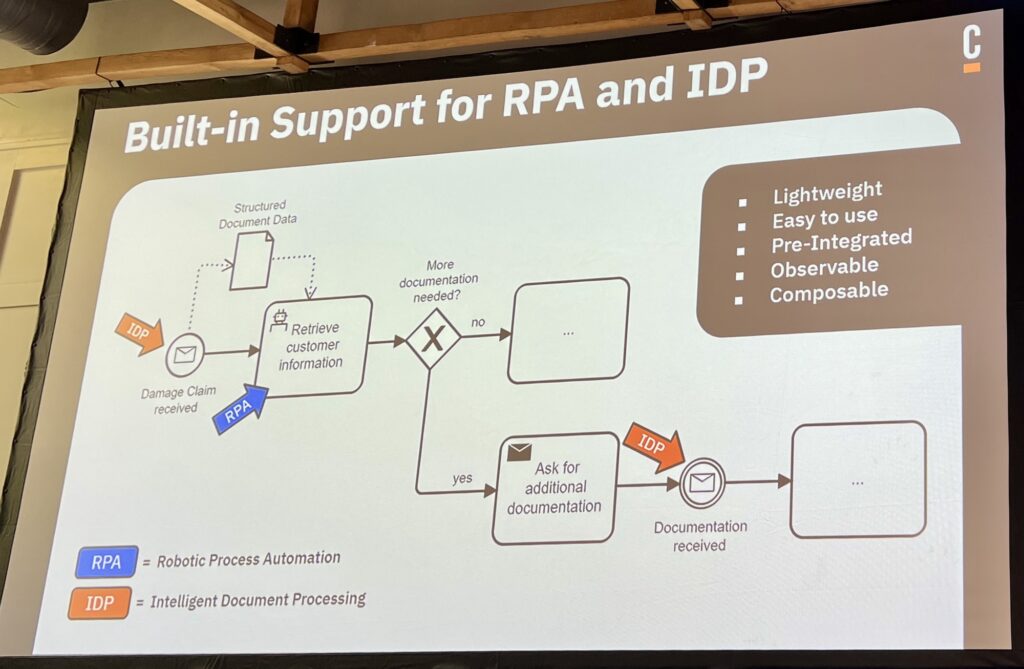

Camunda Con 2025 Unlocking The Power Of Orchestration With Ai And Automation In Amsterdam

May 24, 2025

Camunda Con 2025 Unlocking The Power Of Orchestration With Ai And Automation In Amsterdam

May 24, 2025 -

Evrovidenie Pobediteli Poslednikh 10 Let I Ikh Sudba Segodnya

May 24, 2025

Evrovidenie Pobediteli Poslednikh 10 Let I Ikh Sudba Segodnya

May 24, 2025 -

90 Let Sergeyu Yurskomu Pamyat O Genii Paradoksov

May 24, 2025

90 Let Sergeyu Yurskomu Pamyat O Genii Paradoksov

May 24, 2025 -

13 Vuotias Autourheilun Lupaus Ferrarille Taessae On Haenen Nimensae

May 24, 2025

13 Vuotias Autourheilun Lupaus Ferrarille Taessae On Haenen Nimensae

May 24, 2025 -

Dayamitra Mtel Dan Merdeka Battery Mbma Di Msci Small Cap Prospek And Risiko

May 24, 2025

Dayamitra Mtel Dan Merdeka Battery Mbma Di Msci Small Cap Prospek And Risiko

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025